Child Tax Rebate 2023 Web 14 avr 2023 nbsp 0183 32 How much is the child tax credit in 2023 The maximum tax credit available per child has reverted to its pre expansion level of

Web 5 juil 2017 nbsp 0183 32 For 2023 the child tax credit is worth 2 000 per qualifying dependent child if your modified adjusted gross income is 400 000 or Web 15 ao 251 t 2023 nbsp 0183 32 Up to 1 600 of the credit is refundable in 2023 and the refundable portion is called the Additional Child Tax Credit ACTC The current design expires after 2025 at

Child Tax Rebate 2023

Child Tax Rebate 2023

https://www.freerebate.net/wp-content/uploads/2023/02/this-is-an-attachment-of-iowa-energy-rebates-printable-rebate-form-from-bayer-rebates-2023-post.png

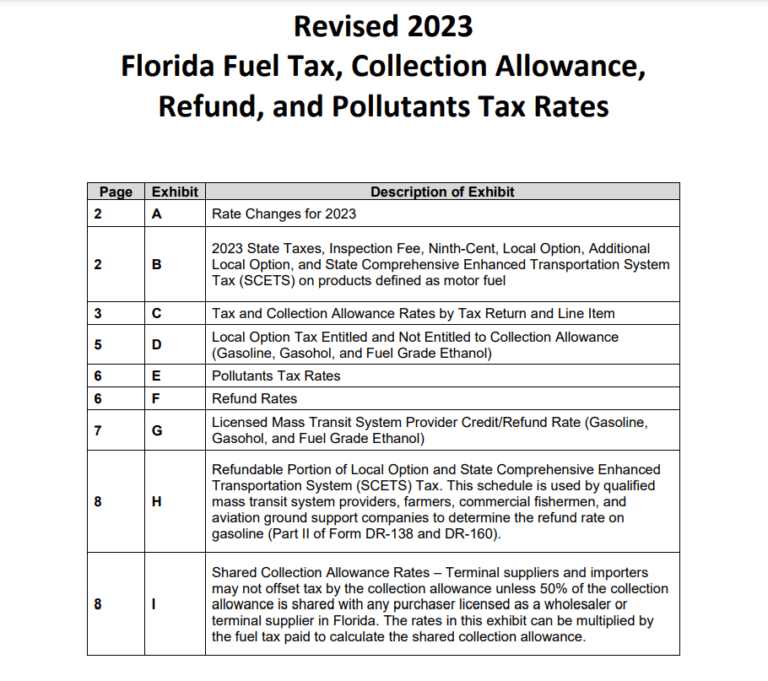

Florida Tax Rebate 2023 Get Tax Relief And Boost Economic Growth

https://printablerebateform.net/wp-content/uploads/2023/03/Florida-Tax-Rebate-2023-768x681.png

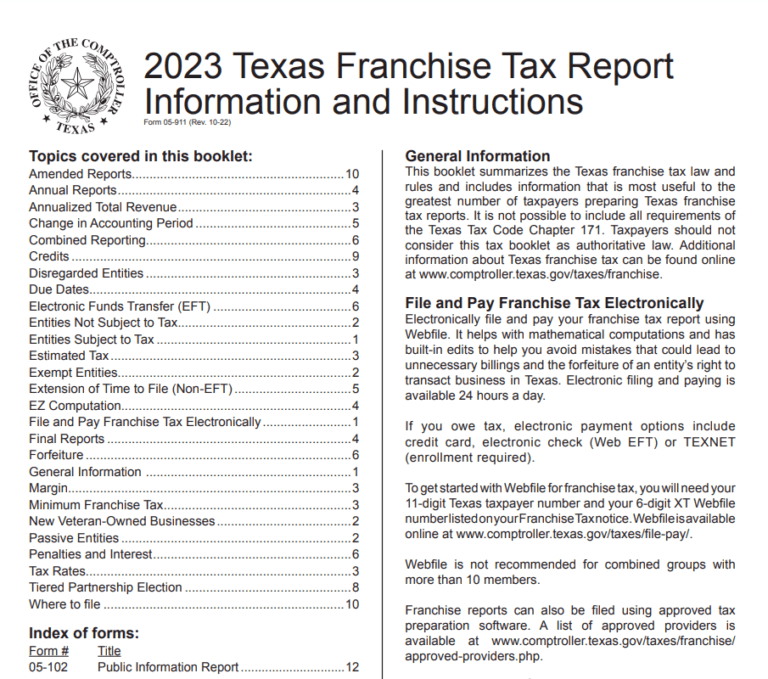

Texas Tax Rebate 2023 Everything You Need To Know Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2023/05/Texas-Tax-Rebate-2023-768x679.png

