Childcare Rebate Tax Return Part of Tax Free Childcare You can get up to 500 every 3 months up to 2 000 a year for each of your children to help with the costs of childcare This goes up to 1 000 every

ABC News Ian Redfearn abc au news childcare subsidies are increasing here s what you need to know 102581828 Share article From today The following FAQs can help you learn if you are eligible and if eligible how to calculate your credit Further information is found below and in IRS Publication 503

Childcare Rebate Tax Return

Childcare Rebate Tax Return

https://www.carrebate.net/wp-content/uploads/2022/08/how-canada-s-revamped-universal-child-care-benefit-affects-you.png

Childcare Tax Rebate Google Docs

https://lh3.googleusercontent.com/docs/AOD9vFr_UKhK8qduqUufb1KgrPjWuQgA9bQz6e_fB4Id6GSAU9bertsDMt_QDKuWXxNyOwyWifG2KNWPFPPizPhVuqSffuQxD5RfFL3awCjHxPMH=w1200-h630-p

Grocery Rebate MinjiMikalla

https://loanscanada.ca/wp-content/uploads/2023/03/Grocery-Rebate.png

Key Takeaways If you paid someone to care for a child who was under age 13 when the care was provided and whom you claim as a dependent on your tax return IRS Tax Tip 2022 33 March 2 2022 Taxpayers who are paying someone to take care of their children or another member of household while they work may qualify for child and

In brief for the 2021 tax year you could get up to 4 000 back for one child and 8 000 back for care of two or more In prior years the maximum return for the credit The child and dependent care credit CDCC is a tax credit for parents or caregivers to help cover the cost of qualified care expenses for a child under 13 a spouse or parent unable to care

Download Childcare Rebate Tax Return

More picture related to Childcare Rebate Tax Return

FamilyBoost Childcare Tax Rebate To Help Families

https://assets.nationbuilder.com/nationalparty/pages/17603/meta_images/original/CLN_copy.png?1677964324

Childcare At No 42

https://lookaside.fbsbx.com/lookaside/crawler/media/?media_id=100063984791480

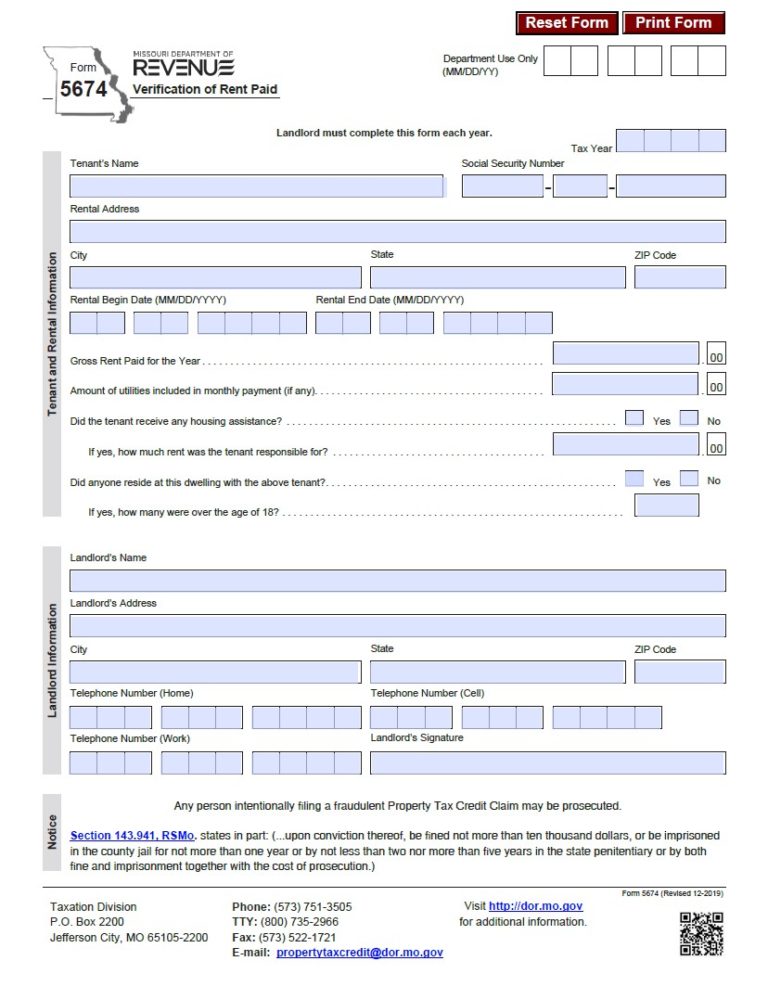

Rent Rebate Tax Form Missouri Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2021/08/Rent-Rebate-Form-Missouri-2021-768x999.jpg

