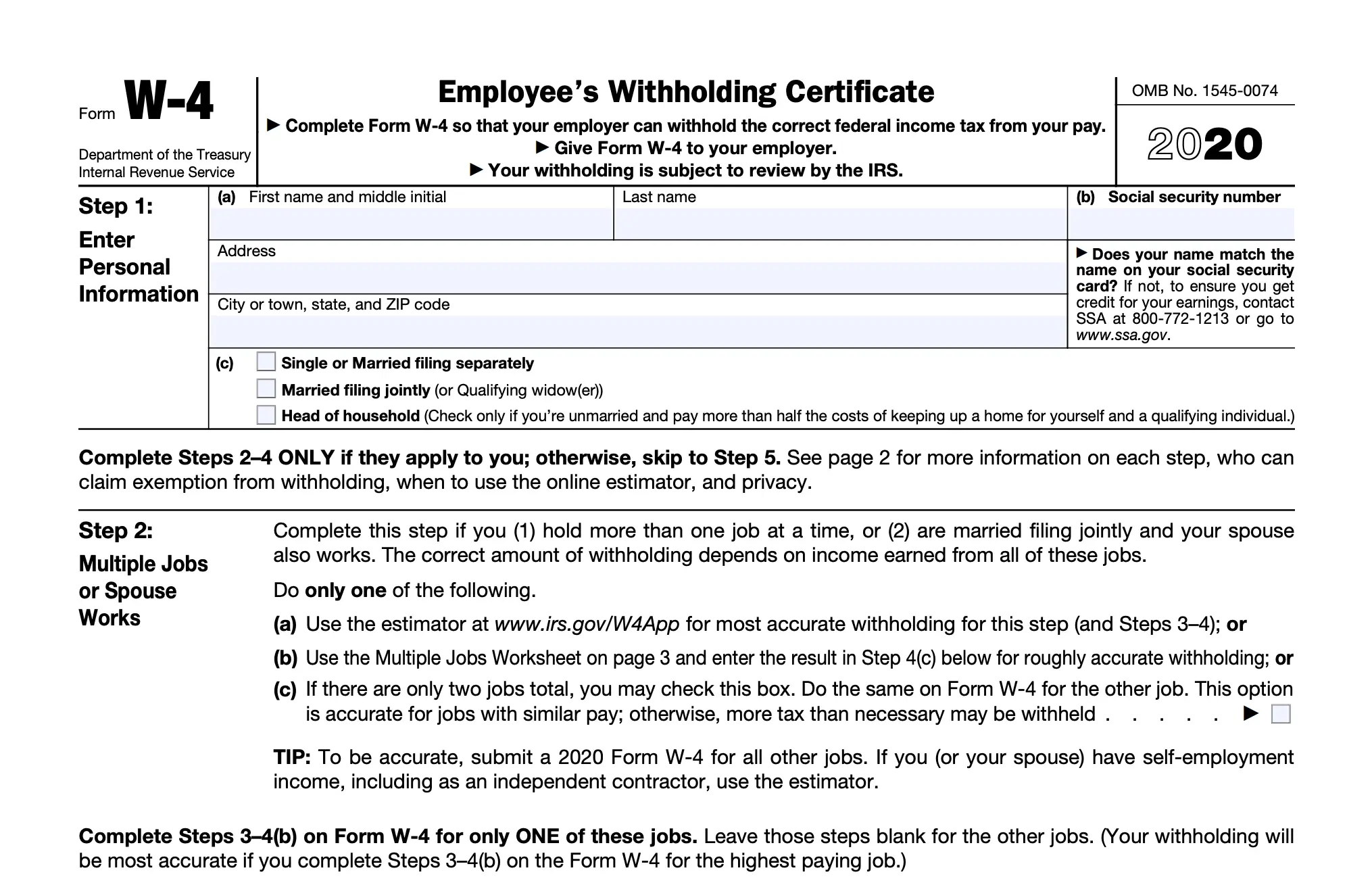

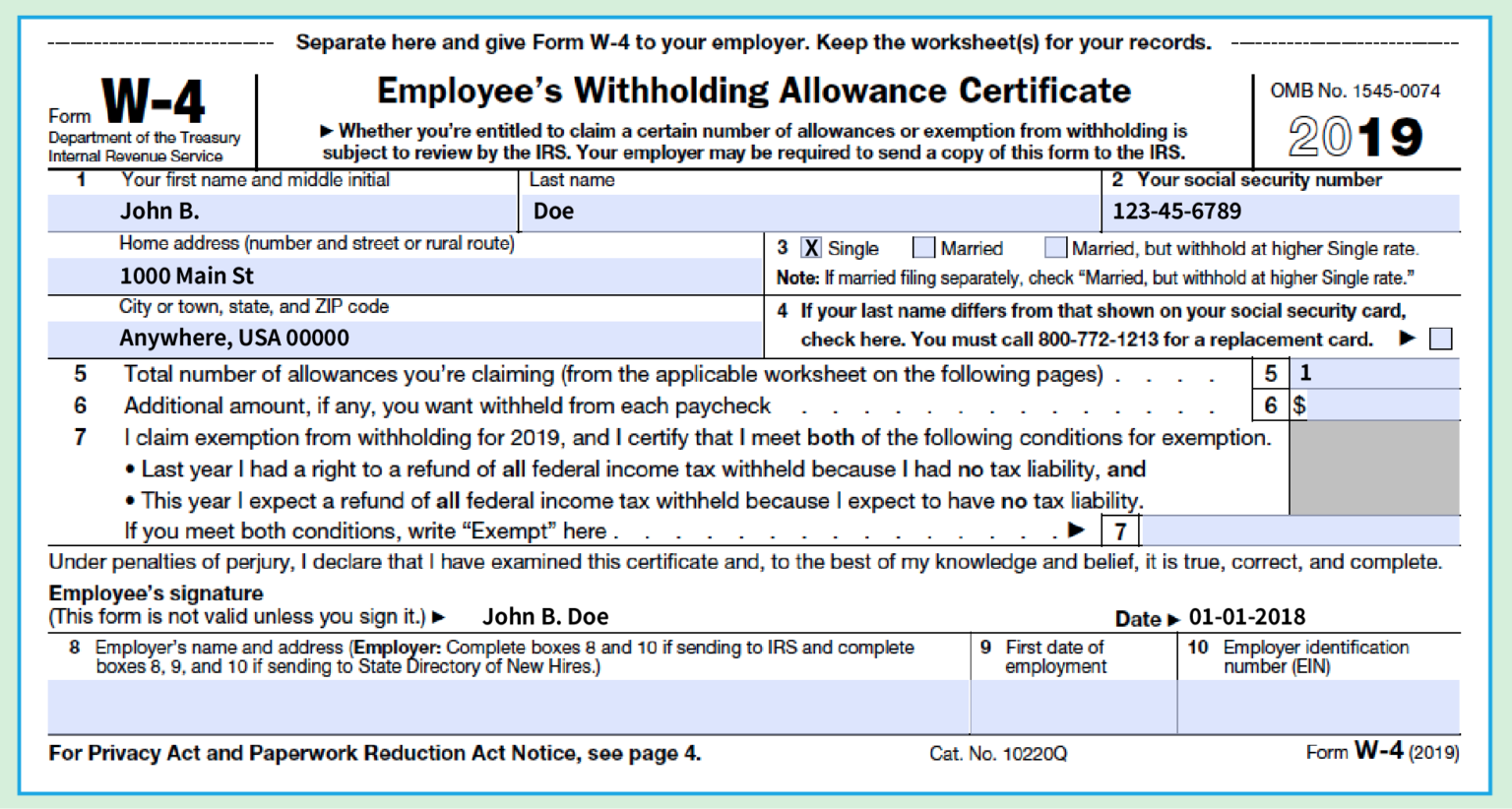

