Medical Expenses Rebate In Income Tax Web 17 juil 2019 nbsp 0183 32 Medical impairments are often crippling and involve huge medical expenditures The Income Tax Act provides a deduction in respect of these

Web 15 mars 2019 nbsp 0183 32 Section 80D of the Income tax Act allows you to save tax by claiming medical expenditures incurred as a deduction from income Web 12 juin 2020 nbsp 0183 32 In case of self financed medical expenses i e from own source there is no income to the person who has incurred expenses Hence the question of chargeability of tax does not arise Now the

Medical Expenses Rebate In Income Tax

Medical Expenses Rebate In Income Tax

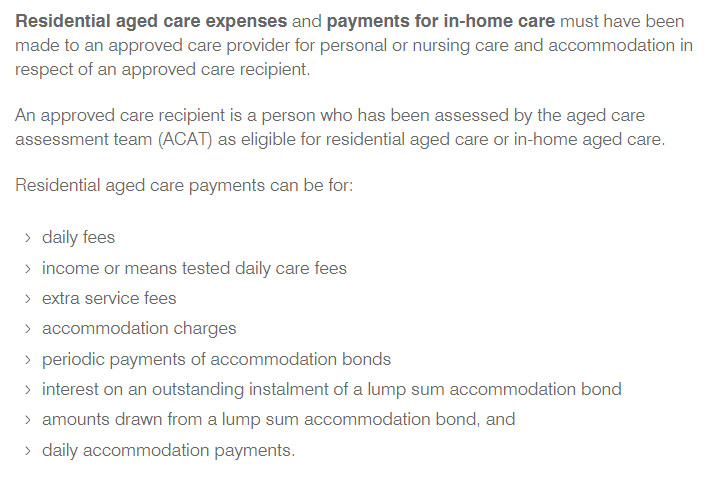

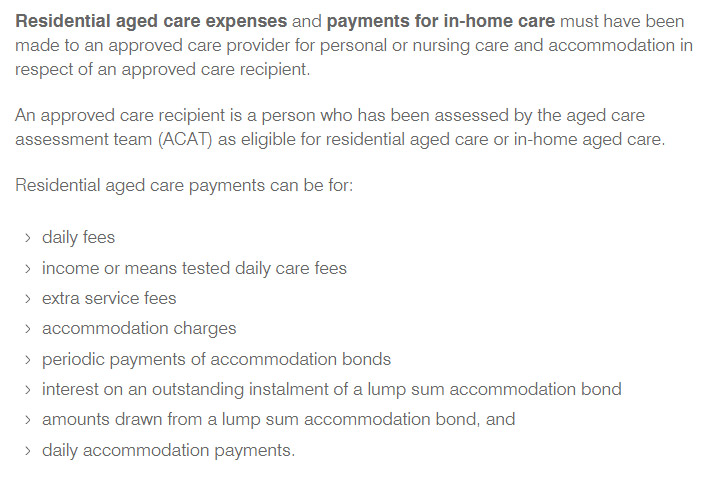

https://daughterlycare.com.au/wp-content/uploads/2019/07/medical-expense-payments.jpg

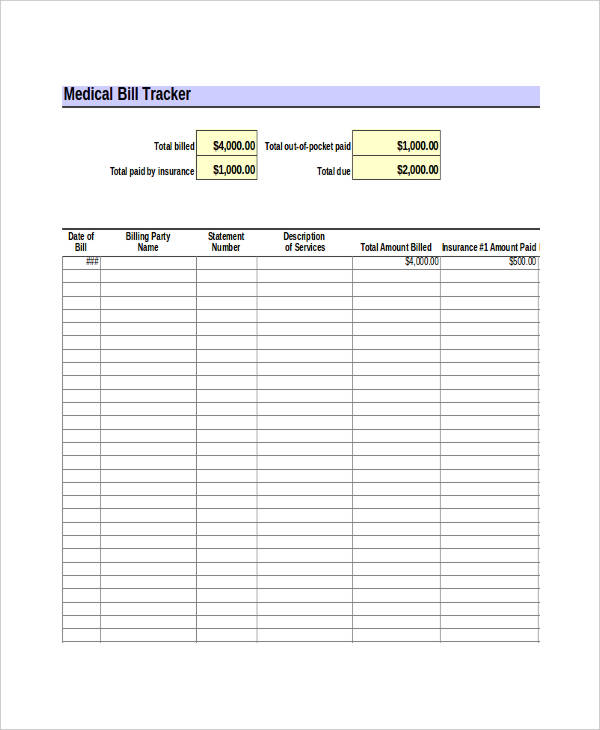

33 Expense Sheet Templates

https://images.template.net/wp-content/uploads/2017/06/Excel-Medical-Expense-Sheet.jpg

