Child Tax Rebate Ny Web The Child Tax Credit CTC is a credit worth up to 2 000 for every child that you claim on your 2022 tax return Qualifying children are 16 or younger Your family can be eligible

Web 18 avr 2022 nbsp 0183 32 The payment for the Empire State child credit is anywhere from 25 to 100 of the amount of the credit you received for 2021 The percentage depends on Web 8 sept 2023 nbsp 0183 32 To find out when your school property taxes are due consult your city town village or school district If your STAR check hasn t shown up and your due date to pay

Child Tax Rebate Ny

Child Tax Rebate Ny

https://stratfordcrier.com/wp-content/uploads/2022/06/hh-1030x1030.png

Tax Child Rebate Fechas Y C mo Obtener Un Reembolso De Hasta 750

https://phantom-marca-us.unidadeditorial.es/bcac9e7e90da614109b28ac10cac5230/resize/1320/f/jpg/assets/multimedia/imagenes/2022/08/04/16596270200550.jpg

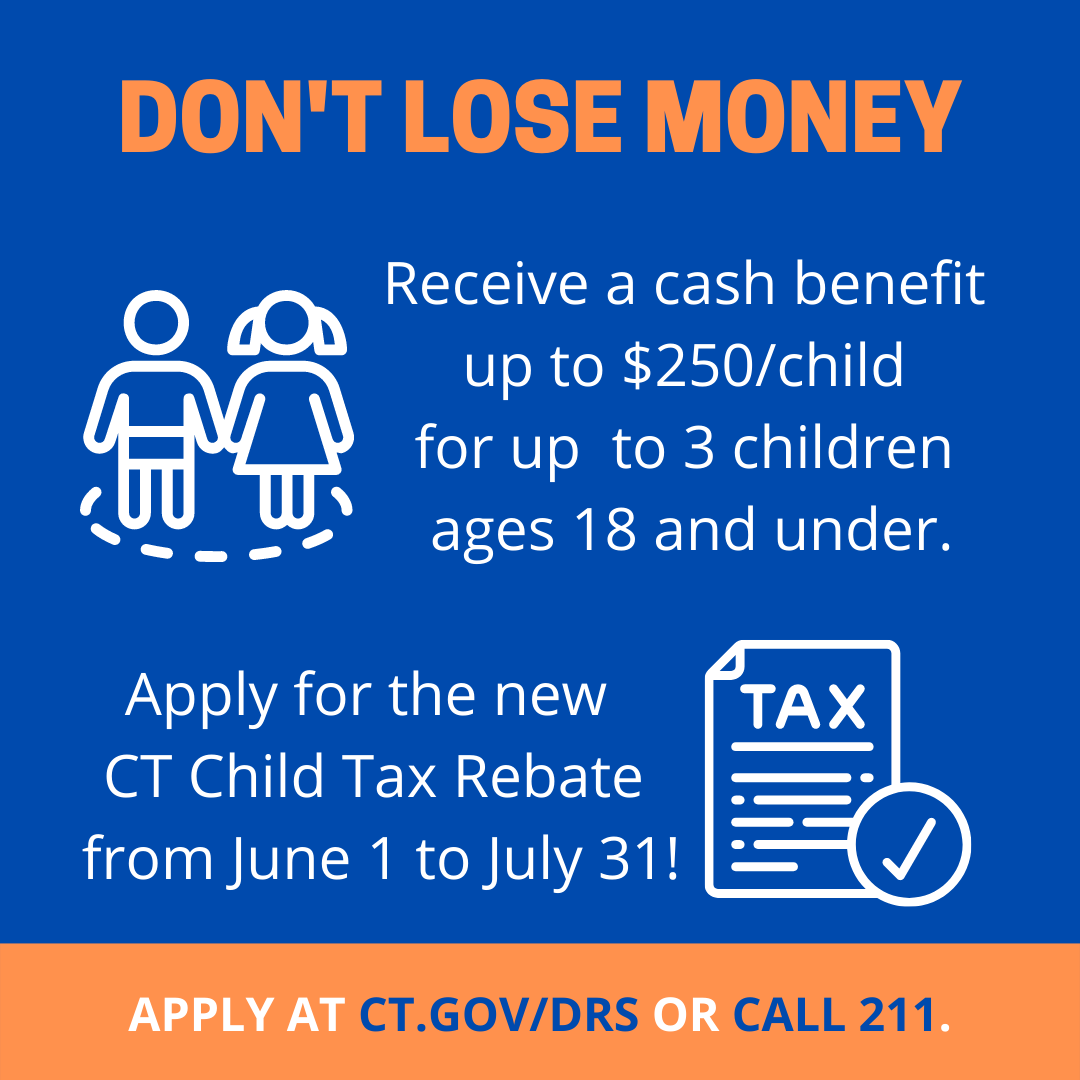

Are YOU Eligible For The CT Child Tax Rebate

https://www.cthousegop.com/ackert/wp-content/uploads/sites/3/2022/06/Child-Tax-Rebate-July-2022.png

