Child Tax Credit Wisconsin 2022 FEDERAL CHILD TAX CREDIT You may be eligible to receive up to 3 000 per dependent child aged 6 17 and 3 600 per child younger than 6 This tax credit directly

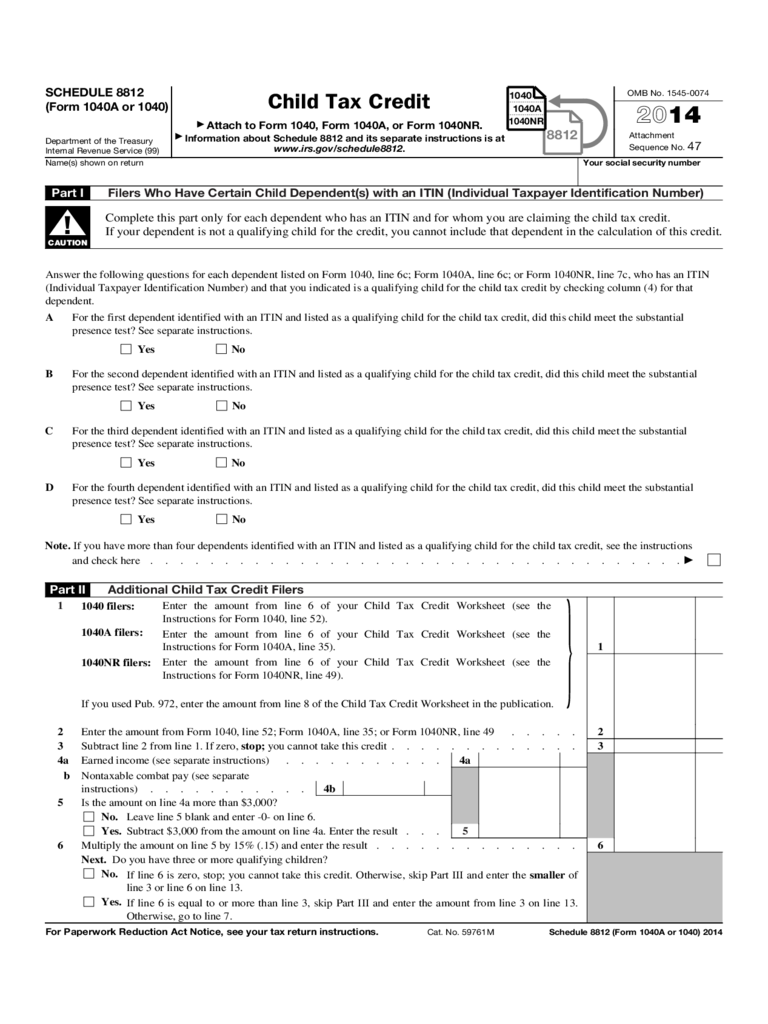

You can claim the Child Tax Credit by entering your children and other dependents on Form 1040 U S Individual Income Tax Return and attaching a completed Schedule A qualifying child is your child step child grandchild niece nephew sibling or authorized foster child For the EiTC children must be under 19 at the end of 2022 or under 24 if

Child Tax Credit Wisconsin 2022

Child Tax Credit Wisconsin 2022

https://phantom-marca.unidadeditorial.es/988259e034d1160741cebb5cc94b0719/resize/1320/f/jpg/assets/multimedia/imagenes/2021/12/18/16398410536614.jpg

2023 Child Tax Credits Form Fillable Printable PDF Forms Handypdf

https://handypdf.com/resources/formfile/images/fb/source_images/child-tax-credits-form-irs-d1.png

What Is The New Child Tax Credit For 2022 A2022c

https://i2.wp.com/www.taxuni.com/wp-content/uploads/2021/06/enhanced-child-tax-credit-2022.jpg

Federal child and dependent care tax credit means the tax credit under section 21 of the Internal Revenue Code The credit must be claimed within 4 years of the unextended The American Rescue Plan raised the maximum Child Tax Credit in 2021 to 3 600 for children under the age of 6 and to 3 000 per child for children between ages 6 and 17

1 Who s Eligible Families whose adjusted gross income was at 150 000 or below for married couples or 75 000 for single filer parents are eligible for the credit 2 You The Wisconsin earned income credit is a special tax benefit for certain working families with at least one qualifying child The earned income credit is refundable

Download Child Tax Credit Wisconsin 2022

More picture related to Child Tax Credit Wisconsin 2022

Child Tax Credit Payment Schedule 2022 Child Tax Credit Payment

https://i2.wp.com/www.taxpolicycenter.org/sites/default/files/model-estimates/images/T05-0195.gif

2022 Child Tax Credit Dates Latest News Update

https://i2.wp.com/images.sampleforms.com/wp-content/uploads/2016/10/Child-Tax-Credit-Form.jpg

Are They Doing Child Tax Credit Monthly Payments In 2022 Leia Aqui

https://www.washingtonpost.com/wp-apps/imrs.php?src=https://arc-anglerfish-washpost-prod-washpost.s3.amazonaws.com/public/IG4VLKSRLRHOTKMRJGUAYSGUEA.jpg&w=1200

Thanks to the ARP the vast majority of families in Wisconsin will receive 3 000 per child ages 6 17 years old and 3 600 per child under 6 as a result of the increased 2021 Child Gov Tony Evers signed a bill into law Monday that will expand the state s tax credit for child care expenses The move comes after the Democratic governor vetoed the rest of

The Child Tax Credit CTC is available to families with a qualifying child Working families may be eligible for up to the maximum federal tax credit of 3 000 per dependent child The new law which Evers signed March 4 expands the state credit called Child and Dependent Care Expenses Tax Credit so that in many cases it will surpass its federal

What To Know About The New Monthly Child Tax Credit Payments

https://www.pgpf.org/sites/default/files/child-tax-credit-2021-chart.jpg

How Much Per Child Tax Credit 2022 A2022b

https://i2.wp.com/www.the-sun.com/wp-content/uploads/sites/6/2021/12/MP-CHILD-TAX-CREDIT-REG-COMP.jpg?strip=all&quality=100&w=1200&h=800&crop=1

https://www.dhs.wisconsin.gov/dms/memos/ops/dms...

FEDERAL CHILD TAX CREDIT You may be eligible to receive up to 3 000 per dependent child aged 6 17 and 3 600 per child younger than 6 This tax credit directly

https://www.irs.gov/credits-deductions/individuals/child-tax-credit

You can claim the Child Tax Credit by entering your children and other dependents on Form 1040 U S Individual Income Tax Return and attaching a completed Schedule

Mayor Duggan Addressed Detroiters July 12 About Importance Of Child Tax

What To Know About The New Monthly Child Tax Credit Payments

Child Tax Credit 2023 Changes Fill Online Printable Fillable Blank

Advance Child Tax Credit Payments Start Today Cook Co News

New Child Tax Credit Opens The Door For Old Scams

How Does The Advanced Child Tax Credit Work Leia Aqui Do You Have To

How Does The Advanced Child Tax Credit Work Leia Aqui Do You Have To

Child Tax Credit 2022 Brackets Latest News Update

CARTOON The Pre Election Child Tax Credit The Badger Project

Child Credit Tax Fill Online Printable Fillable Blank PdfFiller

Child Tax Credit Wisconsin 2022 - The Wisconsin earned income credit is a special tax benefit for certain working families with at least one qualifying child The earned income credit is refundable