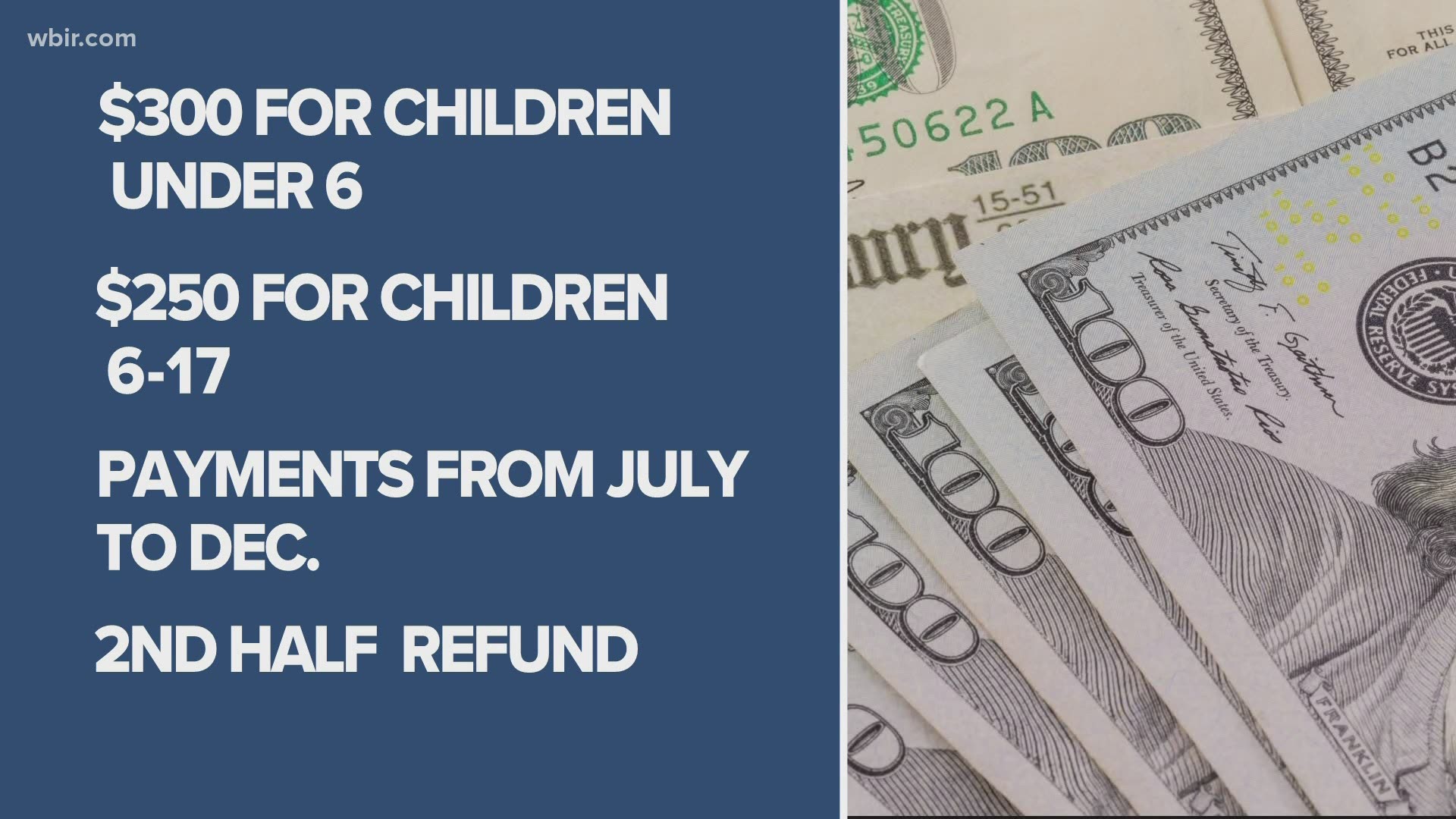

Child Tax Credit Nj NorthJersey 0 00 1 21 Starting July 15 eligible New Jersey families will begin to receive monthly checks of up to 300 per child a result of an expansion of the Child Tax

Information on how to claim the 2023 Child and Dependent Care Credit can be found on page 43 of the NJ 1040 Instructions The credit will reduce the amount of New Jersey Gross Income Tax a taxpayer owes and may result in a 18 million How much will I get Full time residents of the state with earnings of 30 000 or less will get 500 per qualifying child If you have earnings over 30 000 but not more than

Child Tax Credit Nj

Child Tax Credit Nj

https://townsquare.media/site/385/files/2022/01/attachment-RS34914_GettyImages-163352496.jpg?w=980&q=75

