Claim Tax On Professional Fees If your employer has paid some of your expenses you can only claim tax relief on the amount they have not paid This guide is also available in Welsh Cymraeg You must have paid tax

How can I claim for my professional fees from HMRC To claim for your professional fees for the first time you should complete a form P87 or a self assessment tax return if you complete one You now have the complete guide to tax free shopping in Europe specially tailored for UK travellers

Claim Tax On Professional Fees

Claim Tax On Professional Fees

https://www.caviarfeeling.com/wp-content/uploads/2019/06/pexels-pixabay-209224.jpg

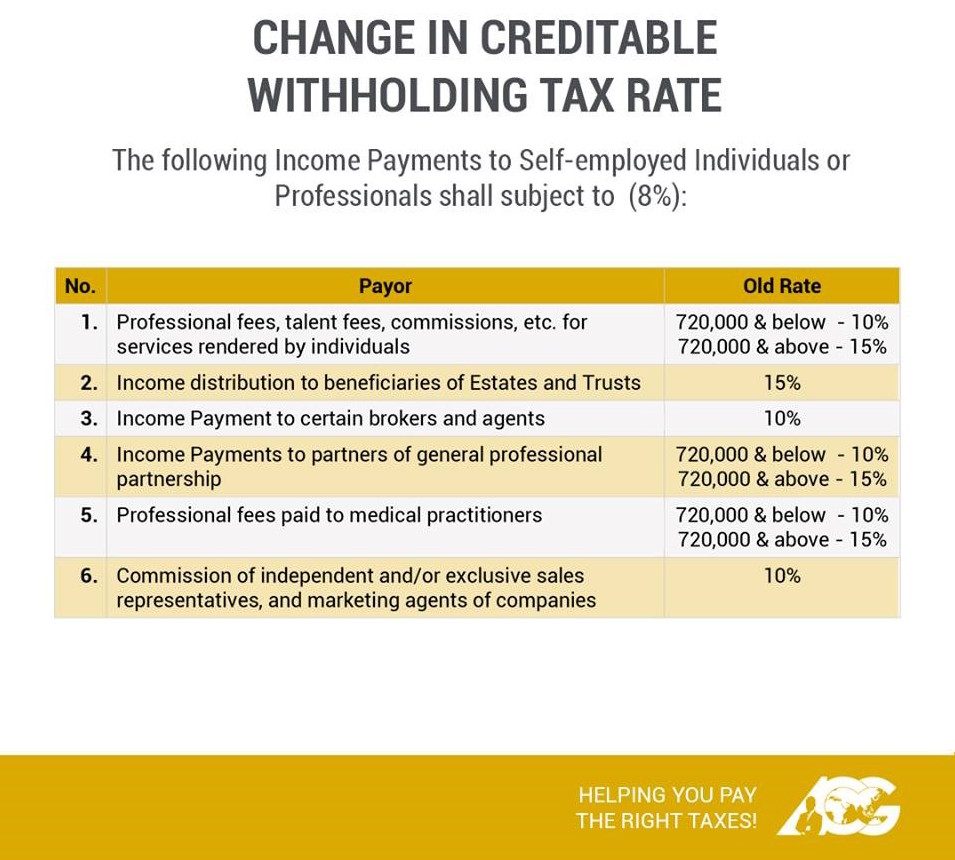

AskTheTaxWhiz Withholding Tax

https://www.rappler.com/tachyon/r3-assets/4ACB916E5A1249EB9CB3D98C3B8013ED/img/A6076DE2D06E4B24A92D8497C1EC3C55/20180222-tax-whiz-1.jpg

LOWERING TAX ON POLL PAY INAPPROPRIATE BIR The POST

https://the-post-assets.sgp1.digitaloceanspaces.com/2022/04/NATION-8-APRIL-23.png

You can claim your professional fees for tax relief as part of your self assessment tax return by entering your subscription amount and the years you re claiming in box 19 on the SA102 form With that we consider A Yes it is true that you can claim tax relief on professional membership fees To be eligible for this the membership is important to have for you to do your job according to the official

