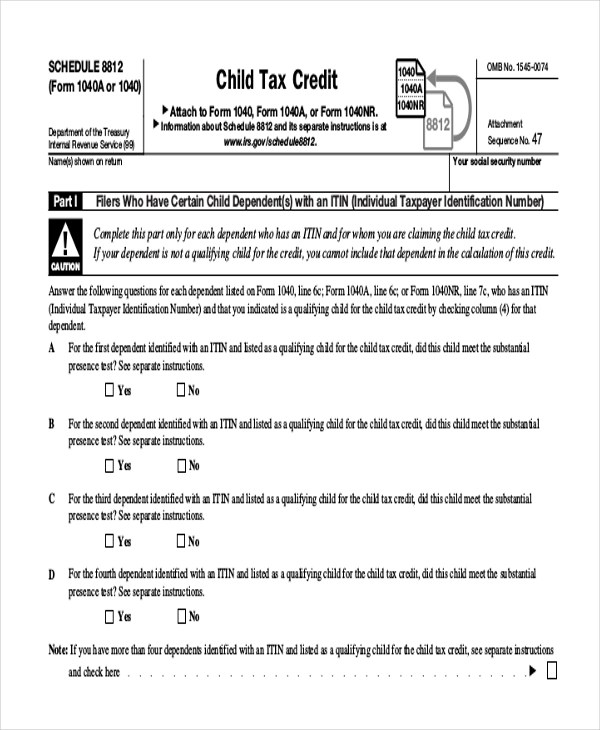

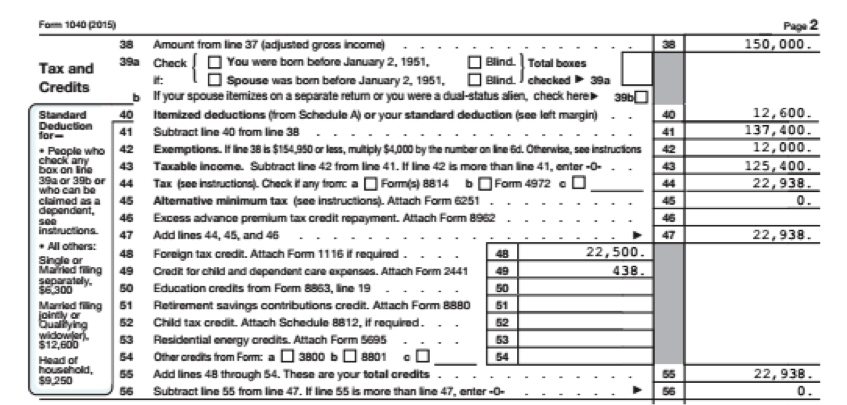

Claiming Child Care Rebate In Tax Return Web 13 f 233 vr 2022 nbsp 0183 32 For 2021 expenses you can claim up to 8 000 for one child or dependent and up to 16 000 for multiple children The one time expansion of the child care credit

Web 2 mars 2022 nbsp 0183 32 Taxpayers who are paying someone to take care of their children or another member of household while they work may qualify for child and dependent care credit Web You can get up to 163 500 every 3 months up to 163 2 000 a year for each of your children to help with the costs of childcare This goes up to 163 1 000 every 3 months if a child is

Claiming Child Care Rebate In Tax Return

Claiming Child Care Rebate In Tax Return

https://lh3.googleusercontent.com/docs/AOD9vFr_UKhK8qduqUufb1KgrPjWuQgA9bQz6e_fB4Id6GSAU9bertsDMt_QDKuWXxNyOwyWifG2KNWPFPPizPhVuqSffuQxD5RfFL3awCjHxPMH=w1200-h630-p

2022 Recovery Rebate Credit Phase Out Recovery Rebate

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2022/11/what-happens-if-i-make-a-mistake-when-claiming-my-remaining-child-tax-8.png?fit=735%2C955&ssl=1

