Claim Tax Rebate On Pension Contributions Web 7 sept 2023 nbsp 0183 32 A basic rate tax relief of 20 is automatically applied on the whole amount You can claim an extra 20 tax relief on 163 30 000 the amount you paid higher rate tax

Web 3 avr 2023 nbsp 0183 32 Tax relief is paid on your pension contributions at the highest rate of income tax you pay So Basic rate taxpayers get 20 pension tax relief Higher rate taxpayers can claim 40 pension tax Web 5 d 233 c 2016 nbsp 0183 32 You can get relief on your contributions up to the value of your earnings that are subject to UK Income Tax You must report the payments to your pension scheme

Claim Tax Rebate On Pension Contributions

Claim Tax Rebate On Pension Contributions

https://1.bp.blogspot.com/-kYuar_lKE48/YEL3EQxSxiI/AAAAAAAAf6g/amsQbDAYWoA5NIBN84_QPU1e_ogPNM8igCLcBGAsYHQ/s16000/0002.bmp

HMRC Give Tax Relief Pre approval Save The Thorold Arms

https://i0.wp.com/save.thethoroldarms.co.uk/wp-content/uploads/2016/06/20160525-EIS-Tax-Rebate-Letter-from-HMRC.jpg?w=2368&ssl=1

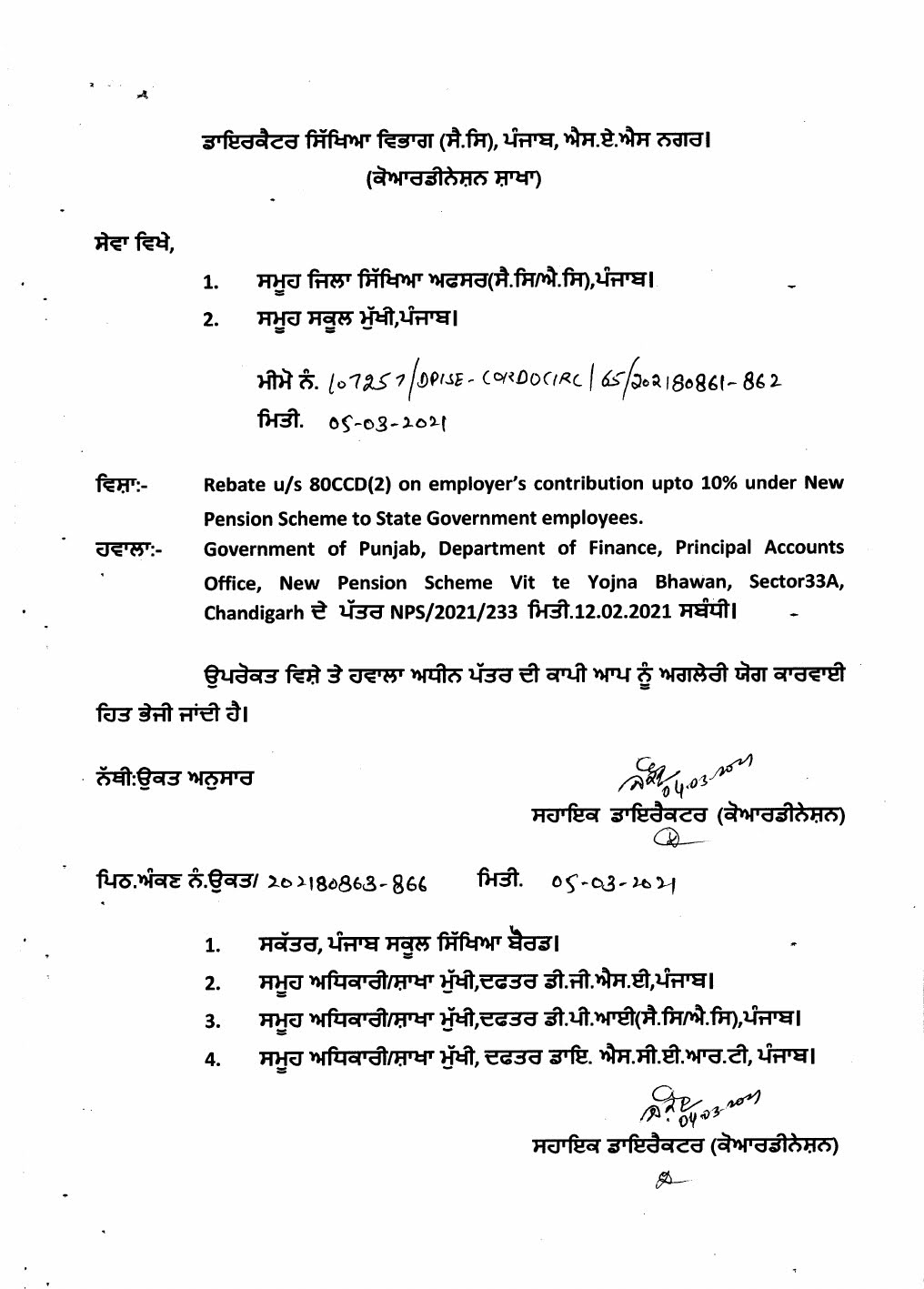

NPS National Pension Scheme A Beginners Guide For Rules Benefits

https://www.jagoinvestor.com/wp-content/uploads/files/Tax-Benefits-of-contributing-in-NPS.png

Web 30 mai 2023 nbsp 0183 32 If you earn over 163 50 270 you can claim an extra 25 back on your pension contributions All you need to do is fill out a tax return or contact HMRC and the government will send you a cheque with the tax Web There are two ways you can get tax relief on your pension contributions If you re in a workplace pension scheme your employer chooses which method to use and must

