Child Relief And Tax Rebate Singapore Web Tax reliefs rebates and deductions Parenthood Tax Rebate PTR Married divorced or widowed parents may claim tax rebates of up to 20 000 per child As PTR is a one off

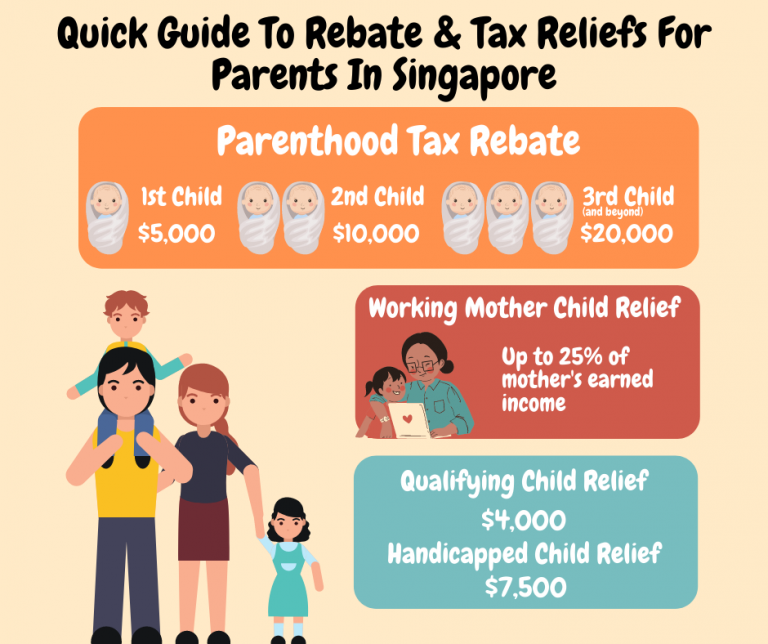

Web Parenthood Tax Rebate If you are a parent you may be eligible to claim the Parenthood Tax Rebate of 5 000 for your first child 10 000 for your second child and 20 000 Web Mr Ang claims the full amount of Qualifying Child Relief QCR of 8 000 i e 4 000 x 2 on their two children while Mrs Ang claims Working Mother s Child Relief WMCR and

Child Relief And Tax Rebate Singapore

Child Relief And Tax Rebate Singapore

https://2.bp.blogspot.com/-_pLNiXKLQqI/WsuZ3S3YQJI/AAAAAAAAYsE/E9ORc-9MkocQGM1lJApJ0ugHZXzRROWAgCLcBGAs/s1600/Child-Related%2BReliefs.JPG

MP Tries 3 Times For Tax Rebate And Child Relief For Single Unwed

https://theindependent.sg/wp-content/uploads/2020/02/Screen-Shot-2020-02-29-at-12.34.17-PM-1024x450.png

Parenthood Tax Rebate Guide For Singapore Parents

https://www.raisingangels.sg/wp-content/uploads/2021/11/Untitled-design-7-1-768x644.png

Web 13 mars 2023 nbsp 0183 32 By being a mother or signing up for a course to upskill you are entitled to relief schemes that can help to subtract your taxable income by up to S 80 000 1 Save up for retirement One of the best ways to Web 29 juil 2021 nbsp 0183 32 Parents can claim a one time amount of 5 000 for their first child 10 000 for their second and 20 000 for their third and each subsequent child Any unutilised balance is automatically carried

Web 18 mars 2022 nbsp 0183 32 Singaporean parents are eligible for the Qualifying Child Relief QCR or Handicapped Child Relief HCR which aim to support parents in their child rearing Web 27 avr 2018 nbsp 0183 32 The Parenthood Tax Rebate PTR allows married divorced or widowed tax resident parents to claim rebates of up to SGD 20 000 per child To qualify for the PTR a number of conditions will need to be met

Download Child Relief And Tax Rebate Singapore

More picture related to Child Relief And Tax Rebate Singapore

Singapore Qualifying Child Relief

https://thenewageparents.com/wp-content/uploads/2015/03/Qualifying-or-handicapped-child-relief.jpg

Tax Relief For Parents In Singapore

https://thenewageparents.com/wp-content/uploads/2015/03/QCR-and-HCR-relief.jpg

2019 Edition Of Parenthood Tax Rebate Qualifying Child Relief

https://i1.wp.com/www.theastuteparent.com/wp-content/uploads/2019/02/Screen-Shot-2019-02-25-at-11.16.02-PM.png?resize=645%2C267&ssl=1

Web Here s How Singapore s Parenthood Tax Rebate 2023 Can Save You up to 50 000 Tax season in Singapore is here Did you know that you re entitled to a range of parenting Web 24 janv 2020 nbsp 0183 32 Parents can claim a tax relief of SGD4 000 per child under the Qualifying Child Relief QCR or SGD7 500 per child under the Handicapped Child Relief HCR Under the NSman Parent Relief the

Web 27 sept 2022 nbsp 0183 32 The lump sum rebate is given to most Singapore tax residents who may be married divorced or widowed and if you are qualified you can claim up to 20 000 per Web 11 nov 2021 nbsp 0183 32 You can get up to 20k in tax relief just from the Parenthood Tax Rebate alone which is no small amount So let s get into it Quick Guide To Parenthood Tax

MP Tries 3 Times For Tax Rebate And Child Relief For Single Unwed

https://theindependent.sg/wp-content/uploads/2020/02/Screen-Shot-2020-02-29-at-12.34.23-PM-1068x204.png

Singapore s Tax Reliefs 2 Scenarios Where It Doesn t Pay To Work

https://dollarsandsense.sg/wp-content/uploads/2018/06/TaxReliefs-2.png

https://www.iras.gov.sg/.../tax-reliefs/parenthood-tax-rebate-(ptr)

Web Tax reliefs rebates and deductions Parenthood Tax Rebate PTR Married divorced or widowed parents may claim tax rebates of up to 20 000 per child As PTR is a one off

https://www.madeforfamilies.gov.sg/.../tax-relief-and-rebates

Web Parenthood Tax Rebate If you are a parent you may be eligible to claim the Parenthood Tax Rebate of 5 000 for your first child 10 000 for your second child and 20 000

Parenthood Tax Rebate Guide For Singapore Parents

MP Tries 3 Times For Tax Rebate And Child Relief For Single Unwed

Singapore s Tax Reliefs 2 Scenarios Where It Doesn t Pay To Work

Are YOU Eligible For The CT Child Tax Rebate

2022 Child Tax Rebate Stratford Crier

Parenthood Tax Rebate Guide For Singapore Parents

Parenthood Tax Rebate Guide For Singapore Parents

MP Tries 3 Times For Tax Rebate And Child Relief For Single Unwed

2019 Edition Of Parenthood Tax Rebate Qualifying Child Relief

Singapore s Tax Reliefs 2 Scenarios Where It Doesn t Pay To Work

Child Relief And Tax Rebate Singapore - Web 30 sept 2020 nbsp 0183 32 0 00 1 42 Object to my tax bill Child relief and rebate Singaporean child Inland Revenue Authority of Singapore 3 3K subscribers 2 6K views 2 years ago