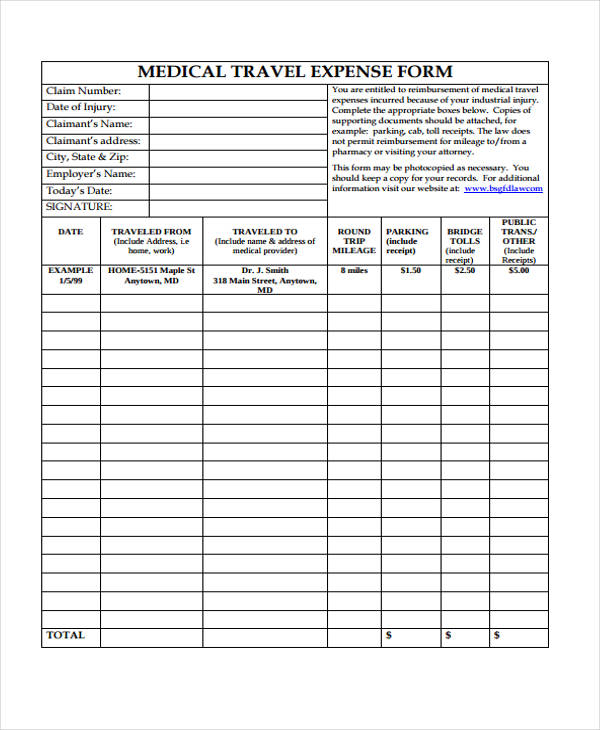

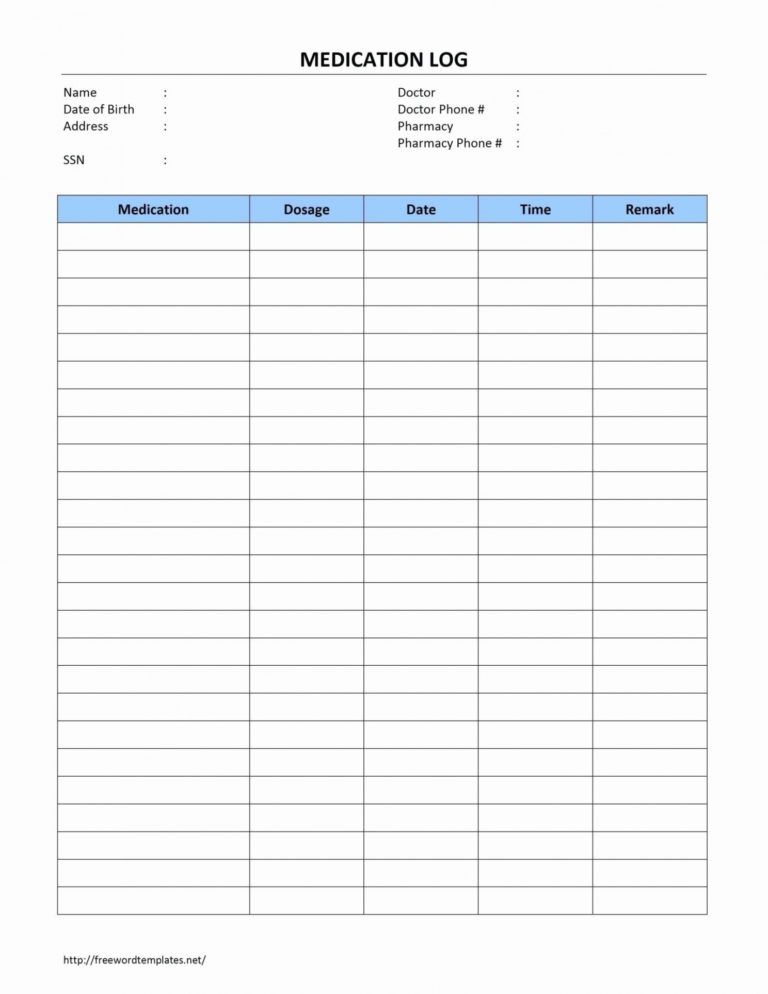

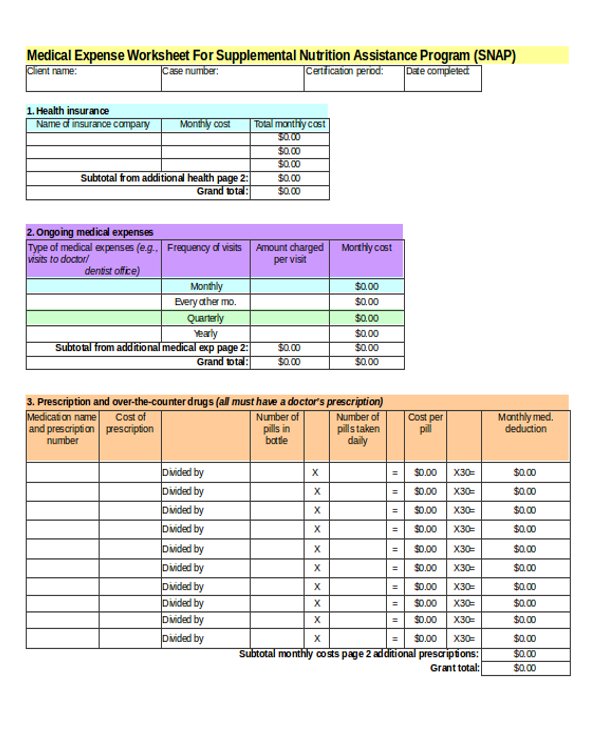

FREE 11 Medical Expense Forms In PDF MS Word

https://images.sampleforms.com/wp-content/uploads/2017/04/Medical-Travel-Expense-Form.jpg

Web 21 f 233 vr 2022 nbsp 0183 32 Section 80D of Income Tax Act allows deduction of up to Rs 50 000 for medical expenses incurred for senior citizens self Web 24 oct 2022 nbsp 0183 32 For this section the medical expenses that you can claim for serious diseases include the treatment of Acquired Immune Deficiency Syndrome AIDS

Web 16 nov 2022 nbsp 0183 32 Additional Medical Expenses Tax Credit What s new 3 October 2022 Invitation to webinar on Allowable Medical Expenses During this year SARS started Web 22 f 233 vr 2023 nbsp 0183 32 A Medical Scheme Fees Tax Credit also known as an MTC is a rebate which in itself is non refundable but which is used to reduce the normal tax a person

