Child Tax Credit Vs Child Tax Rebate Web 11 mars 2023 nbsp 0183 32 The Child Tax Credit lowers taxpayers total taxes owed on a dollar for dollar basis That s better than a tax deduction which reduces total taxable income and generally results in smaller

Web Overview You can only make a claim for Child Tax Credit if you already get Working Tax Credit If you cannot apply for Child Tax Credit you can apply for Universal Credit Web If you qualify for the Child Tax Credit you may also qualify for these tax credits Child and Dependent Care Credit Earned Income Tax Credit Adoption Credit and Adoption

Child Tax Credit Vs Child Tax Rebate

Child Tax Credit Vs Child Tax Rebate

https://psmag.com/.image/t_share/MTUyMDk2MjcxMzI1MjEwNTA2/child-tax-credit-1.png

How The 2021 Child Tax Credits Work Updated June 21st 2021 The

https://s3.amazonaws.com/tleweb/wp-content/uploads/2021/03/16173037/Changes-to-the-Child-Tax-Credit.png

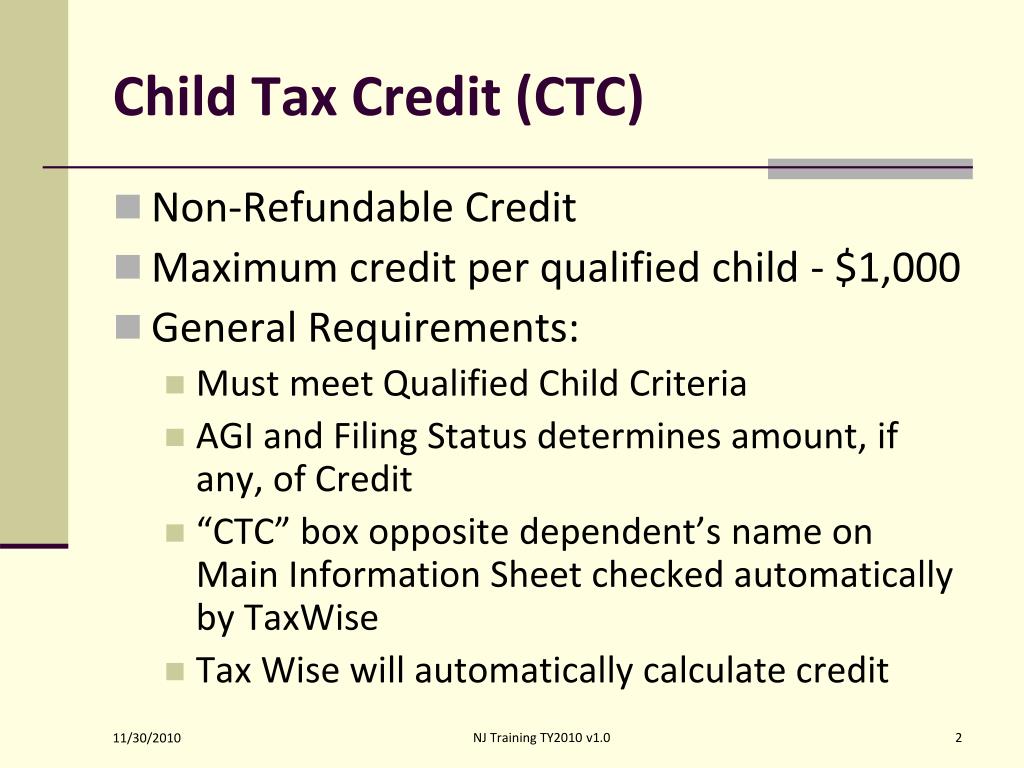

PPT Child Tax Credits Non Refundable Additional CTC Refundable

https://image3.slideserve.com/6676679/child-tax-credit-ctc-l.jpg

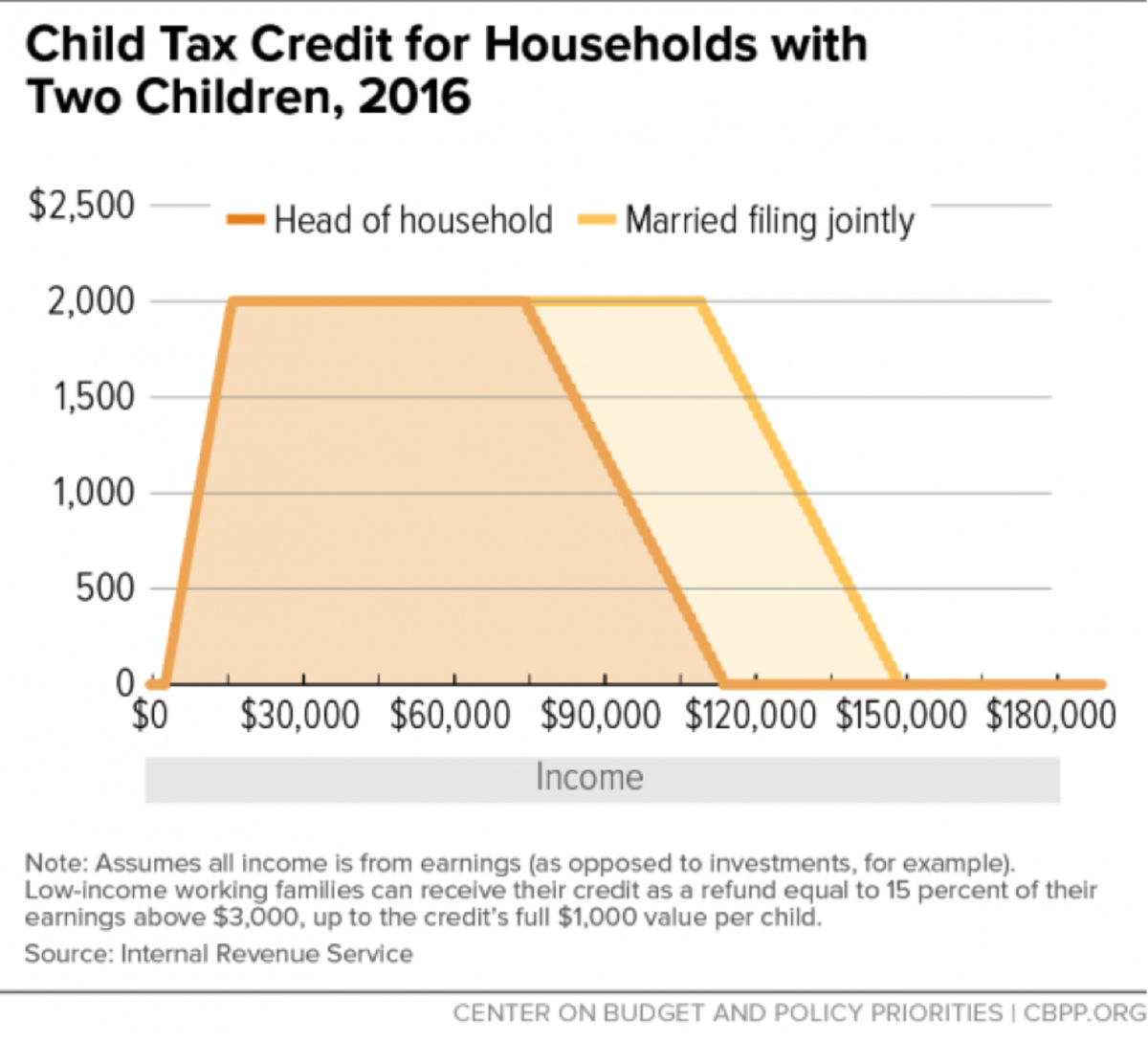