If you re a registrant and a UK taxpayer you can claim back tax on your registration fees Claiming back tax is sometimes called tax relief You can claim tax back on your registration If you complete a self assessment tax return you can claim tax relief from your exam fees on the employment page of the return If you do not file a tax return you can claim tax relief using

Download Claim Tax On Professional Fees

More picture related to Claim Tax On Professional Fees

Professional Fees Subscriptions And Tools Claim My Tax

https://claimmytax.co.uk/wp-content/uploads/2020/08/Claim-My-Tax-Website.png

Tax And Super Tips For Teachers Teacher Teaching Teaching Tips

https://i.pinimg.com/736x/95/a6/3b/95a63b175cc3d5569bc5d28f9a36a0b4.jpg

Withholding Tax On Professional Fees In Kenya Sure I Can Flickr

https://live.staticflickr.com/65535/52904605445_7f5f6c8beb_b.jpg

HMRC allows you to claim tax relief on professional fees subscriptions tools needed for your employment You can claim tax relief on Professional membership fees if you must pay the fees to be able to do your job When completing a tax form claims should be made under the section relating to professional fees and subscriptions The allowable figure to be entered should be 67 of the total

As an employer covering the cost of your employees subscriptions and professional fees you have certain tax National Insurance and reporting obligations You can t claim children s school fees or care Memberships accreditations fees and commissions Deductions for union fees professional memberships working with children