Download Medical Expenses Rebate In Income Tax

More picture related to Medical Expenses Rebate In Income Tax

Section 80D Tax Benefits Health Or Mediclaim Insurance FY 2017 18

http://www.relakhs.com/wp-content/uploads/2014/11/Medical-allowance-form-16.jpg

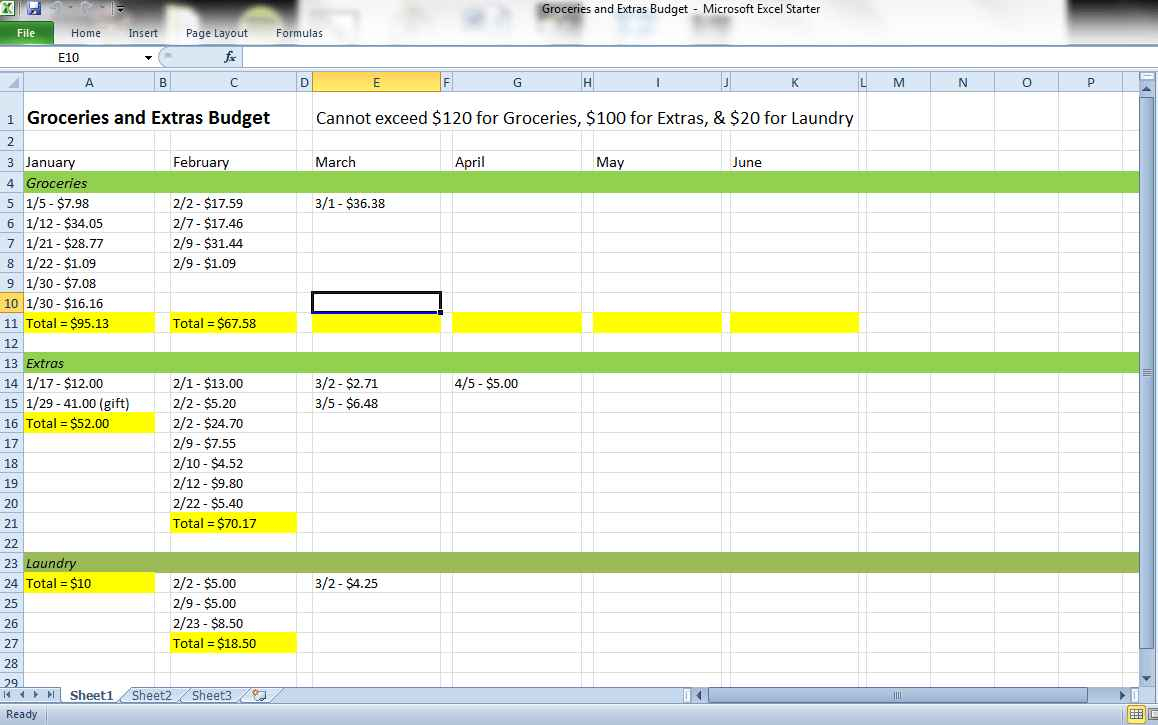

Keep Track Of Medical Expenses Spreadsheet Regarding Track Expenses And

https://db-excel.com/wp-content/uploads/2019/01/keep-track-of-medical-expenses-spreadsheet-regarding-track-expenses-and-keep-track-of-medical-expenses-spreadsheet.jpg

Printable Excel Spreadsheet For Medical Expenses To Track Template

https://wssufoundation.org/wp-content/uploads/2020/12/printable-excel-spreadsheet-for-medical-expenses-to-track-template-medical-expense-log-template-doc-768x994.jpg

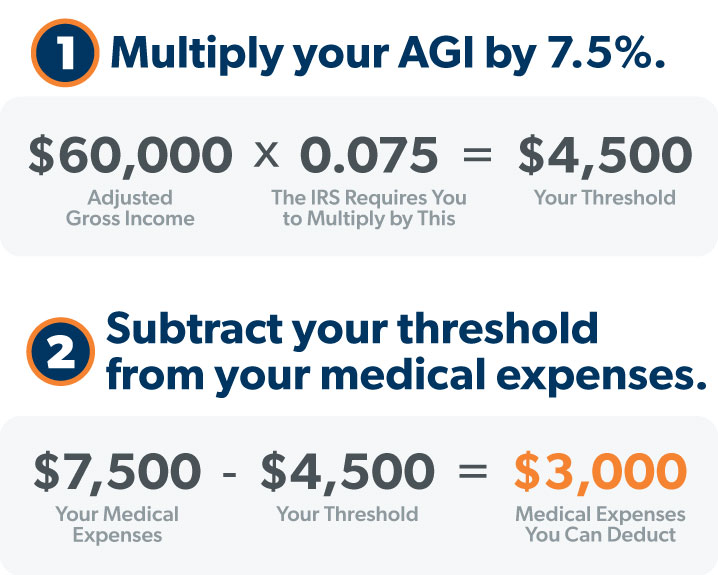

Web 12 f 233 vr 2023 nbsp 0183 32 Key Takeaways In 2022 the IRS allows all taxpayers to deduct their qualified unreimbursed medical care expenses that exceed 7 5 of their adjusted gross income You must itemize your Web 8 oct 2021 nbsp 0183 32 An FSA lets you set aside before tax money up to a certain amount with which to pay out of pocket medical expenses FSA contribution limits are 2 750 for 2020 and 2021 FSA contribution limits

Web 13 f 233 vr 2020 nbsp 0183 32 Income Tax Deduction for Medical Expenses Last updated February 13th 2020 05 46 pm This article provides a list of all income tax deductions and other Web 12 ao 251 t 2021 nbsp 0183 32 Prior to FY 2018 19 medical expenses upto Rs 15 000 was exempt from tax However the same has been withdrawn from FY 2018 19 onwards As a result any

National Budget Speech 2022 SimplePay Blog

https://www.simplepay.co.za/blog/assets/images/tax-rate-tables.png

Can I Deduct Medical Expenses Ramsey

https://cdn.ramseysolutions.net/media/blog/taxes/personal-taxes/can-i-deduct-medical-expenses.jpg

https://tax2win.in/guide/section-80ddb

Web 17 juil 2019 nbsp 0183 32 Medical impairments are often crippling and involve huge medical expenditures The Income Tax Act provides a deduction in respect of these

https://economictimes.indiatimes.com/wealth/t…

Web 15 mars 2019 nbsp 0183 32 Section 80D of the Income tax Act allows you to save tax by claiming medical expenditures incurred as a deduction from income

