Ev Credit Rebate Web 7 janv 2023 nbsp 0183 32 The credit will be available as a quot point of sale rebate quot which means a car dealership would knock 7 500 off the price of the

Web 31 mars 2023 nbsp 0183 32 Currently 21 vehicles are eligible for federal tax credits up to 7 500 That will change on April 18 when Treasury s new guidance goes into effect How many EVs Web 27 ao 251 t 2022 nbsp 0183 32 People who buy new electric vehicles may be eligible for a tax credit as high as 7 500 and used electric car owners may qualify for up to 4 000 in tax breaks as of

Ev Credit Rebate

Ev Credit Rebate

https://wbmlp.org/docs/rebates/EVs/EV-Tax-Credits-23.png

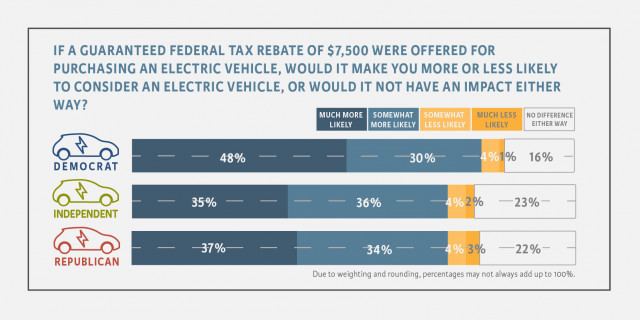

EV Tax Credit Support Climate Nexus May 2019

https://images.hgmsites.net/med/ev-tax-credit-support--climate-nexus-may-2019_100702679_m.jpg

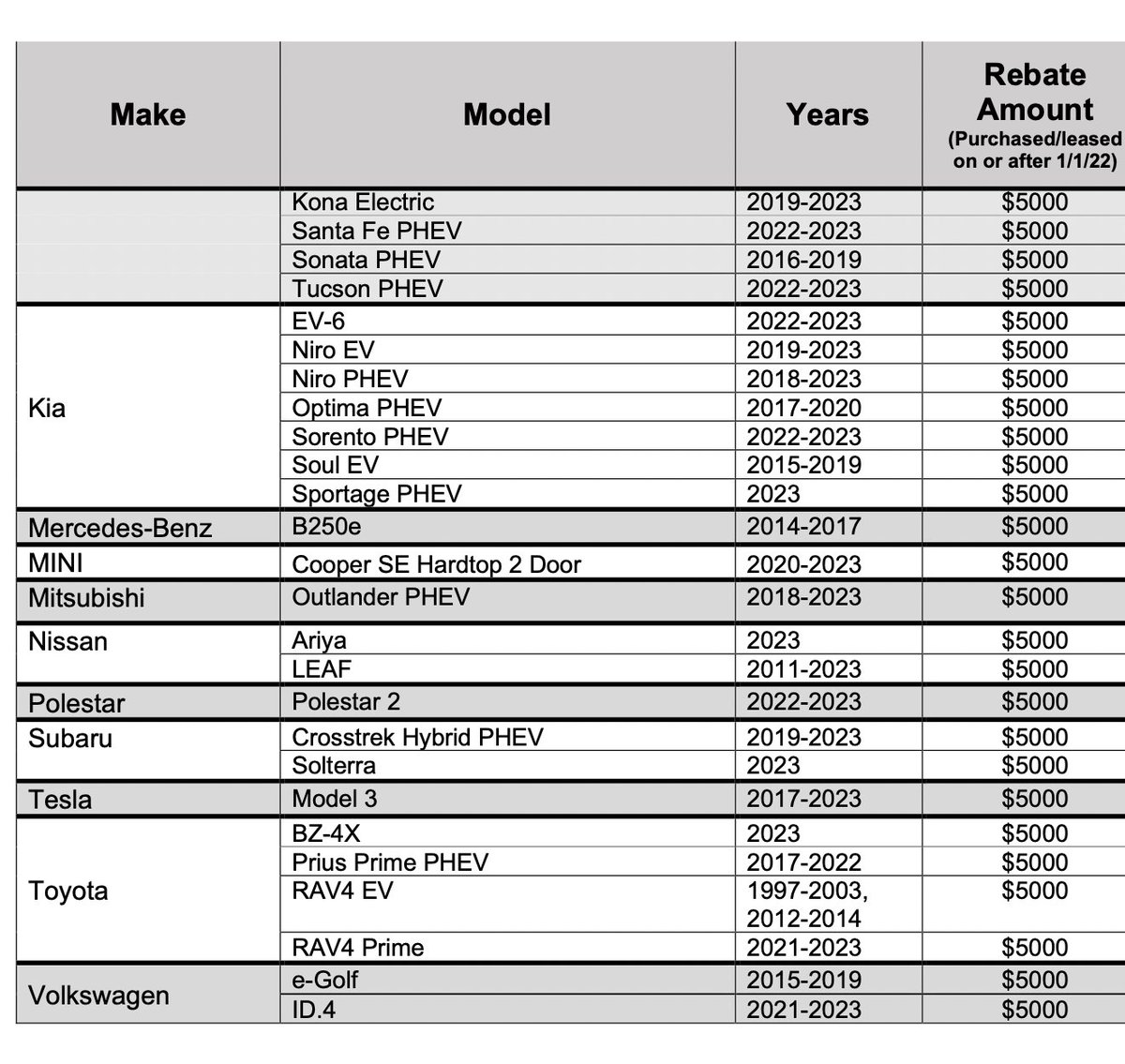

California EV Incentives Rebates A Breakdown EV America

https://ev-america.com/wp-content/uploads/2023/03/california-ev-tax-credit.png

Web You may qualify for a credit up to 7 500 under Internal Revenue Code Section 30D if you buy a new qualified plug in EV or fuel cell electric vehicle FCV The Inflation Web 17 avr 2023 nbsp 0183 32 Which models are eligible for the new EV tax credit 2022 2023 Chrysler Pacifica PHEV 2022 2023 Jeep Wrangler PHEV 4xe 2022 2023 Jeep Grand Cherokee