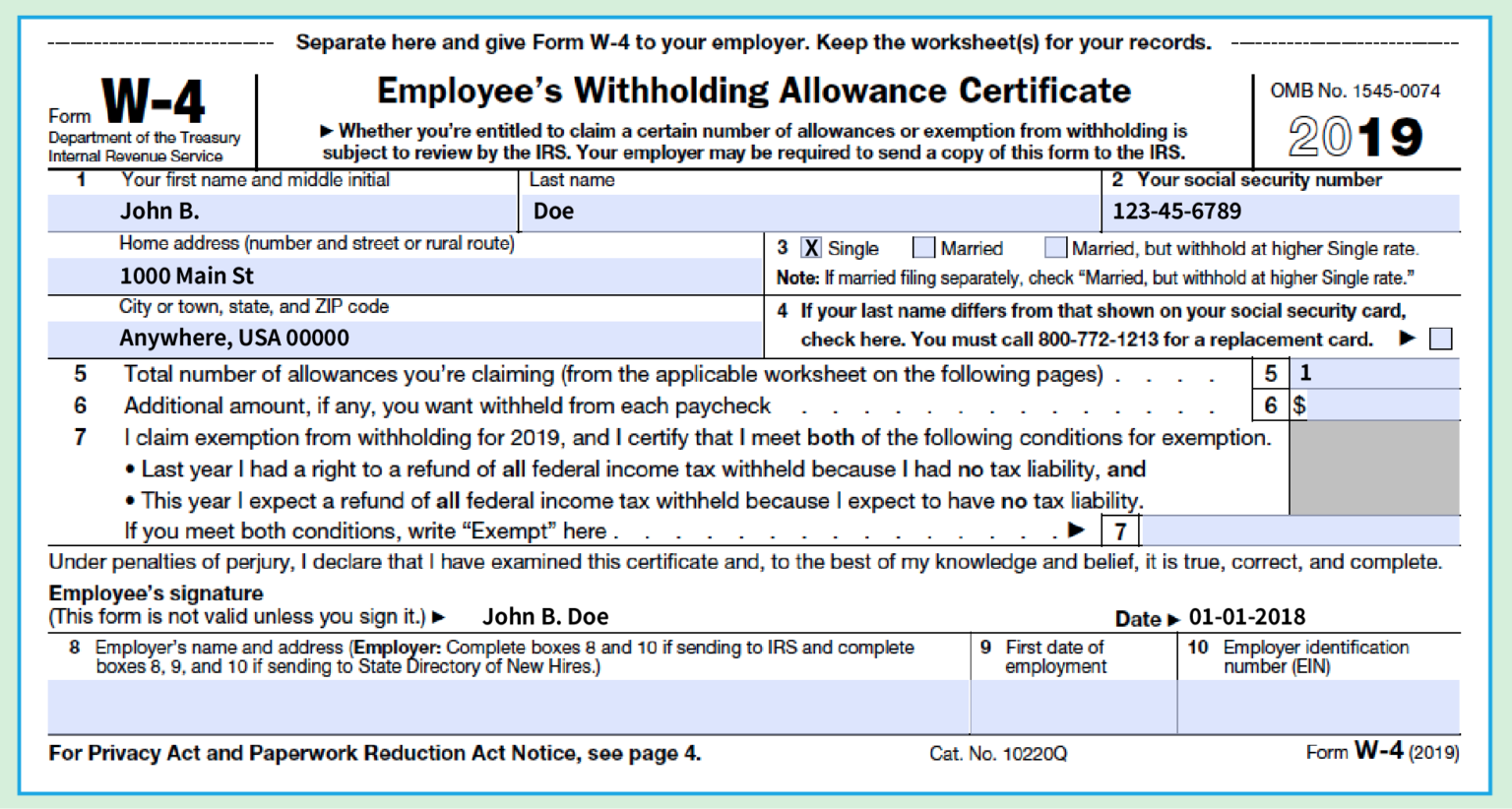

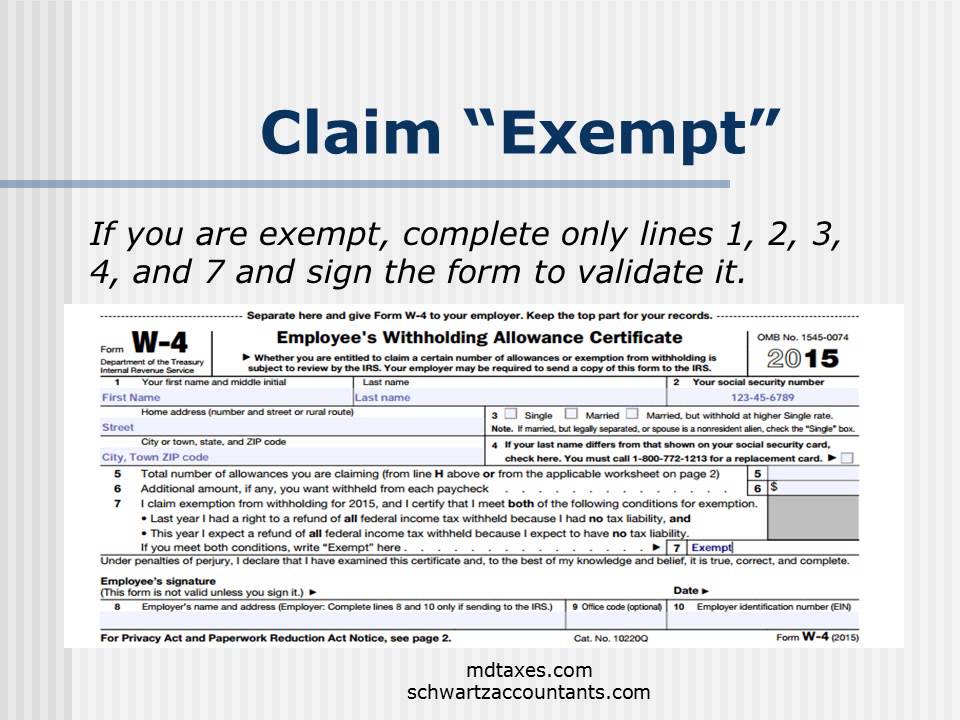

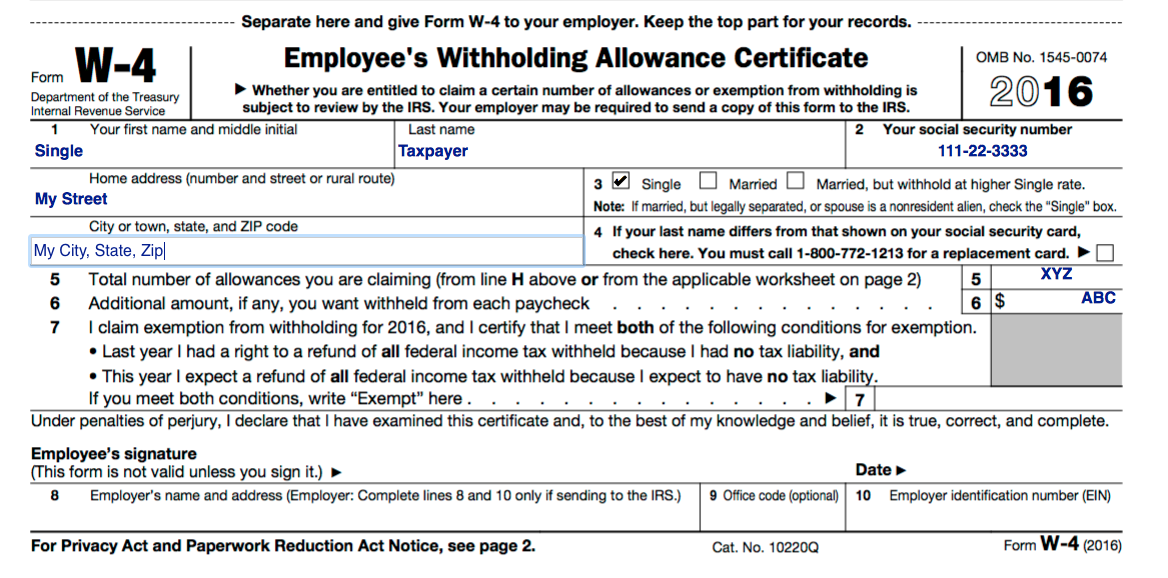

Claiming Tax Exemption On W4 Claiming exemption on Form W 4 avoids federal income tax withholding You must have had no tax liability last year and expect none this year Write Exempt in Box 7 to

