Childcare Tax Credit 2023 The child and dependent care credit CDCC is a tax credit for parents or caregivers to help cover the cost of qualified care expenses for a child under 13 a spouse or

Taxpayers can claim the 2024 child tax credit on the tax return they will file in 2025 If you still need to file your 2023 tax return that was due April 15 2024 or is due Oct 15 Do you pay child and dependent care expenses so you can work You may be eligible for a federal income tax credit Find out if you qualify

Childcare Tax Credit 2023

Childcare Tax Credit 2023

https://www.mdaprograms.com/wp-content/uploads/O_-Employee-Retention-Credit-ERC-ad_FP_Sept-2022_8-scaled.jpg

Daycare Tax Statement Tuition Receipt Child Care Forms Daycare Studio

http://static1.squarespace.com/static/5e1e35b1de448101b3f06ad3/5e1e3da023fb8c15dc45cb0b/5e49f7708497647c6292db9a/1643635963969/5.png?format=1500w

Taking A Stand For Children Through The Child Tax Credit Tax Credits

https://i0.wp.com/www.taxcreditsforworkersandfamilies.org/wp-content/uploads/2022/02/TCWF_knockout_horizontal.png?w=4439&ssl=1

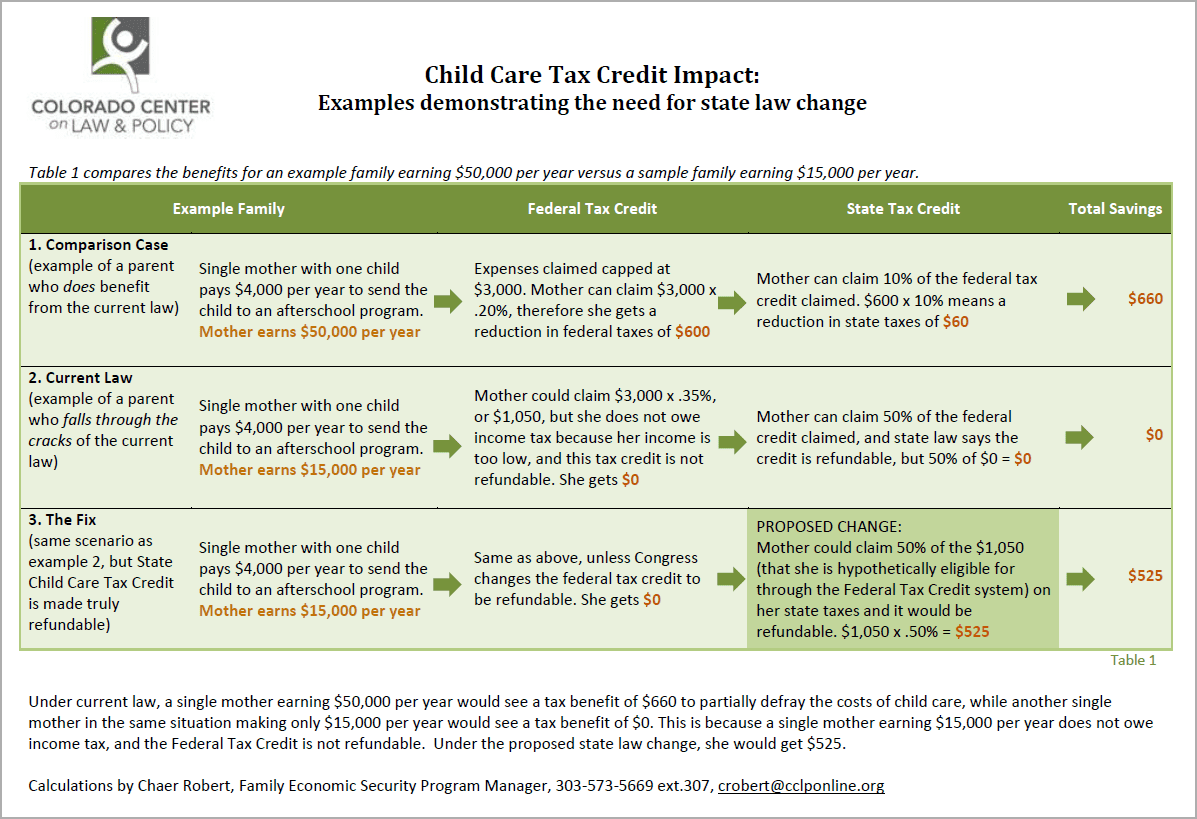

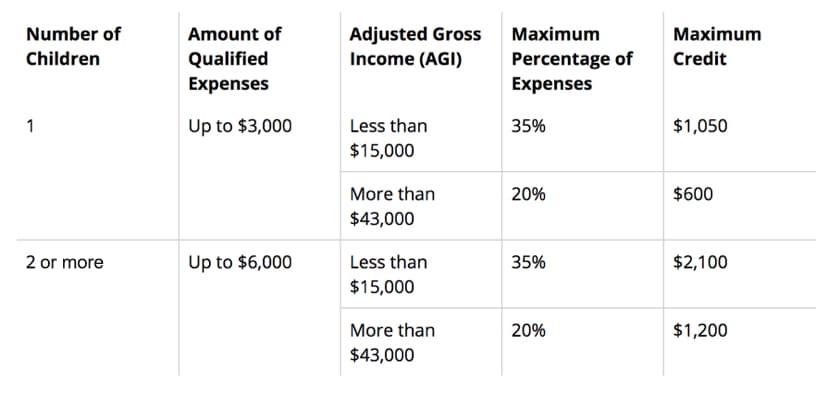

You may be able to claim the child and dependent care credit if you paid expenses for the care of a qualifying individual to enable you and your spouse if filing a joint You can claim from 20 to 35 of your care expenses up to a maximum of 3 000 for one person or 6 000 for two or more people tax year 2023 Benefits of the tax credit The Child

Tax credit per child for 2023 The maximum tax credit per qualifying child is 2 000 for children under 17 For the refundable portion of the credit or the additional child tax credit See how much the 2023 child tax credit is worth how to claim it on your federal tax return and differences in the child tax credit 2023 vs 2022 s credit

Download Childcare Tax Credit 2023

More picture related to Childcare Tax Credit 2023

Daycare Statement Template

https://www.signnow.com/preview/100/315/100315789/large.png

New Child Tax Credit Opens The Door For Old Scams

https://adamlevin.com/wp-content/uploads/2021/05/child-tax-credit-scam-scaled.jpg

CHILD CARE TAX Statement Form Daycare Or Childcare Printable Etsy

