Marriage Tax Rebates Web If you re married or in a civil partnership you may be entitled to a 163 1 250 tax break called marriage tax allowance something 2 4 million qualifying couples miss out on Check

Web 14 mars 2022 nbsp 0183 32 Martin Lewis Three must dos by 5 April 1 Tax code rebate 2 Marriage tax allowance 3 PPI tax back James Flanders News Reporter 14 March 2022 The tax Web 16 f 233 vr 2020 nbsp 0183 32 Le bar 232 me en vigueur est ensuite appliqu 233 224 ce revenu moyen taux de 0 jusqu 224 10 064 euros 11 jusqu 224 de 10 065 224 25 659 euros 30 de 25 660 224 73 369

Marriage Tax Rebates

Marriage Tax Rebates

https://employeetax.co.uk/wp-content/uploads/2020/09/header-2-1024x288.png

Home Tax Rebate Online

https://tax-rebate.online/wp-content/uploads/2020/08/marriage-header.jpeg

Marriage Tax Allowance Rebate My Tax Ltd

https://www.rebatemytax.com/wp-content/uploads/2020/09/Marriage-Allowance.png

Web As a married couple you could save up to 5 050 on your tax bill every year In this article we explain how to assess yourselves as a married couple Then we examine the cash Web 8 nov 2022 nbsp 0183 32 A marriage tax penalty occurs when a married couple incurs a higher tax rate when filing jointly than they would if they were filing separately The reason for this

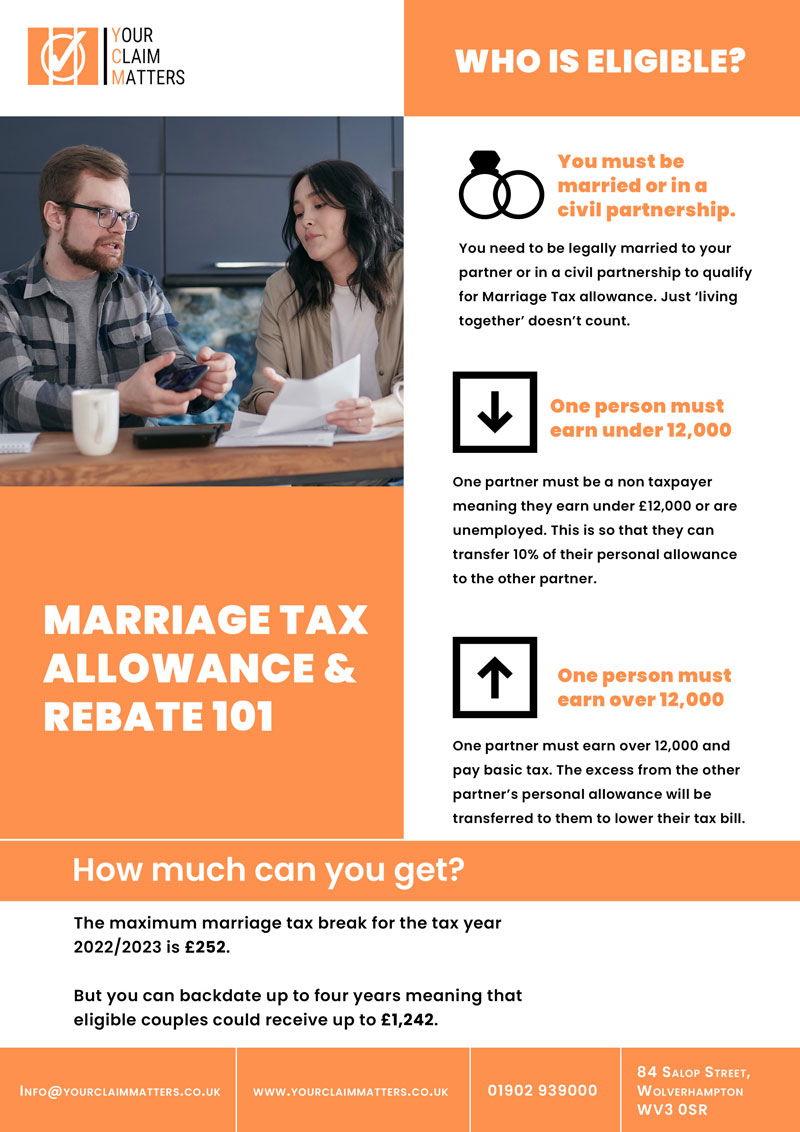

Web 11 sept 2023 nbsp 0183 32 Marriage allowance is a tax perk available to couples who are married or in a civil partnership where one low earner can transfer 163 1 260 of their personal allowance Web For the tax year 2022 23 the maximum amount of personal allowance that can be transferred is 163 1 260 meaning a potential tax rebate of 163 252 163 1 260 x 20 An

Download Marriage Tax Rebates

More picture related to Marriage Tax Rebates

Easy Tax Rebates 4u Just Another WordPress Site

https://easytaxrebates4u.co.uk/wp-content/uploads/2020/10/Marriage-Tax-allowance-5.jpg