Web 16 sept 2014 nbsp 0183 32 Your scheme members who are Scottish taxpayers liable to Income Tax at the Scottish intermediate rate of 21 can claim the additional 1 relief due on some or Web 31 mai 2023 nbsp 0183 32 What about higher earners If you fall into the higher or additional rate tax band i e you earned over 163 50 270 this year declaring your pension contributions in

Download Claim Tax Rebate On Pension Contributions

More picture related to Claim Tax Rebate On Pension Contributions

The Music Freelance World

http://2.bp.blogspot.com/-meLsBNsv3ZY/VCMNQM-Ol3I/AAAAAAAACZc/5PCuEMcM02A/s1600/pension.png

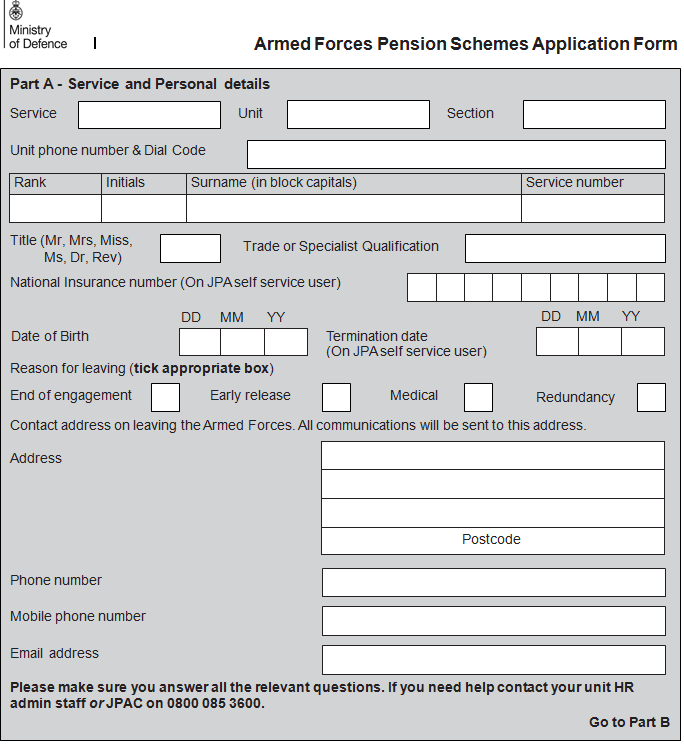

NHS Pensions Deferred Benefits Claim Application Form AW8P DocHub

https://www.pdffiller.com/preview/442/590/442590227/large.png

P55 Tax Rebate Form Business Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2022/09/P55-Tax-Rebate-Form-768x735.png

Web For higher rate taxpayers you still pay 163 80 receiving 163 20 tax relief at source and then claim the further 163 20 through your tax return so that the net cost is effectively 163 60 Web 7 nov 2022 nbsp 0183 32 How to tell if you re due a pension tax refund You may have been affected by this and could be due a refund from HMRC if you are over 55 the age you re allowed

Web 6 mars 2023 nbsp 0183 32 We ve explained how this works in detail in our tax relief on pension contributions guide To use this calculator simply add your annual income and how Web 6 avr 2023 nbsp 0183 32 The Government has announced that from the 2024 2025 tax year you ll be able to claim the tax relief you don t get automatically via payroll if you re in an

