Income Tax Me Home Loan Rebate Verkko Deductions for first time homebuyers If you have taken a loan to buy residential property as a first time homebuyer you may be entitled to higher deductions If you have no capital income during the tax year you can get deductions for home loan interest in the form of a credit for deficit

Verkko 18 jouluk 2023 nbsp 0183 32 how much tax benefit on home loan The tax benefit for a home loan as per different sections in Income Tax Acts is listed below Up to Rs 2 lakh under Section 24 b for self occupied home Up to Rs 1 5 lakh under Section 80C Who is eligible to claim tax deductions on home loans Verkko 5 helmik 2023 nbsp 0183 32 Home Loan Tax Benefit Income Tax Benefit on House Loan know about Tax benefit on Home loan Housing loan interest deduction Income Tax rebate on Home loan Find out Income tax exemption and

Income Tax Me Home Loan Rebate

Income Tax Me Home Loan Rebate

https://cdn.zeebiz.com/sites/default/files/styles/zeebiz_850x478/public/2020/04/28/117658-bank-loan-pti.jpg?itok=G0GkZm2Q&c=4d7c9c9efe3dff224ff5225977fd6c8f

Latest Income Tax Rebate On Home Loan 2024

https://www.homebazaar.com/knowledge/wp-content/uploads/2022/10/Rebate-on-Home-Loan-As-Per-Section-80EE-and-80-EEA-750x362.jpg

Home Loan Tax Exemption Check Tax Benefits On Home Loan

https://www.urbanmoney.com/blog/wp-content/uploads/2022/10/HOME-LOAN-TAX-EXEMPTION-Always-good-to-save-more-100-1-1.jpg

Verkko 11 tammik 2023 nbsp 0183 32 On purchase of property with home loans borrowers enjoy a variety of deductions on their income tax liability These deductions against the tax could be claimed under four sections of the income tax act namely Section 80C Section 24 Section 80EE and Section 80EEA In this article we will discuss at length how these Verkko Things to know about tax benefits on home loan for joint owners The tax deduction fraction is determined by the loan s ownership proportion Each joint owner of the home loan can claim the maximum tax refund i e Rs 2 00 000 for interest on the home loan

Verkko 20 lokak 2023 nbsp 0183 32 As per Section 80C of the Income Tax Act You can claim a deduction of up to Rs 1 5 lakh on the amount paid as the repayment of the home loan principal This may include stamp duty and registration fees but can be claimed once in the same year in which they incurred Verkko 30 maalisk 2023 nbsp 0183 32 Taxation rules for a second home loan depend on the purpose of your purchase So here s how you can claim tax benefits as per the usage of your second home When one of your houses is on rent The income you generate by renting your house is taxable according to the Income Tax Act

Download Income Tax Me Home Loan Rebate

More picture related to Income Tax Me Home Loan Rebate

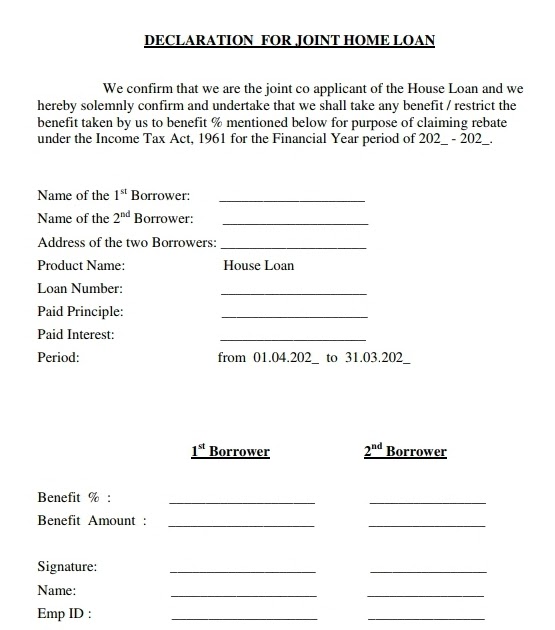

Joint Home Loan Declaration Form For Income Tax Savings And Non

https://lh3.googleusercontent.com/-m3Y3HavWnbc/YgqSD7tknxI/AAAAAAAAYdw/PRErS72JdeIE0B2a37gG1CvGAfWFlQvHwCNcBGAsYHQ/w1200-h630-p-k-no-nu/1644859917358770-0.png

ITR Filing Income Tax Exemption Deduction That Home Loan Borrowers

https://img.etimg.com/thumb/msid-103082793,width-1070,height-580,imgsize-1585531/photo.jpg

Income Tax Benefits On Home Loan Loanfasttrack

https://www.loanfasttrack.com/blog/wp-content/uploads/2020/12/IncomeTaxBenfits-800x534.png

Verkko What is the maximum tax benefit on home loan The maximum tax deduction for a housing loan as per different sections in Income Tax Acts is listed below Up to Rs 2 lakh under Section 24 b for self occupied home Up to Rs 1 5 lakh under Section 80C Verkko 9 syysk 2022 nbsp 0183 32 Income tax rebate on home loan In this guide we will discuss the terms and conditions to claim income tax rebates under various sections of the income tax law in India If you have taken a home loan you can avail of rebates on your income tax liability under various sections of the Income Tax Act in India

