Ny Star Tax Rebate 2024 Make under 500 000 or under per household for the STAR credit and 250 000 or under for the STAR exemption Seniors are eligible for Enhanced STAR if they are 65 or older Own and occupy a

The School Tax Relief STAR and Enhanced School Tax Relief E STAR benefits offer property tax relief to eligible New York homeowners STAR and E STAR can be issued as a credit by the State of New York or in some cases as a tax exemption by the City of New York Enhanced STAR is an extra benefit for seniors age 65 and older with incomes up to 93 200 for the 2023 2024 school year It exempts the first 81 400 of the full value of a home from school

Ny Star Tax Rebate 2024

Ny Star Tax Rebate 2024

https://i.ytimg.com/vi/kf2rESGvkvo/maxresdefault.jpg

Virginia Tax Rebate 2024

https://www.taxuni.com/wp-content/uploads/2023/01/Virginia-Tax-Rebate-1024x576.jpg

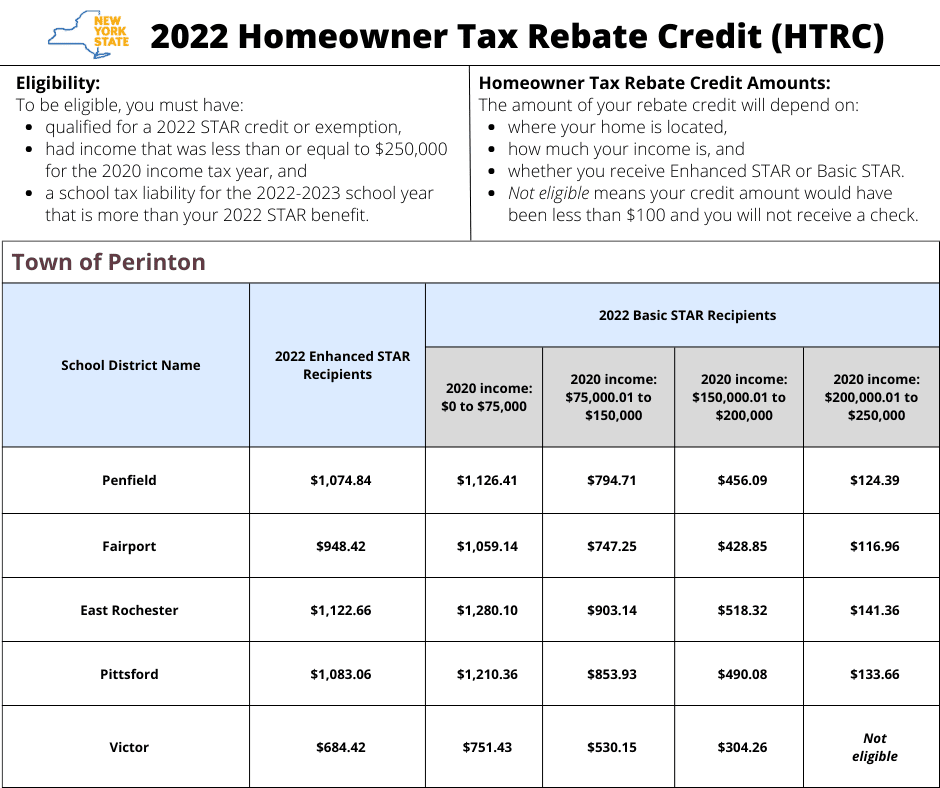

NYS Homeowner Tax Rebate Credit HTRC Info Town Of Perinton

https://perinton.org/wp-content/uploads/2022-Homeowner-Tax-Rebate-Credit-HTRC-1.png

Reporter Consumer Social Trends New Yorkers have just days left to apply for a rebate that could offer a check of 1 400 or more The deadline to apply for a change in the School Tax Relief The benefit is estimated to be a 293 tax reduction Enhanced STAR is for homeowners 65 and older whose total household income for all owners and residents spouses is 93 200 or less The benefit is estimated to be a 650 tax reduction In 2016 STAR was made available as an exemption or a credit You do not need to re register for STAR