10 Recovery Rebate Credit Worksheet Pdf Worksheets Decoomo

https://i2.wp.com/lh5.googleusercontent.com/proxy/lGA90iOjY_1LO-OBBI3qmZMyKEj47RMisqIykTyVbIbO-V2GqH4xUV92z9Uq0pojRygogoMZtKIKKsqfiqET_2bvfJQoMviJq-wHNdbSR8ZyQ-ukMly2632ZZ7bKcCkHDaCeogT6Skm16tenIHu_TkBU8w=w1200-h630-p-k-no-nu

Web 21 ao 251 t 2017 nbsp 0183 32 Use the online form to claim Tax Free Childcare top up compensation If you ve paid for childcare without getting your government top up we ll refund the Web If you got CCS or Additional Child Care Subsidy ACCS for 2021 22 and didn t confirm your family s income by 30 June 2023 your payments will have stopped From 10 July 2023

Web What you need to do to balance your Child Care Subsidy CCS payments depends on your circumstances on this page If you lodge a tax return If you don t need to lodge a tax Web 6 mars 2022 nbsp 0183 32 The child and dependent care credit is a fully refundable tax credit which means even if you don t owe the IRS any money you can still receive the credit as a tax

Download Claiming Child Care Rebate In Tax Return

More picture related to Claiming Child Care Rebate In Tax Return

New Child Care Rebate Calculator 2023 Carrebate

https://i0.wp.com/www.carrebate.net/wp-content/uploads/2022/06/if-only-singaporeans-stopped-to-think-higher-subsidies-for-child.jpg

Claiming The Recovery Rebate Credit Ona Tax Return IRS Gov rrc PDF

https://imgv2-1-f.scribdassets.com/img/document/572963332/original/10dcefeb3b/1681400610?v=1

Child Care Benefit Claim Form Notes Australia Free Download

https://www.formsbirds.com/formimg/child-care-rebate-form/3233/child-care-benefit-claim-form-notes-australia-l1.png

Web 13 janv 2022 nbsp 0183 32 For your 2021 tax return the cap on expenses eligible for the child and dependent care tax credit is 8 000 for one child up from 3 000 or 16 000 up from Web 24 f 233 vr 2022 nbsp 0183 32 For your 2021 tax return the cap on the expenses eligible for the credit is 8 000 for one child up from 3 000 or 16 000 up from 6 000 for two or more

Web 5 d 233 c 2022 nbsp 0183 32 According to IRS Form 2441 the form used for the child care tax credit the credit itself is dependent on your income level but the vast majority of families should Web 13 avr 2022 nbsp 0183 32 If you didn t get the full amount of the third Economic Impact Payment you may be eligible to claim the 2021 Recovery Rebate Credit and must file a 2021 tax

Child Care Rebate

https://s2.studylib.es/store/data/005176746_1-5f58414245153e95907f2f11a65b3252-768x994.png

FREE 11 Child Care Application Forms In PDF MS Word

https://images.sampleforms.com/wp-content/uploads/2017/04/Child-Care-Rebate-Application-Form.jpg?width=390

https://www.cnet.com/personal-finance/taxes/child-care-tax-credit-is...

Web 13 f 233 vr 2022 nbsp 0183 32 For 2021 expenses you can claim up to 8 000 for one child or dependent and up to 16 000 for multiple children The one time expansion of the child care credit

https://www.irs.gov/.../understanding-the-child-and-dependent-care-credit

Web 2 mars 2022 nbsp 0183 32 Taxpayers who are paying someone to take care of their children or another member of household while they work may qualify for child and dependent care credit

Child Care Tax Rebate Payment Dates 2022 2023 Carrebate

Child Care Rebate

Doug Ford Child Care Rebate FordRebates

How Does The Advanced Child Tax Credit Work Leia Aqui Do You Have To

Tax Child Rebate Dates And How To Get A Rebate Of Up To 750 Marca

bob

bob

Recovery Rebate Credit Married Filing Separately Recovery Rebate

2019 Edition Of Parenthood Tax Rebate Qualifying Child Relief

Child Care Rebate Income Tax Return 2022 Carrebate

Claiming Child Care Rebate In Tax Return - Web 21 ao 251 t 2017 nbsp 0183 32 Use the online form to claim Tax Free Childcare top up compensation If you ve paid for childcare without getting your government top up we ll refund the