Child Tax Rebate Program Web You qualify for the full amount of the 2022 Child Tax Credit for each qualifying child if you meet all eligibility factors and your annual income is not more than 200 000 400 000 if filing a joint return Parents and guardians with higher incomes may be eligible to claim

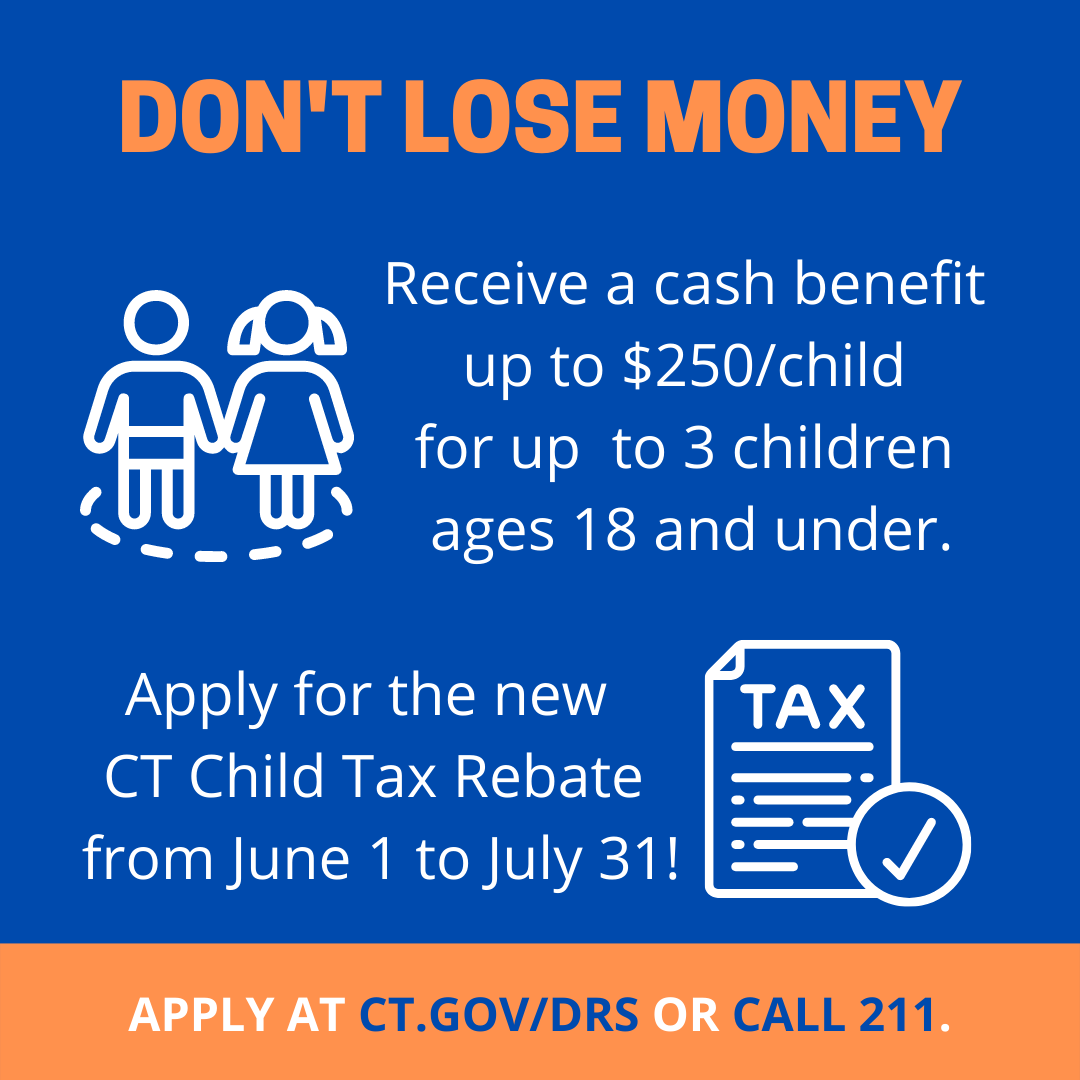

Web The child tax rebate which was recently authorized by the Connecticut General Assembly and signed into law by Governor Ned Lamont is intended to help Connecticut families with children You may be eligible for a child tax rebate of up to a maximum of 750 250 Web HARTFORD CT Governor Ned Lamont today announced that the Connecticut Department of Revenue Services this week began issuing rebates to qualified households as part of the 2022 Connecticut Child Tax Rebate program The state agency