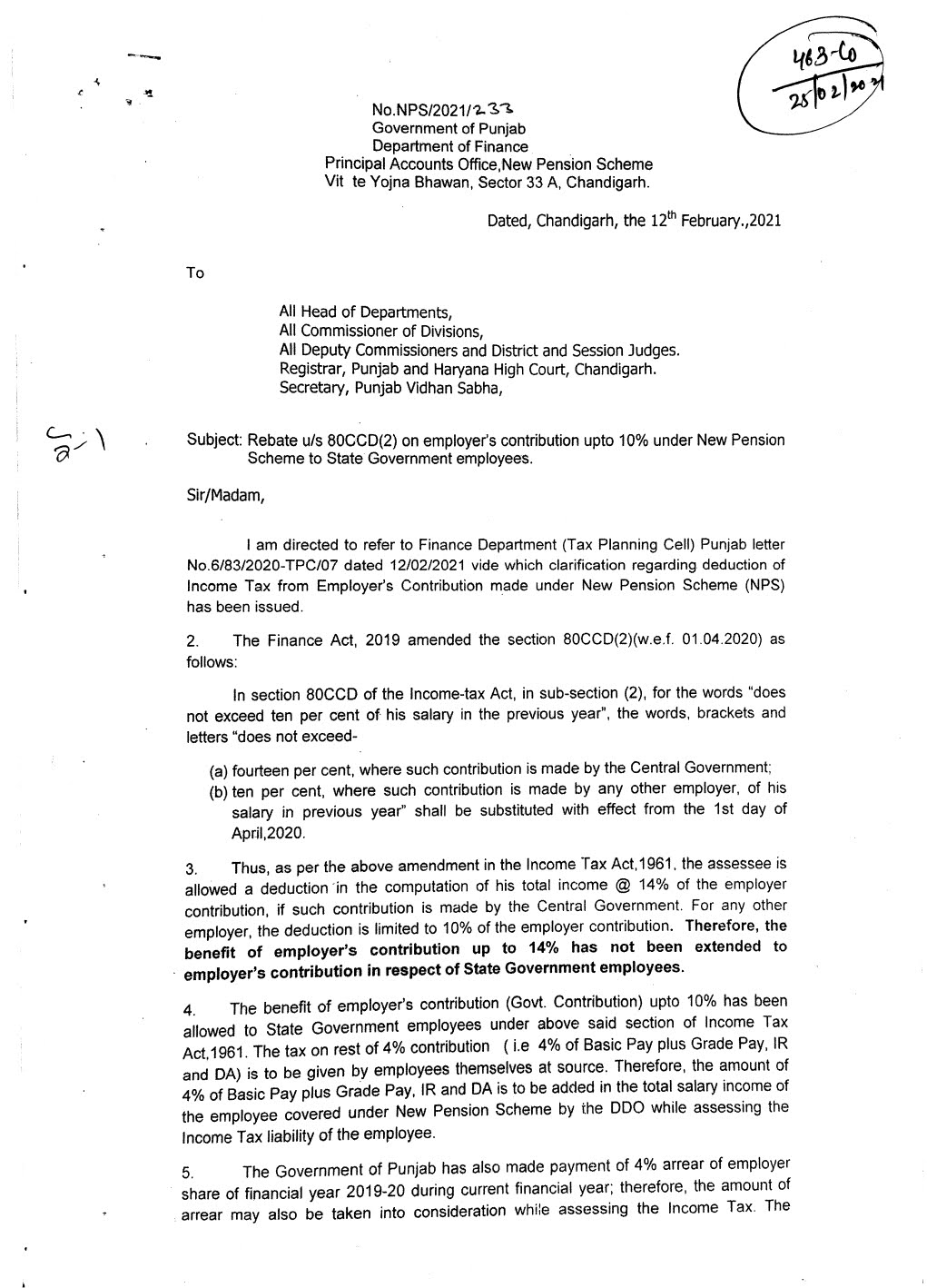

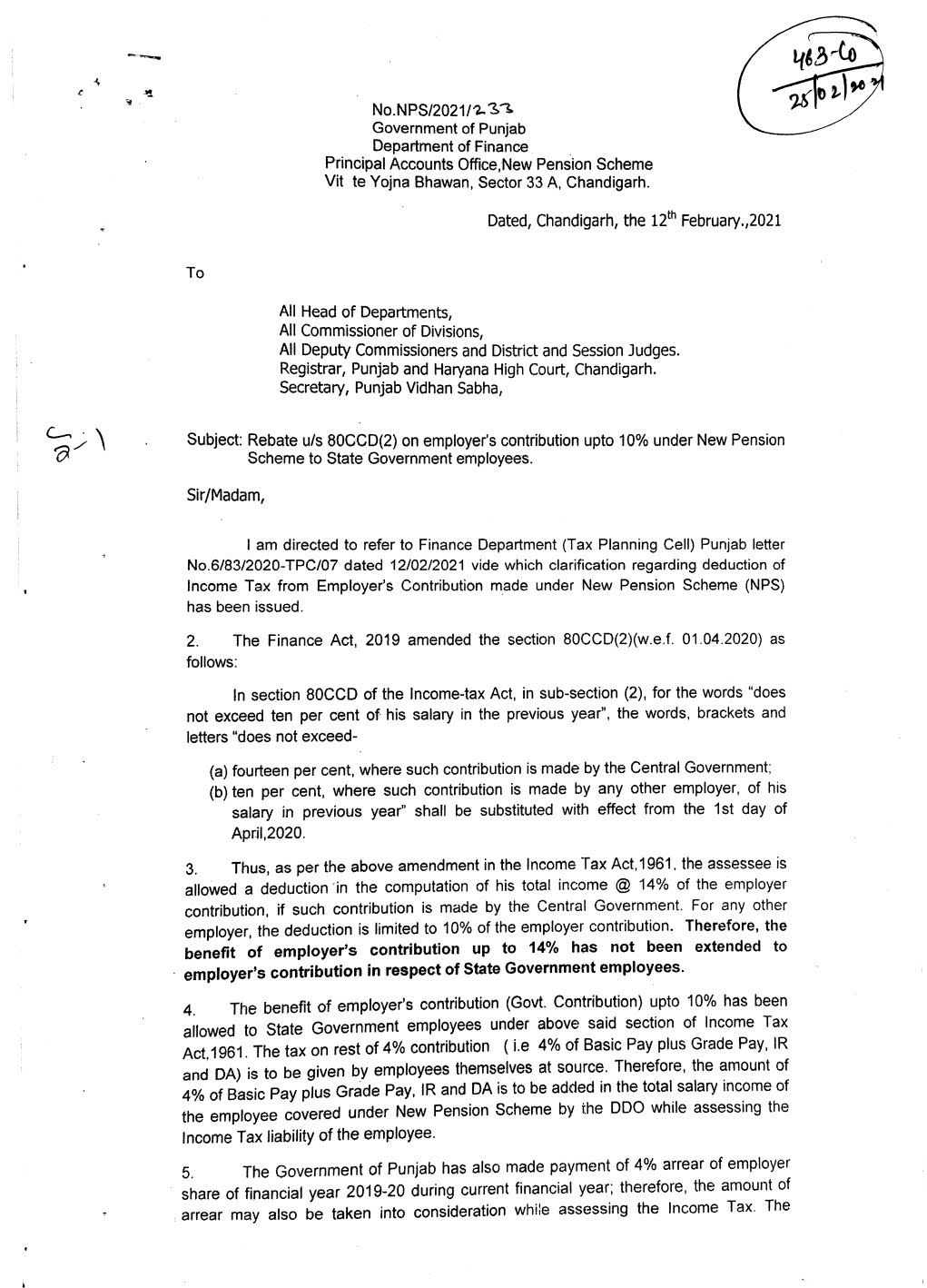

Rebate Under Employers Contribution New Pension Scheme Real Info Blog

https://1.bp.blogspot.com/-o4OKF3poB8U/YEL3EbtdA1I/AAAAAAAAf6k/Yl7J2edNCwI3LmD_Ry4omBU3sPoejqStwCLcBGAsYHQ/s16000/0001.bmp