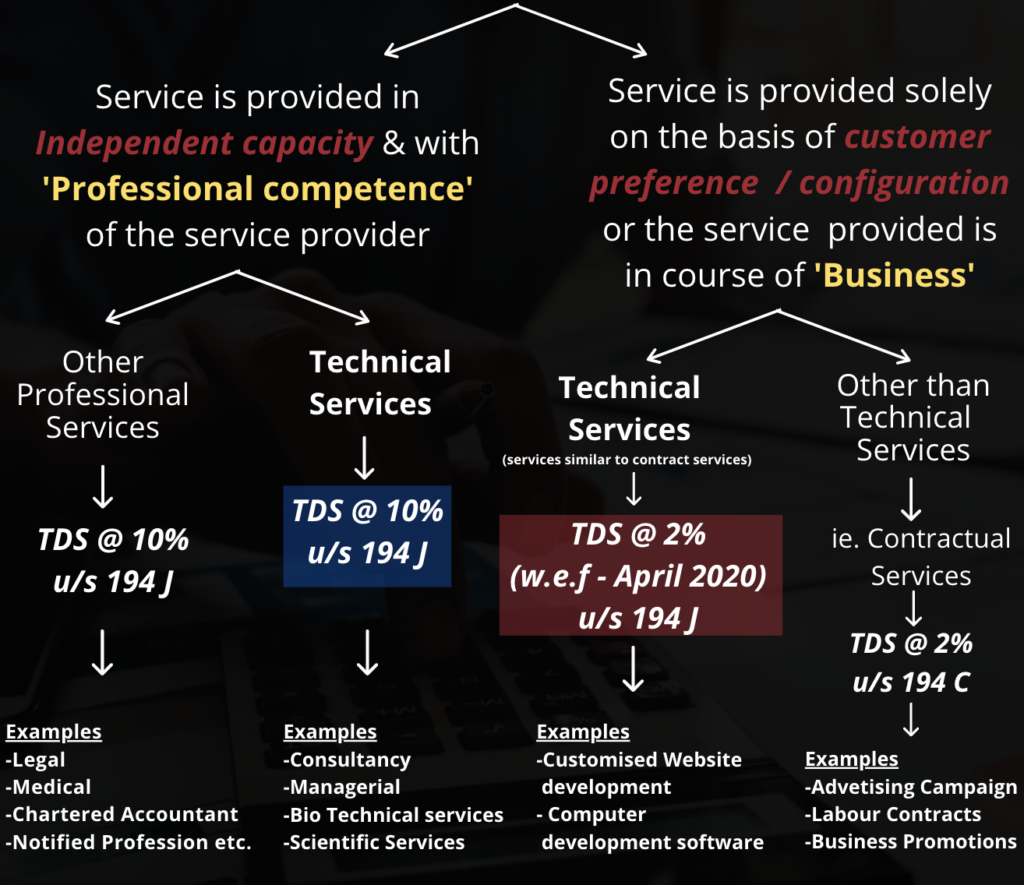

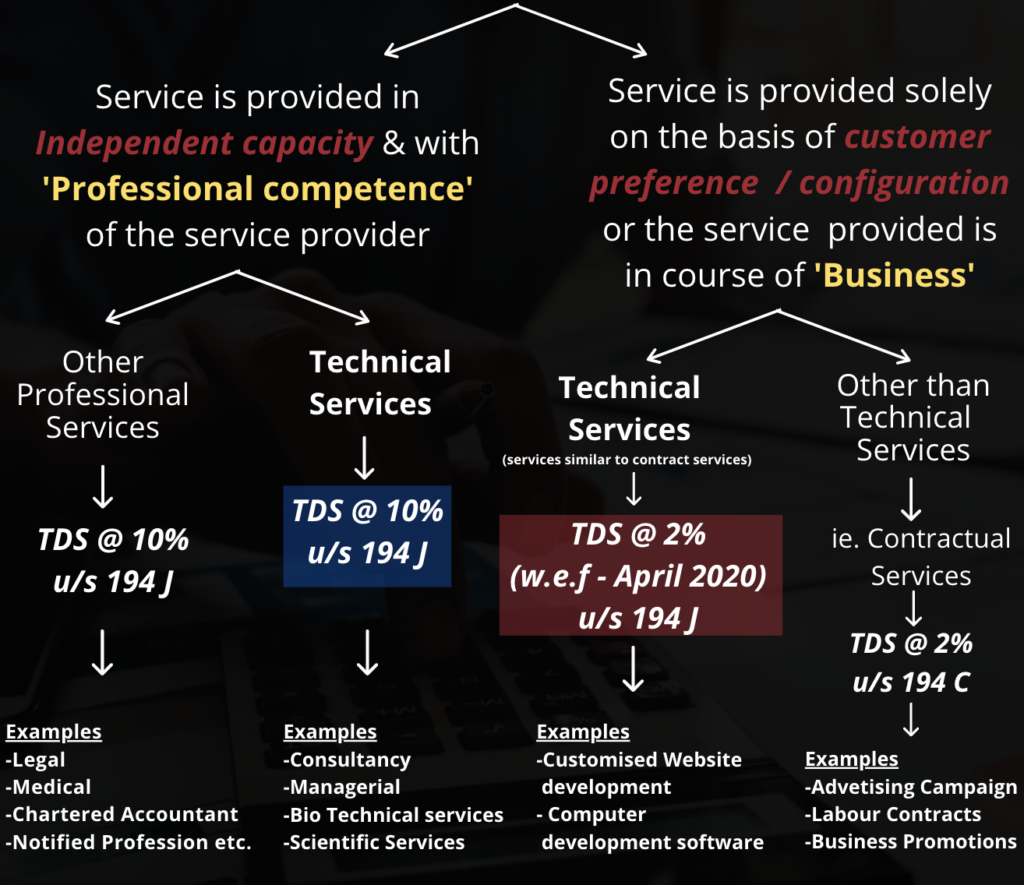

Provision Of TDS On Professional Technical Services Fee

https://carajput.com/blog/wp-content/uploads/2021/12/Screen-Shot-2020-08-17-at-2.44.37-PM-1-1024x885-1.png

Michel Reforms Impacts For Companies Workers And Savers Tax Reforms

https://pragma.international/sites/default/files/styles/blog_header/public/articles/17/09/invest.jpg?itok=C8c55wuy

https://www.gov.uk › tax-relief-for-employees

If your employer has paid some of your expenses you can only claim tax relief on the amount they have not paid This guide is also available in Welsh Cymraeg You must have paid tax

https://www.taxrebateservices.co.uk › tax-guides › ...

