Child Tax Credit 2023 When Will It Start Irs See how much the 2023 child tax credit is worth how to claim it on your federal tax return and differences in the child tax credit 2023 vs 2022 s credit

Here is what you should know about the child tax credit for this year s tax season and whether you qualify Tax credit per child for 2023 The maximum tax credit per qualifying child Unless Congress changes the child tax credit for the 2024 tax year returns you ll file in 2025 the refundable portion of the child tax credit is scheduled to increase to 1 700

Child Tax Credit 2023 When Will It Start Irs

Child Tax Credit 2023 When Will It Start Irs

https://cdn.abcotvs.com/dip/images/14331168_011624-kabc-4pm-child-tax-clean-img.jpg

The Child Tax Credit In 2023 PolicyEngine US

https://policyengine.org/static/media/the-child-tax-credit-in-2023.1ab859f77f30aed7114c.png

Child Tax Credit 2023 Income Limit Eligibility Calculator APSBB

https://apsbb.org/wp-content/uploads/2023/05/Child-Tax-Credit-1.png

Page Last Reviewed or Updated 16 Apr 2024 Share FS 2021 10 July 2021 Starting July 15 millions of American families will automatically begin receiving monthly Child Tax Credit payments from the Treasury Department and the IRS The child tax credit is limited to 2 000 for every dependent you have who s under age 17 1 600 being refundable for the 2023 tax year That increases to 1 700 for the 2024 tax year