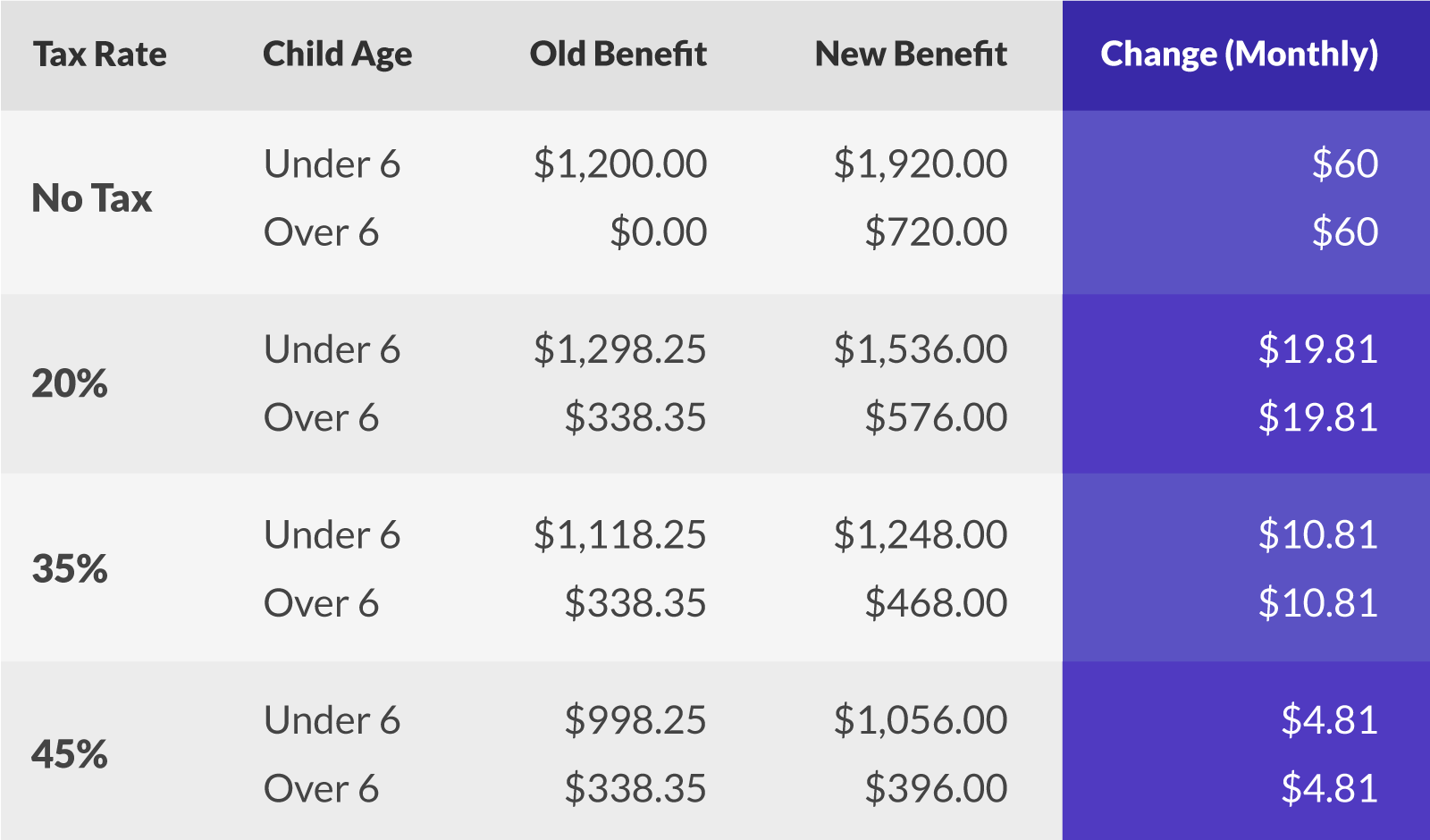

Table of contents How much of a tax credit can I get on my daycare costs Is my child a qualified dependent Who can claim the daycare tax credit What counts as a daycare expense or other child The Child Care Subsidy rates that take effect on 10 July 2023 for Financial Year 2024 FY24 are being used However the results from this childcare subsidy

If eligible you can claim certain child care expenses as a deduction on your personal income tax return Date modified 2024 01 23 Contact the CRA About the You must meet the requirements detailed below to claim the Child and Dependent Care Credit on this year s income tax return You must have earned income

ChildCare Rebate Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2022/02/Childcare-Rebate-2022.png

How I Manage My Childcare I ve Spent Over 50k On Childminders And The

https://wp.inews.co.uk/wp-content/uploads/2022/11/SEI_135500658.jpg

https://www.gov.uk/tax-free-childcare

Part of Tax Free Childcare You can get up to 500 every 3 months up to 2 000 a year for each of your children to help with the costs of childcare This goes up to 1 000 every

https://www.abc.net.au/news/2023-07-10/childcare...

ABC News Ian Redfearn abc au news childcare subsidies are increasing here s what you need to know 102581828 Share article From today

Bookkeeper For Tax Return Prep OnlineJobs ph

ChildCare Rebate Printable Rebate Form

How To Get The Childcare Rebate When You Don t Need Family Assistance

2021 Form PA PA 1000 Fill Online Printable Fillable Blank PdfFiller

Parents Could Be Waiting Months For Childcare Rebate Cheques Watch

XM Rebates 12 45 USD Daily And Direct PipRebate

XM Rebates 12 45 USD Daily And Direct PipRebate

Federal Budget 2020 Mums Working For 1 An Hour Under Childcare Rebate

Recovery Rebate Credit On 2021 Tax Return Could Help Get Missed COVID

Tax Return Employment Self Employment Dividend Rental Property

Childcare Rebate Tax Return - IRS Tax Tip 2022 33 March 2 2022 Taxpayers who are paying someone to take care of their children or another member of household while they work may qualify for child and