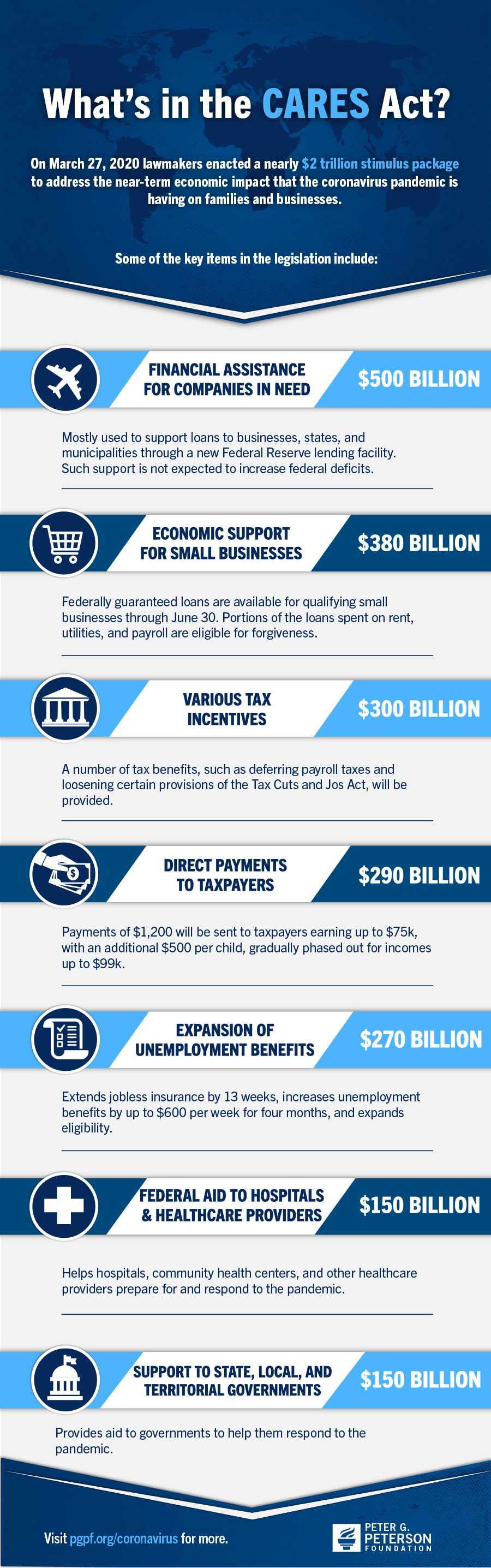

Proposed Relief Rebate In The Cares Act An additional 900 billion in relief was attached to the Consolidated Appropriations Act 2021 which was passed by Congress on December 21 2020 and signed by President Trump on December 27 after some CARES Act programs being renewed had already expired Afficher plus