Can A Married Couple File Single They Can Contribute To A Roth Ira As

https://www.thetaxadviser.com/content/dam/tta/issues/2019/jun/yurko-ex-2.JPG

Marriage Tax Allowance Tax Rebate Online

https://tax-rebate.online/wp-content/uploads/2020/08/marriage-header-2.jpeg

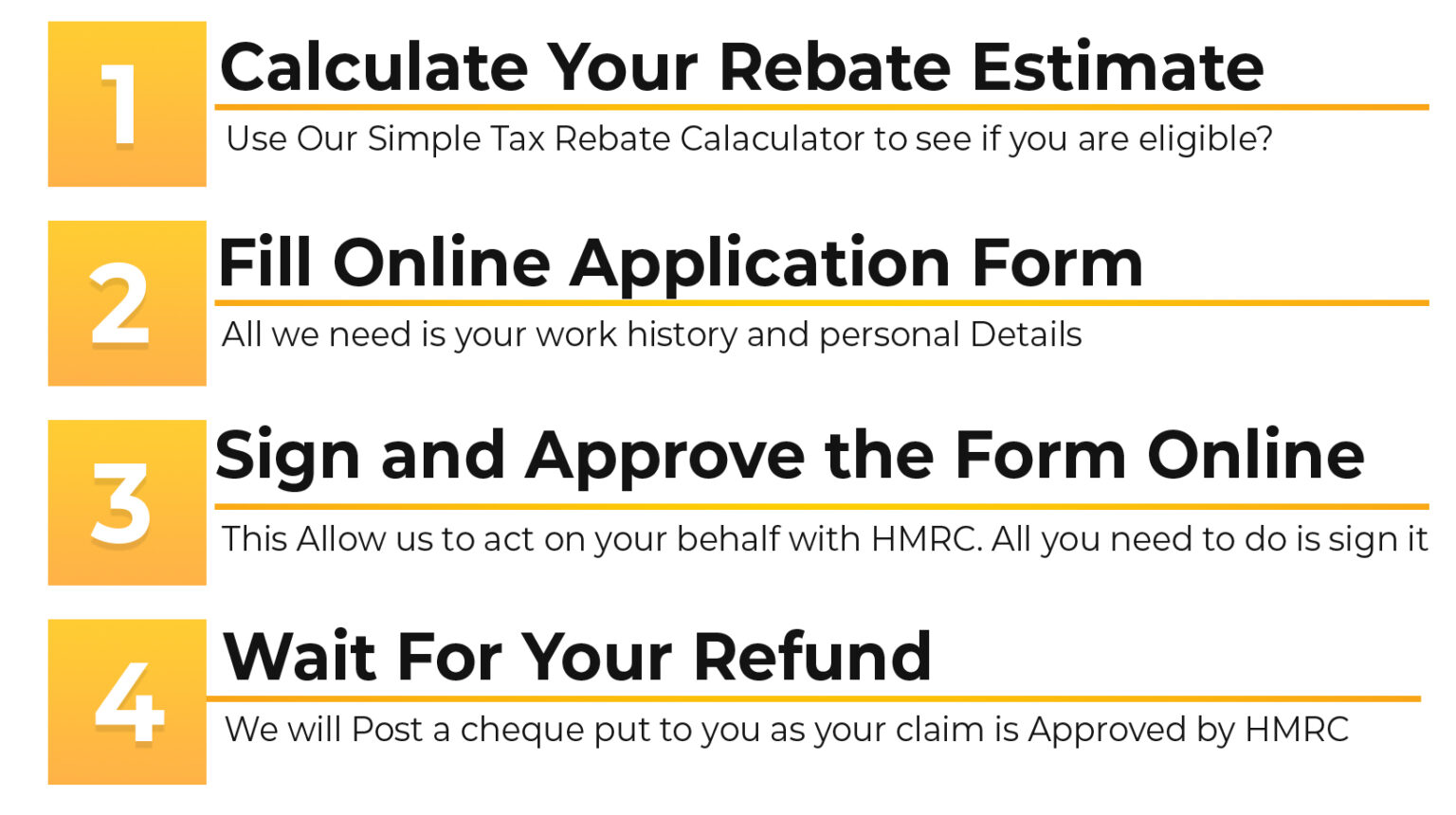

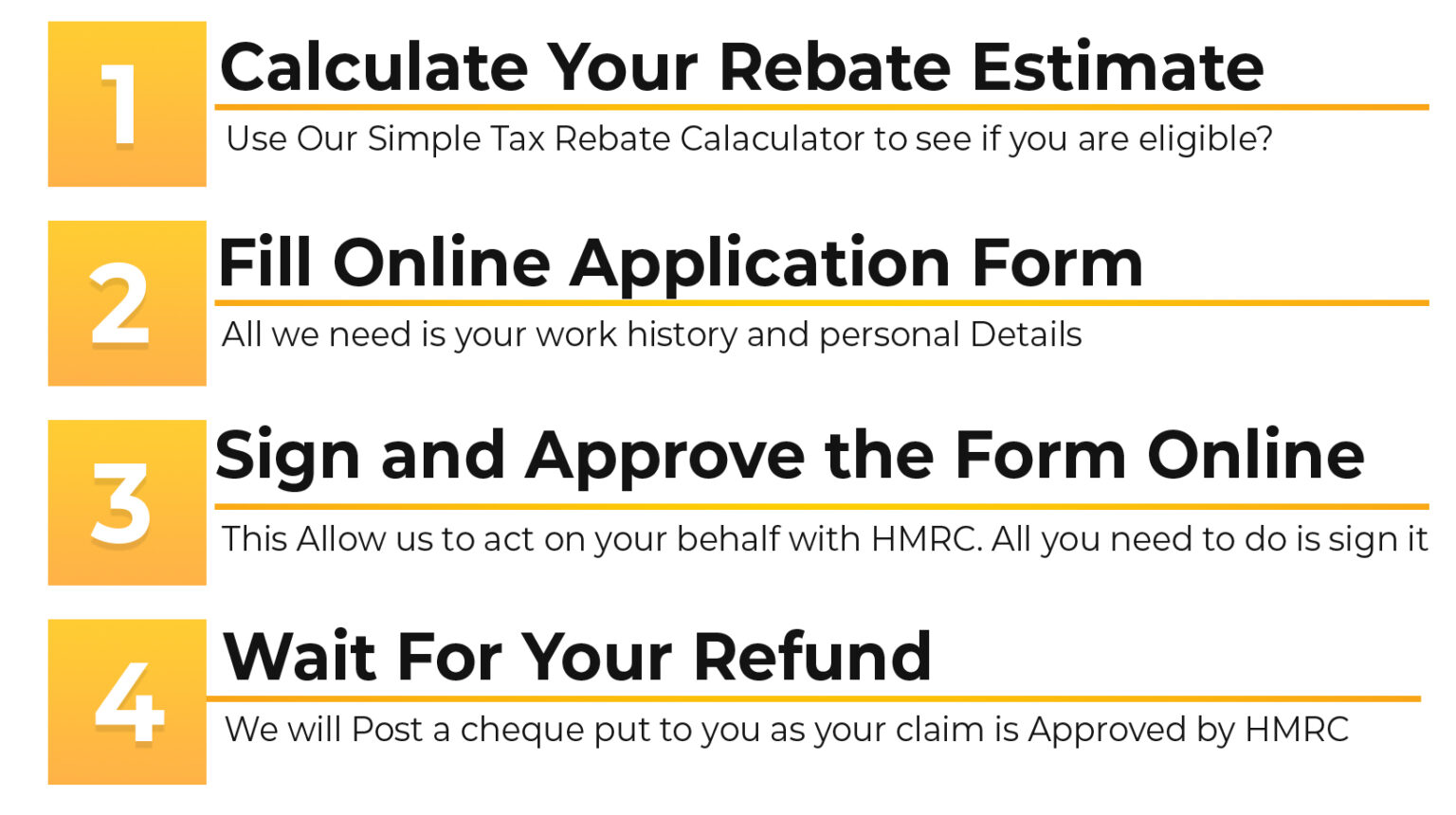

Web 1 Employees can automatically record report and reimburse employee allowance amp expenses 2 Snap and upload receipts on the spot to raise claims and earn rebates 3 Web Marriage Allowance Tax Rebate allows the Lower Earning Partner who has earned less than their Personal Tax Allowance or been Unemployed to transfer 10 of their

Web 14 juil 2023 nbsp 0183 32 If you are married or in a civil partnership under the marriage allowance you can transfer up to 163 1 260 of your personal tax allowance to your spouse or civil partner Web How it works Marriage Allowance lets you transfer 163 1 260 of your Personal Allowance to your husband wife or civil partner This reduces their tax by up to 163 252 in the tax year 6

Home Tax Rebate Online

https://tax-rebate.online/wp-content/uploads/2020/08/Tax-rebate-online-Points-1536x860.jpg

The 101 Marriage Tax Allowance Rebate And Claim Guide

