Claiming Tax Relief On Pension How do I claim pension tax relief The way you get tax relief and whether this happens automatically or not depends on the type of pension you are saving into and the rate of income tax you pay There are two systems

There are two ways you can get tax relief on your pension contributions These are known as relief at source and net pay If you re in a workplace pension your employer chooses which method is used If you re in a personal pension the You can claim tax relief on your Self Assessment return for contributions you make towards registered pension schemes You can get tax relief on most contributions you

Claiming Tax Relief On Pension

Claiming Tax Relief On Pension

https://www.thompsontarazrand.co.uk/wp-content/uploads/2018/05/2015-12-17-223313-1.jpg

Claiming Tax Relief On A Personal Pension Moneycube

https://moneycube.ie/wp-content/uploads/2020/09/Screenshot-2020-09-13-at-21.24.53.png

Clive Owen LLP Claiming Higher Rate Tax Relief For Pension Contributions

https://www.cliveowen.com/wp-content/uploads/2020/12/Claiming-higher-rate-tax-relief-for-pension-contributions-and-gift-aid-donations.jpg

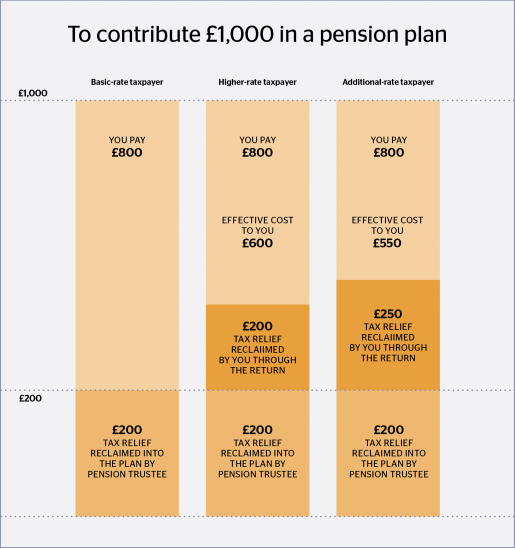

Higher rate taxpayers are entitled to extra tax relief on pension contributions 40 when their income is above 50 270 per annum Additional rate taxpayers are entitled to additional tax relief on pension contributions Higher rate taxpayers can claim an extra 20 tax relief on earnings they pay 40 tax on totalling up to 40 in pension tax relief This means 10 000 of pension contributions could cost as little as 6 000

A higher rate taxpayer who contributes 10 000 into their private pension each year could boost their pension wealth by up to 122 000 over 20 years by claiming a rebate and adding it into their pension For personal pensions such as the HL SIPP and certain workplace pensions basic rate tax relief is usually claimed back automatically by your pension provider If you pay higher rates of

Download Claiming Tax Relief On Pension

More picture related to Claiming Tax Relief On Pension

Pension Tax Relief Chelsea Financial Services

https://www.chelseafs.co.uk/assets/Products-and-Services/Pension/_resampled/ResizedImage515548-R0128-CFS-Tax-Relief-Chart.png

Have You Been Claiming Your Tax Relief On Your Pension Contributions

https://i0.wp.com/www.iepfinancial.co.uk/wp-content/uploads/2018/07/pexels-photo-948887.jpeg?fit=1280%2C770&ssl=1&is-pending-load=1

Can I Get Tax Relief On Pension Contributions Financial Advisers

https://www.insightifa.com/wp-content/uploads/2022/12/Tax-Relief-On-Pensions.jpg

Calculate how much tax relief you could get on your pension contributions with our handy tool Use the calculator below and we ll break down how much tax relief could be added to your pension pot and tell you whether or not you need to Higher rate tax relief can be claimed by entering the amount of gross personal contributions made to a personal pension scheme in the relevant part of the annual self

This comprehensive guide to claiming higher rate tax relief on pension contributions in the UK has aimed to provide a thorough understanding of the topic practical How to claim higher and additional rate tax relief You can claim pension tax relief via a self assessment tax return You can also contact HMRC via their online chat call HMRC

Tax Relief On Pension Contributions Explained Which Top Tips YouTube

https://i.ytimg.com/vi/hFpqFd2yAtI/maxresdefault.jpg

Pension Tax Relief On Pension Contributions Freetrade

https://assets-global.website-files.com/62547917cb5599e815e4d83b/62547917cb559944a8e4de15_61b89c21239fee52c5e81153_hqoO9fMryTKRpnpdV2ZiIxT7ZDJC5fHBX_liGusogxuhBXP3ILsovEpqBXxBHX0sXCQy79MiLRIAaEXmK1c2vJcBYleshZHHX7Jsfqdd-7hM7hPmIZC3zDfhut2hKggUXHvAHoah.jpeg

https://www.which.co.uk › money › pension…

How do I claim pension tax relief The way you get tax relief and whether this happens automatically or not depends on the type of pension you are saving into and the rate of income tax you pay There are two systems

https://www.moneyhelper.org.uk › en › pen…

There are two ways you can get tax relief on your pension contributions These are known as relief at source and net pay If you re in a workplace pension your employer chooses which method is used If you re in a personal pension the

Tax Relief On Pension Contributions Optimise

Tax Relief On Pension Contributions Explained Which Top Tips YouTube

How Does Pension Tax Relief Work

Tax Relief On Pension Contributions FKGB Accounting

Pensions Everything You Need To Know For Retirement

Tax Relief On Your Pension YouTube

Tax Relief On Your Pension YouTube

Are Your Employees Making The Most From Pension Tax Relief

Save It For Another Day Pension Tax Relief And Options For Reform

Tax Relief On Pension Contributions Gooding Accounts

Claiming Tax Relief On Pension - For personal pensions such as the HL SIPP and certain workplace pensions basic rate tax relief is usually claimed back automatically by your pension provider If you pay higher rates of