How can I claim for my professional fees from HMRC To claim for your professional fees for the first time you should complete a form P87 or a self assessment tax return if you complete one

Explore Our Image Of Law Firm Invoice Template Invoice Template Word

Provision Of TDS On Professional Technical Services Fee

Professional Fee Withholding Tax In The Philippines TAXGURO

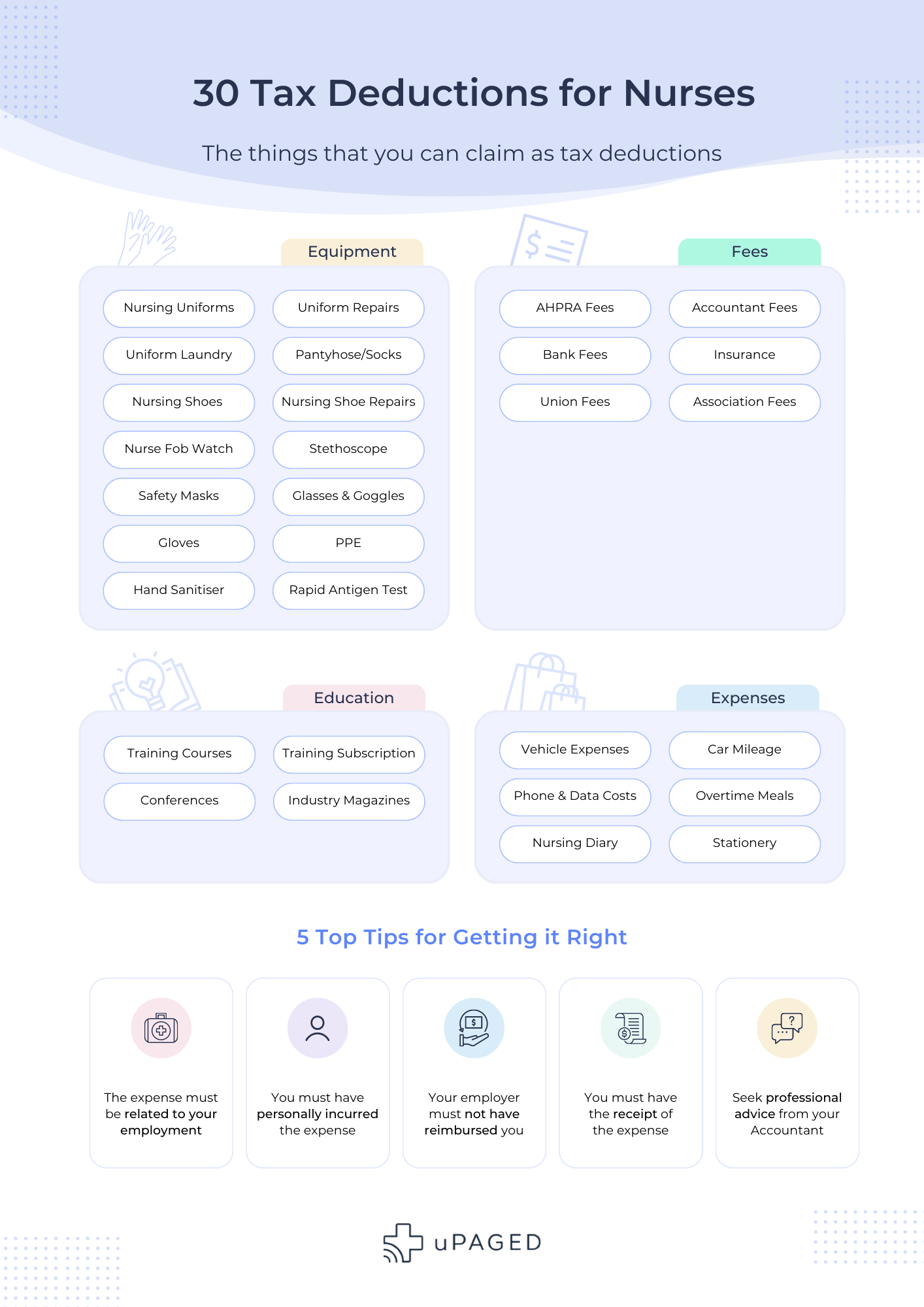

30 Things Nurses Can Claim As Tax Deductions In 2023 UPaged

15 Reasons Why You Could Be Due A Tax Rebate QuickRebates

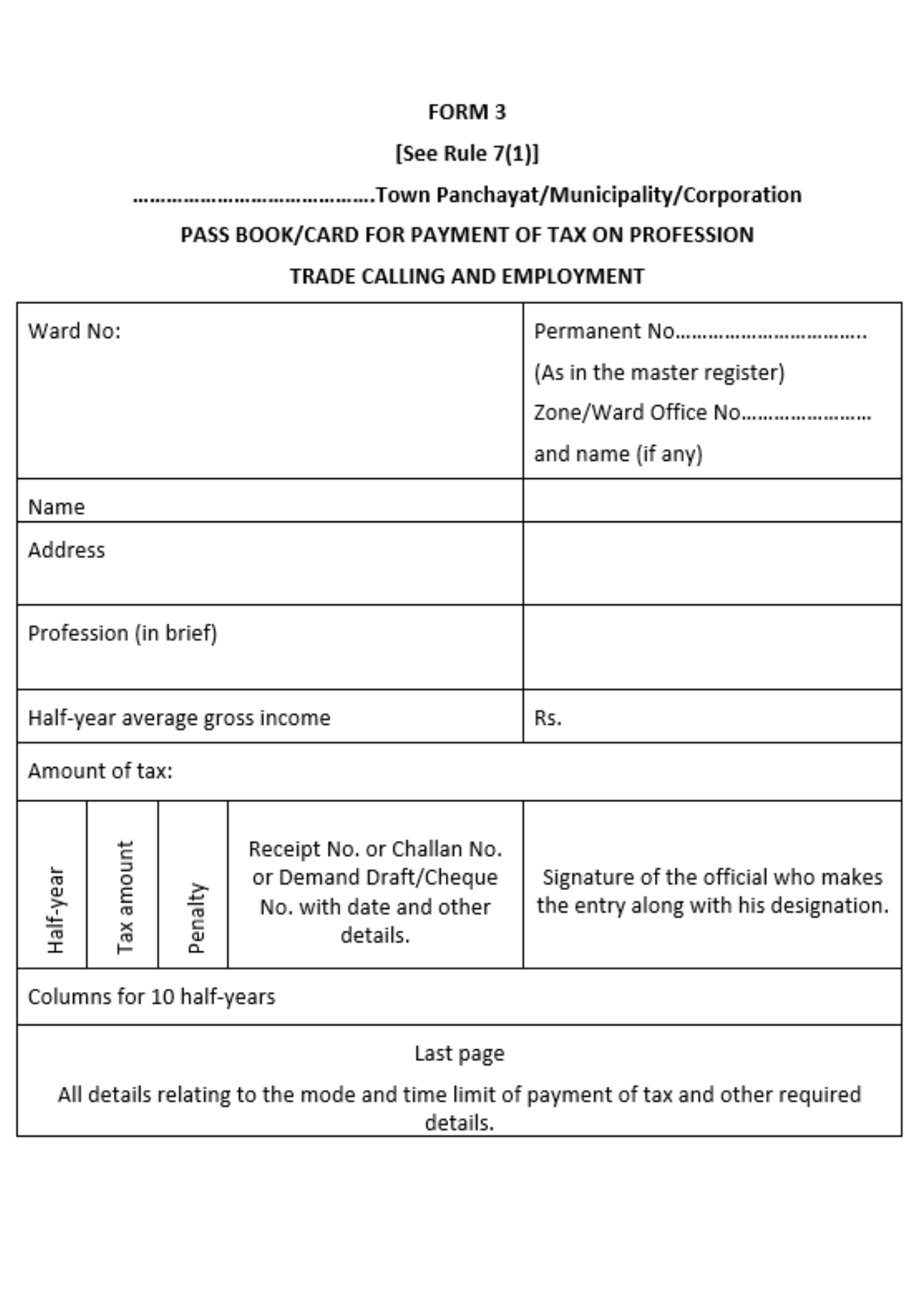

Professional Tax In Tamil Nadu

Professional Tax In Tamil Nadu

A Guide To The Basics Of Withholding Tax Expanded ACCOUNTAHOLICSPH

