Claim My Tax Back Phone Number Check how to claim a tax refund You may be able to get a tax refund rebate if you ve paid too much tax Use this tool to find out what you need to do if you paid too much on

If you were a non taxpayer in the year the PPI was paid out eg currently that means those earning less than the 12 500 personal allowance unless the statutory interest pushes you over the taxpaying threshold Contact HMRC for help with questions about PAYE and Income Tax including coding notices and Marriage Allowance and for advice on savings including ISAs and claiming

Claim My Tax Back Phone Number

Claim My Tax Back Phone Number

https://claimmytaxback.ie/wp-content/uploads/2016/10/step2.png

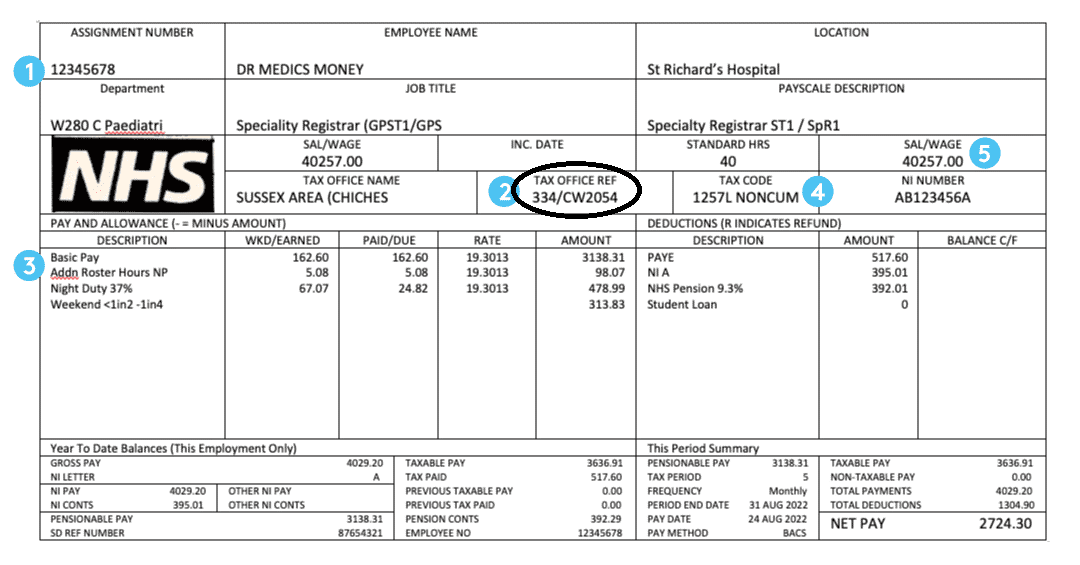

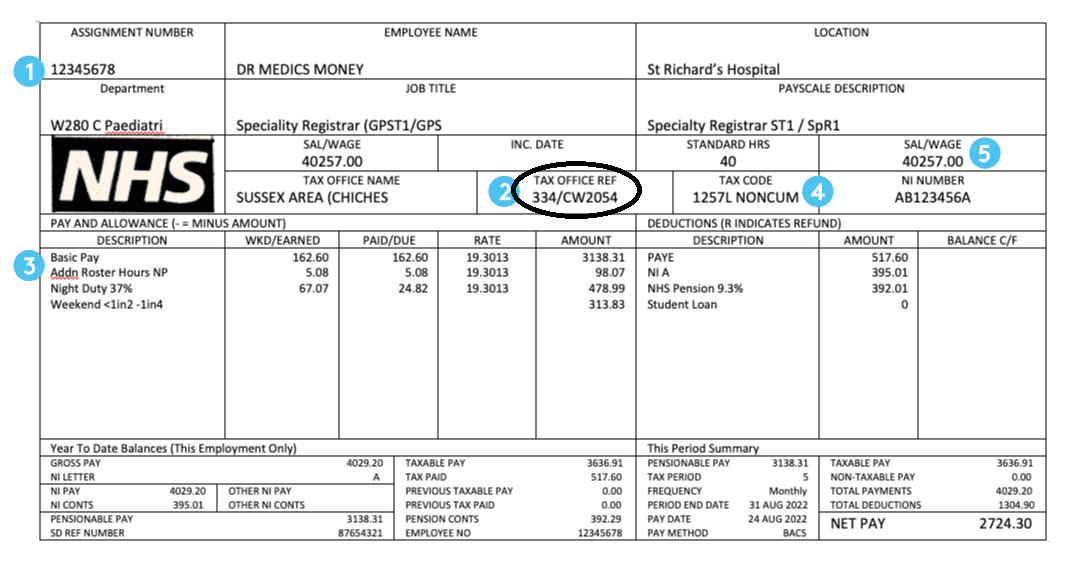

What Is Employer s PAYE Ref Number Claim My Tax Back

https://claimmytaxback.co.uk/wp-content/uploads/2022/12/wage-slip.png

Home Claim My Tax Back

https://claimmytaxback.ie/wp-content/uploads/2016/10/Step1.png

You can also claim a refund through your personal tax account through the HMRC app by contacting HMRC and asking them to send you a cheque When you ll get your 4 Easy Steps To Claim Your Tax Rebate Start Your Claim Click on any of the Calculate Your Tax Refund buttons above from your smart phone tablet or PC to start your claim Eligibility Test Answer the eligibility

Contact Us Claim My Tax Back is a team of tax specialists in UK providing tax return services on Uniform Mileage PPI Marriage and Work From Home Allowances We offer a confidential and stress free service to get started call us on 0161 541 2745 or fill in the contact us form and one of our tax experts will call you back

Download Claim My Tax Back Phone Number

More picture related to Claim My Tax Back Phone Number

Professional Fees Subscriptions And Tools Claim My Tax

https://claimmytax.co.uk/wp-content/uploads/2020/08/Claim-My-Tax-Website.png

Are You Claiming The Correct Tax Credits Claim My Tax Back

https://claimmytaxback.ie/wp-content/uploads/2019/07/38482863171_ff0e852f8e_c.jpg

How To Claim Tax Rebate On Professional Fees Complete Guide

https://claimmytaxback.co.uk/wp-content/uploads/2020/02/tax-refunds-2048x1365.jpg