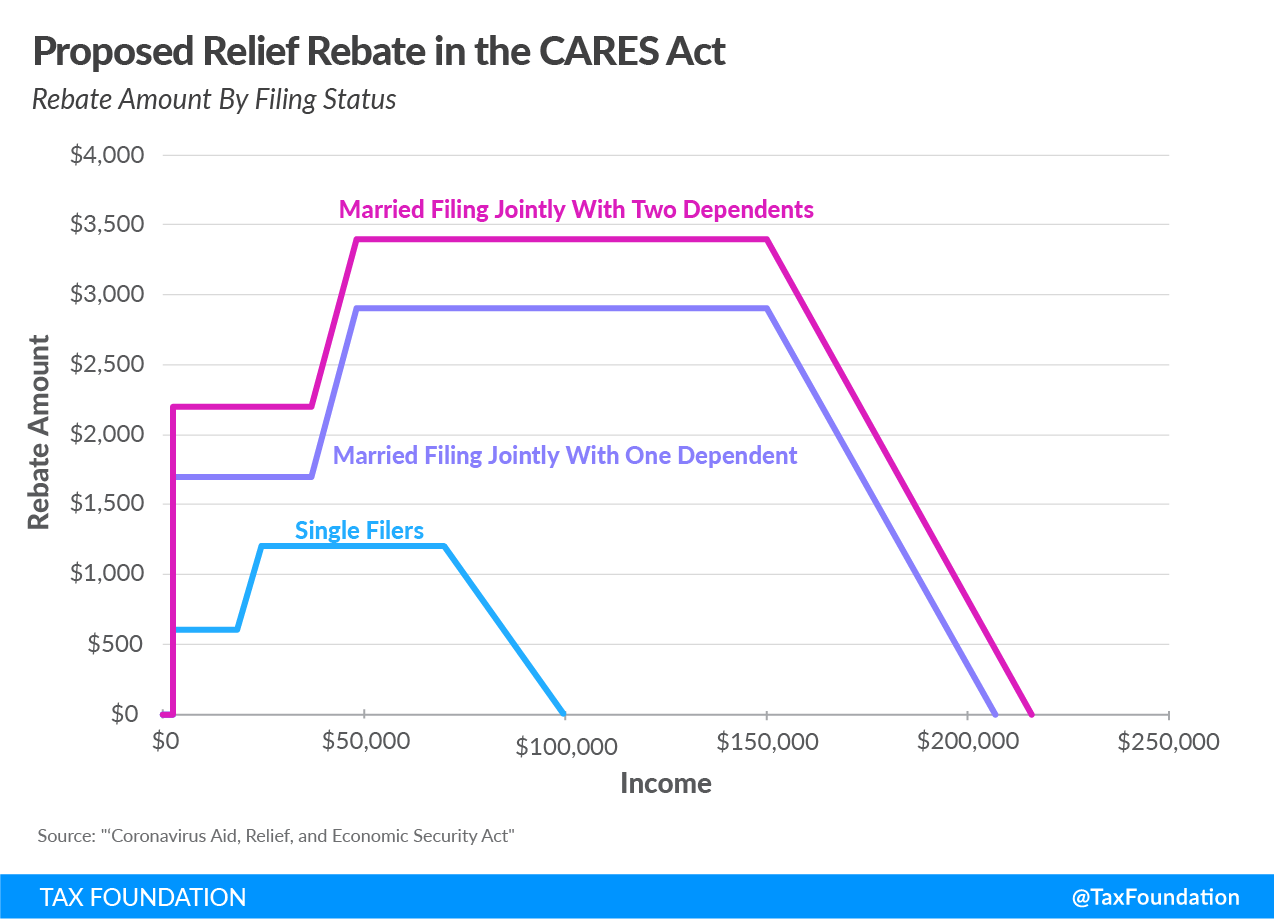

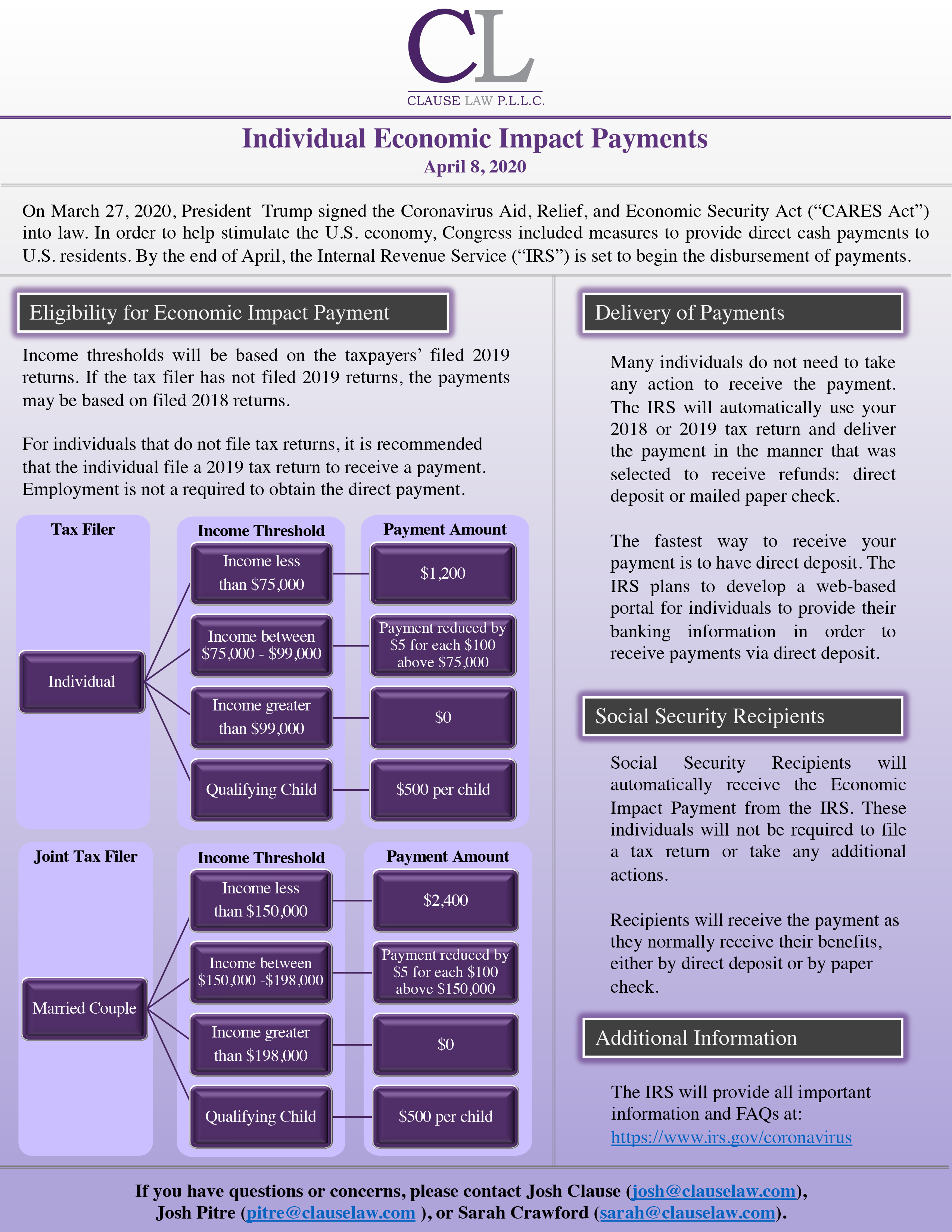

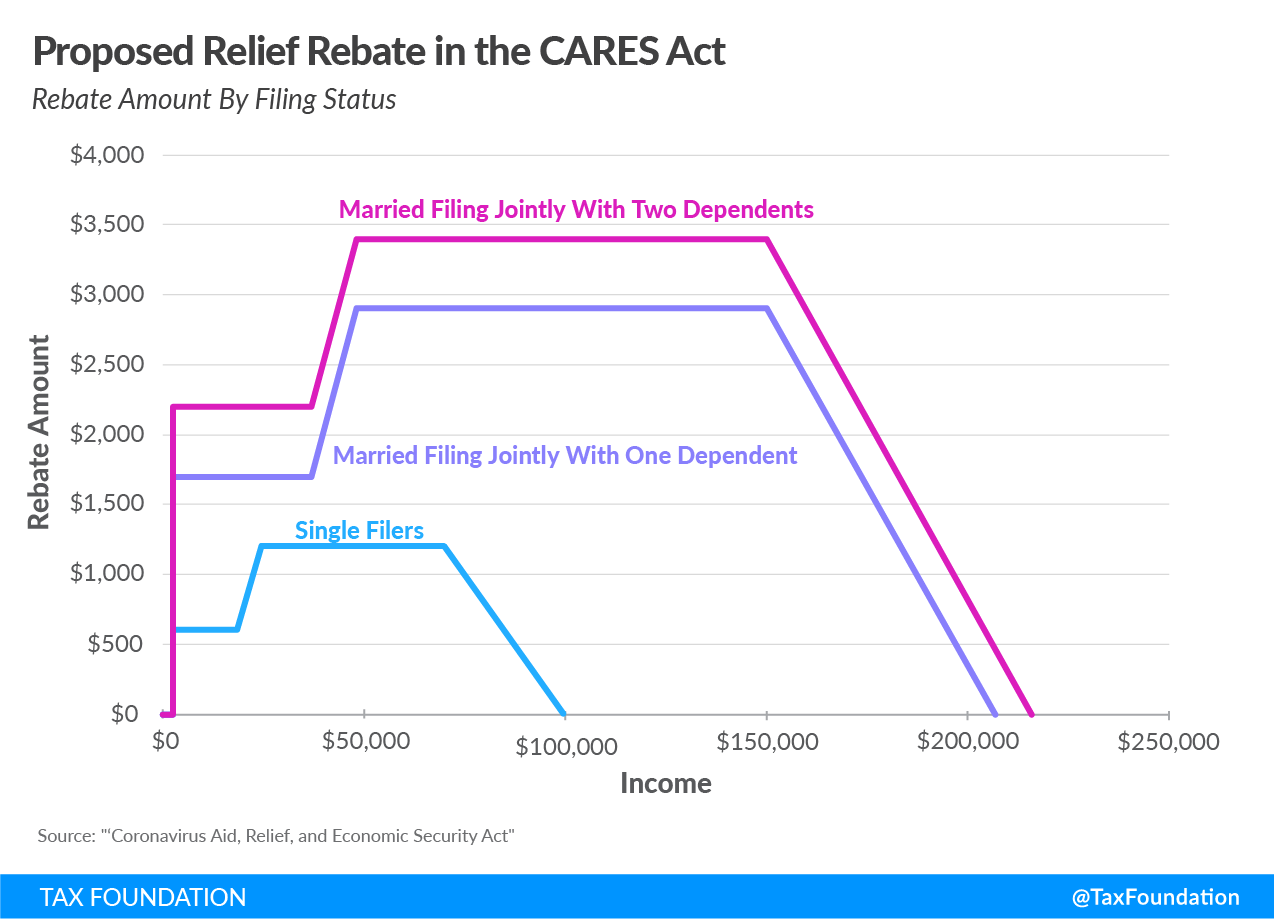

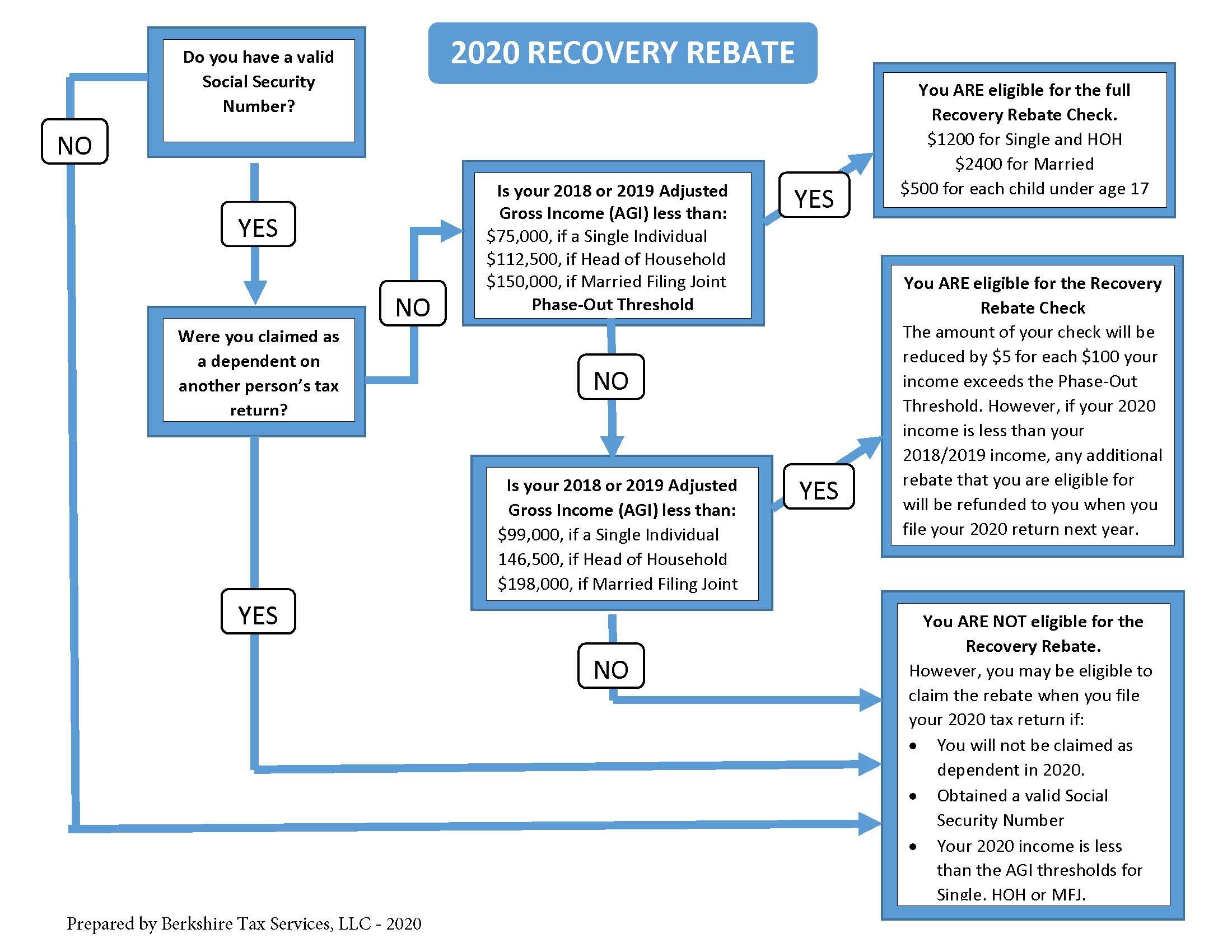

Web 30 mars 2020 nbsp 0183 32 The entire rebate amount phases out by five cents per dollar that a tax filer s adjusted gross