Professional Tax PT Registration In Bangalore Karnataka PatsonLegal

HMRC Tax Rebates Tips And Advice Claim My Tax Back

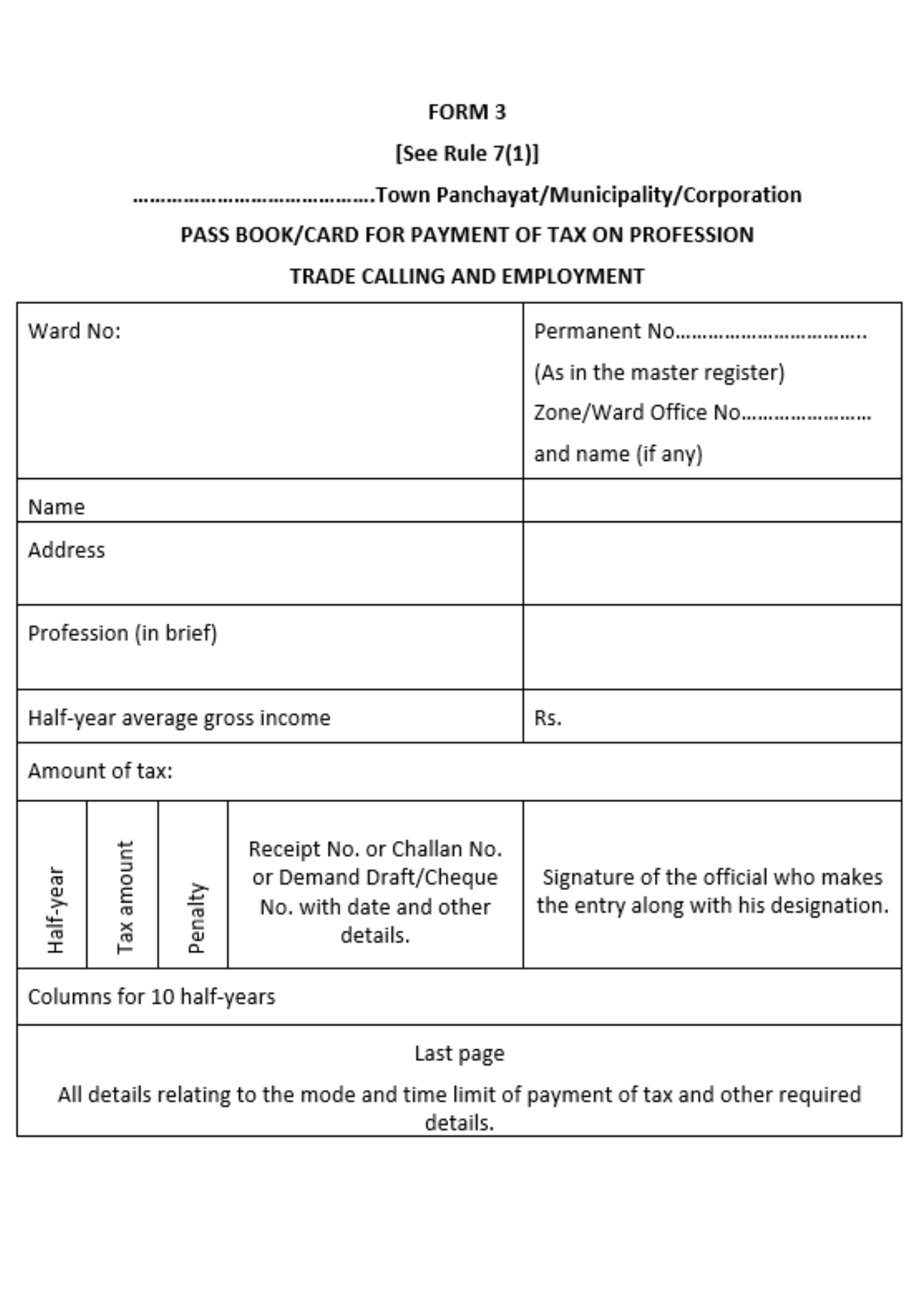

Claim Tax On Professional Fees - UK tax paying employees are allowed to claim tax relief on their annual professional fees or subscriptions to some HMRC approved professional organizations The