Claiming exemption from federal tax withholding without knowing your eligibility can lead to serious consequences If you claim exemption on your tax form but you are not eligible then Furnish a new Form W 4 see Pub 505 Tax Withholding and Estimated Tax Exemption from withholding You may claim exemption from withholding for 2025 if you meet both of the

Claiming Tax Exemption On W4

Claiming Tax Exemption On W4

https://i.pinimg.com/originals/b8/2c/56/b82c56865b402c40f93078a8c7b241d3.png

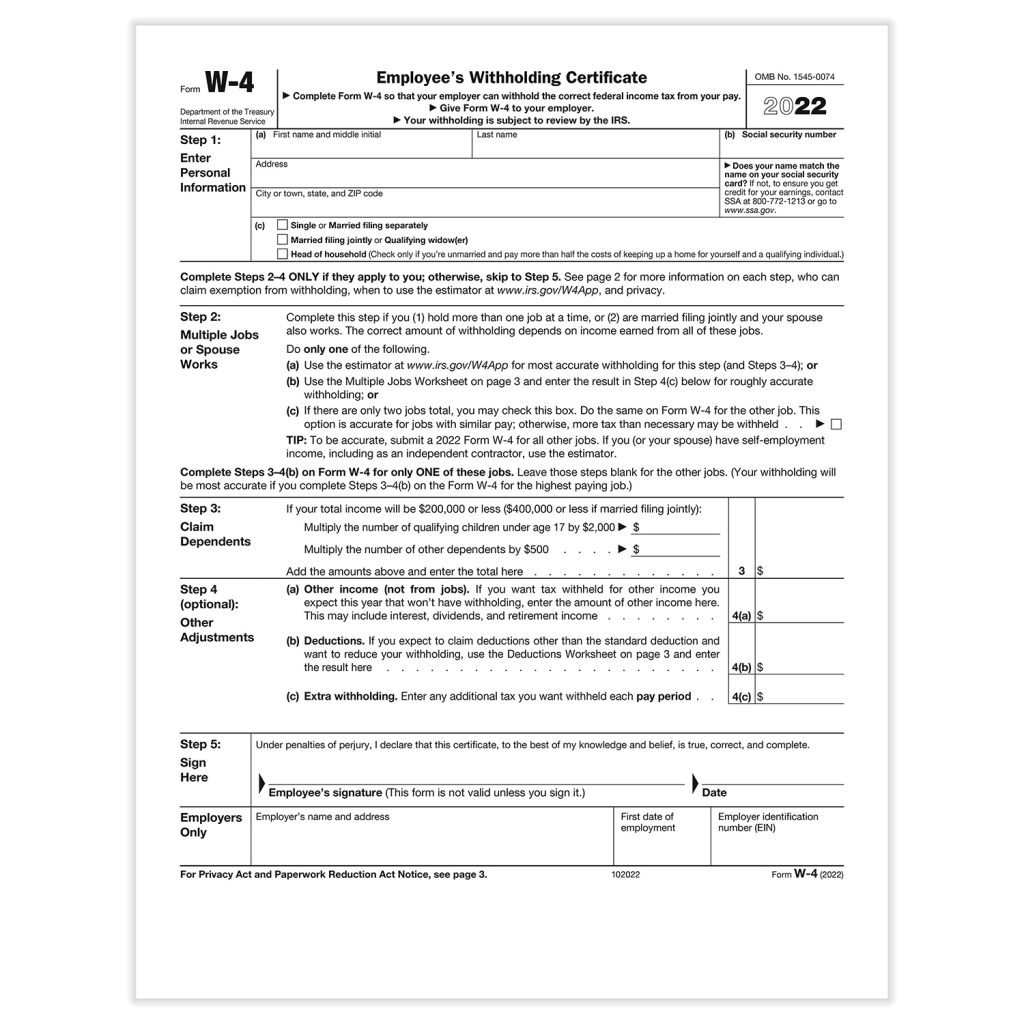

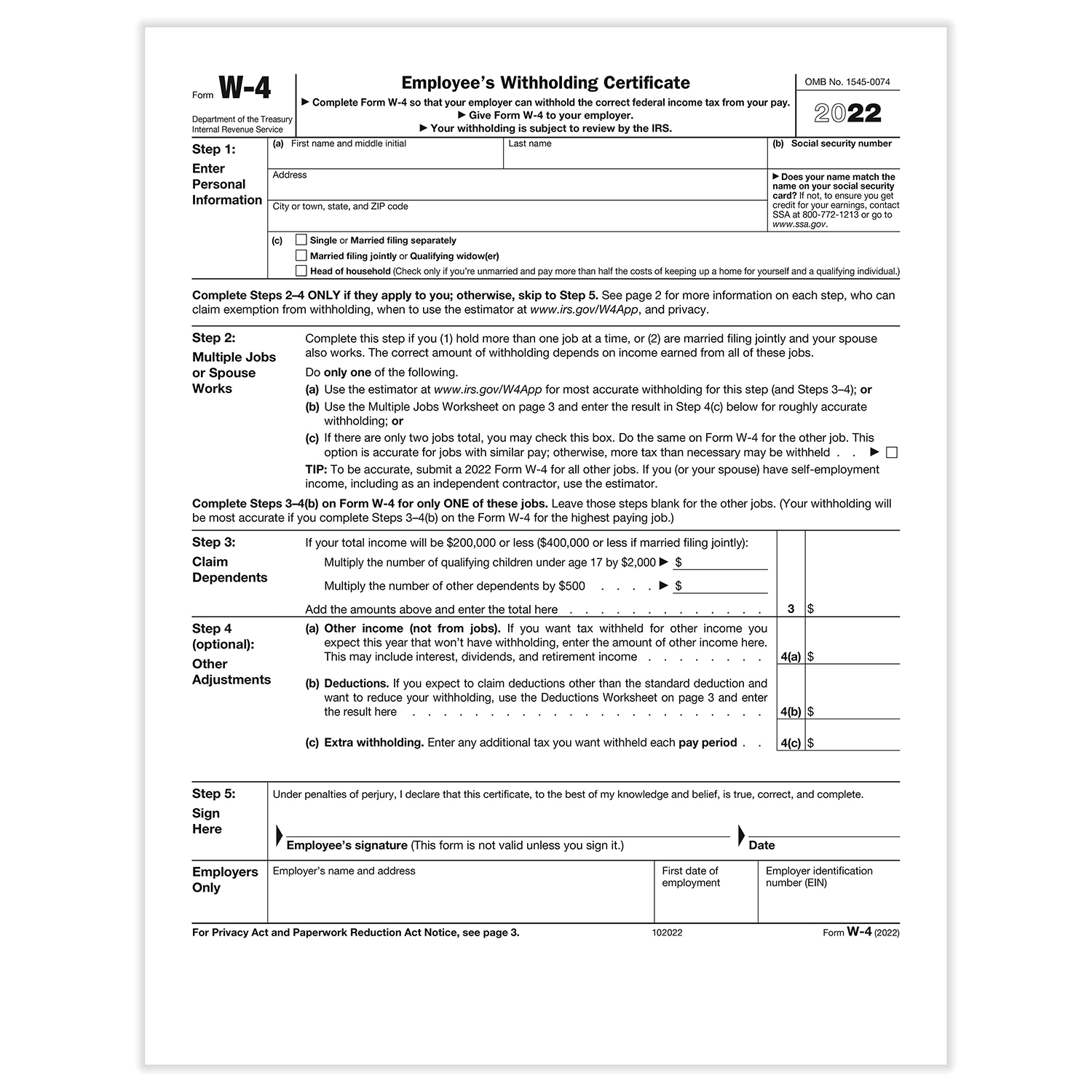

How To Complete The W 4 Tax Form The Georgia Way

https://static2.businessinsider.com/image/544e752f69beddbf31911e8a-1200-1715/form_w-4_1_skitch.jpg