Monthly Child Tax Credit Payments Start Thursday Here s What To Know

https://www.courier-journal.com/gcdn/-mm-/a75b61cdf29c924e642301138dcb5b5b73c5e5d5/c=0-30-1998-1159/local/-/media/2018/01/31/Louisville/Louisville/636530052069237063-IMG-3796.jpg?width=1998&height=1129&fit=crop&format=pjpg&auto=webp

Shakopee MN Tax Preparer Shows How To Write Off Johnny s Soccer Camp

https://mendenaccounting.com/wp-content/uploads/2012/06/child-tax-credit-1-scaled.jpg

Beginning in Tax Year 2022 resident taxpayers with taxable income of 80 000 or less may qualify for a credit of a set amount for each child age 5 and under based on income The credit is available for all filing statuses except married filing separate View Child Tax Credit Page Employee Withholding The child tax credit program estimated to be a 100 million state revenue loss for FY 2023 is available to New Jersey taxpayers with incomes of up to 80 000 and is broken down as follows Resident households with an income of 30 000 or less will receive a refundable gross income tax credit of 500 for each child

Child tax credit of up to 500 available advocates say working families will benefit Credit OIT NJ Governor s Office Tracking tax credits Gov Phil Murphy A state level child tax credit worth up to 500 is available for the first time in New Jersey and Gov Phil Murphy and lawmakers have officially moved up its effective date New Jerseyans are expected to claim the credit for an estimated 374 000 dependent children according to the state fiscal analysis last week Of that group 180 700 dependent children are

Download Child Tax Credit Nj

More picture related to Child Tax Credit Nj

Child Tax Credits 2021 And 2022 What To Do If You Didn t Get Your

https://www.the-sun.com/wp-content/uploads/sites/6/2021/11/KB_COMP_child-tax-credit-ctc-2.jpg?strip=all&quality=100&w=1500&h=1000&crop=1

Taking A Stand For Children Through The Child Tax Credit Tax Credits

https://i0.wp.com/www.taxcreditsforworkersandfamilies.org/wp-content/uploads/2022/02/TCWF_knockout_horizontal.png?w=4439&ssl=1

Earned Income Tax Credit EITC Get My Payment IL

https://getmypaymentil.org/wp-content/uploads/2022/10/gmpil-website-poll-banner.jpg

The bill S3940 part of the state budget proposal Gov Phil Murphy laid out in February would increase the maximum credit for eligible families from 500 to 1 000 for each child under The proposal which was fast tracked in Trenton amid a chaotic budget season would create the New Jersey Child Tax Credit Program and give a refundable tax credit of up to 500 per

For those earning between 30 000 and 40 000 annually the credits totaled 400 those earning between 40 000 and 50 000 a total of 300 between 50 000 and 60 000 credits of 200 and those earning between 60 000 and 80 000 annually would be eligible for per child credits totaling 100 Under current law the state tax credits can be provided to those who care for a child under age 13 or a spouse or dependent who lived with the taxpayer for more than half the year and is physically or mentally incapable of self care

Child Tax Credit

https://hansonattorney.com/wp-content/uploads/2023/04/taxes-file-contains-taxation-reports-and-documents-SBI-300168771.jpg

Watch CBS Mornings Child Tax Credit Set To Expire Full Show On

https://thumbnails.cbsig.net/CBS_Production_News_VMS/2021/12/30/1988419651508/1230_CBSMORNINGS_BidenTaxCredit_Crawford_864649_1920x1080.jpg

https://www.northjersey.com/story/news/new-jersey/...

NorthJersey 0 00 1 21 Starting July 15 eligible New Jersey families will begin to receive monthly checks of up to 300 per child a result of an expansion of the Child Tax

https://www.nj.gov/treasury/taxation/depcarecred.shtml

Information on how to claim the 2023 Child and Dependent Care Credit can be found on page 43 of the NJ 1040 Instructions The credit will reduce the amount of New Jersey Gross Income Tax a taxpayer owes and may result in a

New Child Tax Credit Opens The Door For Old Scams

Child Tax Credit

Stimulus Check Update Here s How To Tell If You Qualify For The

The Child Tax Credit Is Coming Here s What To Expect From The IRS

Want The Child Tax Credit File Tax Form 1040 For 2019 By Wednesday B

The Child Tax Credit Proved Unrestricted Cash Keeps Families Out Of

The Child Tax Credit Proved Unrestricted Cash Keeps Families Out Of

Child Tax Credit Portal Now Open For Non filers How To Claim Up To

Child Tax Credit You Can Opt out Of Monthly Payment Soon Fox61

Month 2 Of Child Tax Credit Hits Bank Accounts AP News

Child Tax Credit Nj - The child tax credit program estimated to be a 100 million state revenue loss for FY 2023 is available to New Jersey taxpayers with incomes of up to 80 000 and is broken down as follows Resident households with an income of 30 000 or less will receive a refundable gross income tax credit of 500 for each child