Claim Marriage Allowance Tax Rebate Web Marriage Allowance lets you transfer 163 1 260 of your Personal Allowance to your husband wife or civil partner It s free to apply for Marriage Allowance This can reduce their tax

Web It s free to apply If both of you have no income other than your wages then the person who earns the least should make the claim If either of you gets other income such as Web Claim by completing the Married Couple s Allowance section of the tax return If you do not fill in a Self Assessment tax return each year Contact HM Revenue amp Customs

Claim Marriage Allowance Tax Rebate

Claim Marriage Allowance Tax Rebate

https://performanceaccountancy.co.uk/wp-content/uploads/2016/07/Marriage_allowance_details.png

Marriage Allowance Tax Advantages For Married Couples

https://moneystepper.com/wp-content/uploads/2015/11/Marriage-Allowance-Example.jpg

Marriage Tax Allowance Claims What Do You Need To Know Gowing Law

https://i.ibb.co/Tmffpxh/marriage.png

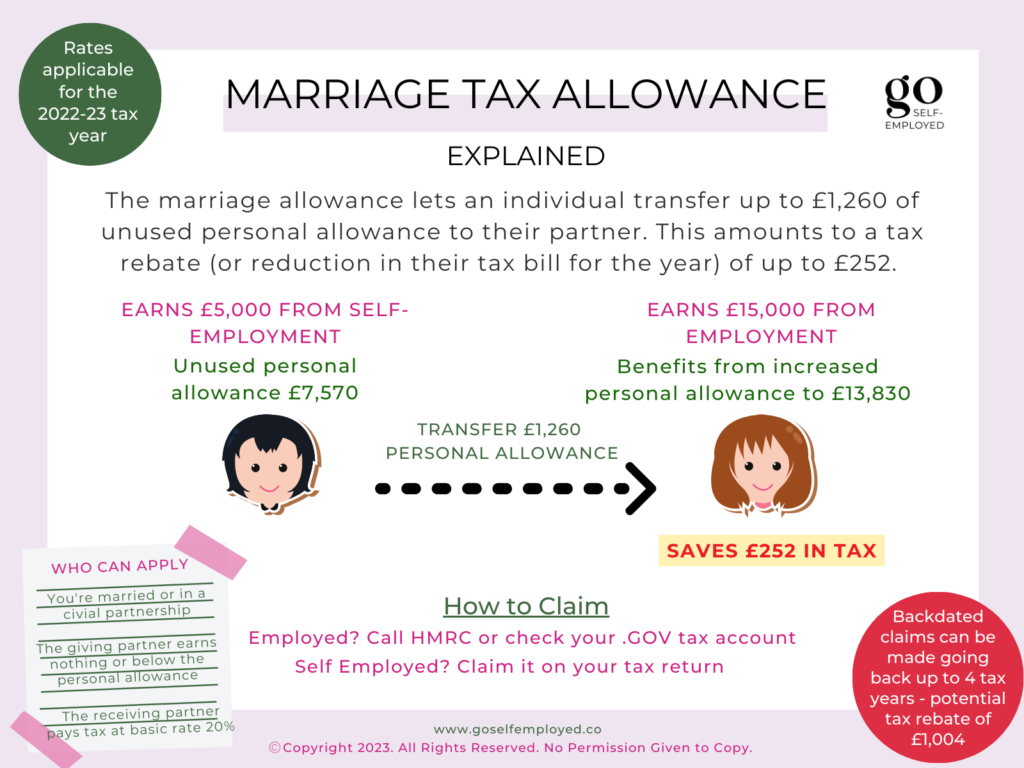

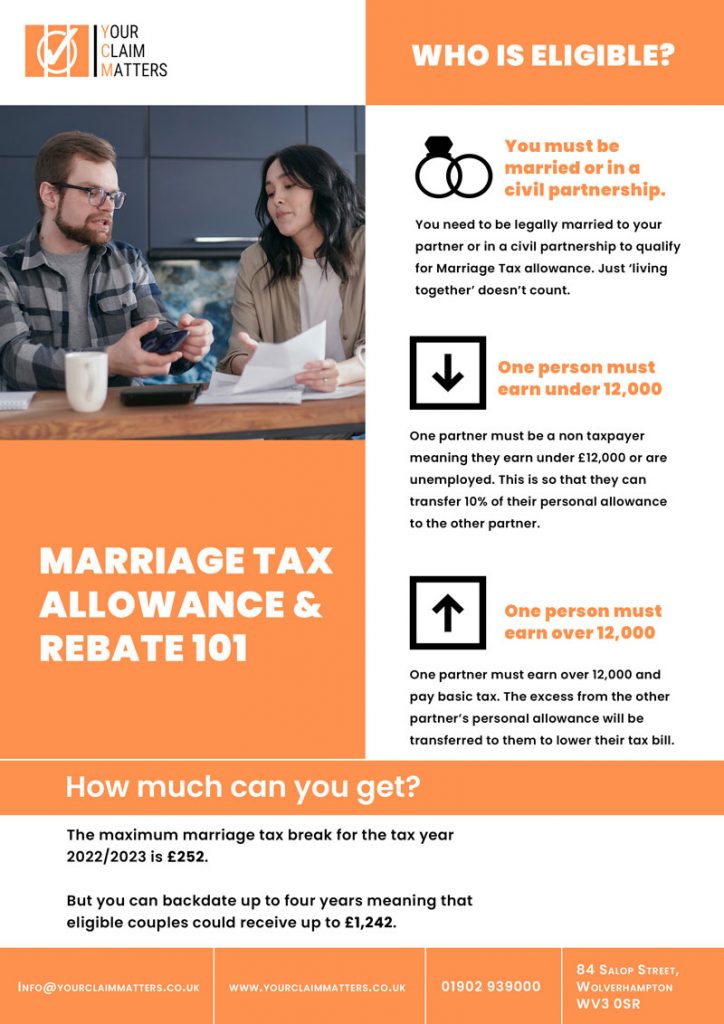

Web 6 avr 2023 nbsp 0183 32 The marriage allowance allows an individual to give up 10 of their personal allowance 163 12 570 in 2023 24 so the amount is 163 1 260 to their spouse or civil partner 20 of this allowance is then given as a Web Kit Sproson Edited by Martin Lewis Updated 16 May 2023 If you re married or in a civil partnership and under 88 years old you may be entitled to a 163 1 260 tax break called the marriage tax allowance something

Web 11 f 233 vr 2022 nbsp 0183 32 Marriage Allowance is free to apply for and customers who claim directly via HMRC s online portal will receive 100 of the tax relief they are eligible for Visit Web If you re married or in a civil partnership you may be entitled to a 163 1 250 tax break called marriage tax allowance something 2 4 million qualifying couples miss out on Check

Download Claim Marriage Allowance Tax Rebate

More picture related to Claim Marriage Allowance Tax Rebate

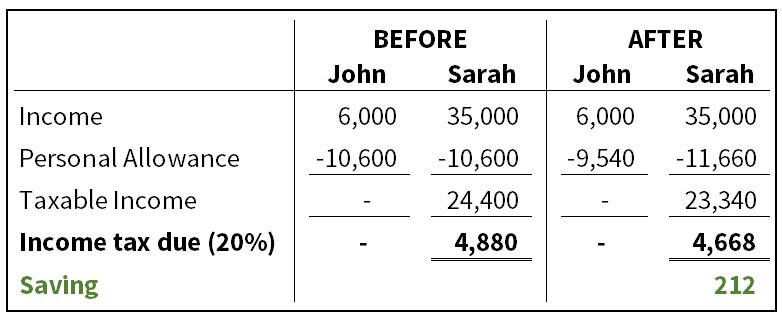

Get An Extra 212 By Using Govt s Marriage Allowance Scheme HotUKDeals

https://images.hotukdeals.com/threads/thread_full_screen/default/2318988_1.jpg

Marriage Allowances You Can Claim

https://theoliversmadhouse.co.uk/wp-content/uploads/2017/07/Screenshot-2017-07-13-20.30.36.png

Marriage Tax Allowance Explained Goselfemployed co