Web 17 janv 2023 nbsp 0183 32 Answer For 2022 the child tax credit is 2 000 per kid under the age of 17 claimed as a dependent on your return The child has to be related to you and generally live with you for at Web 18 mai 2021 nbsp 0183 32 The advance child tax credit program is part of the Biden administration s 1 9 trillion economic aid package called the American Rescue Plan that was passed in March

Web 7 janv 2022 nbsp 0183 32 A quick refresher Congress temporarily expanded the child tax credit for the 2021 tax year It made the credit more generous providing as much as 3 600 per child up from 2 000 And because it Web 17 ao 251 t 2023 nbsp 0183 32 For 2023 the child tax credit is worth 2 000 per qualifying dependent child if your modified adjusted gross income is 400 000 or below married filing jointly or 200 000 or below all

Download Child Tax Credit Vs Child Tax Rebate

More picture related to Child Tax Credit Vs Child Tax Rebate

The American Families Plan Too Many Tax Credits For Children Brookings

https://i2.wp.com/www.brookings.edu/wp-content/uploads/2021/05/CDCTC-chart-2.png

Child Tax Credit 2021 Amount Tereasa Sikes

https://i.pinimg.com/736x/9f/13/5e/9f135e8d89955e3dea41d76cd0ff4d6b.jpg

Why Opting Out Of Monthly Child Tax Credit Payments May Work For Some

https://www.cpabr.com/assets/htmlimages/Articles/child tax credit payments chart.JPG

