Child Education Tax Rebate Web Text The Australian Government is helping you with the of educating your kids The Education Tax Refund provides up to 50 back on a range of children s education

Web 27 f 233 vr 2023 nbsp 0183 32 Updated 27 02 2023 10 21 02 AM If your employer provides you children education allowance as a part of your salary structure for the payment of education Web The qualified education expenses would be 4 000 and the AGI and MAGI would be 23 500 The tax liability before any credits would be 413 Jane would be able to

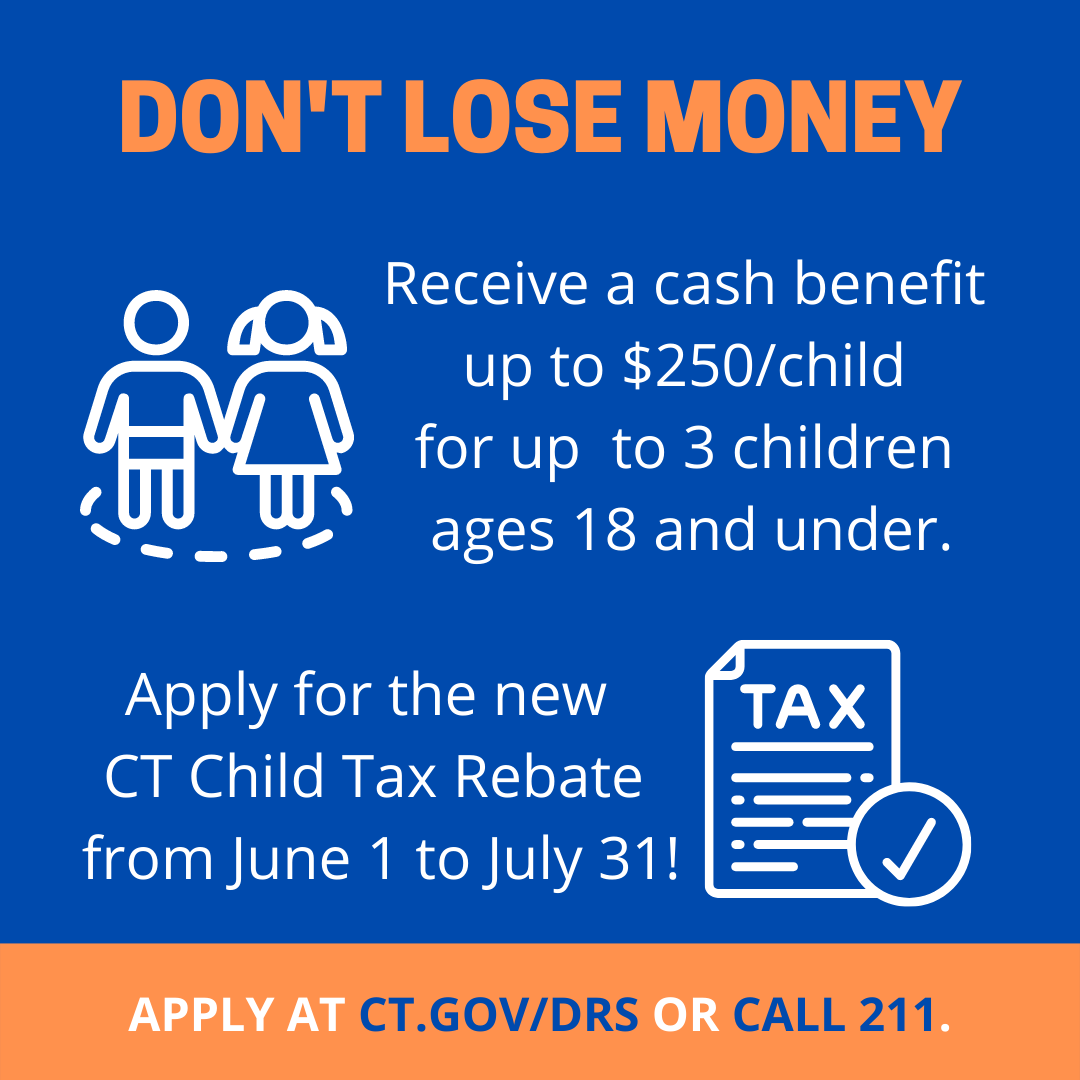

Child Education Tax Rebate

Child Education Tax Rebate

https://accessagency.org/wp-content/uploads/2022/06/Story-Get-your-2022-Child-Tax-Rebate.png

