Child Tax Credit And Income The American Rescue Plan raised the maximum Child Tax Credit in 2021 to 3 600 for children under the age of 6 and to 3 000 per child for children between ages 6 and 17 Before 2021 the credit was worth up to 2 000 per eligible child

For tax year 2021 the Child Tax Credit increased from 2 000 per qualifying child to 3 600 for children ages 5 and under at the end of 2021 and 3 000 for children ages 6 through 17 at the end of 2021 Here is what the child tax credit means for you what the income limits are for 2020 and how it might change under President Biden

Child Tax Credit And Income

Child Tax Credit And Income

https://www.hrblock.com/tax-center/wp-content/uploads/2017/06/child-tax-credit-1080x675.jpg

Monthly Child Tax Credit Payments Start Thursday Here s What To Know

https://www.courier-journal.com/gcdn/-mm-/a75b61cdf29c924e642301138dcb5b5b73c5e5d5/c=0-30-1998-1159/local/-/media/2018/01/31/Louisville/Louisville/636530052069237063-IMG-3796.jpg?width=1998&height=1129&fit=crop&format=pjpg&auto=webp

2021 Child Tax Credit And Payments What Your Family Needs To Know

https://static.twentyoverten.com/5d5413591d304774fba39eb3/6kFYVeqmtJC/Adjusted-Gross-Income.jpg

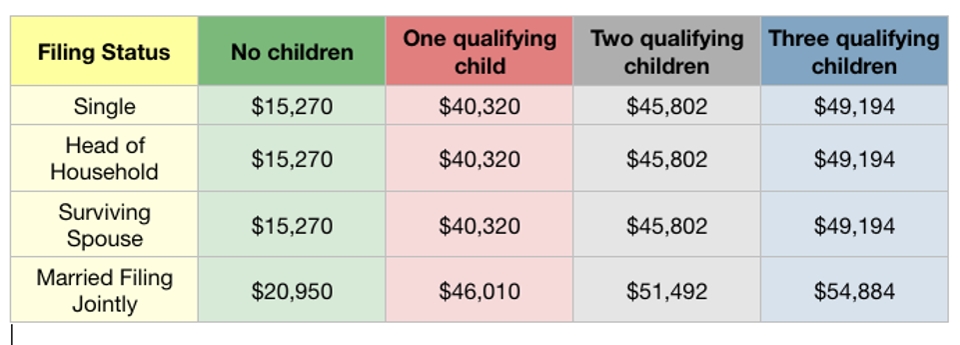

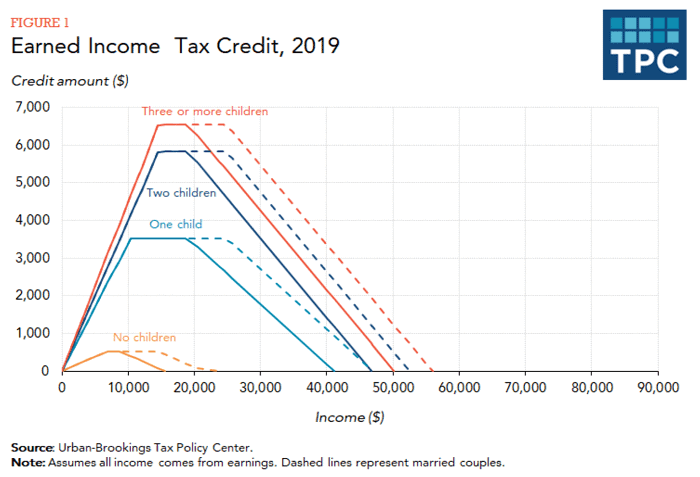

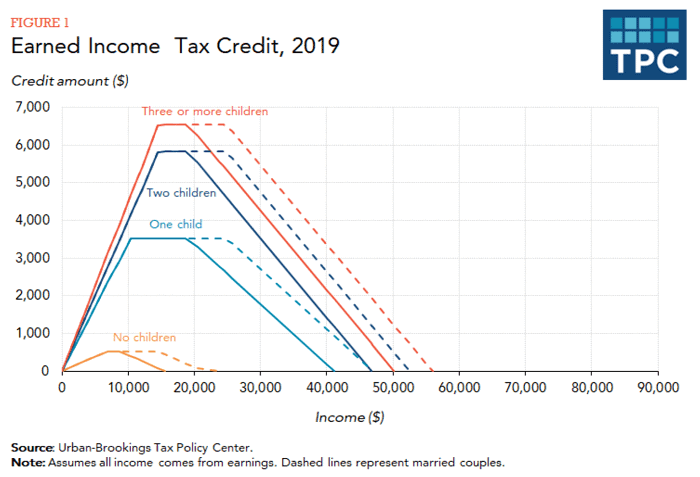

The Earned Income Tax Credit and the Child Tax Credit are both programs designed to help alleviate poverty but there are key differences The EITC is a credit available to employed low income households Even if you do not normally file a tax return you may qualify for a tax break by claiming the Child Tax Credit Your eligibility depends on your income the child s age how you are related to the child and other factors