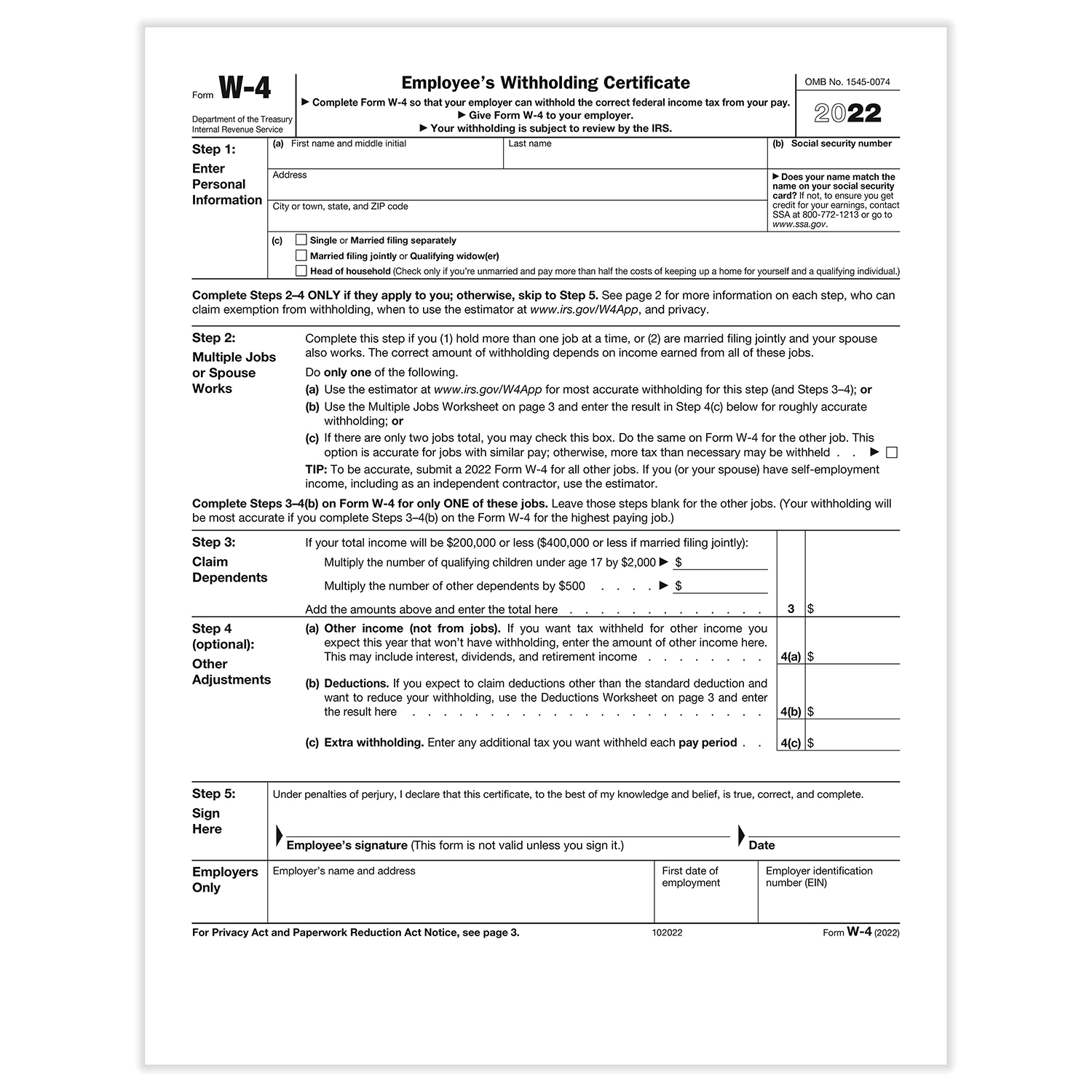

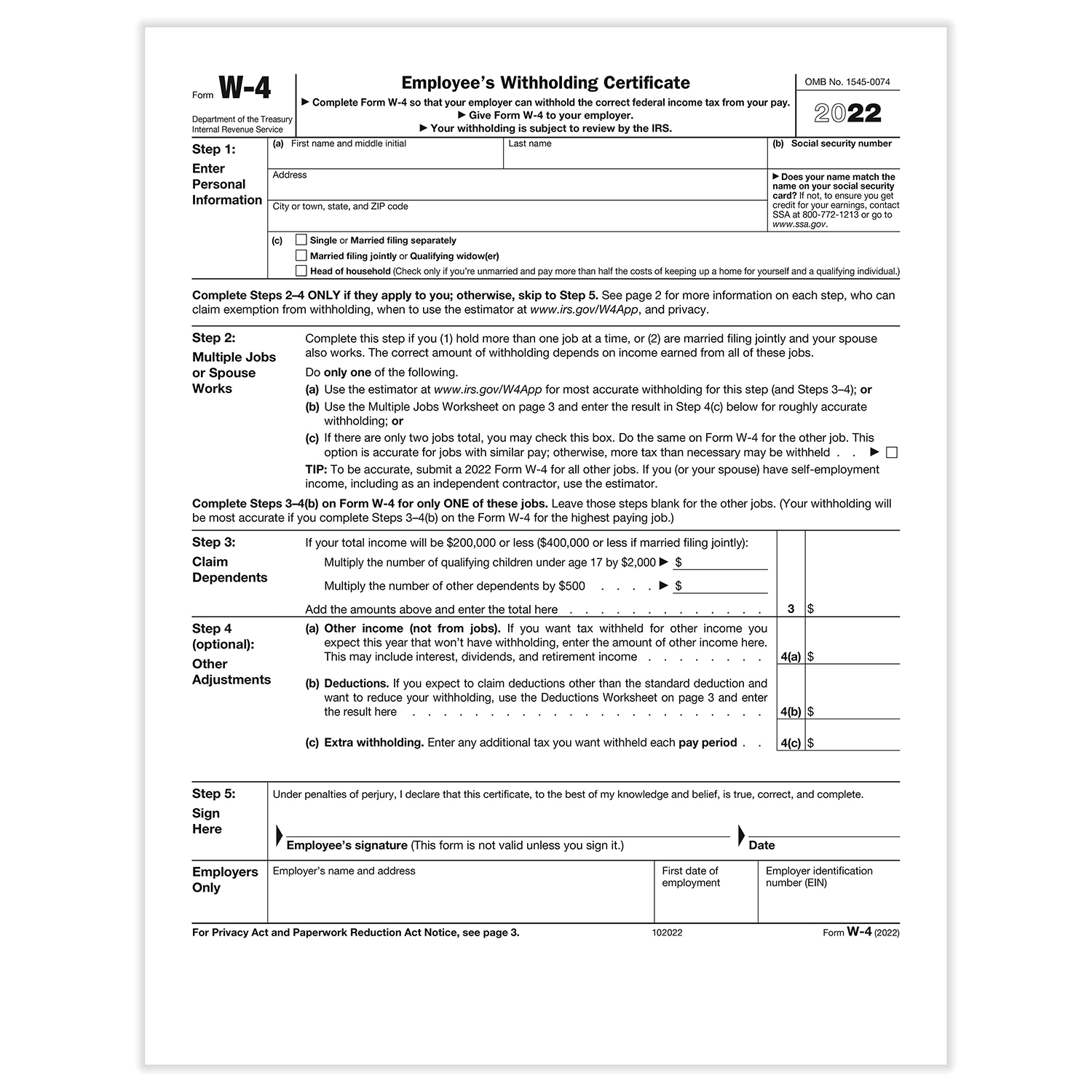

2023 and 2024 Child Tax Credit Written by a TurboTax Expert Reviewed by a TurboTax CPA Updated for Tax Year 2023 January 27 2024 2 29 PM OVERVIEW Tax reform has caused some changes to the rules for the Child Tax Credit in recent years Here s how to know whether you qualify for this credit While the IRS will begin accepting returns January 23 the IRS cannot issue a refund that includes the Earned Income Tax Credit or Additional Child Tax Credit ACTC before mid February This is due to the 2015 PATH Act law passed by Congress which provides this additional time to help the IRS stop fraudulent refunds from being issued

Download Child Tax Credit 2023 When Will It Start Irs

More picture related to Child Tax Credit 2023 When Will It Start Irs

Child Tax Credit Changes You Should Know In 2024 Apply Now

https://www.questioninsight.com/wp-content/uploads/2024/01/child-tax-credits.jpg

Child Tax Credit 2023 Get Up To 3 600 Per Child

https://biospc.org/wp-content/uploads/2023/08/Child-Tax-Credit-2023-1024x683.png

8 Incredible Tips What Is Dependent Care Credit Outbackvoices

https://i2.wp.com/static.twentyoverten.com/5afae91ee233a94fd2b8b963/AyQa5SwvUG/1616431432591.png

