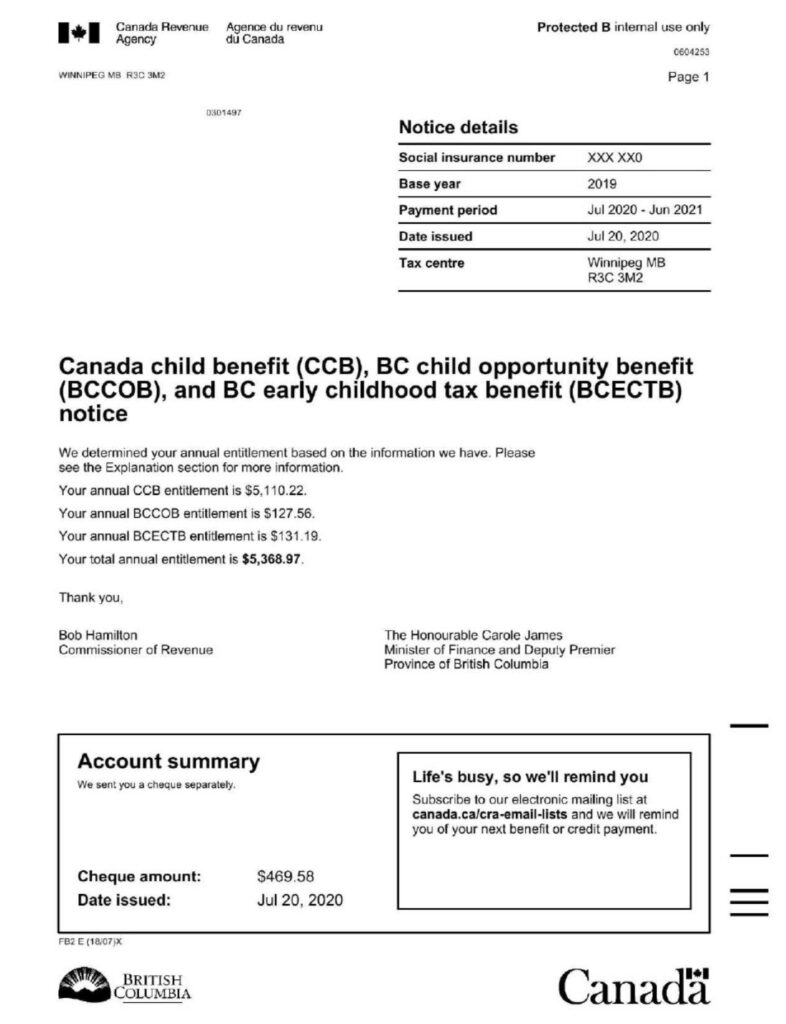

Child Tax Benefit Eligibility Bc Web Canada child benefit Starting November 20 2023 all individuals will be required to provide proof of birth when applying for the Canada child benefit CCB The Canada child benefit CCB is administered by the Canada Revenue Agency CRA It is a tax free monthly payment made to eligible families to help with the cost of raising children

Web Who can get the Canada child benefit You must meet all of the following conditions You live with a child who is under 18 years of age You are primarily responsible for the care and upbringing of the child See who is primarily responsible You are Web If your child is eligible for the disability tax credit you may also be eligible for the child disability benefit For the period of July 2023 to June 2024 you could get up to 3 173 264 41 per month for each child who is eligible for the disability tax credit Go to Child disability benefit

Child Tax Benefit Eligibility Bc

Child Tax Benefit Eligibility Bc

http://freedomnetworkusa.org/app/uploads/2020/06/SRP-ACF-Eligibility-Letter-for-Minor-Foreign-National-Survivors-Aug2015-scaled.jpg

Child Care Tax Benefit Ontario Ericvisser

https://www.wellington.ca/en/social-services/resources/Child_Care/2016-CEYD/CCB.png