PUBLISHED 2 55 PM ET Aug 29 2022 If you haven t yet received your STAR property tax rebate check there s an easy way to find out what its status is Simply visit this website https www8 tax ny gov SCDS scdsGateway You will need to input your zip code county of residence and school district It s that simple You May Also Be Interested In If your STAR check hasn t shown up and your due date to pay your school property taxes has passed contact the Department of Taxation and Finance through your Online Services Account or by

Download Ny Star Tax Rebate 2024

More picture related to Ny Star Tax Rebate 2024

Muth Encourages Eligible Residents To Apply For Extended Property Tax Rent Rebate Program

https://www.senatormuth.com/wp-content/uploads/2019/06/PropertyTaxRebate2018.jpg

2022 New York Stimulus Here s Why You Didn t Receive A 270 Check Silive

https://www.silive.com/resizer/9RWdJGcP8YouWOrvWGjveXNsJRI=/1280x0/smart/cloudfront-us-east-1.images.arcpublishing.com/advancelocal/5PKOU7FSPNHA3NDX7CWARKGHRQ.jpeg

NY Homeowner Tax Rebate Checks Are In The Mail RBT CPAs LLP

https://www.rbtcpas.com/wp-content/uploads/2022/07/NY-Homeowner-Tax-Rebate-Checks-Are-in-the-Mail.jpg

2024 Enhanced STAR Information Sheet For those who turned 65 in 2023 or are turning 65 in 2024 An extra Property Tax Exemption may be available Please view documents below Ownership of 1 2 or 3 family home or condominium by March 1 2024 STAR Registration Security Check Enter the security code displayed below and then select Continue Required fields Security check The following security code is necessary to prevent unauthorized use of this web site If you are using a screen reading program select listen to have the number announced

STAR Property Tax Relief Program 01 09 2024 8 25 am Contact Erie County Real Property Tax Services Edward A Rath County Office Building 95 Franklin Street Room 100 Buffalo New York 14202 Tax Line 716 858 8333 Fax 716 858 7744 ec rpts erie gov Tax Information The new application forms for 2024 25 tax year are due by March 1st 2024 The New York State School Tax Relief Program STAR provides homeowners with two types of partial exemptions from school property taxes The Basic STAR Exemption and the Enhanced STAR Exemption

Tax Rebate Checks Come Early This Year Yonkers Times

https://yonkerstimes.com/wp-content/uploads/2018/09/check-2-2.jpg

New York State Star Rebate Checks LatestRebate

https://www.latestrebate.com/wp-content/uploads/2023/02/new-york-state-star-rebate-checks-2-1536x868.jpg

https://www.democratandchronicle.com/story/news/2023/09/08/ny-star-checks-when-to-expect-yours-school-tax-relief/70785077007/

Make under 500 000 or under per household for the STAR credit and 250 000 or under for the STAR exemption Seniors are eligible for Enhanced STAR if they are 65 or older Own and occupy a

https://www.nyc.gov/site/finance/property/landlords-star.page

The School Tax Relief STAR and Enhanced School Tax Relief E STAR benefits offer property tax relief to eligible New York homeowners STAR and E STAR can be issued as a credit by the State of New York or in some cases as a tax exemption by the City of New York