Verkko Under Section 24 of the Income Tax Act an individual can claim a tax deduction of the interest payment on the housing loan up to a maximum amount of Rs 2 00 000 You can claim this deduction if you complete the building of the house within 5 years otherwise you can claim only Rs 30 000 Verkko 26 hein 228 k 2019 nbsp 0183 32 1 Income Tax benefits on a joint home loan can be claimed by all the joint owners 2 Ownership is required for joint owners i e Co owner 3 Joint owners have taken the loan jointly i e Co borrower 4 Not being a under construction property i e complete property 5

SBI Credai Sign MoU For Home Loan Rebate For Budget Housing

https://roofandfloor.thehindu.com/raf/real-estate-blog/wp-content/uploads/sites/14/2017/04/thumbnail_MoU-for-home-loan-rebate_Banner.jpg

Income Tax Rebate On Home Loan 2022

https://www.homebazaar.com/knowledge/wp-content/uploads/2022/10/FeatureImage_Income-tax-rebate-on-home-loan-750x512.jpg

https://www.vero.fi/en/individuals/tax-cards-and-tax-returns/...

Verkko Deductions for first time homebuyers If you have taken a loan to buy residential property as a first time homebuyer you may be entitled to higher deductions If you have no capital income during the tax year you can get deductions for home loan interest in the form of a credit for deficit

https://cleartax.in/s/home-loan-tax-benefits

Verkko 18 jouluk 2023 nbsp 0183 32 how much tax benefit on home loan The tax benefit for a home loan as per different sections in Income Tax Acts is listed below Up to Rs 2 lakh under Section 24 b for self occupied home Up to Rs 1 5 lakh under Section 80C Who is eligible to claim tax deductions on home loans

Federal Bank Home Loan 2023

SBI Credai Sign MoU For Home Loan Rebate For Budget Housing

Property Tax Rebate Checks Are Coming Here s How Much Money You re Due

Tax Rebate Service No Rebate No Fee MBL Accounting

Income Tax Rebate Under Section 87A For Income Up To 5 Lakh

Latest Income Tax Rebate On Home Loan 2024

Latest Income Tax Rebate On Home Loan 2024

Deadline For Tax And Rent Relief Extended

Joint Home Loan Declaration Form For Income Tax Savings And Non

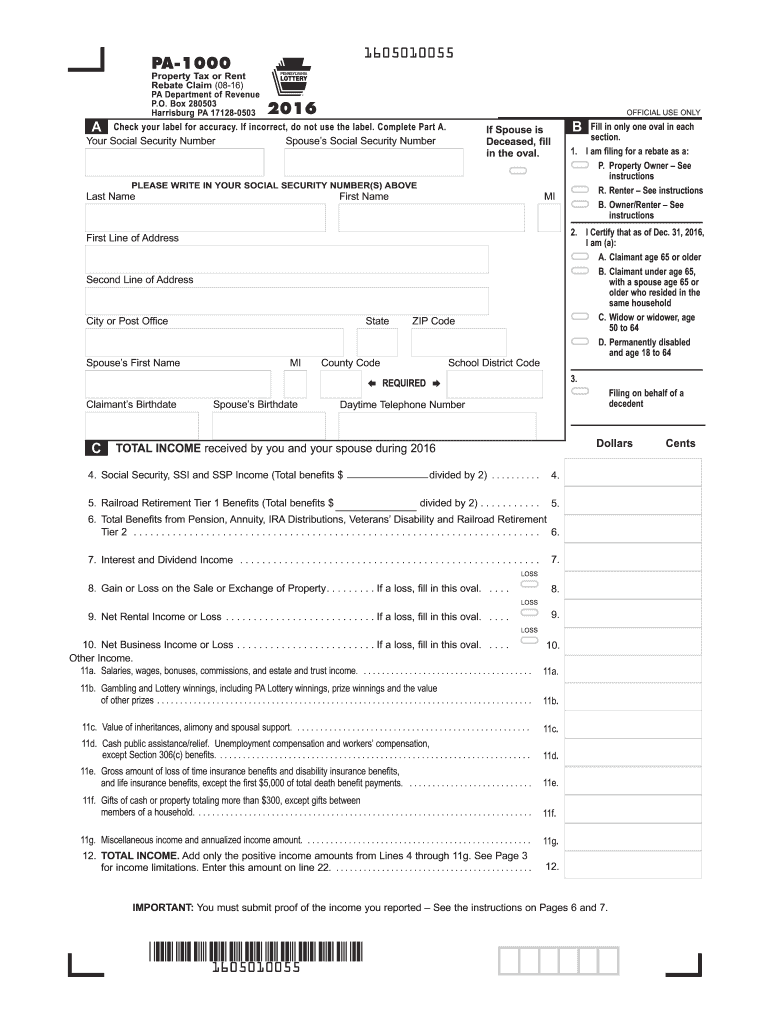

Property Tax Or Rent Rebate Claim PA 1000 FormsPublications Fill Out

Income Tax Me Home Loan Rebate - Verkko 21 maalisk 2021 nbsp 0183 32 Whether you have one home loan or more the deduction allowable under Section 80 C for repayment of home loan is restricted to Rs 1 50 lakh together with various other eligible items