income exceeds 75 000 150 000 for married couples filing jointly Web March 20 2020 The Coronavirus Aid Relief and Economic Security CARES Act S 3548 as introduced on March 19 2020 proposes direct payments of up to 1 200 per

Proposed Relief Rebate In The Cares Act

Proposed Relief Rebate In The Cares Act

https://arizent.brightspotcdn.com/dims4/default/560218c/2147483647/strip/true/crop/840x691+0+0/resize/840x691!/quality/90/?url=https:%2F%2Fsource-media-brightspot.s3.amazonaws.com%2F12%2F0c%2F182e372c43c4a9f0509c83e75b53%2Fproposed-taxpayers-refundable-tax-credits-levine-kitces.png

Senate Republicans Release Economic Relief Plan For Individuals And

https://upstatetaxp.com/wp-content/uploads/2020/03/image-1.png

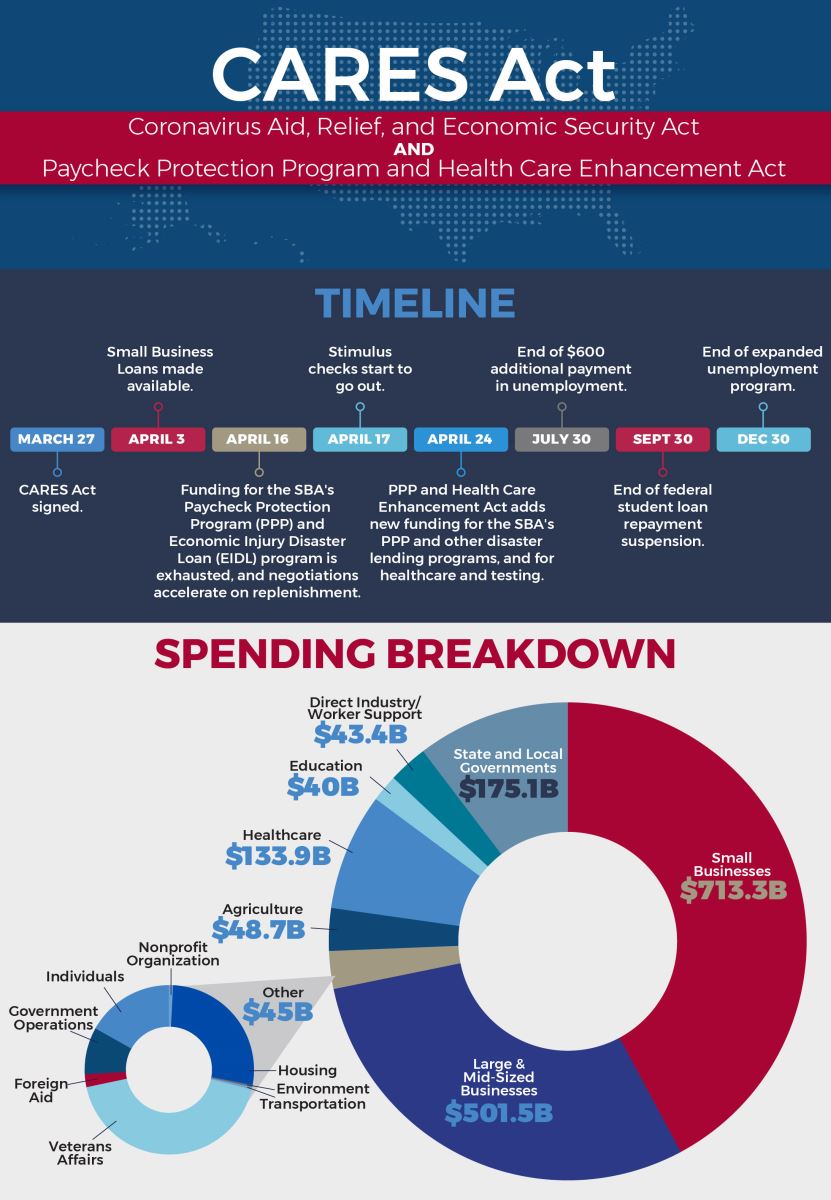

The CARES Act Funding Breakdown

http://www.gray-robinson.com/uploads/images/CARES-Act-Infographic_MainGraphic.jpg