https://goselfemployed.co/wp-content/uploads/2018/07/Marriage-Tax-Allowance-1024x768.png

Web For the 2023 to 2024 tax year it could cut your tax bill by between 163 401 and 163 1 037 50 a year Use the Married Couple s Allowance calculator to work out what you could get If Web What are the time limits In order to claim back to 2017 18 couples have until 5 April 2022 For 2021 22 you have until 5 April 2026 to submit a claim Ready To Get Started Tax

Web 14 f 233 vr 2023 nbsp 0183 32 This is illustrated as follows 2021 22 tax year 163 251 reclaim 2020 21 tax year 163 250 reclaim 2019 20 tax year 163 250 reclaim 2018 19 tax year 163 238 Web 50 Who can claim a marriage allowance tax rebate To make a claim with us you must meet the following criteria You are married or in a civil partnership You earn

Marriage Allowance Claim Your 252 Tax Rebate

https://www.pattersonhallaccountants.co.uk/wp-content/uploads/2023/02/Marriage-Allowance-1024x576.jpg

The 101 Marriage Tax Allowance Rebate And Claim Guide

https://yourclaimmatters.co.uk/wp-content/uploads/2022/12/marriage-tax-allowance-724x1024.jpg

https://www.gov.uk/apply-marriage-allowance

Web Marriage Allowance lets you transfer 163 1 260 of your Personal Allowance to your husband wife or civil partner It s free to apply for Marriage Allowance This can reduce their tax

https://www.gov.uk/marriage-allowance/how-to-apply

Web It s free to apply If both of you have no income other than your wages then the person who earns the least should make the claim If either of you gets other income such as

Marriage Tax Claims What Could I Claim This Christmas Gowing Law

Marriage Allowance Claim Your 252 Tax Rebate

UK Marriage Allowance

Claim The 220 Transferrable Marriage Allowance Today

Marriage Allowance Tax Rebate In UK EmployeeTax

Marriage Allowance Should I Claim Alpha Business Services

Marriage Allowance Should I Claim Alpha Business Services

Married Couples Tax Allowance Claim Form Blank Template Imgflip

Marriage Tax Allowance Rebate My Tax Ltd

How To Claim Marriage Allowance UK Malayalam Uniform Washing Allowance

Claim Marriage Allowance Tax Rebate - Web 11 f 233 vr 2022 nbsp 0183 32 Marriage Allowance is free to apply for and customers who claim directly via HMRC s online portal will receive 100 of the tax relief they are eligible for Visit