Child Tax Rebate Program

Child Tax Rebate Program

https://www.cthousegop.com/ackert/wp-content/uploads/sites/3/2022/06/Child-Tax-Rebate-July-2022.png

Lamont Families Can Apply For The 2022 CT Child Tax Rebate Beginning

https://greenwichfreepress.com/wp-content/uploads/2022/05/Screen-Shot-2022-05-19-at-12.17.52-PM.jpg

2022 Child Tax Rebate Ends July 31 Access Community Action Agency

https://accessagency.org/wp-content/uploads/2022/06/2022-Child-Tax-RebateFB-Insta-2.png

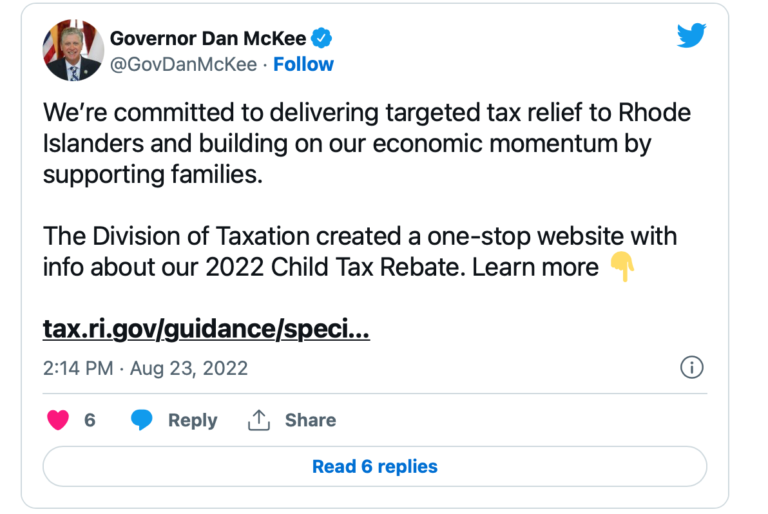

Web 26 ao 251 t 2022 nbsp 0183 32 The provision stated that any taxpayer that claimed a dependent under the age of 18 on their 2021 federal income tax may be eligible for a rebate of up to 250 for a maximum of three children Web 31 ao 251 t 2022 nbsp 0183 32 Families in Rhode Island are eligible to claim a statewide child tax rebate of up to 750 according to Governor Dan McKee Around 115 000 Rhode Island households are anticipated to get the cash Any taxpayer who files an income tax return before the

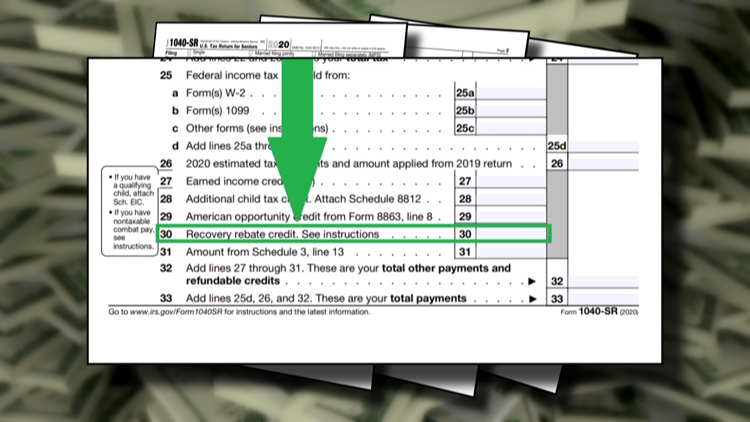

Web Il y a 7 heures nbsp 0183 32 Working families received 3 600 for children under the age of 6 and 3 000 for kids ages 6 to 17 The legislation also provided a third round of stimulus checks following earlier relief under the Web 12 d 233 c 2022 nbsp 0183 32 With the upcoming Congress sharply split between a Republican majority in the U S House of Representatives and Democrats holding the Senate social service advocates on Monday asked the

Download Child Tax Rebate Program

More picture related to Child Tax Rebate Program

2022 Child Tax Rebate Stratford Crier

https://stratfordcrier.com/wp-content/uploads/2022/06/hh-1030x1030.png

Child Tax Rebate Program MUST APPLY BY 7 31 22 Borgida CPAs

https://borgidacpas.com/wp-content/uploads/2022/06/CTCTRLOGOforweb.jpg

The 1 100 Per Child Tax Rebate Bonus For Divorced And Unmarried

https://i.pinimg.com/originals/7b/5e/11/7b5e110bedeb8a7d6b667e145b402fbb.jpg

Web 31 juil 2022 nbsp 0183 32 The child tax rebate which was recently authorized by the Connecticut General Assembly and signed into law by Governor Ned Lamont is intended to help Connecticut families with children You may be eligible for a child tax rebate of up to a Web 11 juil 2023 nbsp 0183 32 The full child tax credit is 1 750 per child which begins to phase out for married filers who make 35 000 annually and 29 500 for single taxpayers According to the Legislature s nonpartisan staff here are a few examples of the amounts and income