For tax year 2023 you can claim the child tax credit and the additional child tax credit on the federal tax return Form 1040 or 1040 SR that was due by April 15 2024 or by Oct 15 Most families will automatically start receiving the new monthly Child Tax Credit payments on July 15th Families who normally aren t required to file an income tax return should use this Non Filers Tool to register quickly for the expanded and newly advanceable Child Tax Credit from the American Rescue Plan

According to the IRS the nonrefundable 2023 child tax credit is currently 2 000 per child The refundable portion of the credit known as the additional child tax credit is worth up to 1 600 The monthly payments will start on July 15 and will continue through the end of the year Since the monthly payments will provide only half the year s credit taxpayers can claim the remaining

Fillable Forms Office 20232023 Fillable Form 2024

https://fillableforms.net/wp-content/uploads/2022/10/2023-irs-w-4-form-hrdirect.jpg

Child Tax Credit 2023 Why Is CTC Not Included In The Omnibus Spending

https://phantom-marca.unidadeditorial.es/edf668f581c98d2150ca230adf7af8c8/crop/106x0/1168x709/f/jpg/assets/multimedia/imagenes/2022/12/16/16711816684903.png

https://finance.yahoo.com/personal-finance/child...

See how much the 2023 child tax credit is worth how to claim it on your federal tax return and differences in the child tax credit 2023 vs 2022 s credit

https://www.usatoday.com/story/money/taxes/2024/01/...

Here is what you should know about the child tax credit for this year s tax season and whether you qualify Tax credit per child for 2023 The maximum tax credit per qualifying child