Should I Claim 1 Or 0 On My W4 Tax Allowances Expert s Answer

https://avocadoughtoast.com/wp-content/uploads/2018/03/w4-2020.png

Understanding the process of claiming exemption on Form W 4 is crucial for both employers and employees Timely submission and compliance with the February 15 deadline A Form W 4 claiming withholding exemption will only be valid for the current calendar year in which it was submitted Employees must submit a new Form W 4 claiming exempt status by February 15 of the following year to remain exempt

Exempt on your W 4 means you had no federal income tax liability last year and expect none this year Getting a refund doesn t automatically qualify you to claim exempt Improperly claiming exempt from federal tax withholding can have major consequences So as you complete your Form W 4 make sure to do it with care and be sure about if you can file a W 4 claiming exempt status

Download Claiming Tax Exemption On W4

More picture related to Claiming Tax Exemption On W4

:max_bytes(150000):strip_icc()/FormW-42022-310142d4de9449bbb48dd89327589ace.jpeg)

How To Fill Out Form W 4 In 2022 2023

https://www.investopedia.com/thmb/PvvAUlJB5Ssb6I7nPLUAsKSnDDk=/1500x0/filters:no_upscale():max_bytes(150000):strip_icc()/FormW-42022-310142d4de9449bbb48dd89327589ace.jpeg

2018 Exempt Form W 4 News Illinois State

https://news.illinoisstate.edu/files/2019/01/aid3093687-v4-728px-Fill-Out-a-W-4-Step-15.jpg

:max_bytes(150000):strip_icc()/ScreenShot2021-02-05at7.25.53PM-30d1f6f9936c4f7aa8c22c5f33269801.png)

How To Fill Out Your W 4 Form In 2023 2023

https://www.investopedia.com/thmb/awNpjixXP6AyOgQYYIasG_qKkjo=/818x0/filters:no_upscale():max_bytes(150000):strip_icc()/ScreenShot2021-02-05at7.25.53PM-30d1f6f9936c4f7aa8c22c5f33269801.png

If you claim EXEMPT on your W 4 it means that no taxes will be taken out of your paycheck throughout the year to cover what you may owe to the IRS Claiming exempt does Qualified employees use Form W 4 to tell employers not to deduct any federal income tax from their wages To qualify for exempt status an employee must not have had any tax liability for the previous year and must

When filling out a W 4 an employee has the option to claim exempt from federal withholding tax If you claim exempt this means no taxes will be taken out of your paycheck If you claim zero exemptions then you will have no federal income taxes taken out of your paycheck and you would receive your maximum possible refund check A good rule of

How To Fill Out A W 4 Form The Only Guide You Need W4 2020 Form Printable

https://w4formsprintable.com/wp-content/uploads/2020/09/how-to-fill-out-a-w-4-form-the-only-guide-you-need-1536x822.png

How To Complete The W 4 Tax Form The Georgia Way

https://static5.businessinsider.com/image/544e75a7eab8ea3571911e8a-1200-1715/form_w-4_2_skitch.jpg

https://www.upcounsel.com

Claiming exemption on Form W 4 avoids federal income tax withholding You must have had no tax liability last year and expect none this year Write Exempt in Box 7 to

https://taxsharkinc.com › tax-allowances

Claiming exemption from federal tax withholding without knowing your eligibility can lead to serious consequences If you claim exemption on your tax form but you are not eligible then

How To Fill Out W 4 For A Single Person MKRD info

How To Fill Out A W 4 Form The Only Guide You Need W4 2020 Form Printable

W4 Form 2024 Withholding Adjustment W 4 Forms TaxUni

Help Working Kids And Students Correctly Complete A W 4 Form YouTube

2023 IRS W 4 Form HRdirect Fillable Form 2023

Should I Claim 1 Or 0 On My W4 What s Best For Your Tax Allowances

Should I Claim 1 Or 0 On My W4 What s Best For Your Tax Allowances

2023 IRS W 4 Form HRdirect Fillable Form 2023

W 4 RLE Taxes

How Are Bonuses Taxed with Bonus Calculator Minafi

Claiming Tax Exemption On W4 - A Form W 4 claiming withholding exemption will only be valid for the current calendar year in which it was submitted Employees must submit a new Form W 4 claiming exempt status by February 15 of the following year to remain exempt