To claim a deduction for a mobile phone handset or smartphone or other devices you must incur the cost and use the item to perform your work duties have a Former President Donald Trump delivered his usual bombardment of false claims at least 20 in all during a Monday conversation with billionaire supporter Elon Musk which was aired on

The quickest and easiest way to claim a refund is by using our online service myAccount to complete an Income Tax Return For 2020 and subsequent years Sign Telephone and local assistance If you mailed a tax return or letter and haven t yet heard from us don t call or file a second return Find expected wait times for

Claim My Tax Back Reviews Read Customer Service Reviews Of

https://s3-eu-west-1.amazonaws.com/tpd/logos/5e78c4fc600d1a0001be2f68/0x0.png

Claim My Tax Back Reviews Read Customer Service Reviews Of

https://share.trustpilot.com/images/company-rating?locale=en-GB&businessUnitId=5e78c4fc600d1a0001be2f68

https://www.gov.uk/claim-tax-refund

Check how to claim a tax refund You may be able to get a tax refund rebate if you ve paid too much tax Use this tool to find out what you need to do if you paid too much on

https://claimmytax.co.uk/contact-us

If you were a non taxpayer in the year the PPI was paid out eg currently that means those earning less than the 12 500 personal allowance unless the statutory interest pushes you over the taxpaying threshold

What Is Employer s PAYE Ref Number Claim My Tax Back

Claim My Tax Back Reviews Read Customer Service Reviews Of

Claim My Tax Reviews Read Customer Service Reviews Of Claimmytax co uk

Flat Rate Expenses Claim My Tax Back

What Are Back Taxes And How Do I Get Rid Of Them BC Tax

How Do I Claim My Tax Back On Revenue

How Do I Claim My Tax Back On Revenue

Claiming Income Tax Refund Here s What You Should Keep In Mind YouTube

Can I Claim Back Tax Paid In The US

Detailed Guide To Claiming Back Tax On PPI PPI Tax Refund 2021

Claim My Tax Back Phone Number - You can also claim a refund through your personal tax account through the HMRC app by contacting HMRC and asking them to send you a cheque When you ll get your