Kansas Rebate Web 22 d 233 c 2021 nbsp 0183 32 Governor Kelly is calling for a one time rebate in the form of a non taxable direct payment of 250 for every Kansas resident tax filer Resident tax filers who filed

Web 3 f 233 vr 2022 nbsp 0183 32 TOPEKA KSNT Kansans could be eligible for a tax rebate of up to 500 as soon as this summer Governor Laura Kelly announced her plans for the rebate Web 23 avr 2022 nbsp 0183 32 Governor Kelly announced an additional 460 million through a Governor s Budget Amendment GBA for a one time 250 tax rebate to all Kansas residents who

Kansas Rebate

/cloudfront-us-east-1.images.arcpublishing.com/gray/23VLHX7OHBFUXM5IIFU5AYJIGY.jpg)

Kansas Rebate

https://gray-wibw-prod.cdn.arcpublishing.com/resizer/1RIRb4fT1ukw024Z-gmayz_iTyU=/1200x600/smart/filters:quality(85)/cloudfront-us-east-1.images.arcpublishing.com/gray/23VLHX7OHBFUXM5IIFU5AYJIGY.jpg

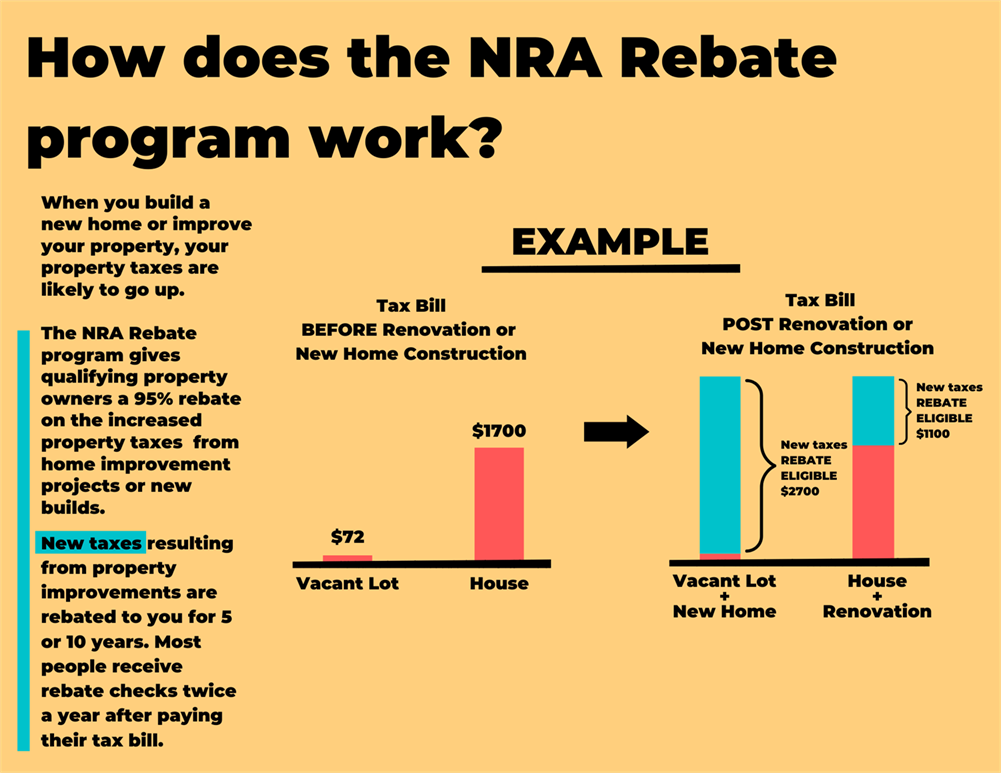

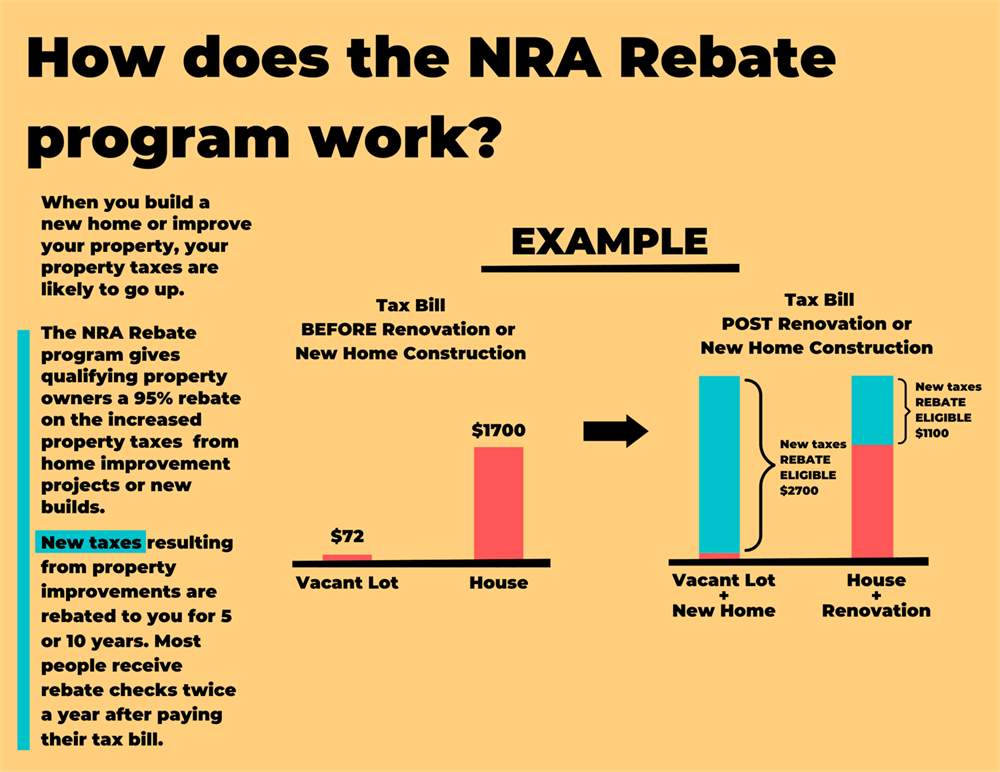

Incentives Unified Government Of Wyandotte County And Kansas City

https://clivetest.com/b072074f/https/b6dbdc/www.wycokck.org/files/assets/public/economic-development/documents/nra-rebate-explained-2022-png.png?w=1000&h=773