https://i.etsystatic.com/23403566/r/il/f7133a/3736849859/il_1140xN.3736849859_31z4.jpg

The child tax credit CTC allows eligible parents and caregivers to reduce their tax liability and might even result in a tax refund However not everyone can claim the credit and Learn how to claim a tax credit for childcare expenses in 2023 Find out if you qualify how much you can get and how to report it on your tax return

Let s say you earned 57 250 and paid 16 050 in daycare expenses in 2023 for a single child under age 13 You can claim 20 of 3 000 or 600 as a credit If you owe the How the child tax credit will look in 2023 Will Congress approve more monthly child tax credit payments How the scaled down child tax credit could impact the 2023 tax

Childcare Tax Credit Small Business Advocacy Council SBAC

https://growthzonesitesprod.azureedge.net/wp-content/uploads/sites/1735/2022/02/Childcare-Tax-Credit-Blog.png

What The New Child Tax Credit Could Mean For You Now And For Your 2021

https://cdn.newswire.com/files/x/32/c9/0bc29c33e2af4d42f581fad9e660.png

https://www.nerdwallet.com/article/taxes/child-and...

The child and dependent care credit CDCC is a tax credit for parents or caregivers to help cover the cost of qualified care expenses for a child under 13 a spouse or

https://www.nerdwallet.com/article/taxes/qualify...

Taxpayers can claim the 2024 child tax credit on the tax return they will file in 2025 If you still need to file your 2023 tax return that was due April 15 2024 or is due Oct 15

Fixing The Child Care Tax Credit EOPRTF CCLP

Childcare Tax Credit Small Business Advocacy Council SBAC

Editable DAYCARE TAX STATEMENT Printable End Of The Year Etsy

Am I Eligible For A Summer Childcare Tax Credit SME CPA

Total Quality Childcare Center Cincinnati OH

Child Tax Credit Payments 06 28 2021 News Affordable Housing

Child Tax Credit Payments 06 28 2021 News Affordable Housing

What Is The Childcare Tax Credit

Top 7 Daycare Tax Form Templates Free To Download In PDF Format

Update What You Need To Know About The Childcare Tax Credit Changes

Childcare Tax Credit 2023 - Tax credit per child for 2023 The maximum tax credit per qualifying child is 2 000 for children under 17 For the refundable portion of the credit or the additional child tax credit