Child Tax Rebate 2023 Status Web 1 ao 251 t 2023 nbsp 0183 32 Democrats seek a complete return of the expanded child tax credit from President Joe Biden s COVID 19 stimulus bill while Republicans are spearheading their

Web 6 d 233 c 2022 nbsp 0183 32 Will There Be an Expanded Child Tax Credit in 2023 The short answer is maybe Vox reporting suggests that Senate Democrats under the wire are trying to squeeze in a more modest expansion of Web Element Yearly amount The basic amount this is known as the family element Up to 163 545 For each child this is known as the child element Up to 163 3 235 For each

Child Tax Rebate 2023 Status

Child Tax Rebate 2023 Status

https://i0.wp.com/www.goodyearrebates.net/wp-content/uploads/2023/06/Goodyear-Rebate-Form-October-2023.jpg?resize=840%2C641&ssl=1

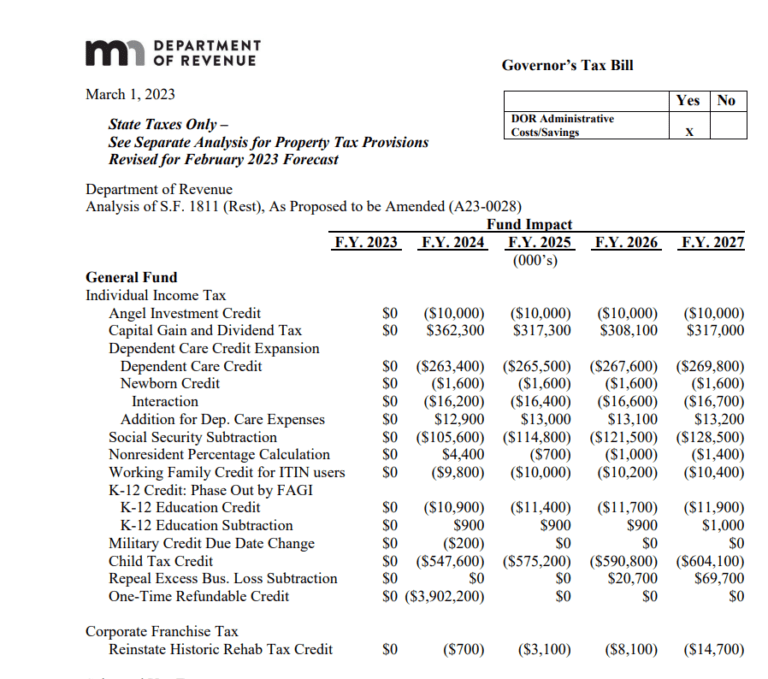

Minnesota Tax Rebate 2023 Your Comprehensive Guide Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2023/04/Minnesota-Tax-Rebate-2023-768x679.png