Web 4 avr 2023 nbsp 0183 32 Families with eligible dependents including children under the age of 18 may be eligible for the Child Tax Rebate 2023 Eligibility is based on a number of factors Web 16 avr 2023 nbsp 0183 32 Taxpayer income requirements to claim the 2022 Child Tax Credit Parents of eligible children must have an adjusted gross income AGI of less than 200 000 for single filers and 400 000 for

Web 6 d 233 c 2022 nbsp 0183 32 Democrat Senators Are Pushing For It Before the end of 2022 a group of senators are trying to squeeze in a child tax credit plan The pandemic era Expanded Child Tax Credit a Biden Administration Web Child Tax Credit Comparison Key Features of the 2023 Child Tax Credit Maximum Credit Amount In 2023 the Child Tax Credit offers a maximum credit amount of 3 000 per qualifying child which is an increase from

Download Child Tax Rebate 2023

More picture related to Child Tax Rebate 2023

Minnesota Tax Rebate 2023 Your Comprehensive Guide Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2023/04/Minnesota-Tax-Rebate-2023-768x679.png

Michigan Tax Rebate 2023 Eligibility Types Deadlines How To Claim

https://printablerebateform.net/wp-content/uploads/2023/04/Michigan-Tax-Rebate-2023-768x675.png

CT Child Tax Rebate 2023 Eligibility Claim Process Important Dates

https://www.tax-rebate.net/wp-content/uploads/2023/04/Ct-Child-Tax-Rebate-2023.jpg

Web Il y a 1 jour nbsp 0183 32 Minnesota One time tax rebate payments of up to 1 300 per family started going out in August 2023 according to the Minnesota Department of Revenue The Web 6 juil 2023 nbsp 0183 32 For the 2023 tax year taxes filed in 2024 the maximum child tax credit will remain 2 000 per qualifying dependent but the partially refundable payment will increase up to 1 600 per the IRS

Web 12 d 233 c 2022 nbsp 0183 32 CT child tax rebate program brought 84 5 million to families now there s a push to provide it again With the upcoming Congress sharply split between a Web 4 ao 251 t 2023 nbsp 0183 32 If you are looking for 2023 Child Tax Rebate you ve come to the right place We have 35 rebates about 2023 Child Tax Rebate including images pictures photos

Know New Rebate Under Section 87A Budget 2023

https://studycafe.in/wp-content/uploads/2023/02/Know-new-rebate-under-section-87A.jpg

Maximize Your Savings New Jersey Tax Rebate 2023 Tax Rebate

https://i0.wp.com/www.tax-rebate.net/wp-content/uploads/2023/05/New-Jersey-Tax-Rebate-2023.jpg?ssl=1

https://www.cnet.com/personal-finance/taxes/…

Web 14 avr 2023 nbsp 0183 32 How much is the child tax credit in 2023 The maximum tax credit available per child has reverted to its pre expansion level of

https://www.nerdwallet.com/article/taxes/qual…

Web 5 juil 2017 nbsp 0183 32 For 2023 the child tax credit is worth 2 000 per qualifying dependent child if your modified adjusted gross income is 400 000 or

