Tax Rebate For Life Insurance Web 5 mai 2023 nbsp 0183 32 Types of Tax Rebates in Life Insurance Section 80C This section allows the deduction of the taxable income up 1 5 Lakhs Instruments under this section 1 ELSS

Web Total amount of contributions from YA 2023 onwards Less than 5 000 Amount of Life Insurance Relief allowed You may claim the lower of a the difference between 5 000 Web 11 nov 2019 nbsp 0183 32 Tax rebate Section 33 4 d of Personal Income Tax Act PITA allows a deducon of the annual amount of any premium paid by an individual in respect of

Tax Rebate For Life Insurance

Tax Rebate For Life Insurance

https://i2.wp.com/greatoutdoorsabq.com/wp-content/uploads/2019/02/tax-on-life-insurance-payout-1.jpg

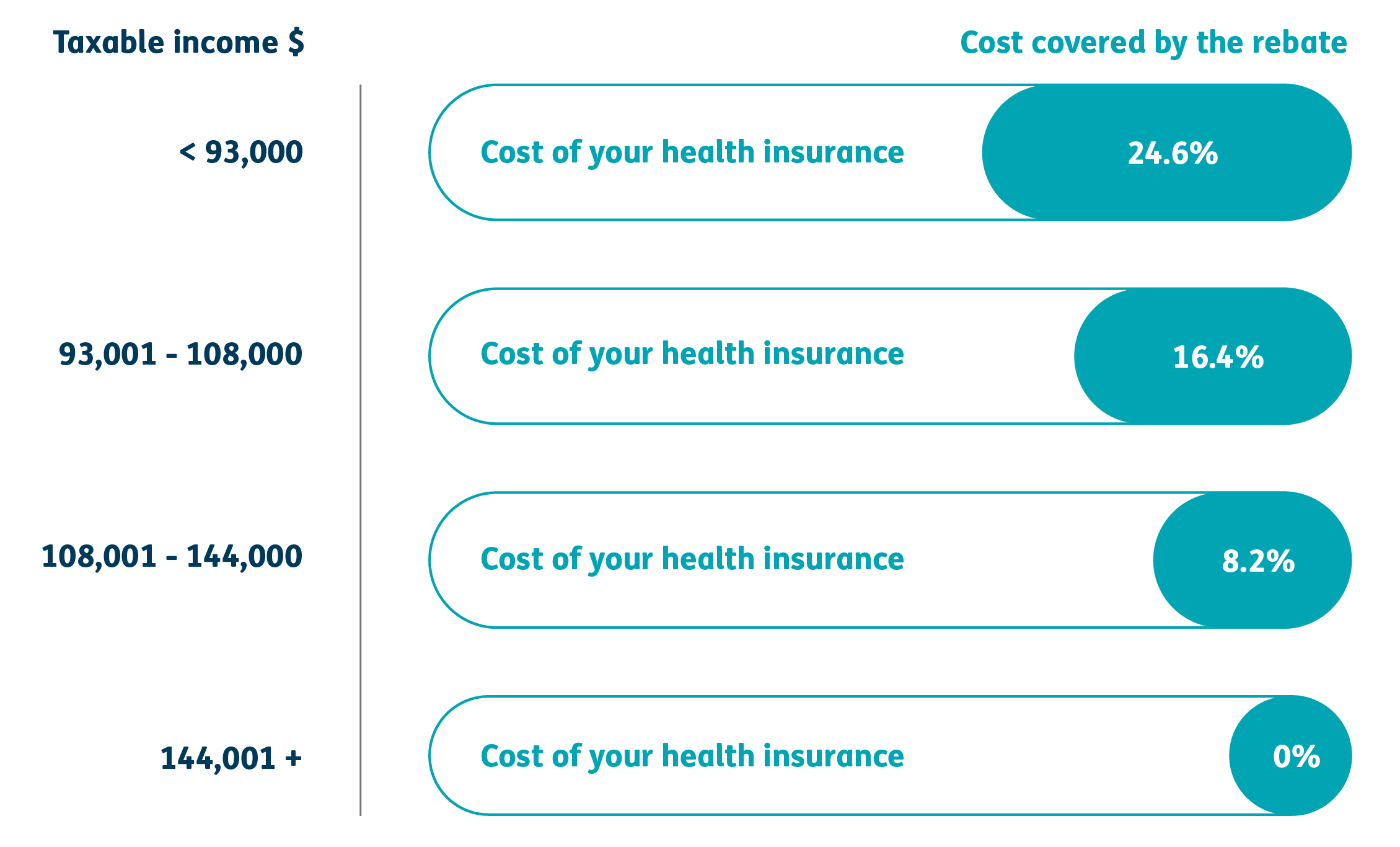

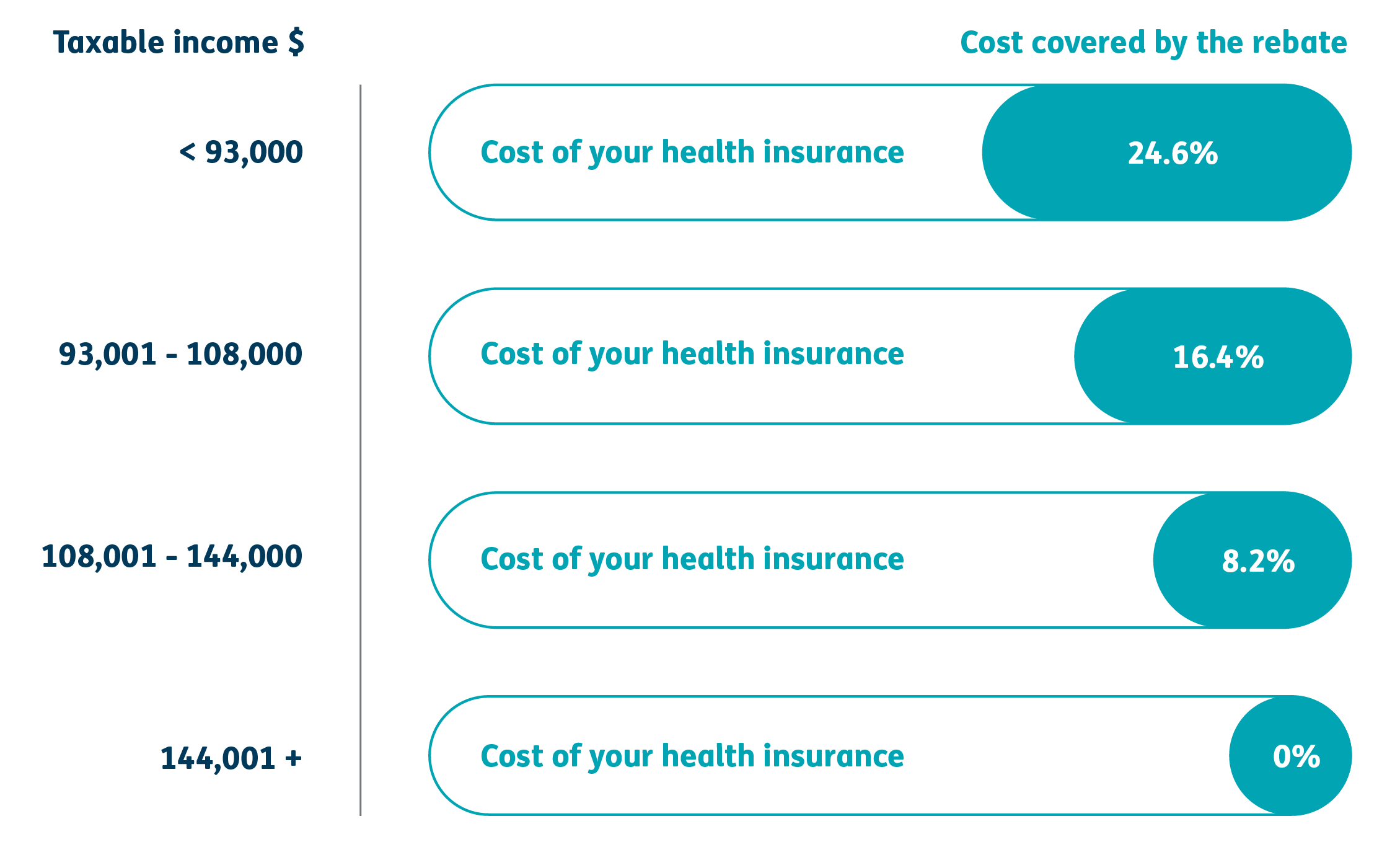

Tax And Rebates HBF Health Insurance

https://www.hbf.com.au/-/media/images/hbf/health-insurance/extras/singles-under-65.png?la=en&hash=46D4FB6E7BDC69C8763810EDA3F938B622C37A8C

Private Health Insurance Rebate Navy Health

https://navyhealth.com.au/wp-content/uploads/2018/03/Federal-Government-Rebate-1-APR-2019.png

Web Tax Exemption on Insurance Premiums Salaried employees and businessmen can invest in life insurance or medical insurance in order to consider themselves eligible for tax Web 7 juin 2022 nbsp 0183 32 Key Takeaways Life insurance premiums under most circumstances are not taxed i e no sales tax is added or charged These premiums are also not tax deductible If an employer pays

Web Title Tax Leaflet Final CTP Created Date 10 12 2021 6 00 42 PM Web 27 sept 2021 nbsp 0183 32 Here are ways your life insurance benefits could be taxed Withdrawing too much from a universal life policy Terminating a cash value policy with outstanding loans