Web 5 juil 2023 nbsp 0183 32 your New York recomputed federal adjusted gross income is A qualifying child must be at least four but less than 17 years old on December 31 of the tax year Web 12 oct 2022 nbsp 0183 32 New York is sending out 475 million in tax relief checks this week Gov Kathy Hochul announced that nearly 2 million New York residents will receive additional

Web 5 sept 2023 nbsp 0183 32 The School Tax Relief STAR program offers property tax relief to eligible New York State homeowners If you are eligible and enrolled in the STAR program you ll receive your benefit each year in one of two Web 25 juin 2021 nbsp 0183 32 The American Rescue Plan increased the Child Tax Credit to 3 600 per child for children under 6 years old and 3 000 per child for children ages 6 17 The

Download Child Tax Rebate Ny

More picture related to Child Tax Rebate Ny

New Haven CSA On Twitter Applications For The Child Tax Rebate Are

https://pbs.twimg.com/media/FUQO00dXsAARVR7?format=jpg&name=4096x4096

What You Need To Know About RI s Child Tax Rebate As Gov McKee Holds

https://s.yimg.com/ny/api/res/1.2/KJZBwzfaO_71BTOC.Tgs_w--/YXBwaWQ9aGlnaGxhbmRlcjt3PTEyMDA7aD04NTk-/https://media.zenfs.com/en/the-newport-daily-news/1299f37febf688e2a1d4d3859ee35aa6

2022 Child Tax Rebate Ends July 31 Access Community Action Agency

https://i0.wp.com/www.rebate2022.com/wp-content/uploads/2023/03/2022-child-tax-rebate-ends-july-31-access-community-action-agency-1.png

Web New York s Empire State Child Tax Credit is a refundable credit for full year New York State residents with children who qualify for the Federal Child Tax Credit and are at least four Web 28 avr 2023 nbsp 0183 32 2023 Stimulus Update NY Child Tax Credit will be expanded NEW YORK As part of the state s Fiscal Year 2024 budget Gov Kathy Hochul announced the

Web 7 janv 2022 nbsp 0183 32 Families with children 5 and younger are eligible for credits of as much as 3 600 per child with up to 300 received monthly in advance those with children ages Web 14 d 233 c 2021 nbsp 0183 32 If you have a newborn child in December or adopt a child you can claim up to 3 600 for that child when you file your taxes in 2022 That includes the late payment

WarwickPost Police Government Politics Events News In Warwick RI

https://warwickpost.com/wp-content/uploads/2022/08/McKee-RI-child-tax-rebate.jpg

Gov s Office Announces Final Tally Of Applications For Child Tax Rebate

https://img-s-msn-com.akamaized.net/tenant/amp/entityid/AAZZRwK.img?w=1280&h=720&m=4&q=79

https://access.nyc.gov/programs/child-tax-credit-ctc

Web The Child Tax Credit CTC is a credit worth up to 2 000 for every child that you claim on your 2022 tax return Qualifying children are 16 or younger Your family can be eligible

https://www.tax.ny.gov/pit/child-earned-payments.htm

Web 18 avr 2022 nbsp 0183 32 The payment for the Empire State child credit is anywhere from 25 to 100 of the amount of the credit you received for 2021 The percentage depends on

Online Portal To Help Rhode Islanders With Child Tax Rebate

WarwickPost Police Government Politics Events News In Warwick RI

Gov Lamont Child Tax Rebate Checks Going Out In The Mail CBS New York

/cloudfront-us-east-1.images.arcpublishing.com/gray/POPXNPLVGVH6RB6S2K5SW2CPRE.jpg)

Gov Lamont Child Tax Rebate Checks Will Start Going Out Next Week

CT Is Offering 250 Child Tax Rebates Starting This Week

The 1 100 Per Child Tax Rebate Bonus For Divorced And Unmarried

The 1 100 Per Child Tax Rebate Bonus For Divorced And Unmarried

Celebrity News 106 5 WYRK

2022 Child Tax Rebate Ends July 31 Access Community Action Agency

/cloudfront-us-east-1.images.arcpublishing.com/gray/ZMKNLBZWRJDNXJOLDBQSHYZB3Y.jpg)

Gov Lamont Child Tax Rebate Checks Will Start Going Out Next Week

Child Tax Rebate Ny - Web 5 sept 2023 nbsp 0183 32 The School Tax Relief STAR program offers property tax relief to eligible New York State homeowners If you are eligible and enrolled in the STAR program you ll receive your benefit each year in one of two