Federal Tax Rebate 2023 Maximize Your Savings And Boost Your Finances

Know New Rebate Under Section 87A Budget 2023

Ct Rebate Check 2023 RebateCheck

Delaware Tax Rebate 2023 Printable Rebate Form

Missouri State Tax Rebate 2023 Printable Rebate Form

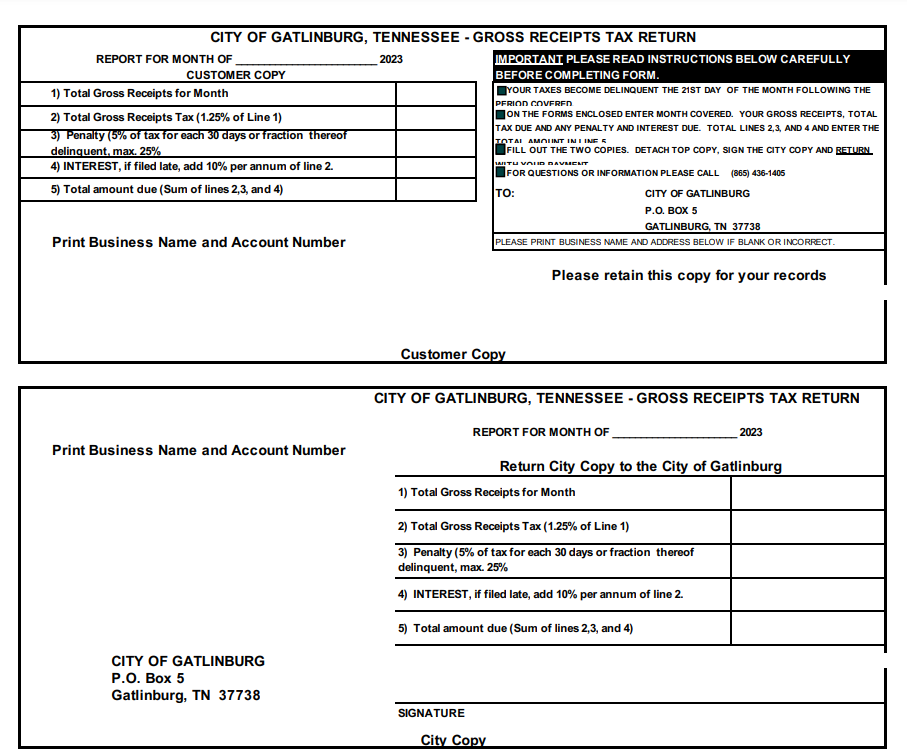

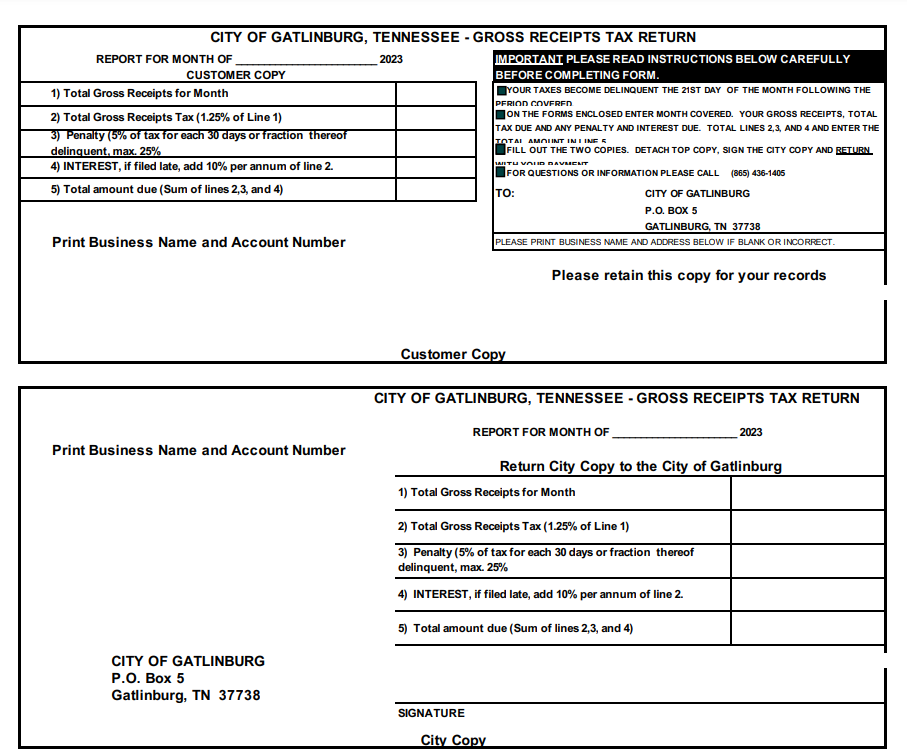

Tennessee Tax Rebate 2023 A Comprehensive Guide Printable Rebate Form

Tennessee Tax Rebate 2023 A Comprehensive Guide Printable Rebate Form