Download Tax Rebate For Life Insurance

More picture related to Tax Rebate For Life Insurance

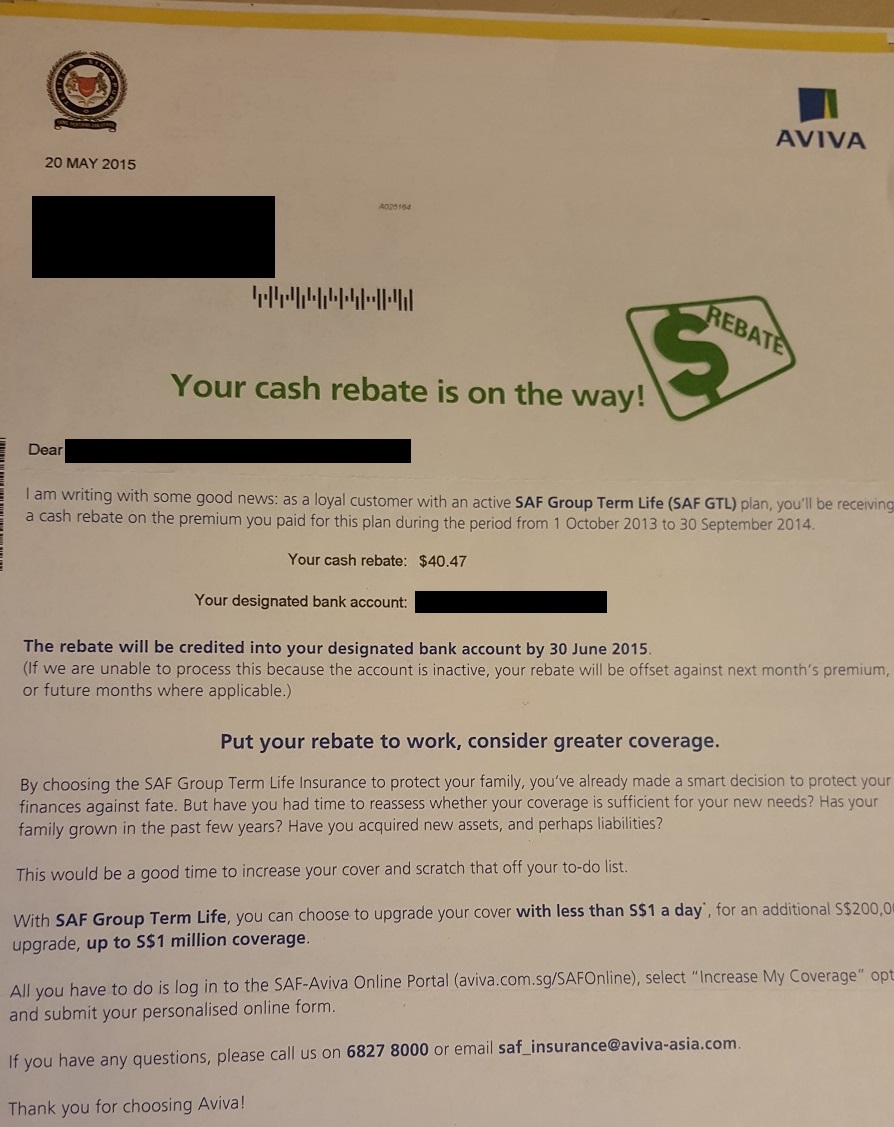

Notice Regarding Rebate On Late Fee Of Renewal Premium Mahalaxmi Life

https://mahalaxmilife.com.np/wp-content/uploads/2020/09/Rebate-on-Renewal-scaled.jpg

Save On 2020 Taxes Fi Life

https://fi.life/assets/upload/malaysia-tax-relief-2020-mypf.png

Tax Reductions Rebates And Credits Taxpayer S Facilitation Guide

https://imgv2-1-f.scribdassets.com/img/document/426675806/original/0fd05ff978/1688390654?v=1

Web 4 janv 2023 nbsp 0183 32 500K Monthly estimates for Life insurance rates are influenced by a number of factors but your health has the biggest impact on the final cost Best health Good health Average Web 30 oct 2018 nbsp 0183 32 Moreover under Section 80C and 10D of the Income Tax Act there are income tax benefits on life insurance Under section 80C premiums that you pay towards a life insurance policy qualify for a

Web 17 juil 2023 nbsp 0183 32 You could claim up to 100 of your premium under the life insurance category or up to 60 under the medical benefit category In this example it makes Web 26 juil 2021 nbsp 0183 32 Jul 26 2021 Fact checked Most types of life insurance are not tax deductible This is because according to the ATO insurance premiums aren t tax

Premium Calculator Of State Life Insurance Savings Tax rebate

https://i.pinimg.com/originals/1b/f7/1f/1bf71f3892b43d8202305bb537e6baa5.png

What Is Australian Government Rebate On Private Health Insurance

https://www.iselect.com.au/content/uploads/2018/05/ISEL0021-Article-35-PrivateHealthInsuranceTax_v2_3.png

https://www.myinsuranceclub.com/articles/tax-rebates-in-life-insurance...