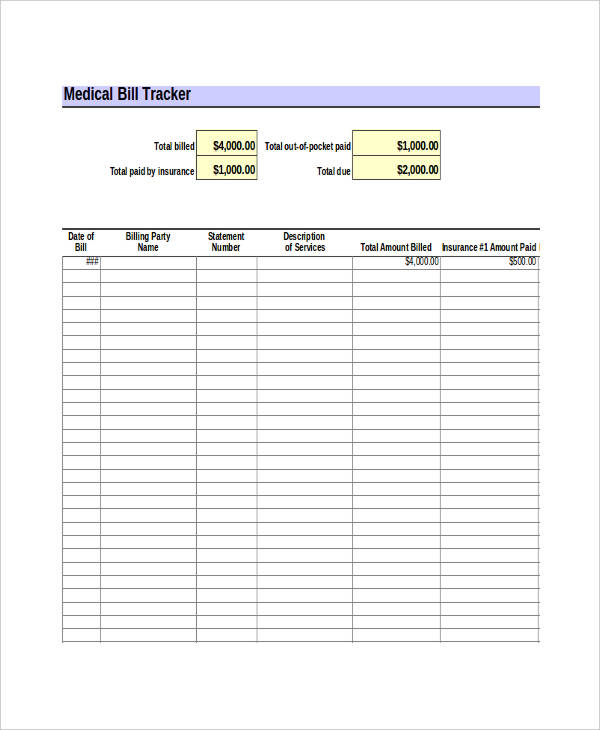

10 Patient Medical Bill Tracker Sample Excel Templates

National Budget Speech 2022 SimplePay Blog

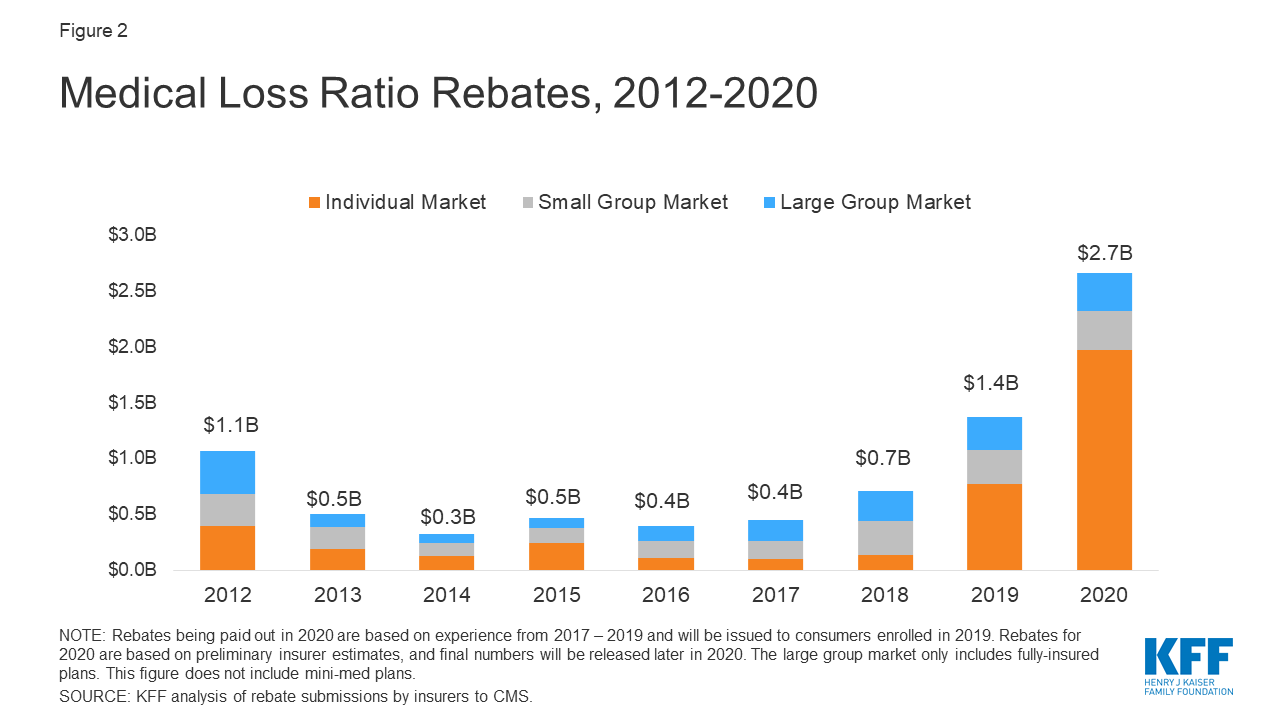

Data Note 2020 Medical Loss Ratio Rebates KFF

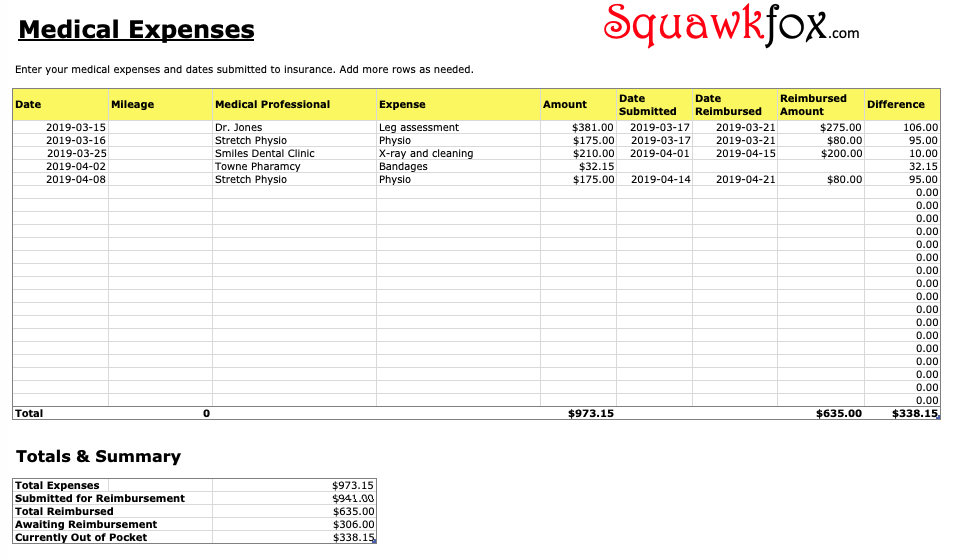

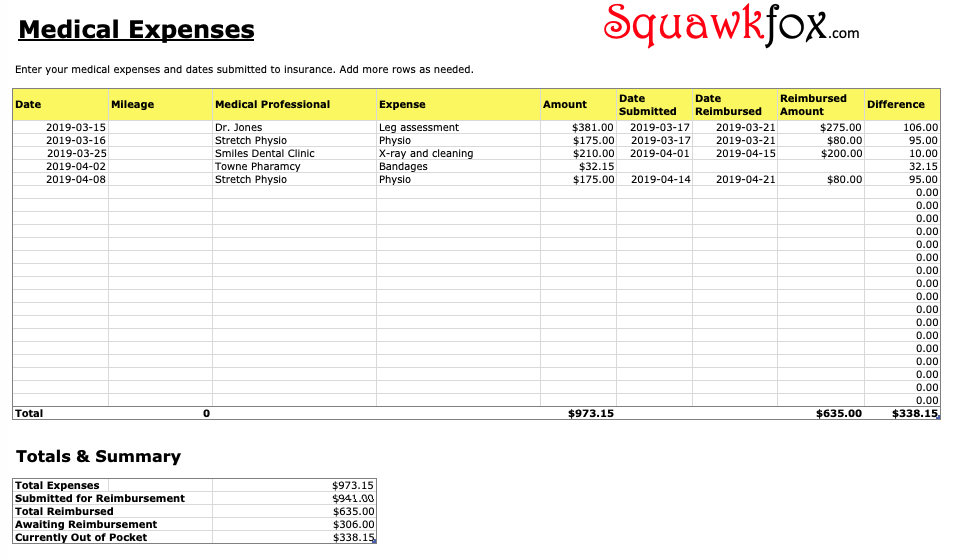

EXCEL TEMPLATES Medical Bill Tracker Template

Reba Dixon Is A Fifth grade School Teacher Who Earned A Salary Of

Medical Expense Template Megiaaume

Medical Expense Template Megiaaume

22 Sample Sheets In Excel

Income Tax Rebate U s 87A For A Y 2017 18 F Y 2016 17

16 Travel Budget Worksheet Excel Templates Worksheeto

Medical Expenses Rebate In Income Tax - Web 22 f 233 vr 2023 nbsp 0183 32 A Medical Scheme Fees Tax Credit also known as an MTC is a rebate which in itself is non refundable but which is used to reduce the normal tax a person