https://www.yourclaimmatters.co.uk/wp-content/uploads/2022/12/marriage-tax-allowance.jpg

https://rebategateway.org/marriage

Web If you re married or in a civil partnership you may be entitled to a 163 1 250 tax break called marriage tax allowance something 2 4 million qualifying couples miss out on Check

https://www.moneysavingexpert.com/news/2022/03/martin-lewis-three-mu…

Web 14 mars 2022 nbsp 0183 32 Martin Lewis Three must dos by 5 April 1 Tax code rebate 2 Marriage tax allowance 3 PPI tax back James Flanders News Reporter 14 March 2022 The tax

Marriage Tax Claims What Could I Claim This Christmas Gowing Law

Home Tax Rebate Online

Marriage Family Irish Tax Rebates

Marriage Allowance Rebate HMRC Rebates Refunds Rebate Gateway

Tax Rebates

Marriage Tax Benefits

Marriage Tax Benefits

What Is The Marriage Tax Allowance A Million Couples Missing Out On

Tax Shock How Unmarried Couples Are Losing 1150 To The Taxman

The Dividend Allowance Is Being Halved Tax Rebate Services

Marriage Tax Rebates - Web Insulation and weatherization 1 600 Unlike the tax credits these rebates are based on your income level If you make less than 80 of your area s median income you can