Tire Rebate Sale Gary Crossley Ford Service Department Kansas

https://i.ytimg.com/vi/wvcStCKiOac/maxresdefault.jpg?sqp=-oaymwEmCIAKENAF8quKqQMa8AEB-AH-CYAC0AWKAgwIABABGBMgFSh_MA8=&rs=AOn4CLCu86CEYD2whIaQRJBZRPvk_CM1iQ

Web 24 avr 2023 nbsp 0183 32 Governor Kelly s proposal for a one time tax rebate provides relief to all Kansas resident taxpayers without breaking the bank or jeopardizing funds for our public Web 24 avr 2023 nbsp 0183 32 Sherman Smith Kansas Reflector TOPEKA Gov Laura Kelly said Monday she was vetoing a flat tax package that predominantly favors the most wealthy Kansans and proposing instead a one time

Web 4 janv 2022 nbsp 0183 32 14 Kansas Gov Laura Kelly played not so Secret Santa recently offering a one time plan to put 250 in the hands of virtually every state income tax payer this year Web 31 mars 2023 nbsp 0183 32 Kansas Tax Rebate 2023 Kansas is offering a Tax Rebate for 2023 to its residents This rebate aims to provide tax credits to low income households providing some relief from their tax burden In

Download Kansas Rebate

More picture related to Kansas Rebate

Kansas Rebates For Residential EV Chargers

https://rebates4evchargers.com/assets/img/KS.png

Affordable Care Act Rebate Amounts For Kansas Health Medical

https://i.pinimg.com/originals/ea/4e/3d/ea4e3def47a43f83902ac70ec7fbe1f9.jpg

Naomi Shapiro On Twitter RT GovLauraKelly Kansans Deserve Tax

https://pbs.twimg.com/media/FuqqWHGXsAMORH_.jpg

Web 1 janv 2022 nbsp 0183 32 The Homestead Refund is a rebate program for the property taxes paid by homeowners The refund is based on a portion of the property tax paid on a Kansas Web SAFESR is a property tax refund program that is administered under the provisions of the Kansas Homestead Act property tax refund by the Kansas Department of Revenue

Web 22 d 233 c 2021 nbsp 0183 32 TOPEKA Kan AP Democratic Gov Laura Kelly on Wednesday proposed giving Kansas residents who filed state income tax returns last year a one Web 21 avr 2022 nbsp 0183 32 WICHITA Kan KWCH Governor Laura Kelly is urging the Kansas Legislature to reconsider one time 250 tax rebate through a budget amendment If

KS Receives Nearly 130 000 In Rebates For Its Energy saving Efforts

https://www.ksbe.edu/_apps/image-bridge/big_check__large-article__www-width-710/jpeg/1549

Senior Tax Rebate Program Downtown KCK 701 N 7th St Trfy Kansas

https://cdn.happeningnext.com/events3/banners/88a6c08cb461e0a2bc73142167fed1d1dbc2767f53f1ff5d5e647f6ec938c417-rimg-w960-h799-gmir.jpg?v=1675207298

/cloudfront-us-east-1.images.arcpublishing.com/gray/23VLHX7OHBFUXM5IIFU5AYJIGY.jpg?w=186)

https://governor.kansas.gov/governor-laura-kelly-announces-proposal …

Web 22 d 233 c 2021 nbsp 0183 32 Governor Kelly is calling for a one time rebate in the form of a non taxable direct payment of 250 for every Kansas resident tax filer Resident tax filers who filed

https://www.ksnt.com/capitol-bureau/kansans-could-be-eligible-for-tax...

Web 3 f 233 vr 2022 nbsp 0183 32 TOPEKA KSNT Kansans could be eligible for a tax rebate of up to 500 as soon as this summer Governor Laura Kelly announced her plans for the rebate

Laura Kelly Vetoes Flat Income Tax Proposed By Kansas Republicans

KS Receives Nearly 130 000 In Rebates For Its Energy saving Efforts

Three Rebates Of 150 To 700 For Eligible Kansas Residents C Heslop

Kroger Week 2 Mega Sale Plus Rebates 12 08 21 YouTube

Three Rebates Of 150 To 700 For Eligible Kansas Residents C Heslop

Second Owner Pleads Guilty In 1 4M Solar Rebate Fraud Kansas City

Second Owner Pleads Guilty In 1 4M Solar Rebate Fraud Kansas City

Kansas Governor Proposes Tax Rebate Up To 900

Kansas City Power And Light Rebate Program PowerRebate

Kansas Governor Vetoes Flat Tax Plan Proposes One time 800M Rebate

Kansas Rebate - Web 31 mars 2023 nbsp 0183 32 Kansas Tax Rebate 2023 Kansas is offering a Tax Rebate for 2023 to its residents This rebate aims to provide tax credits to low income households providing some relief from their tax burden In