Homeowners Asked To Re register For STAR Tax Rebate Newsday

Tax Rebate Checks Come Early This Year Yonkers Times

Property Tax Rebate Checks Are Coming Here s How Much Money You re Due

Property Tax Rebate Pennsylvania LatestRebate

Income Tax Rebate Under Section 87A

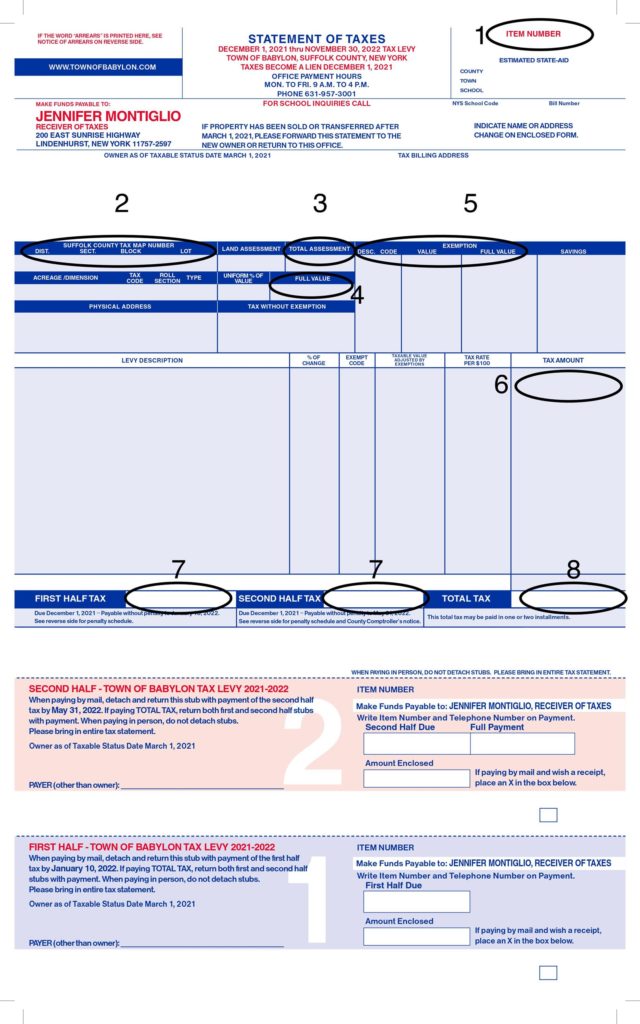

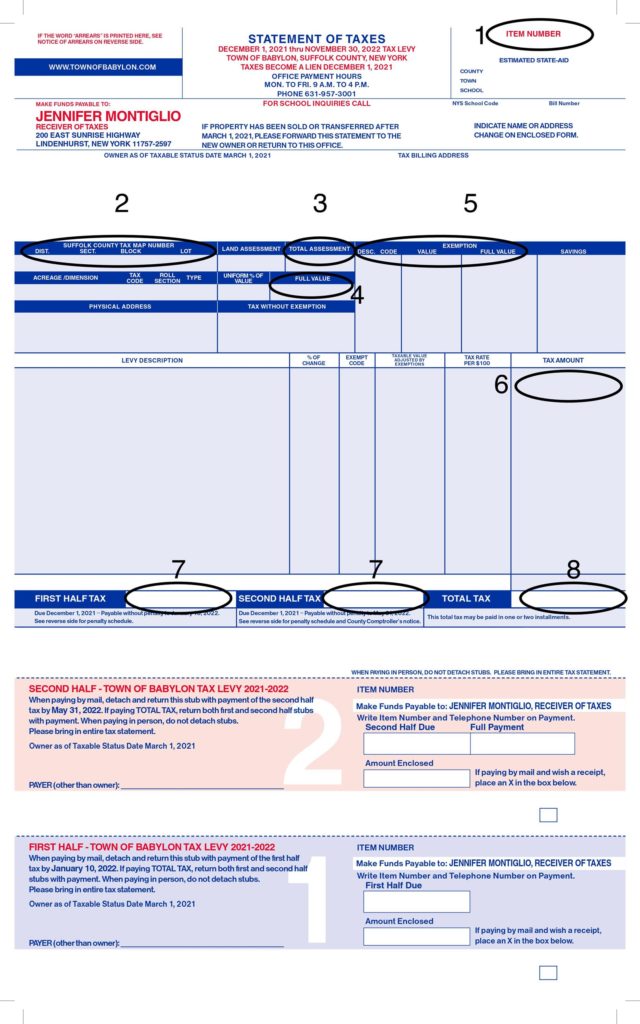

Suffolk County NY Property Taxes 2022 Ultimate Guide What You Need To Know rates Lookup

Suffolk County NY Property Taxes 2022 Ultimate Guide What You Need To Know rates Lookup

Uniform Tax Rebate HMRC Tax Rebate Refund Rebate Gateway

Tax Rebate In Thailand For 2023 Save Up To 40 000 THB

Kansas Tax Rebate 2023 Eligibility Application Deadline PrintableRebateForm

Ny Star Tax Rebate 2024 - If your STAR check hasn t shown up and your due date to pay your school property taxes has passed contact the Department of Taxation and Finance through your Online Services Account or by