The Child Tax Credit CTC is designed to give an income boost to the parents or guardians of children and other dependents This credit applies to dependents who are 17 or younger as of the last day of the tax year For the 2024 tax year tax returns filed in 2025 the child tax credit will be worth 2 000 per qualifying child with 1 700 being potentially refundable through the additional child tax

Download Child Tax Credit And Income

More picture related to Child Tax Credit And Income

Child Tax Credit 2023 What Are The Changes YouTube

https://i.ytimg.com/vi/jZkTfYSsaw8/maxresdefault.jpg

8 Photos Earned Income Credit Table 2019 And Review Alqu Blog

https://alquilercastilloshinchables.info/wp-content/uploads/2020/06/Taxes-From-A-To-Z-2019-E-Is-For-Earned-Income-Tax-Credit-EITC.png

What Do I Do If I Haven t Received Child Tax Credit In August

https://cdn.newswire.com/files/x/32/c9/0bc29c33e2af4d42f581fad9e660.png

The Child Tax Credit can significantly reduce your tax bill if you meet all seven requirements 1 age 2 relationship 3 support 4 dependent status 5 citizenship 6 length of residency and 7 family income You and or your child must pass all seven to claim this tax credit Child tax credit is a means tested benefit that tops up your income if you re a parent or responsible for a child however it is being replaced by Universal Credit Find out how much you could get in child tax credit in 2024 25 and how the payments work

The Child Tax Credit is a 2 000 per child tax benefit claimed by filing Form 1040 and attaching Schedule 8812 to the return To qualify for the credit the taxpayer s dependent must Unlike a tax deduction which reduces the amount of your income that is subjected to income tax child tax credit cut down your tax liability directly For example if you owe 5 500 of income tax to the government getting awarded 2 000 of the child tax credit will reduce your tax bill to 3 500

Your First Look At 2023 Tax Brackets Deductions And Credits 3

https://db0ip7zd23b50.cloudfront.net/dims4/default/aedfbe6/2147483647/resize/633x10000>/quality/90/?url=http:%2F%2Fbloomberg-bna-brightspot.s3.amazonaws.com%2Fae%2F00%2F2ce5bb3d4ec493a63ec4724e6e05%2Fd64957248d6c49ebb92ef34db2768c4e

Child Tax Credit CTC Update 2024

https://www.zrivo.com/wp-content/uploads/2022/10/Child-Tax-Credit-CTC-Update-Zrivo-Cover-1-1536x864.jpg

https://www.irs.gov/newsroom/child-tax-credit-most...

The American Rescue Plan raised the maximum Child Tax Credit in 2021 to 3 600 for children under the age of 6 and to 3 000 per child for children between ages 6 and 17 Before 2021 the credit was worth up to 2 000 per eligible child

https://www.irs.gov/credits-deductions/2021-child...

For tax year 2021 the Child Tax Credit increased from 2 000 per qualifying child to 3 600 for children ages 5 and under at the end of 2021 and 3 000 for children ages 6 through 17 at the end of 2021

Earned Income Tax Credit For Households With One Child 2023 Center

Your First Look At 2023 Tax Brackets Deductions And Credits 3

See The EIC Earned Income Credit Table Income Tax Return Income

Do You Have To Pay Back The Child Tax Credit In 2022 Leia Aqui Will

Advance Child Tax Credit Payments Start Today Cook Co News

Earned Income Tax Credit 2020 What You Need To Know

Earned Income Tax Credit 2020 What You Need To Know

What Is The Child Tax Credit And How Much Of It Is Refundable 2022

Publication 972 2020 Child Tax Credit And Credit For Other

What Is Child Tax Benefit

Child Tax Credit And Income - Even if you do not normally file a tax return you may qualify for a tax break by claiming the Child Tax Credit Your eligibility depends on your income the child s age how you are related to the child and other factors