2022 Child Tax Rebate

https://portal.ct.gov/-/media/DCF/SPOTLIGHT/2022/June/Child-Tax-Rebate.png?sc_lang=en&h=1080&w=1080&la=en&hash=71DF1F1C6E19B1AE7C1DCCD9E598E4C5

/cloudfront-us-east-1.images.arcpublishing.com/gray/ZMKNLBZWRJDNXJOLDBQSHYZB3Y.jpg)

Gov Lamont Child Tax Rebate Checks Will Start Going Out Next Week

https://gray-wfsb-prod.cdn.arcpublishing.com/resizer/gKQ2psaELuOBCeaQ8VxbmEjmLAI=/800x450/smart/filters:quality(70)/cloudfront-us-east-1.images.arcpublishing.com/gray/ZMKNLBZWRJDNXJOLDBQSHYZB3Y.jpg

Web 22 juil 2019 nbsp 0183 32 Discover Tax Benefits on Children s Education Learn how Section 80C offers deductions for Education Allowance Tuition Fees and School Fees Web 27 juin 2018 nbsp 0183 32 One relief is the tax benefit provided for spending on children s education The Income Tax Act provides a direct deduction on account of fees paid for the

Web 5 janv 2023 nbsp 0183 32 Can you claim tuition fees for an adopted child on your tax return Yes any legal guardian of a child can claim tax benefits but only for two children Wrapping Up In India the average cost of education is Web 1 janv 2013 nbsp 0183 32 for 2010 11 the offset is calculated as 50 of eligible primary school expenses to a maximum of 794 for a refund of 397 per child secondary school

Download Child Education Tax Rebate

More picture related to Child Education Tax Rebate

2022 Child Tax Rebate Stratford Crier

https://stratfordcrier.com/wp-content/uploads/2022/06/hh-1030x1030.png

Nearly 200 000 Families Can Still Apply For 2022 CT Child Tax Rebate

https://thevillage.org/wp-content/uploads/2022/07/ChildTaxRebate-002_web.jpg

Province Of Manitoba School Tax Rebate

https://www.gov.mb.ca/asset_library/en/schooltaxrebate/white-slip-school-taxes-2023.jpg

Web 17 f 233 vr 2017 nbsp 0183 32 Let us say you fall in the highest income bracket and you pay 31 2 per cent as tax and you pay Rs 80 000 a year as schools fees Here the tax saved will amount Web 13 janv 2022 nbsp 0183 32 For your 2021 tax return the cap on expenses eligible for the child and dependent care tax credit is 8 000 for one child up from 3 000 or 16 000 up from

Web 7 janv 2020 nbsp 0183 32 Maximum Limit for Section 80C Deduction Deduction available on payment basis Section 80C Deduction not available for part time course Fees for Private Web 17 ao 251 t 2023 nbsp 0183 32 The child tax credit is a tax benefit for people with qualifying children For 2023 taxpayers may be eligible for a credit of up to 2 000 and 1 600 of that may be

High Income Child Benefit Charge Tax Rebates

https://www.taxrebates.co.uk/wp-content/uploads/High-Income-Child-Benefit-Charge.jpeg

CT s New Child Tax Rebate Connecticut Association For Community Action

https://www.cafca.org/wp-content/uploads/2022/06/CTCTR-Spanish-scaled.jpg

https://treasury.gov.au/.../3jj_MCD_Education_Tax_Refund…

Web Text The Australian Government is helping you with the of educating your kids The Education Tax Refund provides up to 50 back on a range of children s education

https://www.paisabazaar.com/tax/children-education-allowance

Web 27 f 233 vr 2023 nbsp 0183 32 Updated 27 02 2023 10 21 02 AM If your employer provides you children education allowance as a part of your salary structure for the payment of education

How Much Tax Savings For A Child Tax Walls

High Income Child Benefit Charge Tax Rebates

Here s How You Calculate Your Adjusted Gross Income AGI

2022 Child Tax Rebate Ends July 31 Access Community Action Agency

2019 Edition Of Parenthood Tax Rebate Qualifying Child Relief

WarwickPost Police Government Politics Events News In Warwick RI

WarwickPost Police Government Politics Events News In Warwick RI

Wisconsin Families Get 94M From Child Tax Rebate Wisconsin Public Radio

Education Property Tax Rebate Continues In 2022 City Of Portage La

More Tax Credits More Rebates Education Magazine

Child Education Tax Rebate - Web 22 juil 2019 nbsp 0183 32 Discover Tax Benefits on Children s Education Learn how Section 80C offers deductions for Education Allowance Tuition Fees and School Fees