Web 28 d 233 c 2021 nbsp 0183 32 And of particular importance for 2021 it explains How families who received advance child tax credit CTC payments will need to compare the total advance CTC Web 9 mars 2021 nbsp 0183 32 Under the current child tax credit if taxpayers credits exceed their taxes owed they only can get up to 1 400 as a refund But under the new rules they could

Web 5 f 233 vr 2022 nbsp 0183 32 The expanded child tax credit also introduced advance monthly payments Half of the money up to 300 per month per child was distributed to eligible families who didn t opt out using the IRS Web 31 janv 2022 nbsp 0183 32 Q A1 What is the 2021 Child Tax Credit added January 31 2022 Q A2 What is the amount of the Child Tax Credit for 2021 added January 31 2022 Q A3

Child Tax Credit Get Additional Tax Credit For Dependents

https://www.communitytax.com/wp-content/uploads/2019/06/CTC-1.png

Two Child Limit To Tax Credits Set To Drive Child Poverty Up By 10 By

https://i2.wp.com/policyinpractice.co.uk/wp-content/uploads/2017/04/Two-Child-Tax-Credit-table.png?resize=940%2C205

https://www.investopedia.com/terms/c/childta…

Web 11 mars 2023 nbsp 0183 32 The Child Tax Credit lowers taxpayers total taxes owed on a dollar for dollar basis That s better than a tax deduction which reduces total taxable income and generally results in smaller

https://www.gov.uk/child-tax-credit

Web Overview You can only make a claim for Child Tax Credit if you already get Working Tax Credit If you cannot apply for Child Tax Credit you can apply for Universal Credit

What Is The Child Tax Credit And How Much Of It Is Refundable

Child Tax Credit Get Additional Tax Credit For Dependents

How Many Monthly Child Tax Credit Payments Were There Leia Aqui How

Child Tax Credits Calculator CALCULATORUK HJW

What Does US Expat Need To Know About Child Tax Credit

Child Tax Credit 2022 Tax Return 2022 VGH

Child Tax Credit 2022 Tax Return 2022 VGH

Who Gets Tax Credits Leia Aqui Who Gets Federal Tax Credits

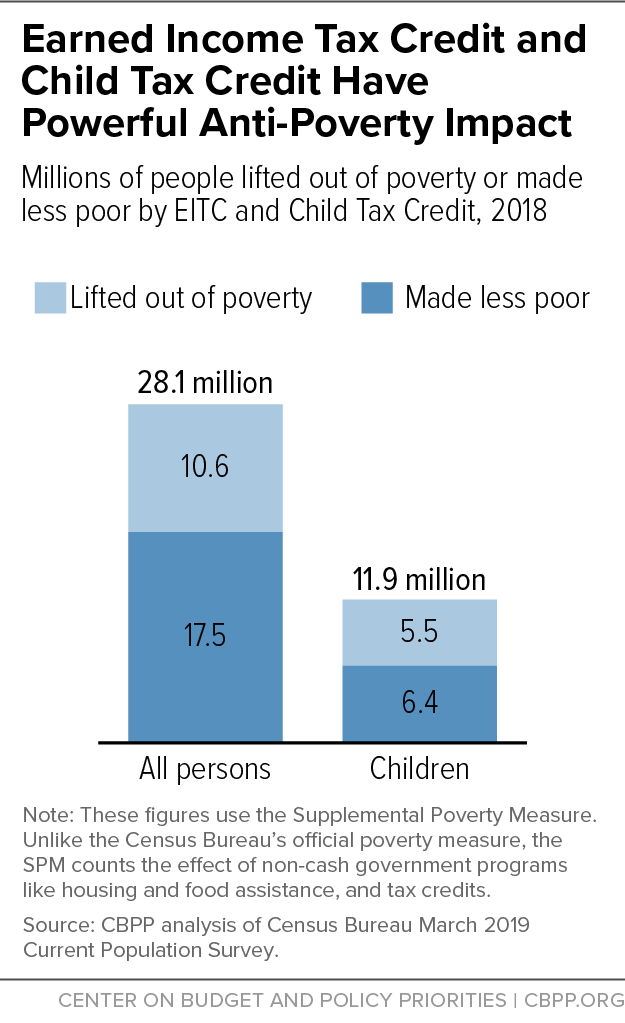

Earned Income Tax Credit And Child Tax Credit Have Powerful Anti

Child Tax Credit Worksheet Form 8812 Additional Child Tax Credit

Child Tax Credit Vs Child Tax Rebate - Web 17 janv 2023 nbsp 0183 32 Answer For 2022 the child tax credit is 2 000 per kid under the age of 17 claimed as a dependent on your return The child has to be related to you and generally live with you for at