Child Tax Credit Refundable 2021 If you are eligible for the Child Tax Credit but did not receive advance Child Tax Credit payments you can claim the full credit amount when you file your 2021 tax return during the 2022 tax filing season

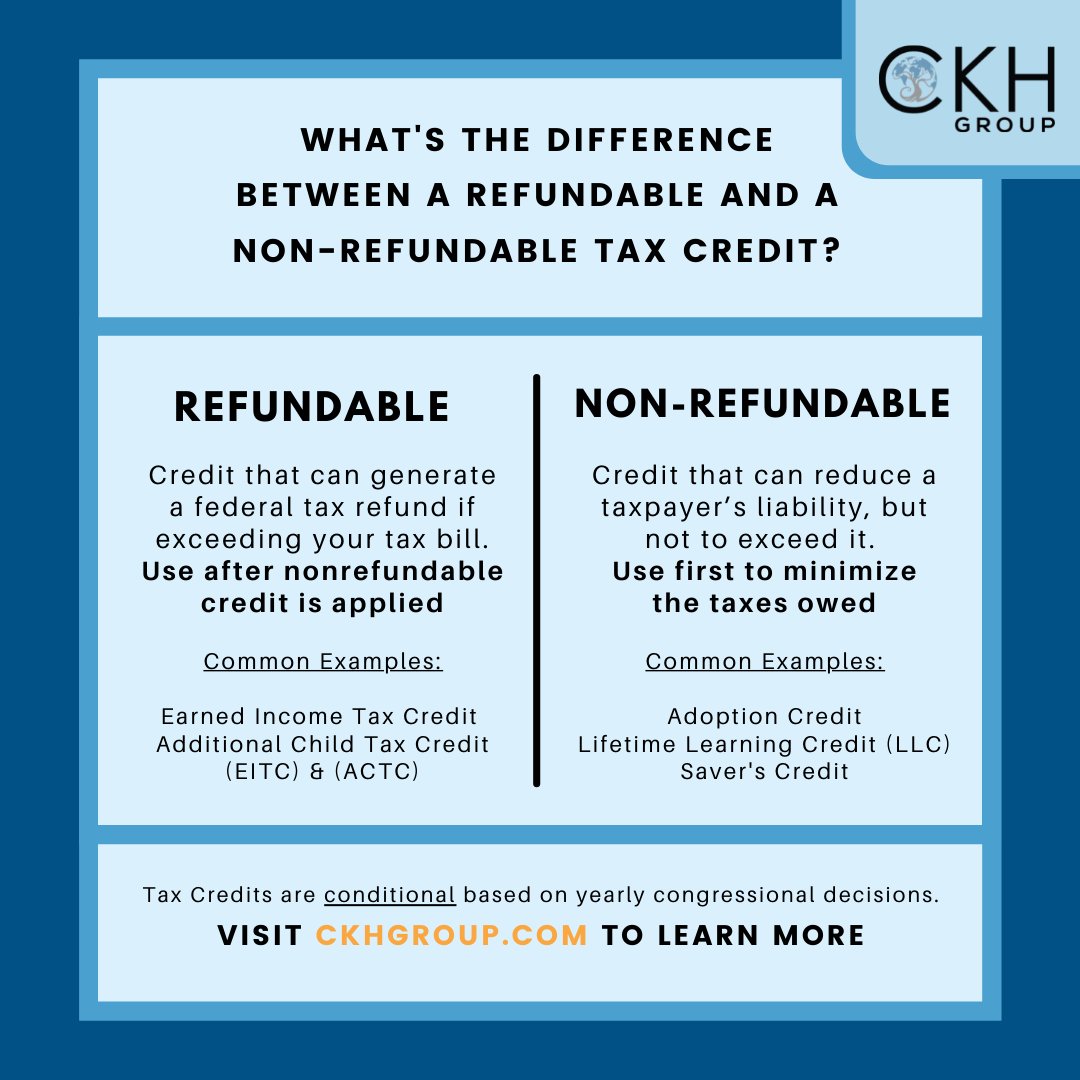

Note Refundable for 2021 only A refundable tax credit available to working families The credit amount depends on the taxpayer s earned income number of qualifying children and marital status Maximum Amount of Credit Maximum credit for 2021 is 3 600 per young child 0 5 years old 3 000 per older child 6 17 years old A10 Yes For 2021 the credit is refundable for eligible taxpayers This means that even if your credit exceeds the amount of Federal income tax that you owe you can still claim the full amount of your credit and the amount of the credit in excess of your tax liability can be refunded to you