Web 21 juil 2022 nbsp 0183 32 The deadline is drawing near for Connecticut families looking to take part in the state s one time Child Tax Rebate program Applications for the program close July 31 and are available online through the Connecticut Department of Revenue Services Web 19 mai 2022 nbsp 0183 32 Rebates of up to 250 per child are expected to be issued in late August The rebates will be provided for up to three children per family While any Connecticut resident who claimed at least one

CT s New Child Tax Rebate Connecticut Association For Community Action

https://www.cafca.org/wp-content/uploads/2022/06/CTCTR-Spanish-scaled.jpg

Jimmy Tickey On Twitter Starting Today 250 Per Child Tax Rebates

https://pbs.twimg.com/media/FUNcpk7XEAIy3dE?format=jpg&name=large

https://www.irs.gov/credits-deductions/individuals/child-tax-credit

Web You qualify for the full amount of the 2022 Child Tax Credit for each qualifying child if you meet all eligibility factors and your annual income is not more than 200 000 400 000 if filing a joint return Parents and guardians with higher incomes may be eligible to claim

https://portal.ct.gov/DRS/Credit-Programs/Child-Tax-Rebate/Overview

Web The child tax rebate which was recently authorized by the Connecticut General Assembly and signed into law by Governor Ned Lamont is intended to help Connecticut families with children You may be eligible for a child tax rebate of up to a maximum of 750 250

2019 Edition Of Parenthood Tax Rebate Qualifying Child Relief

CT s New Child Tax Rebate Connecticut Association For Community Action

Proposal To Update Ailing PA Rent Property Tax Rebate Program Would

Who s Eligible For The Connecticut Child Tax Rebate

WarwickPost Police Government Politics Events News In Warwick RI

Child Tax Rebates

Child Tax Rebates

Online Portal To Help Rhode Islanders With Child Tax Rebate

Child Tax Credit 2020 Changes Bezyah

Child Tax Credit 2022 1 050 In Direct Deposits Are Available To

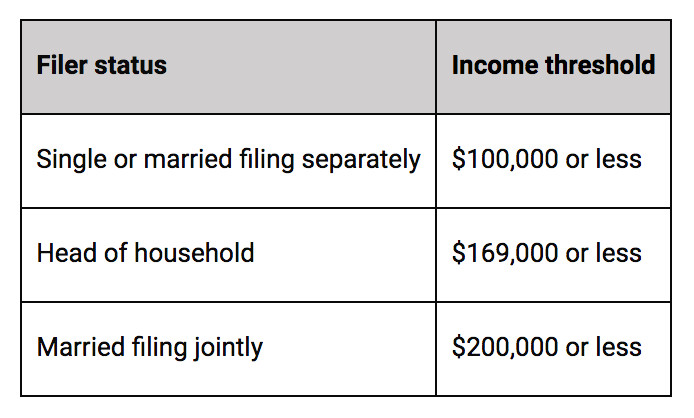

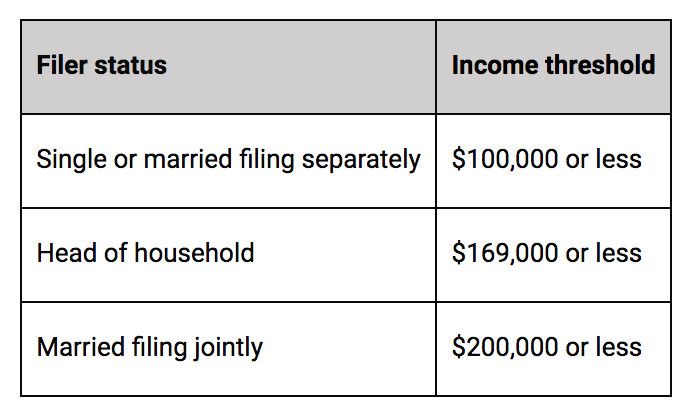

Child Tax Rebate Program - Web To receive the maximum rebate of 250 per child for up to three children the following income guidelines must be met Those who have higher income rates may be eligible to receive a reduced rebate based on their income Anyone interested in seeking a rebate