Ohio Tax Rebate 2023 Maximize Your Tax Savings Printable Rebate Form

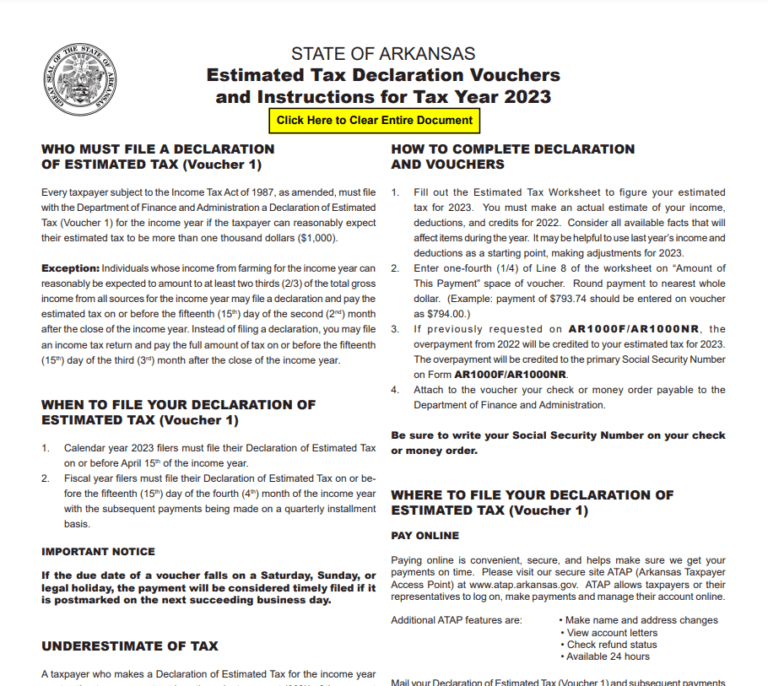

Arkansas Tax Rebate 2023 Printable Rebate Form

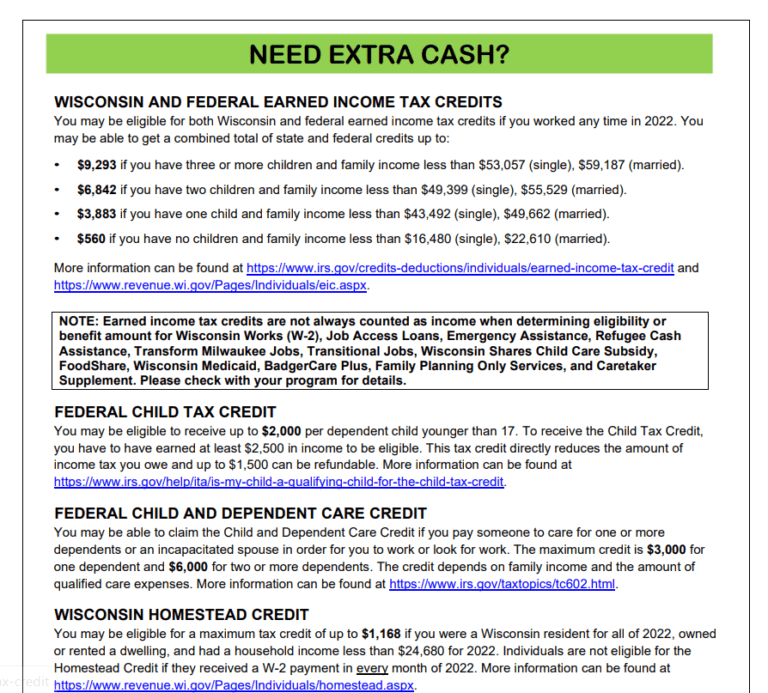

Wisconsin Tax Rebate 2023 Your Comprehensive Guide Printable Rebate Form

Child Tax Rebate 2023 - Web Child Tax Credit Comparison Key Features of the 2023 Child Tax Credit Maximum Credit Amount In 2023 the Child Tax Credit offers a maximum credit amount of 3 000 per qualifying child which is an increase from