Child Tax Rebate 2024 Florida Under the proposed bill the maximum refundable amount per child would rise to 1 800 in 2023 1 900 in 2024 and 2 000 in 2025 What else would change with the Child Tax Credit Millions

For the 2024 tax year tax returns filed in 2025 the child tax credit will be worth 2 000 per qualifying child with 1 700 being potentially refundable through the additional To be a qualifying child for the 2023 tax year your dependent generally must You qualify for the full amount of the 2023 Child Tax Credit for each qualifying child if you meet all eligibility factors and your annual income is not more than 200 000 400 000 if filing a joint return Parents and guardians with higher incomes may be eligible

Child Tax Rebate 2024 Florida

Child Tax Rebate 2024 Florida

https://baileyscarano.com/wp-content/uploads/2022/06/Depositphotos_329030836_XL.jpg

CT Child Tax Rebate Checks Are In The Mail Lamont Across Connecticut CT Patch

https://patch.com/img/cdn20/users/22994611/20220825/105526/styles/patch_image/public/money-bills___25105510368.jpg

CT Families Should Begin Receiving Child Tax Rebates This Week Governor NBC Connecticut

https://media.nbcconnecticut.com/2022/08/child-tax-rebate-news-conference.jpeg?quality=85&strip=all&resize=1200%2C675

The credit would be adjusted for inflation starting in 2024 which is expected to bump up the maximum credit to 2 100 per child in 2025 up from the current 2 000 according to the The credit amount was increased for 2021 The American Rescue Plan increased the amount of the Child Tax Credit from 2 000 to 3 600 for qualifying children under age 6 and 3 000 for other qualifying children under age 18 The credit was made fully refundable By making the Child Tax Credit fully refundable low income households

Phasing out what s known as the refundability cap by 2025 which can limit the tax credit amount allowed for low income families Protecting parents who lost income in the filing year from disqualification for or a loss in child tax credits by instating a lookback provision in 2024 The new rules would increase the maximum refundable amount from 1 600 per child For the tax year 2023 it would increase to 1 800 for the tax year 2024 to 1 900 and for the tax

Download Child Tax Rebate 2024 Florida

More picture related to Child Tax Rebate 2024 Florida

2022 Child Tax Rebate

https://portal.ct.gov/-/media/DCF/SPOTLIGHT/2022/June/Child-Tax-Rebate.png?sc_lang=en&h=1080&w=1080&la=en&hash=71DF1F1C6E19B1AE7C1DCCD9E598E4C5

Minnesota Rebate Checks And Child Tax Credit Coming Soon Kiplinger

https://cdn.mos.cms.futurecdn.net/6s7GLrUiaDFw4PtLwHLk5U-1024-80.jpg

Connecticut Families Can Soon Apply For State issued Child Tax Rebate

https://npr.brightspotcdn.com/dims4/default/e1ecf5a/2147483647/strip/true/crop/1280x960+0+0/resize/1760x1320!/quality/90/?url=http:%2F%2Fnpr-brightspot.s3.amazonaws.com%2Fd0%2Fc1%2F77a94cb64caa822d89adeab92118%2Flamont-child-tax-rebate.jpg

Under the expansion the maximum amount a lower income family can receive is multiplied by the number of children in the family A married couple making 12 500 a year would be eligible for a DCF opens offices DCF has reopened its brick and mortar storefronts which were previously closed due to coronavirus DCF adds call center numbers DCF has added a call center number for Monday through Friday from 7 a m to 6 p m Call center numbers now include 850 300 4323 866 762 2237 or TTY 1 800 955 8771 Certification periods

Florida Department of Revenue The Florida Department of Revenue has three primary lines of business 1 Administer tax law for 36 taxes and fees processing nearly 37 5 billion and more than 10 million tax filings annually 2 Enforce child support law on behalf of about 1 025 000 children with 1 26 billion collected in FY 06 07 3 Oversee OCALA Fla Today Governor Ron DeSantis was joined by Senate President Kathleen Passidomo and House Speaker Paul Renner to highlight their intent to pass the largest tax relief proposal in Florida history to save Florida families a historic 2 billion during the 2023 2024 fiscal year

The 1 100 Per Child Tax Rebate Bonus For Divorced And Unmarried Parents

https://womenbusinessnews.tv/the-1100-per-child-tax-rebate-bonus-for-divorced-and-unmarried-parents/1614527890_0x0.jpg

Child Tax Credit 2022 How Much Is It And When Will I Get It The US Sun

https://www.the-sun.com/wp-content/uploads/sites/6/2022/09/SC-Child-Tax-Credit-Comp-copy.jpg?w=1440

https://www. cbsnews.com /news/child-tax-credit-2024-who-qualifies

Under the proposed bill the maximum refundable amount per child would rise to 1 800 in 2023 1 900 in 2024 and 2 000 in 2025 What else would change with the Child Tax Credit Millions

https://www. nerdwallet.com /article/taxes/qualify...