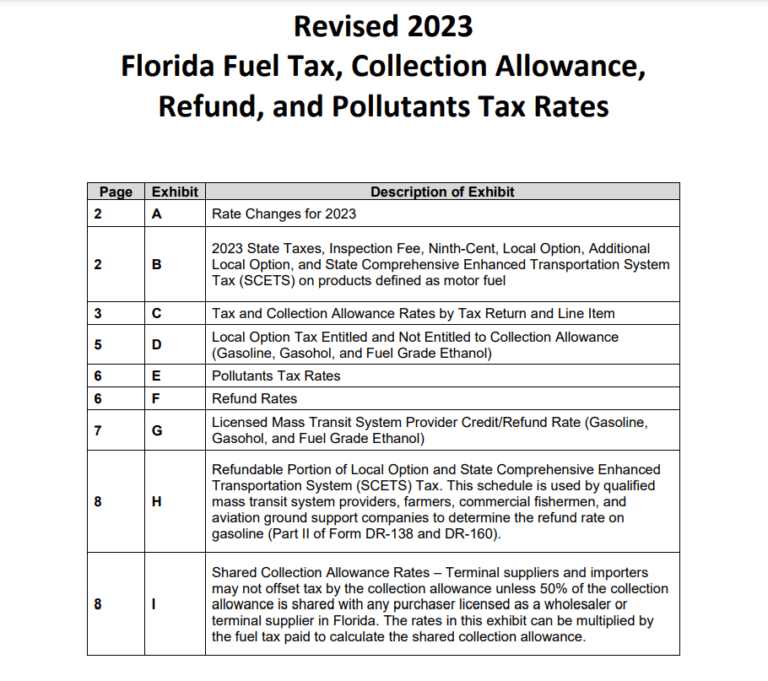

Florida Tax Rebate 2023 Get Tax Relief And Boost Economic Growth

https://printablerebateform.net/wp-content/uploads/2023/03/Florida-Tax-Rebate-2023-768x681.png

Web 5 f 233 vr 2023 nbsp 0183 32 For 2023 the maximum Child Tax Credit per qualifying child is 2 000 for children under 5 years old and 3 000 for children aged 6 to 17 It is important to note that the advance payment option available in Web 4 avr 2023 nbsp 0183 32 Families with eligible dependents including children under the age of 18 may be eligible for the Child Tax Rebate 2023 Eligibility is based on a number of factors

Web Child Tax Credit Comparison Key Features of the 2023 Child Tax Credit Maximum Credit Amount In 2023 the Child Tax Credit offers a maximum credit amount of 3 000 per qualifying child which is an increase from Web 27 juin 2023 nbsp 0183 32 After submitting your claim you can track the status of your rebate check by visiting the manufacturer s or retailer s website and then enter your tracking number or

Download Child Tax Rebate 2023 Status

More picture related to Child Tax Rebate 2023 Status

Ohio Tax Rebate 2023 Maximize Your Tax Savings Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2023/04/Ohio-Tax-Rebate-2023.png

Missouri State Tax Rebate 2023 Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2023/04/Missouri-Tax-Rebate-2023-768x587.png

Maine Tax Relief 2023 Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2023/04/Maine-Tax-Rebate-2023-768x690.png

Web 12 ao 251 t 2023 nbsp 0183 32 August 12 2023by tamble If you are looking for Ct Child Tax Rebate 2023 Status you ve come to the right place We have 35 rebates about Ct Child Tax Rebate Web Il y a 13 heures nbsp 0183 32 State stimulus check 2023 update Clarity from the IRS on so called state stimulus checks is essential because millions of taxpayers across the U S have

Web 16 nov 2022 nbsp 0183 32 The Child Tax Credit got a sizable boost in 2021 While that boost went away for 2022 lawmakers are still fighting to bring it back Check out our pick for Best Web 28 d 233 c 2022 nbsp 0183 32 For the 2022 tax year the Child Tax Credit CTC has returned to pre pandemic levels This means that the maximum credit will return to 2 000 per child

CT Families Should Begin Receiving Child Tax Rebates This Week

https://media.nbcconnecticut.com/2022/08/child-tax-rebate-news-conference.jpeg?quality=85&strip=all&resize=1200%2C675

Ct Rebate Check 2023 RebateCheck

https://i0.wp.com/www.rebatecheck.net/wp-content/uploads/2023/04/who-s-eligible-for-the-connecticut-child-tax-rebate.jpg

https://www.usatoday.com/story/news/politics/2023/08/01/revive...

Web 1 ao 251 t 2023 nbsp 0183 32 Democrats seek a complete return of the expanded child tax credit from President Joe Biden s COVID 19 stimulus bill while Republicans are spearheading their

https://www.fatherly.com/news/child-tax-credi…

Web 6 d 233 c 2022 nbsp 0183 32 Will There Be an Expanded Child Tax Credit in 2023 The short answer is maybe Vox reporting suggests that Senate Democrats under the wire are trying to squeeze in a more modest expansion of