The Canada Child Benefit CCB Explained Finance Bloggers Personal

https://i.pinimg.com/originals/2d/17/93/2d17931fd43de57c168d6203583d9b8b.jpg

Web BC family benefit The BC family benefit BCFB previously called the BC child opportunity benefit is a tax free monthly payment to families with children under the age of 18 The amount is combined with the CCB into a single monthly payment For July 2023 to June 2024 you may be entitled to receive the following amounts Web The BC family benefit formely the BC child opportunity benefit is a non taxable amount paid monthly to qualifying families with children under 18 years of age The amounts are combined with the CCB into a single monthly payment

Web Home Family and social supports Benefits and affordability B C early childhood tax benefit The B C early childhood tax benefit was a tax free monthly payment made to eligible families to help with the cost of raising young children under age 6 Web 13 Mai 2015 nbsp 0183 32 The Province of B C and the Canada Revenue Agency have created a detailed list of available child and family tax benefits at both provincial and federal levels The list includes short descriptions of benefits as well as direct links to appropriate webpages to find more information

Download Child Tax Benefit Eligibility Bc

More picture related to Child Tax Benefit Eligibility Bc

Update On The Canada Emergency Response Benefit CERB Canda s

http://aolmississauga.com/wp-content/uploads/2020/08/CERB.png

What The New Child Tax Credit Could Mean For You Now And For Your 2021

https://cdn.newswire.com/files/x/32/c9/0bc29c33e2af4d42f581fad9e660.png

How To Find Out Child Benefit Number Wastereality13

https://www.comoxmortgages.com/wp-content/uploads/2021/06/CCB-annual-notice-sample-doc-786x1024.jpg

Web 20 M 228 rz 2023 nbsp 0183 32 Eligibility is based on income and number of children The B C benefit is sent automatically to families who are eligible for the federal Canada Child Benefit and may take as long as 10 days to be deposited by the Canada Revenue Agency Web The Canada child benefit CCB is a non taxable amount paid monthly to help eligible families with the cost of raising children under 18 years of age The CCB

Web In Canada child benefits meaning income payments on behalf of children delivered either in the form of cheques or income tax reductions have historically pursued two fundamental and related purposes poverty reduction and parental recognition Web 18 Juli 2023 nbsp 0183 32 Eligibility is based on income and number of children The benefit reaches families with yearly earnings below 106 908 with one child and 143 783 with three children As of July 2023 the benefit increased by an additional 250 per year for a two parent family of four and as much as 750 for a single parent family with two children