Web Which EVs are eligible for the full 7 500 tax credit The Inflation Reduction Act broke the credit into two halves You can claim 3 750 if at least half of the value of your vehicle s Web 19 juil 2023 nbsp 0183 32 The Inflation Reduction Act broke the credit into two halves You can claim 3 750 if at least half of the value of your vehicle s battery components are manufactured or assembled in North

Download Ev Credit Rebate

More picture related to Ev Credit Rebate

7500 Federal Rebate Limits Chevy Bolt EV Forum

https://www.chevybolt.org/attachments/ev-credit-form-8936-png.52873/

Irs ev Credit

https://www.uscardforum.com/uploads/default/original/3X/6/a/6aaa66879830e94d6f2dd2d67ff758fea073eee1.jpeg

EV Tax Credit Are You Claiming The Correct Rebates Benefits

https://electricvehiclepedia.com/wp-content/uploads/2022/05/Federal-EV-Tax-Credit.jpg

Web Applications received on or after September 6 2023 will be placed on a standby list and are not guaranteed a rebate Please read the standby list FAQ for more information Web WASHINGTON March 31 Reuters The U S Treasury Department unveiled stricter electric vehicle tax rules on Friday that will reduce or remove tax credits on some zero

Web 5 janv 2023 nbsp 0183 32 Bonus 233 cologique voiture ou camionnette r 232 gles en 2022 V 233 rifi 233 le 05 janvier 2023 Direction de l information l 233 gale et administrative Premi 232 re ministre Cette Web 30 juin 2023 nbsp 0183 32 Illinois offers a 4 000 electric vehicle rebate instead of a tax credit Maine electric vehicle rebates Maryland offers a tax credit up to 3 000 for qualified electric

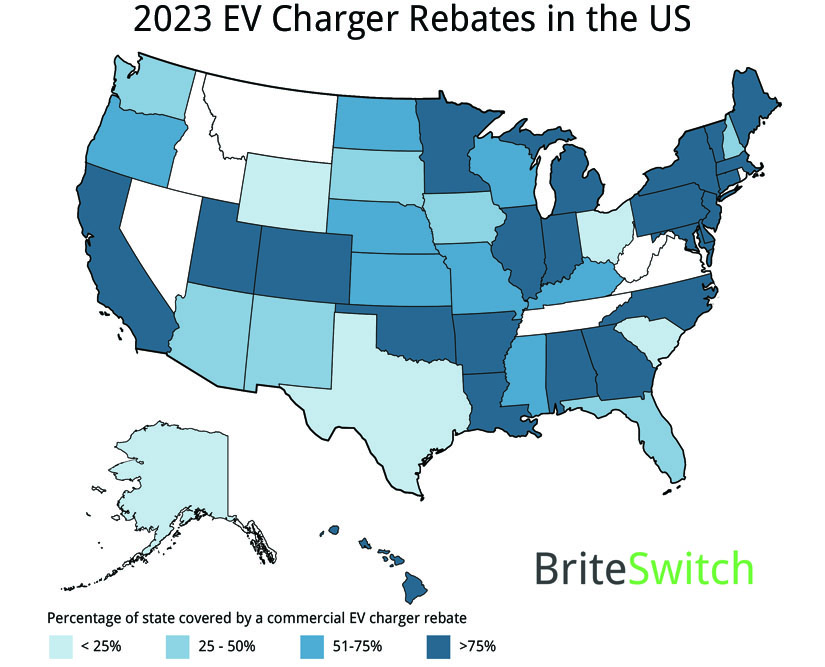

EV Charger Rebate Trends For 2023

https://insights.regencysupply.com/hubfs/EV Charger Rebate Trends.jpg

Claiming The 7 500 Electric Vehicle Tax Credit A Step by Step Guide

https://www.cheatsheet.com/wp-content/uploads/2018/09/Untitled.png?x18731

https://www.npr.org/2023/01/07/1147209505

Web 7 janv 2023 nbsp 0183 32 The credit will be available as a quot point of sale rebate quot which means a car dealership would knock 7 500 off the price of the

https://www.cnn.com/2023/03/31/business/biden-ev-tax-credits-explained...

Web 31 mars 2023 nbsp 0183 32 Currently 21 vehicles are eligible for federal tax credits up to 7 500 That will change on April 18 when Treasury s new guidance goes into effect How many EVs

Mississippi EV Tax Credit Rebates Incentives EV Tax Incentives

EV Charger Rebate Trends For 2023

Sawyer Merritt On Twitter The Tesla Model 3 RWD Still Qualifies For A

EV Rebate Vs Tax Credit What s The Difference Between EV Incentives

How Much Is The 2023 EV Tax Credit

Trump Bill Signing Meme Imgflip

Trump Bill Signing Meme Imgflip

EV Charger Rebates Trends For 2023

EV Tax Credit Are You Claiming The Correct Rebates Benefits

EV Tax Credit Are You Claiming The Correct Rebates Benefits

Ev Credit Rebate - Web You may qualify for a credit up to 7 500 under Internal Revenue Code Section 30D if you buy a new qualified plug in EV or fuel cell electric vehicle FCV The Inflation