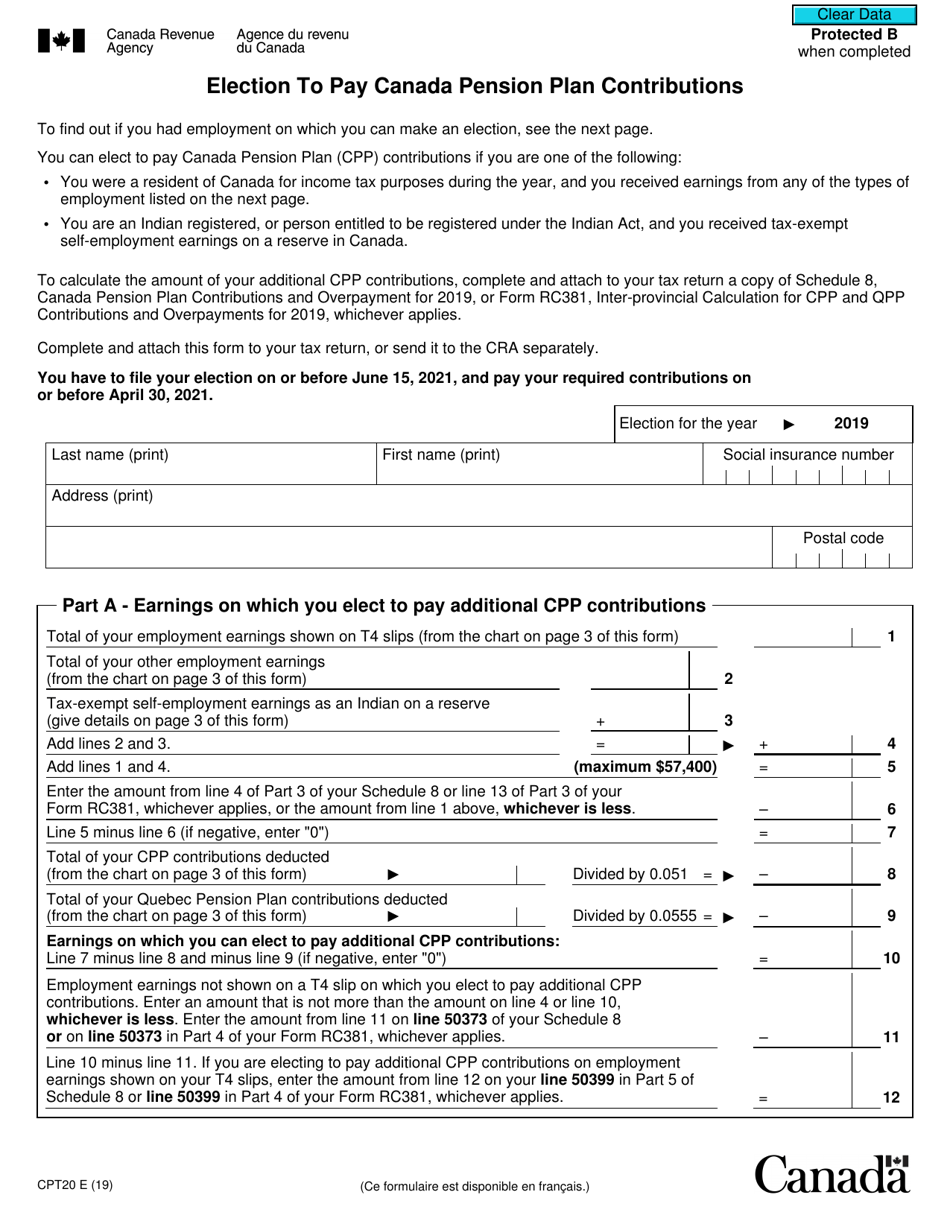

Form CPT20 Download Fillable PDF Or Fill Online Election To Pay Canada

https://data.templateroller.com/pdf_docs_html/2066/20661/2066185/form-cpt20-election-to-pay-canada-pension-plan-contributions-canada_print_big.png

https://www.unbiased.co.uk/discover/pensions-retirement/managing-a...

Web 7 sept 2023 nbsp 0183 32 A basic rate tax relief of 20 is automatically applied on the whole amount You can claim an extra 20 tax relief on 163 30 000 the amount you paid higher rate tax

https://www.which.co.uk/money/pensions-an…

Web 3 avr 2023 nbsp 0183 32 Tax relief is paid on your pension contributions at the highest rate of income tax you pay So Basic rate taxpayers get 20 pension tax relief Higher rate taxpayers can claim 40 pension tax