T22 0188 Repeal Child Tax Credit CTC Earned Income Threshold By

Fillable Forms Office 20232023 Fillable Form 2024

Child Tax Credit 2023 Income Limit Calculator Amount Monthly Payment

Claiming Advance Child Tax Care Credits For Tax Year 2021 Haugen Law

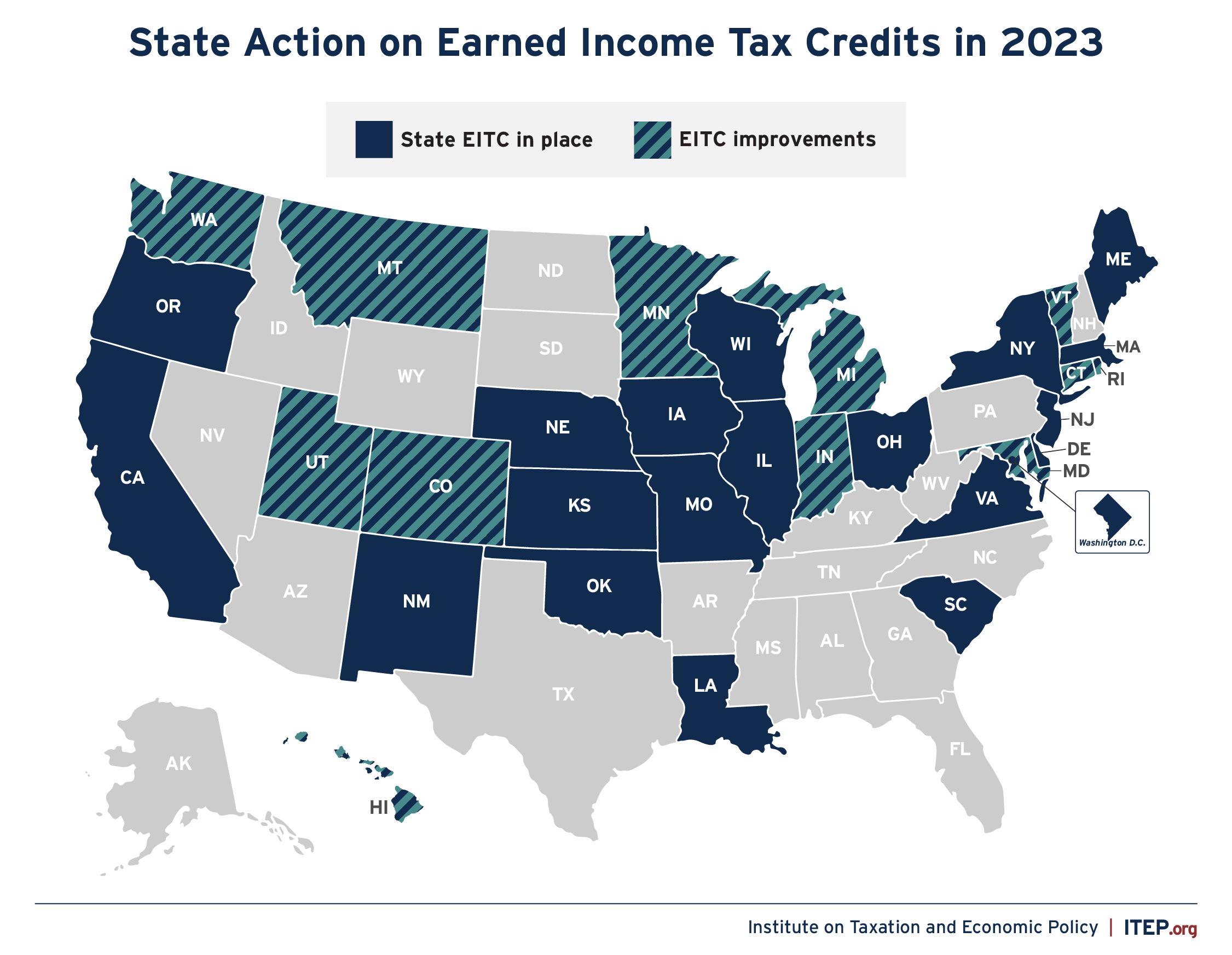

Refundable Credits A Winning Policy Choice Again In 2023 ITEP

Child Tax Credit Portal Now Open For Non filers How To Claim Up To

Child Tax Credit Portal Now Open For Non filers How To Claim Up To

Are They Doing Child Tax Credit Monthly Payments In 2022 Leia Aqui

2023 Child Tax Credit Changes Eligibility And Benefits Explained

IRS Child Tax Credit 2023 Requirement How To Claim

Child Tax Credit 2023 When Will It Start Irs - The child tax credit is limited to 2 000 for every dependent you have who s under age 17 1 600 being refundable for the 2023 tax year That increases to 1 700 for the 2024 tax year