Child Tax Credit Refundable 2021

Child Tax Credit Refundable 2021

https://lirp.cdn-website.com/md/pexels/dms3rep/multi/opt/pexels-photo-6863513-1920w.jpeg

The 2021 Child Tax Credit An Overview Letitia Berbaum

https://www.letitiaberbaum.com/wp-content/uploads/2022/11/07132022-scaled.jpg

Is There A Refundable Child Tax Credit For 2023 Leia Aqui How Much Is

https://pbs.twimg.com/media/FMICWgDXsAYhCqs.jpg

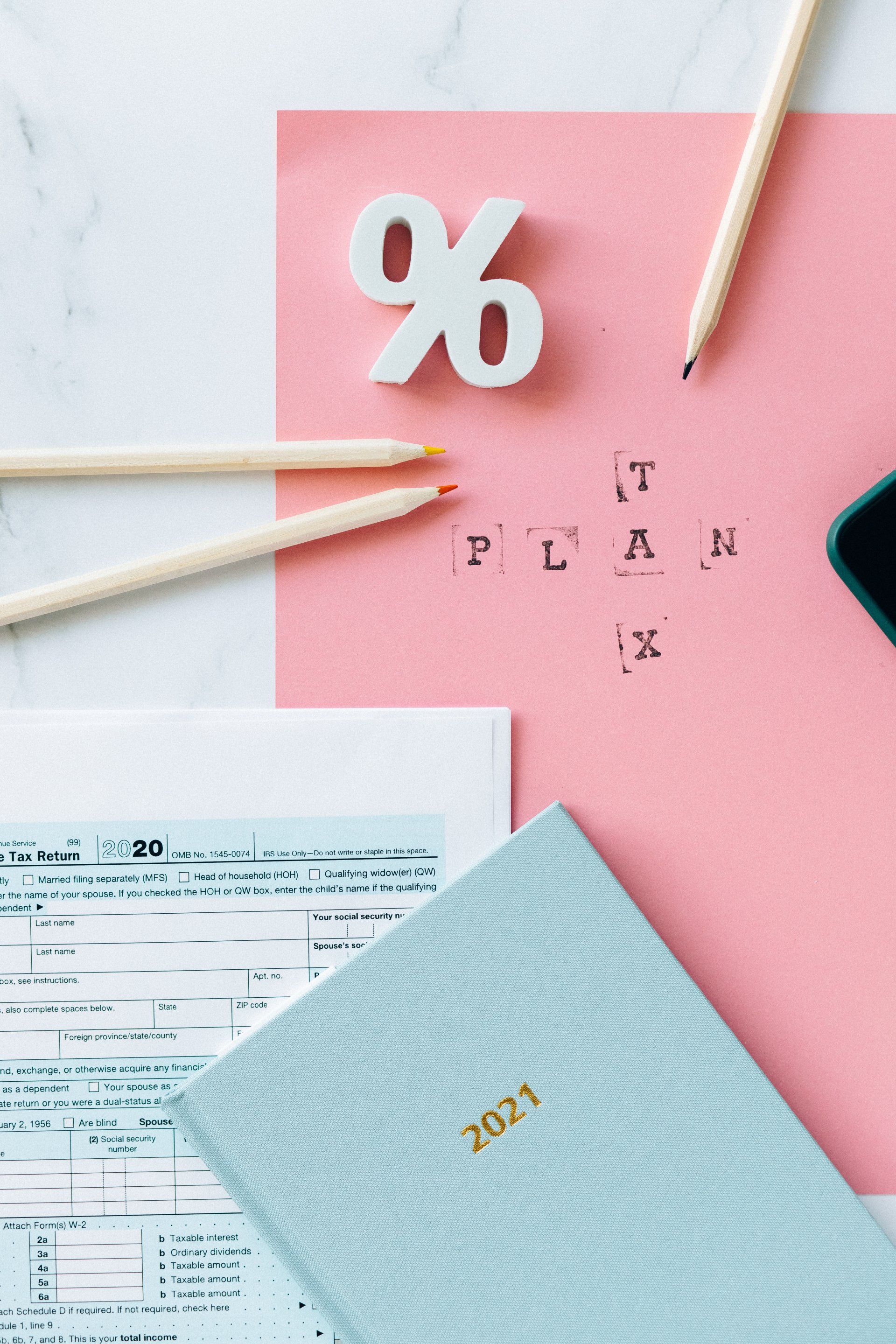

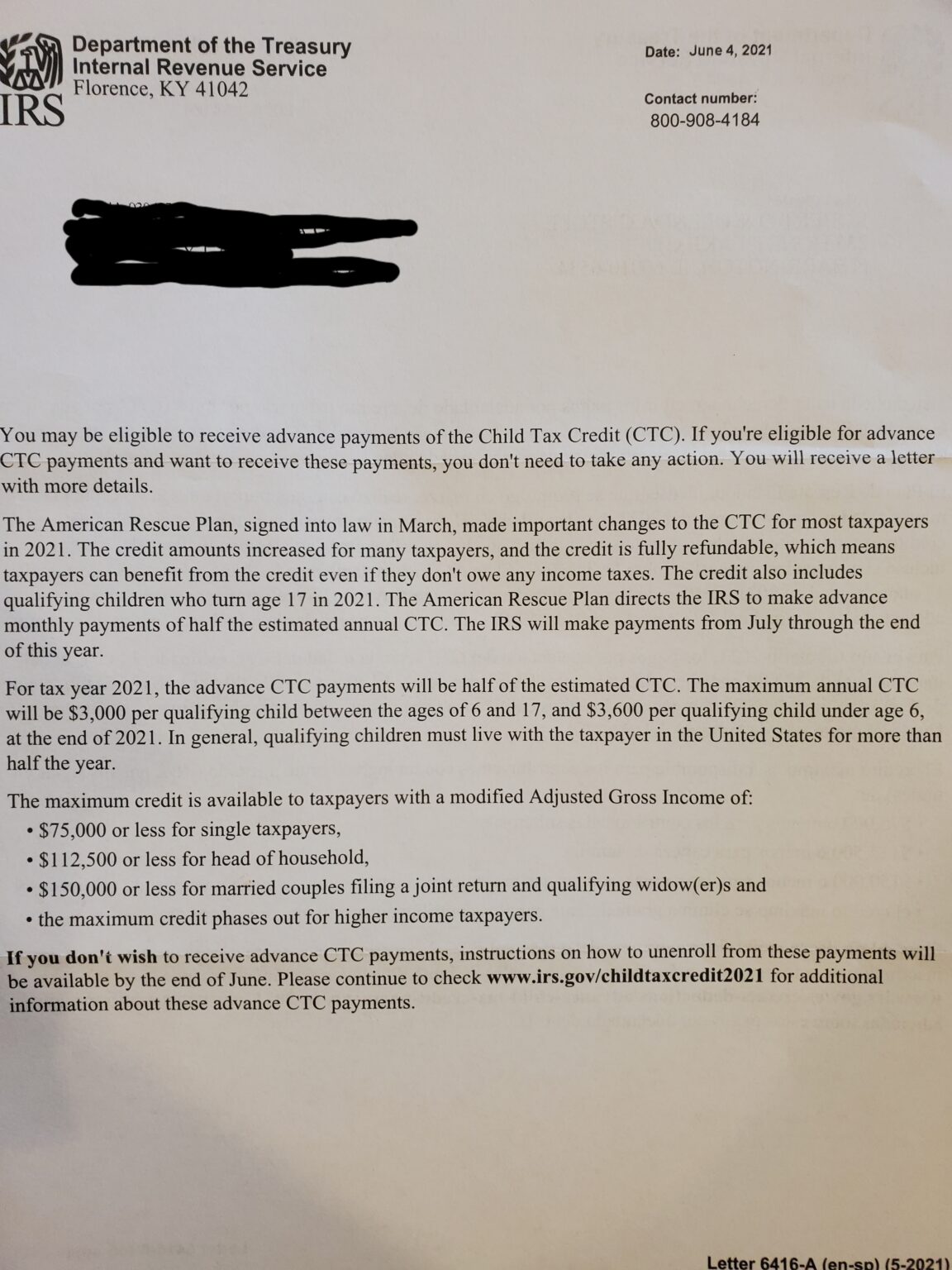

The American Rescue Plan only guarantees the increased amounts for the 2021 tax year so unless Congress makes them permanent they will revert in 2022 to the previous rules of 2 000 per child with up to 1 500 of that amount being refundable Likewise the advance payments will only apply to 2021 Children under 6 3 600 for each child split among six monthly payments of 300 per qualifying child and then 1 800 claimed on your 2021 tax return Children 6 to 17 3 000 for