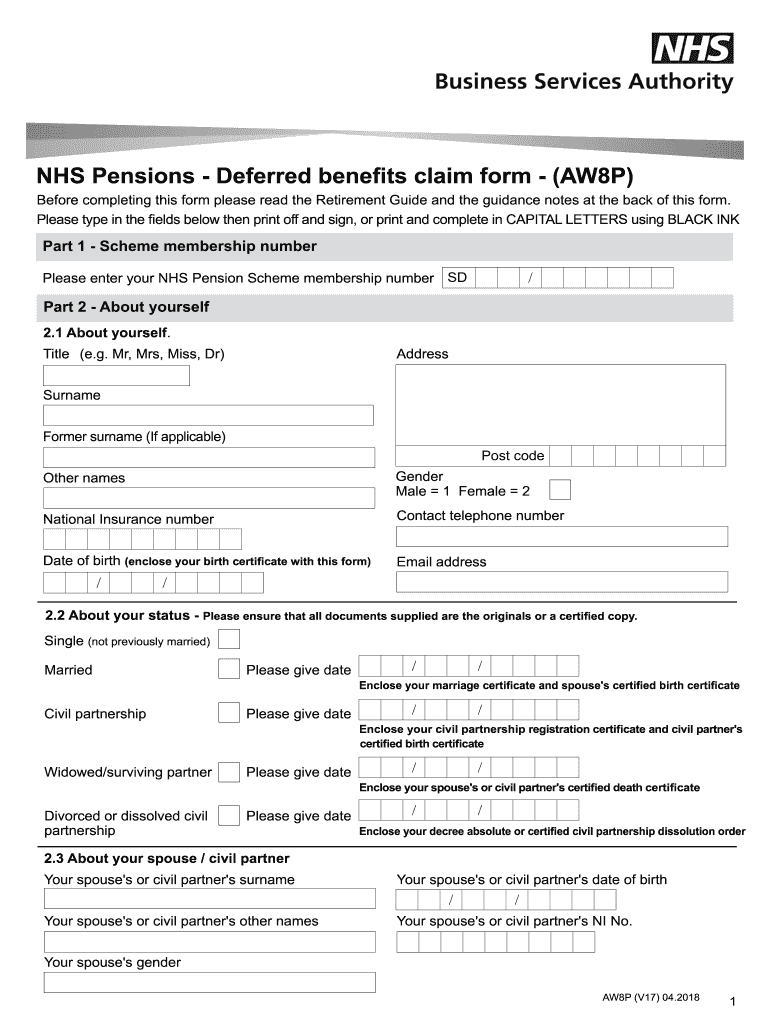

The Pension Service Claim Sample Form Free Download

Rebate Under Employers Contribution New Pension Scheme Real Info Blog

Do You Get Tax Relief On Pension Payments Tax Walls

2016 Property Tax Or Rent Rebate Claim PA 1000 Forms Publications

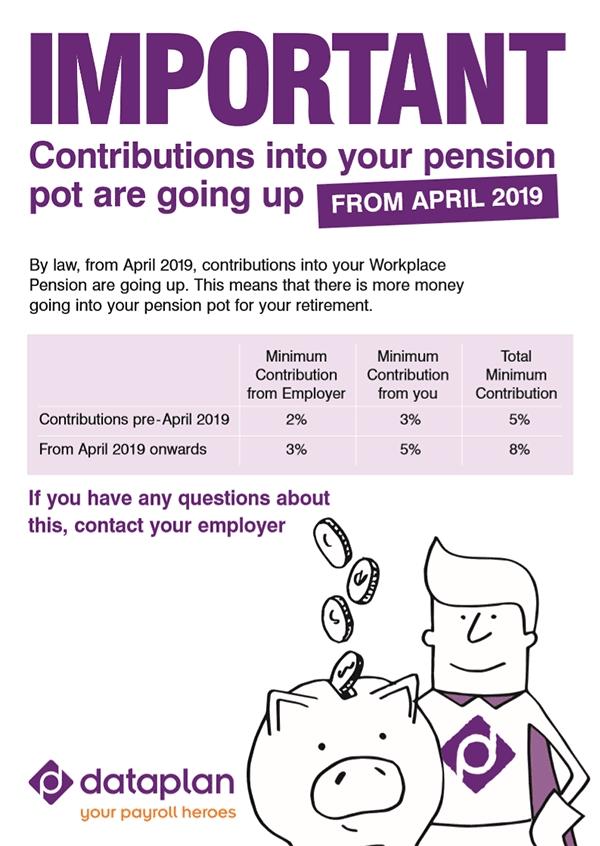

Pension Contributions

How To Claim Deduction For Pension U s 80CCD Learn By Quicko

How To Claim Deduction For Pension U s 80CCD Learn By Quicko

Claim For Age Pension And Pension Bonus Free Download

Your State Pension Forecast Explained Which

How To Claim Tax Relief On Pension Contributions 2023 Updated

Claim Tax Rebate On Pension Contributions - Web If your pension contributions have been deducted from net pay after tax has been deducted and you re a higher rate taxpayer eg paying 40 tax you can claim your