Web 30 mars 2020 nbsp 0183 32 The rebate phases out at 75 000 for singles 112 500 for heads of household and 150 000 for joint taxpayers at 5 percent per dollar of qualified income Web 17 avr 2020 nbsp 0183 32 CARES Act P L 116 136 Updated April 17 2020 The Coronavirus Aid Relief and Economic Security Act CARES Act P L 116 136 which was signed into

Web 26 mars 2020 nbsp 0183 32 Most individuals earning less than 75 000 can expect a one time cash payment of 1 200 Married couples would each receive a check and families would get Web 31 mars 2020 nbsp 0183 32 Rebates in the CARES Act as Taxpayers eligible for the credit could also receive 500 for each child eligible for the child tax credit The total credit to phase out at

Download Proposed Relief Rebate In The Cares Act

More picture related to Proposed Relief Rebate In The Cares Act

The CARES Act Recovery Rebates Fee Only Financial Advisor Deer Park

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2023/02/the-cares-act-recovery-rebates-fee-only-financial-advisor-deer-park-2.png?resize=1024%2C884&ssl=1

CARES Act How Much You Can Expect The Suquamish Tribe

https://suquamish.nsn.us/wp-content/uploads/2020/04/CARES-Act-Cash-Rebate-One-Pager.png

Calam o Get Fast ERTC Refund Take This Free CARES Act Rebate

https://p.calameoassets.com/220804122808-d58824bfe67a91ab06be411d93ef16ac/p1.jpg

Web 27 mars 2020 nbsp 0183 32 The recovery rebate is reduced by 5 for every 100 of adjusted gross income AGI above 75 000 for individuals 112 500 for heads of households and Web 28 avr 2020 nbsp 0183 32 One such proposal the Coronavirus Aid Relief and Economic Security CARES Act P L 116 136 was signed into law on March 27 2020 Tax relief for

Web The Coronavirus Aid Relief and Economic Security CARES Act 2020 and the Coronavirus Response and Consolidated Appropriations Act 2021 provided fast and Web 22 d 233 c 2020 nbsp 0183 32 After weeks of back and forth Congress has approved a new 900 billion stimulus package to follow up the CARES Act from March which included a 1 200

The CARES Act Paycheck Protection Program What You Need To Know

https://wordstream-files-prod.s3.amazonaws.com/s3fs-public/styles/simple_image/public/images/media/images/cares-act-image.jpg?3su6ysWNjZ4UZVwZWYEj5gZlBSepiujj&itok=PrD1lwOq

Recovery Rebate Income Limits Recovery Rebate

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2022/11/cares-act-q-a-about-recovery-rebates-student-loans-health-care-4.png

https://en.wikipedia.org/wiki/CARES_Act

An additional 900 billion in relief was attached to the Consolidated Appropriations Act 2021 which was passed by Congress on December 21 2020 and signed by President Trump on December 27 after some CARES Act programs being renewed had already expired Afficher plus

https://www.aei.org/economics/the-care-act-who-will-get-

Web 30 mars 2020 nbsp 0183 32 The entire rebate amount phases out by five cents per dollar that a tax filer s adjusted gross income exceeds 75 000 150 000 for married couples filing jointly

2020 Recovery Rebate Berkshire Tax Services LLC

The CARES Act Paycheck Protection Program What You Need To Know

Check Status Of Recovery Rebate Recovery Rebate

CARES Act Relief Summary For Nonprofits BakerHostetler JDSupra

Eligible Dependents In The CARES Act And HEROES Act Economic Relief

The CARES Act Relief Bill And How It Can Help You As A Homeowner pdf

The CARES Act Relief Bill And How It Can Help You As A Homeowner pdf

Updated CARES Act Provides Relief To Individuals And Businesses

I Put This Together To Help People Understand If They ll Get A Rebate

Coronavirus The CARES Act PPP Loans 4A s

Proposed Relief Rebate In The Cares Act - Web 15 janv 2021 nbsp 0183 32 Title V of the CARES Act established the Coronavirus Relief Fund for the purpose of providing 150 billion in direct assistance to States units of local government