Claim Tax Rebate For Working From Home During Covid In October 2020 the Government created the working from home microservice to help people claim tax relief in the pandemic Within this the rules

Don t forget to claim tax relief Tax The Guardian You can claim tax relief if you have been working at home over the past 12 months because of Covid If so you can apply for tax relief up to 140 per tax year Some workers will be able to claim for this 2022 23 tax year too giving them up to 420 in The money is

Claim Tax Rebate For Working From Home During Covid

Claim Tax Rebate For Working From Home During Covid

https://cljgives.org/wp-content/uploads/2017/08/20170809-MM0000809-rebates.png

Older Disabled Residents Can File For Property Tax Rent Rebate Program

https://cdn.centraljersey.com/wp-content/uploads/sites/28/2022/01/20425_rev_rentRebate_NK_01-scaled.jpg

List Of Personal Tax Relief And Incentives In Malaysia 2024

https://iqiglobal.com/blog/wp-content/uploads/2023/01/tax-relief.jpg

Millions of workers were able to claim tax relief on expenses they incurred from working from home during the Covid 19 pandemic but the rules have changed since then Some people will still be eligible For basic rate taxpayers the relief was worth 20 of the 6 1 20 a week Higher rate taxpayers could claim 40 of the 6 2 40 a week Over the course of the year this meant people could

Complete Form T777S Statement of Employment Expenses for Working at Home Due to COVID 19 if you are only claiming home office expenses on line 22900 All taxpayers can get a flat rate of tax relief on 6 a week basic rate taxpayers will gain 1 20 a week 20 of 6 which equates to 60 a year Higher rate

Download Claim Tax Rebate For Working From Home During Covid

More picture related to Claim Tax Rebate For Working From Home During Covid

Income Tax Rebate On Personal Loan Claim Tax Rebate For Personal Loan

https://i.ytimg.com/vi/d7NE7aZzU2Q/maxresdefault.jpg

Working From Home Allowance Calculator Employed Individuals

https://www.spondoo.co.uk/wp-content/uploads/2022/02/Working-from-Home-Allowance-Calculator-–-employed-individuals.png

Pa 1000 2021 2024 Form Fill Out And Sign Printable PDF Template SignNow

https://www.signnow.com/preview/585/571/585571881/large.png

The percentage of your costs that Revenue counts as working from home expenses You can claim relief on the following From 2022 30 of electricity heating and internet This can be paid by your employer but given many are struggling right now they might tell you to claim tax relief on this payment via HM Revenue Customs

Last tax year people who had been forced to work from home due to Covid 19 even if only for one day were able to claim a tax allowance of 6 a week if their extra expenses Higher rate taxpayers those earning 50 000 plus can claim 40 or 2 40 a week If you end up working the whole tax year at home from 6 April 2020 onwards

Tax Rebate For First Time Homeowners How To Claim Your Tax Rebate

https://asapapartmentfinders.com/wp-content/uploads/2016/12/tax-rebate.jpg

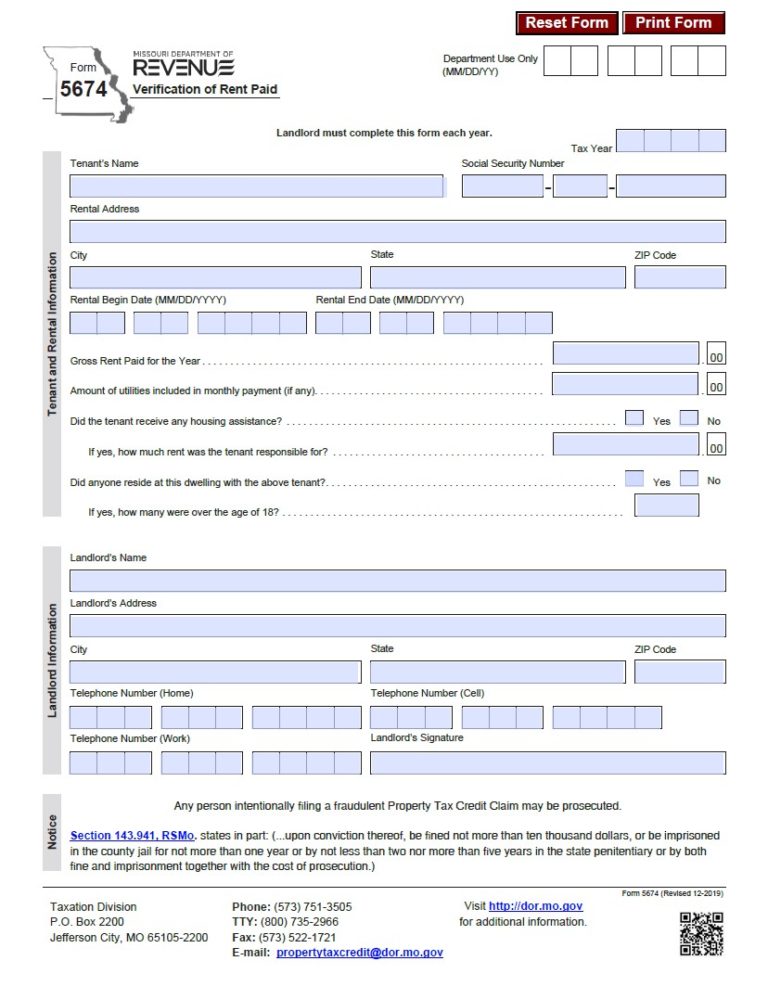

Rent Rebate Form Missouri Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2021/08/Rent-Rebate-Form-Missouri-2021-768x999.jpg

https://blog.moneysavingexpert.com/2020/04/martin...

In October 2020 the Government created the working from home microservice to help people claim tax relief in the pandemic Within this the rules

https://www.theguardian.com/money/2021/apr/13/...

Don t forget to claim tax relief Tax The Guardian You can claim tax relief if you have been working at home over the past 12 months because of Covid

PA Property Tax Rent Rebate Apply By 6 30 2023 Legal Aid Of

Tax Rebate For First Time Homeowners How To Claim Your Tax Rebate

Income Tax Rebate Under Section 87A For Income Up To 5 Lakh

Claim A Tax Rebate For Your Uniform Rmt

Property Tax Rebate Pennsylvania LatestRebate

Chart The Perks Of Working From Home Statista

Chart The Perks Of Working From Home Statista

Printable Rebate Form For Old Style Beer Printable Forms Free Online

Income Tax Rebate Under Section 87A

Breathtaking Income Tax Calculation Statement Two Types Of Financial

Claim Tax Rebate For Working From Home During Covid - People who worked from home during the pandemic could be eligible for tax relief of up to 125 a year even if they only did so for one day Employees