Canada Child Tax Benefit Things To Know Law Student Months In A Year

https://i.pinimg.com/originals/b2/7c/9a/b27c9afffbc6d5cfb2d3141a07c5dc1e.jpg

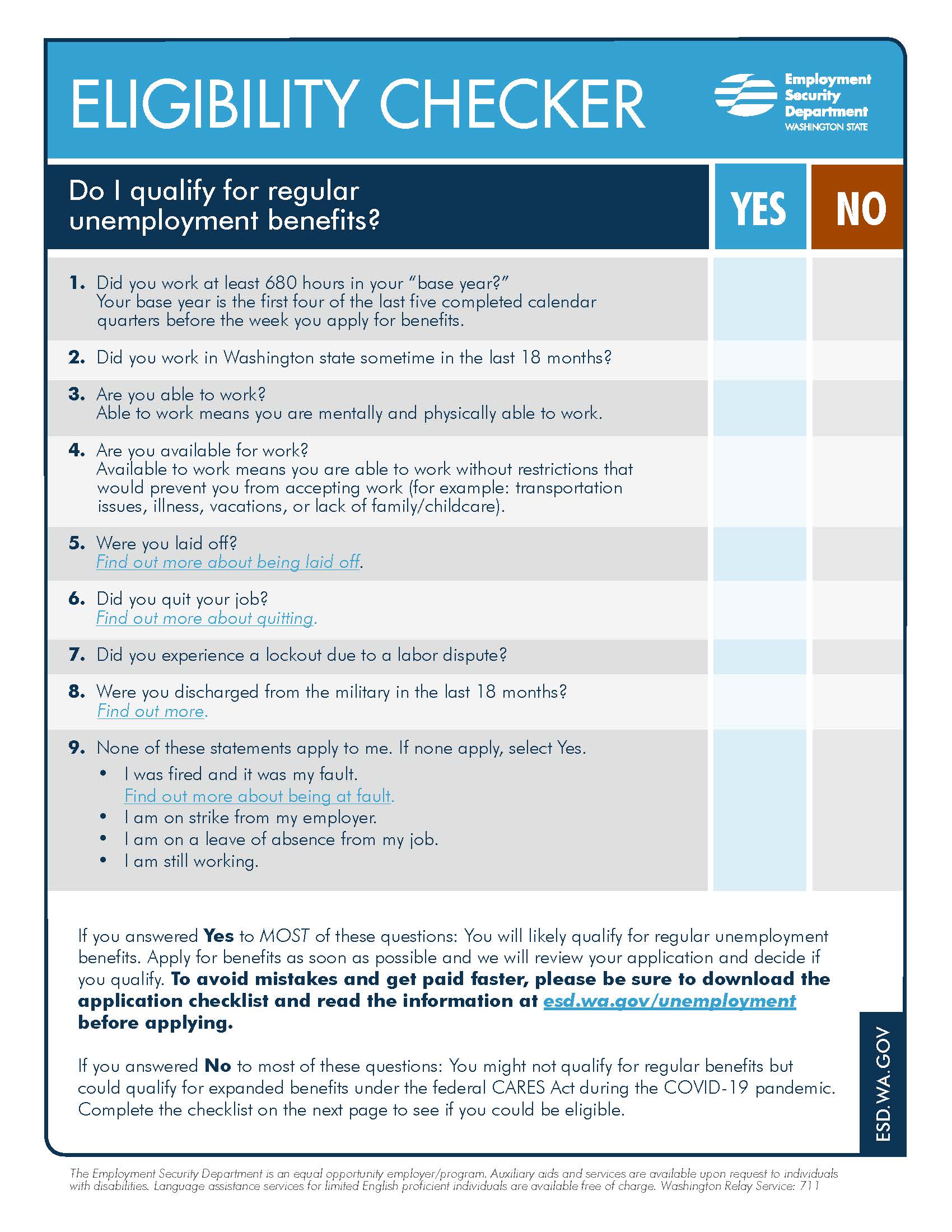

Unemployment Benefits Eligibility Checklist Unemployment Law Project

https://unemploymentlawproject.org/wp-content/uploads/2020/04/UIEligibilityChecker_Page_1.jpg

https://www.canada.ca/en/revenue-agency/services/child-family-benefits...

Web Canada child benefit Starting November 20 2023 all individuals will be required to provide proof of birth when applying for the Canada child benefit CCB The Canada child benefit CCB is administered by the Canada Revenue Agency CRA It is a tax free monthly payment made to eligible families to help with the cost of raising children

https://www.canada.ca/en/revenue-agency/services/child-family-benefits/...

Web Who can get the Canada child benefit You must meet all of the following conditions You live with a child who is under 18 years of age You are primarily responsible for the care and upbringing of the child See who is primarily responsible You are

Child Tax Benefit Application Form 2 Free Templates In PDF Word

Canada Child Tax Benefit Things To Know Law Student Months In A Year

Community Update October 21 2021 Firelands Local Schools Blog

WeeLove Financial Tax Relief For Working Families

Child Tax Benefit Payment Dates For 2021

2019 2023 Form Canada CF2900 Fill Online Printable Fillable Blank

2019 2023 Form Canada CF2900 Fill Online Printable Fillable Blank

Child Tax Credit 2021 Dates Canada Canada Child Tax Benefit Increase

Expand The Child Tax Credit KVSP Power 103 5

3 Results On Employment earnings As The Major Source Of Income From

Child Tax Benefit Eligibility Bc - Web The BC family benefit formely the BC child opportunity benefit is a non taxable amount paid monthly to qualifying families with children under 18 years of age The amounts are combined with the CCB into a single monthly payment