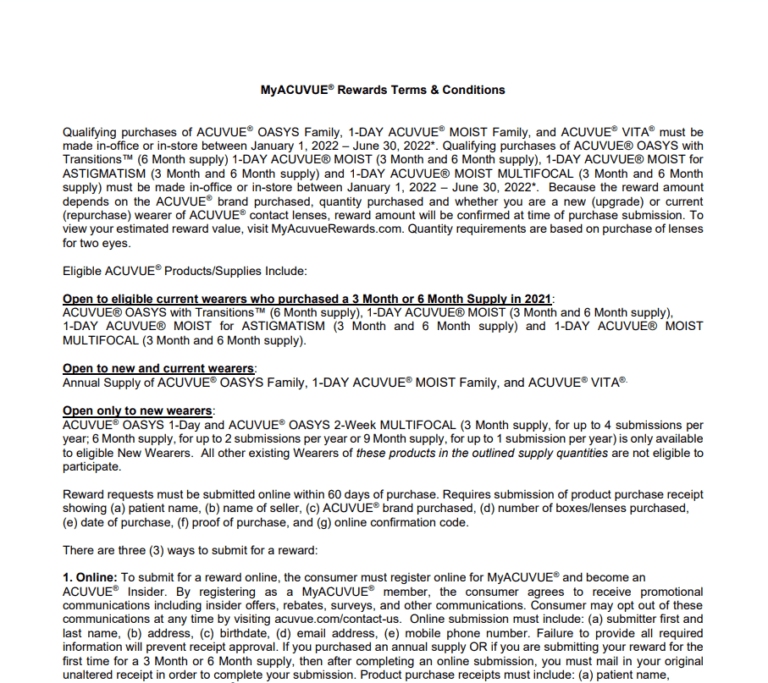

Acuvue Rebate 2023 Printable Rebate Form

CT Families Should Begin Receiving Child Tax Rebates This Week

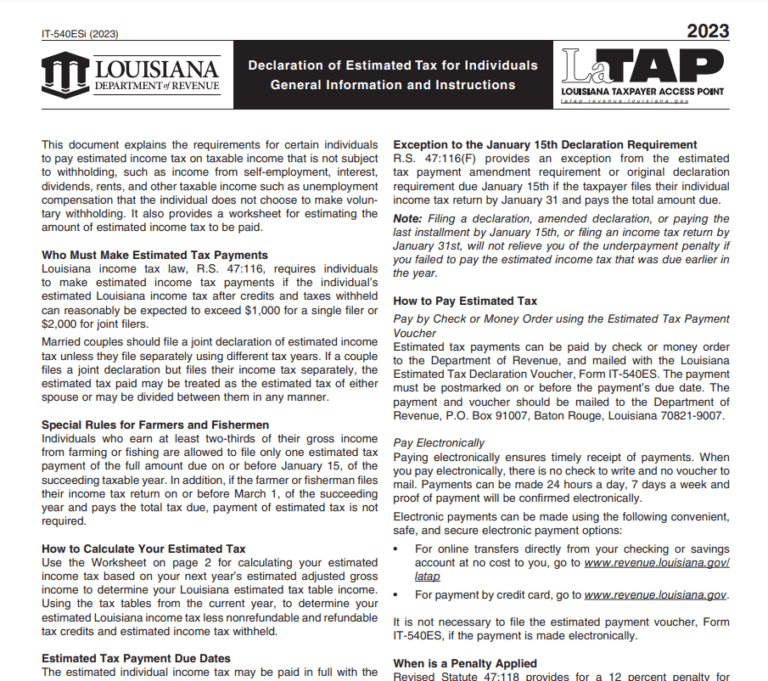

Louisiana Tax Credits 2023 Printable Rebate Form

Delaware Tax Rebate 2023 Printable Rebate Form

Are YOU Eligible For The CT Child Tax Rebate

Michigan Tax Rebate 2023 Eligibility Types Deadlines How To Claim

Michigan Tax Rebate 2023 Eligibility Types Deadlines How To Claim

Georgia Income Tax Rebate 2023 Printable Rebate Form

CT Child Tax Rebate 2023 Eligibility Claim Process Important Dates

Hawaii Rebate 2023 Printable Rebate Form

Child Tax Rebate 2023 Status - Web 24 ao 251 t 2023 nbsp 0183 32 You qualify for the full amount of the 2022 Child Tax Credit for each qualifying child if you meet all eligibility factors and your annual income is not more than