In the tax year 2021 under the new provisions families are set to receive a 3 000 annual benefit per child ages 6 to 17 and 3 600 per child under 6 The credit will also be fully US Census Bureau The Impact of the 2021 Expanded Child Tax Credit on Child Poverty Internal Revenue Service Resources and Guidance for Puerto Rico families that may qualify for the Child

Download Child Tax Credit Refundable 2021

More picture related to Child Tax Credit Refundable 2021

2022 Child Tax Credit Refundable Amount Latest News Update

https://i2.wp.com/www.taxpolicycenter.org/sites/default/files/model-estimates/images/T05-0195.gif

Child Tax Credit 2021 Income Limit Latrina Julian

https://static01.nyt.com/images/2021/06/25/business/25Adviser-illo/25Adviser-illo-superJumbo.jpg

See The EIC Earned Income Credit Table Income Tax Return Income

https://i.pinimg.com/originals/aa/af/be/aaafbed0a4b639f5c32ede742b5dd17b.png

Eligible families will receive a payment of up to 300 per month for each child under age 6 and up to 250 per month for each child age 6 and above The American Rescue Plan increased the maximum Child Tax Credit in 2021 to 3 600 for children under the age of 6 and to 3 000 per child for children between ages 6 and 17 For the 2024 tax year tax returns filed in 2025 the child tax credit will be worth 2 000 per qualifying child with 1 700 being potentially refundable through the additional

Expanded Child Tax Credit Leads to Further Decline in Child Poverty Rates in August 2021 To evaluate the actual employment effects of the expanded CTC we use two large national datasets to investigate whether there is any evidence that the initial child payments led to reductions in employment Resources Use these additional resources to stay informed about refundable credits and how to claim them Where s My Refund Get the status of your refund News and Updates for Paid Preparers Learn the rules to properly prepare refundable credit claims Divorced and Separated Parents Help divorced or separated parents claim the EITC

2021 Advanced Child Tax Credit What It Means For Your Family

https://financialdesignstudio.com/wp-content/uploads/2021/06/Child-Tax-Credit-IRS-Letter-1152x1536.jpeg

New 2021 IRS Income Tax Brackets And Phaseouts

https://specials-images.forbesimg.com/imageserve/5f9efb6cca80f05baa42a4a2/960x0.jpg?fit=scale

https://www.irs.gov/credits-deductions/2021-child...

If you are eligible for the Child Tax Credit but did not receive advance Child Tax Credit payments you can claim the full credit amount when you file your 2021 tax return during the 2022 tax filing season

https://crsreports.congress.gov/product/pdf/IF/IF12025

Note Refundable for 2021 only A refundable tax credit available to working families The credit amount depends on the taxpayer s earned income number of qualifying children and marital status Maximum Amount of Credit Maximum credit for 2021 is 3 600 per young child 0 5 years old 3 000 per older child 6 17 years old

Taking A Stand For Children Through The Child Tax Credit Tax Credits

2021 Advanced Child Tax Credit What It Means For Your Family

The 2021 Child Tax Credit Explained Alron Enterprises Inc

Do You Have To Pay Back The Child Tax Credit In 2022 Leia Aqui Will

2021 Child Tax Credit And Payments What Your Family Needs To Know

Monthly Child Tax Credit Payments Understand The Options Articles

Monthly Child Tax Credit Payments Understand The Options Articles

2022 Education Tax Credits Are You Eligible

Understanding Child Tax Credit Is It Refundable Or Nonrefundable

Did The Child Tax Credit Change For 2023 What You Need To Know

Child Tax Credit Refundable 2021 - In the tax year 2021 under the new provisions families are set to receive a 3 000 annual benefit per child ages 6 to 17 and 3 600 per child under 6 The credit will also be fully