For the 2024 tax year tax returns filed in 2025 the child tax credit will be worth 2 000 per qualifying child with 1 700 being potentially refundable through the additional

Military Journal Ri Child Tax Rebate Child Tax Credits Are One Of The Most Important Ways

The 1 100 Per Child Tax Rebate Bonus For Divorced And Unmarried Parents

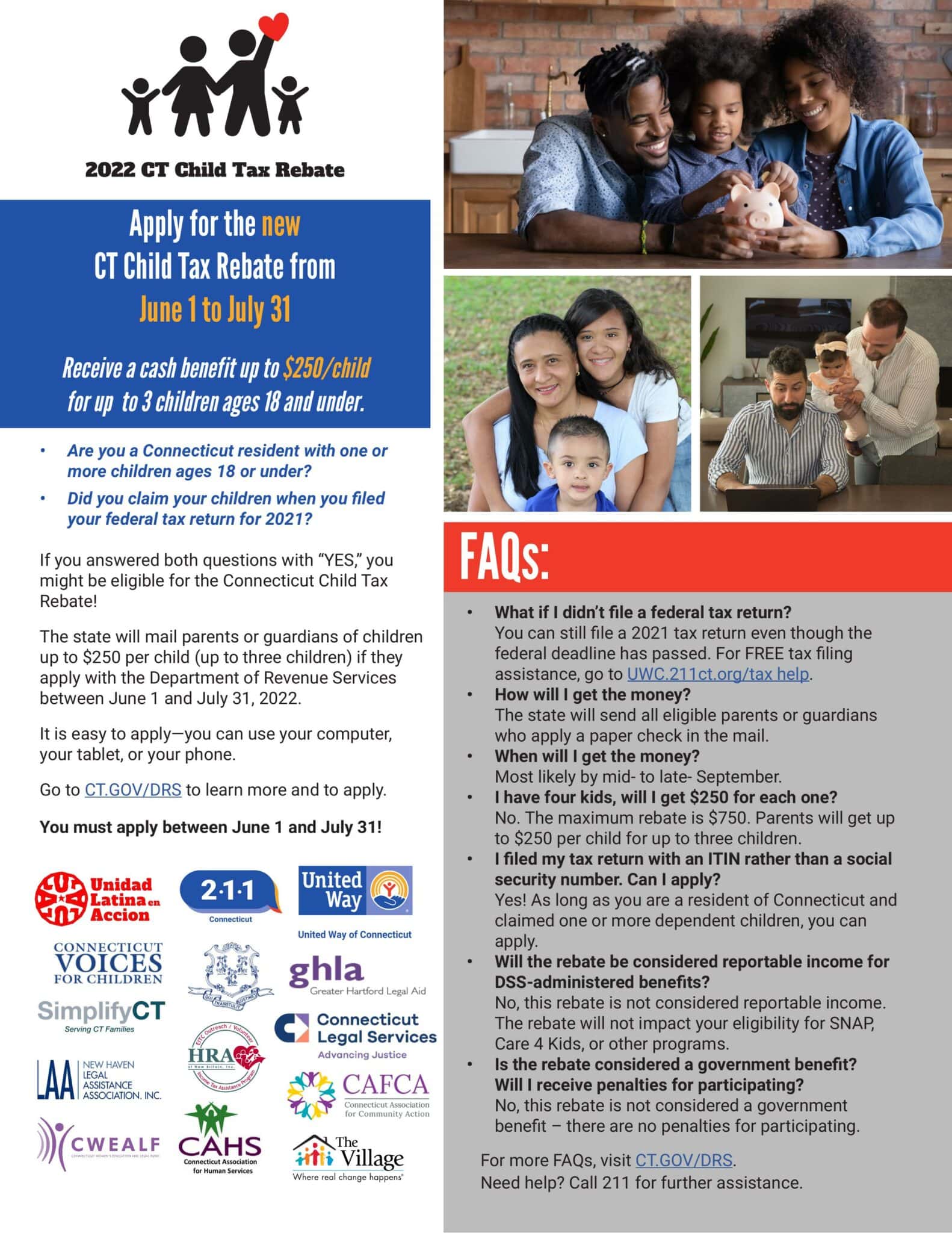

Nearly 200 000 Families Can Still Apply For 2022 CT Child Tax Rebate Before July 31 Deadline

Application For 2022 Connecticut Child Tax Rebate Now Open

What Is The Child Tax Credit Going To Be For 2023 Leia Aqui What Is The Monthly Child Tax

Child Tax Rebate Program MUST APPLY BY 7 31 22 Borgida CPAs

Child Tax Rebate Program MUST APPLY BY 7 31 22 Borgida CPAs

CT s New Child Tax Rebate Connecticut Association For Community Action

Child Tax Credits 1st Payments Sent July 15 Welcomed By Chicago Area Families ABC7 Chicago

Topic Child Tax Credit Change

Child Tax Rebate 2024 Florida - For the 2024 tax year returns you ll file in 2025 the refundable portion of the credit increases to 1 700 That means eligible taxpayers could receive an additional 100 per qualifying