Income Tax Home Loan Rebate Web 12 juin 2023 nbsp 0183 32 Updated on Jun 15th 2023 9 min read CONTENTS Show Acquiring a home loan can provide opportunities to save on taxes in accordance with the

Web under Section 80C of the Income Tax Act you can claim a maximum home loan tax deduction of up to 1 5 lakh from your annual taxable income on the principal loan Web Home Loan Tax Benefits under Section 80C Principal Deductions Section 80C deals with the principal amount deductions For both self occupied and let out properties you can

Income Tax Home Loan Rebate

Income Tax Home Loan Rebate

https://lh5.googleusercontent.com/proxy/_to2OsQ67tRR4OwClZoiK8C99OHj3utcTVj3Q3bWbdpZVdQj_PtSnOS_64ZT2jiqSPfBqvnDWsCyETNMDekbIwWLP_7zi7sagEKJarz_V0esJDVAQsIgvY3jjvwKYw=w1200-h630-p-k-no-nu

Latest Income Tax Rebate On Home Loan 2023

https://www.homebazaar.com/knowledge/wp-content/uploads/2022/10/table_Rebate-for-Joint-House-Loan.png

Latest Income Tax Rebate On Home Loan 2023

https://www.homebazaar.com/knowledge/wp-content/uploads/2022/10/line_Rebate-on-Home-Loan-for-Interest-Paid.png

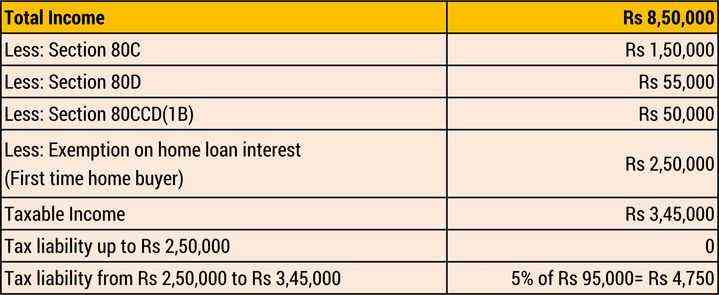

Web 3 mars 2023 nbsp 0183 32 Income Tax Rebate on Home Loan for Interest Paid Principal payment Interest payment Web 24 ao 251 t 2023 nbsp 0183 32 Updated 24 08 2023 09 31 08 AM The Government of India offers home loan tax benefits of up to Rs 5 lakh to individuals deduction of up to Rs 1 5 lakh

Web 7 janv 2023 nbsp 0183 32 The tax rebate on housing loan interest under Section 24 b needs to be hiked to at least Rs 5 lakh This will add momentum to housing demand particularly in the affordable segment said Anuj Puri Web Income tax rebate on home loan Joint mortgage deductions Borrowers may deduct up to Rs 2 lakhs in interest and Rs 1 5 lakh in principle from their house loan but only if they

Download Income Tax Home Loan Rebate

More picture related to Income Tax Home Loan Rebate

Income Tax Rebate For Housing Loan Form No 12C Pallikalvi Teachers News

https://1.bp.blogspot.com/-oW8FNR-IJDU/XikG4UEcNwI/AAAAAAAAHps/3fzchCO4L400lsdyUEyhQ4S0xHA0wQ9tQCLcBGAsYHQ/w1200-h630-p-k-no-nu/FORM12C_2015_16_001.jpg

DEDUCTION UNDER SECTION 80C TO 80U PDF

https://www.relakhs.com/wp-content/uploads/2018/03/Income-Tax-Deductions-List-FY-2018-19-Income-tax-exemptions-tax-benefits-Fy-2018-19-AY-2019-20-Section-80c-limit-80D-80E-NPS-Home-loan-interest-loss-standard-deduction.jpg

Home Loan Rebate In Income Tax In Hindi

https://expertkamai.com/wp-content/uploads/2023/05/Home-Loan-Rebate-In-Income-Tax-In-Hindi-768x431.jpg

Web 6 sept 2023 nbsp 0183 32 Income Tax Rebate on Home Loan 2020 21 As per the Union Budget 2020 taxpayers have the full freedom to either opt for the new tax slab or stick to the old tax regime However if you go by the Web 2 avr 2022 nbsp 0183 32 New income tax rules from April 2022 Those first time home buyers who have got home loan sanction letter before 1st April 2022 and their property value is less

Web Section 80C Deductions under this section can help you with tax benefits of up to Rs 1 5 lakhs on the principal amount Section 24 Under this section you are allowed to enjoy Web Income tax benefit on home loan is available under Section 80 EEA which provides income tax benefits of up to Rs 1 5 lakh on the home loan interests paid These home

Home Loan Tax Benefits In India Important Facts

https://propertyadviser.in/assets/front/images/real-estate-news/s1/income-tax-rebate-on-home-loan-819-s1.jpg

Joint Home Loan Declaration Form For Income Tax Savings And Non

https://lh3.googleusercontent.com/-m3Y3HavWnbc/YgqSD7tknxI/AAAAAAAAYdw/PRErS72JdeIE0B2a37gG1CvGAfWFlQvHwCNcBGAsYHQ/s1600/1644859917358770-0.png

https://cleartax.in/s/home-loan-tax-benefits

Web 12 juin 2023 nbsp 0183 32 Updated on Jun 15th 2023 9 min read CONTENTS Show Acquiring a home loan can provide opportunities to save on taxes in accordance with the

https://cred.club/calculators/articles/how-to-calculate-home-loan-tax...

Web under Section 80C of the Income Tax Act you can claim a maximum home loan tax deduction of up to 1 5 lakh from your annual taxable income on the principal loan

Know The Tax Amount You Can Save On Your Home Loan Under Section 24 And

Home Loan Tax Benefits In India Important Facts

Section 87A Tax Rebate Under Section 87A

How To Claim Interest On Home Loan Deduction While Efiling ITR

Home Loan Interest Exemption In Income Tax Home Sweet Home

Section 80EE Income Tax Deduction For Interest On Home Loan Housing News

Section 80EE Income Tax Deduction For Interest On Home Loan Housing News

How To Celebrate With Rebate Planning For Incomes PRACTICAL TAX

Interim Budget 2019 20 The Talk Of The Town Trade Brains

Pin On Best Samples Receipt Templates

Income Tax Home Loan Rebate - Web Updated on Jul 30th 2022 8 34 49 PM 6 min read CONTENTS Show Section 80EE allows income tax benefits on the interest portion of the residential house property loan