Web 5 mai 2023 nbsp 0183 32 Types of Tax Rebates in Life Insurance Section 80C This section allows the deduction of the taxable income up 1 5 Lakhs Instruments under this section 1 ELSS

https://www.iras.gov.sg/.../tax-reliefs/life-insurance-relief

Web Total amount of contributions from YA 2023 onwards Less than 5 000 Amount of Life Insurance Relief allowed You may claim the lower of a the difference between 5 000

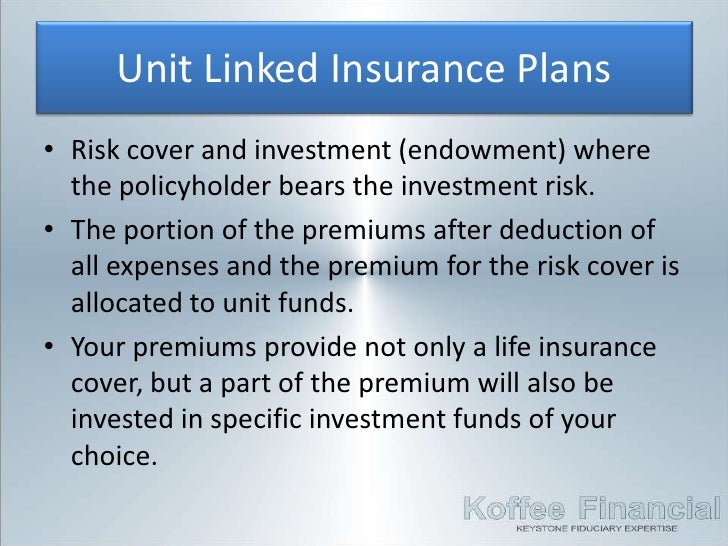

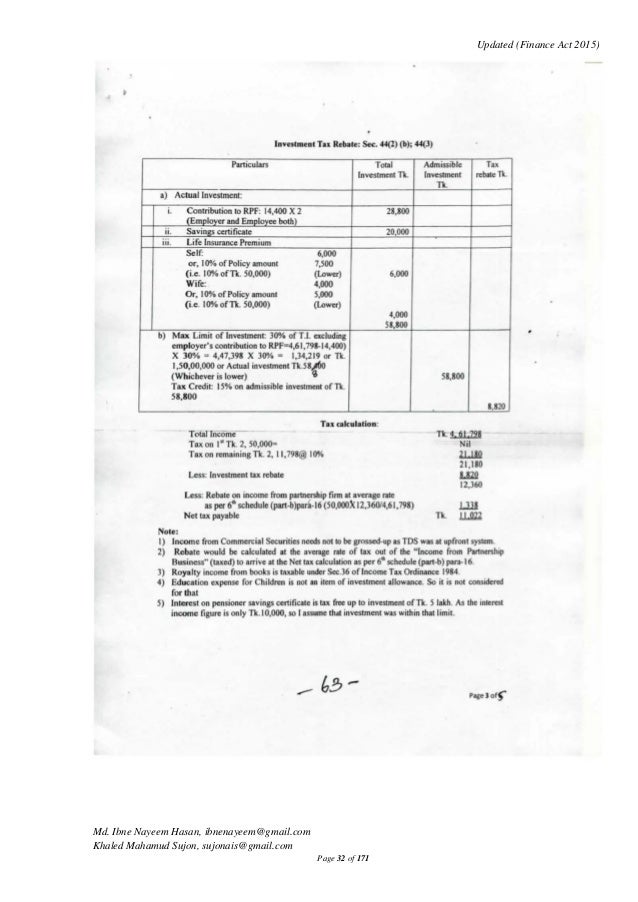

3 Insurance Life Insurance

Premium Calculator Of State Life Insurance Savings Tax rebate

Section 80D Tax Benefits Health Or Mediclaim Insurance FY 2017 18

Rebating Meaning In Insurance What Is Insurance Rebating The

Rebate On Life Insurance Premia Contribution To Provident Fund Etc

Whole Life Insurance Life Insurance Rebate

Whole Life Insurance Life Insurance Rebate

Private Health Insurance Rebate Navy Health

Life Insurance Premium Tax Deduction References Qarbit

Life Insurance Telemarketing Life Insurance Rebate In Income Tax

Tax Rebate For Life Insurance - Web 19 avr 2022 nbsp 0183 32 A life insurance payout can be taxable in the following situations The insurer issues the death benefit in installments The death benefit is typically paid out in a lump