Tax Rebate In Bangladesh Web Income Tax and VAT changes by Finance Bill 2023 Technical Highlights of Finance Bill 2023 Summary of key changes proposed by the Finance Bill 2023 as discussed in

Web Web 18 ao 251 t 2017 nbsp 0183 32 What is the tax rebate As per section 44 2 b of the Income Tax Ordinance 1984 an individual taxpayer will get tax rebate at 15 on investment allowance Now

Tax Rebate In Bangladesh

Tax Rebate In Bangladesh

https://daptari.com/wp-content/uploads/2022/07/income-tax-rebate-in-bangladesh.jpg

Income Protector DHAMU Employer employee Insurance A Tax efficient

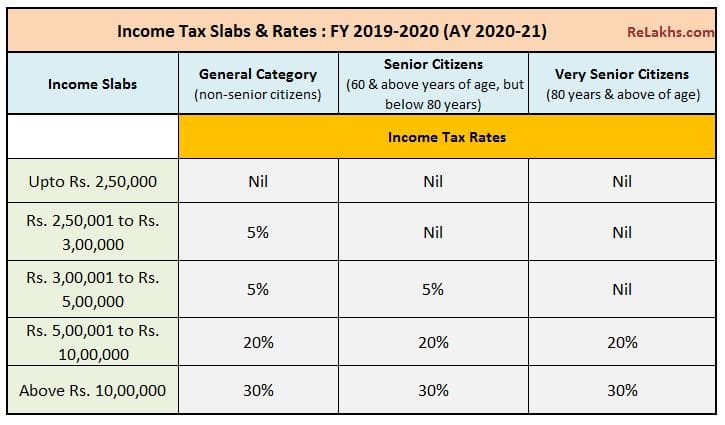

https://www.relakhs.com/wp-content/uploads/2019/02/Latest-income-tax-slab-rates-FY-2018-19-AY-2019-20-Tax-rates-for-individuals-budget-2019-2020-pic.jpg

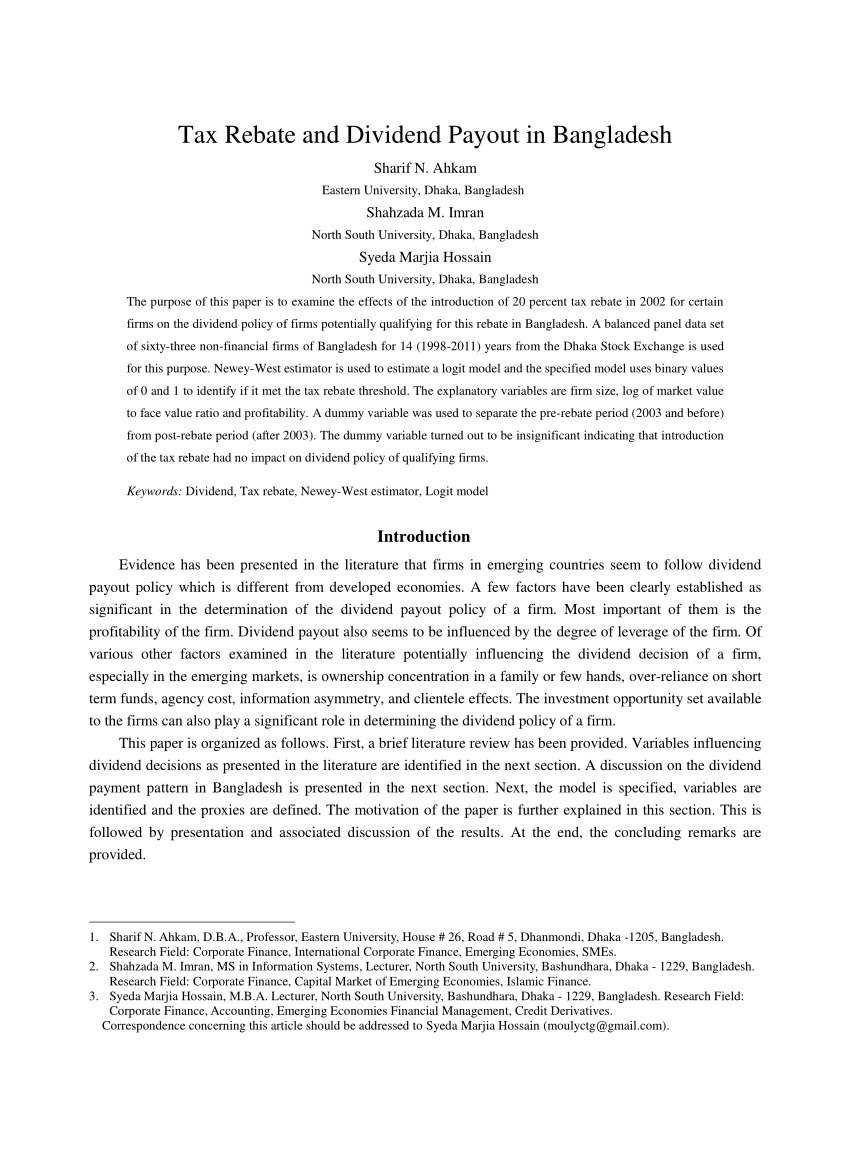

PDF Tax Rebate And Dividend Payout In Bangladesh

https://i1.rgstatic.net/publication/303993373_Tax_Rebate_and_Dividend_Payout_in_Bangladesh/links/5763ace408ae192f513e4636/largepreview.png

Web 15 juin 2023 nbsp 0183 32 For a person earning BDT 200 000 monthly the maximum rebate possible is BDT64 500 and he she has to invest BDT430 000 in that year in the above mentioned Web 1 juin 2023 nbsp 0183 32 The proposed tax rates and tax slabs for all categories of individual taxpayers except companies and local authorities are no tax on first Tk 3 5 lakh 5 per cent tax on

Web 13 ao 251 t 2023 nbsp 0183 32 1 3 percent of taxable income or 2 15 percent of actual investment or 3 Tk 1 million So you know that the lower amount among the three numbers mentioned Web Il y a 1 jour nbsp 0183 32 The taxpayer will not be entitled to enjoy the tax on the income benefit of reduced tax rate and tax rebate Hence this provision is expected to increase

Download Tax Rebate In Bangladesh

More picture related to Tax Rebate In Bangladesh

Where To Invest For Tax Rebate

https://i.ytimg.com/vi/wHMetXXJeXU/maxresdefault.jpg

How To Calculate Tax Rebate In Income Tax Of Bangladesh

http://www.jasimrasel.com/wp-content/uploads/2017/08/Calculate-tax-rebate.jpg

Income Tax Rebate 2023 22 Bangladesh Bank Info

https://bank.bdteletalk.com/imgcc/image/4229/

Web 14 ao 251 t 2017 nbsp 0183 32 Government has encouraged taxpayers to invest money and get tax rebate And therefore specified the areas where you could invest for tax rebate From this article we will know where to invest or donate Web The 2022 23 National budget of Bangladesh was presented by the Minister of Finance AHM Mustafa Kamal on 9 June 2022 The National budget is for the fiscal year beginning

Web 8 juil 2023 nbsp 0183 32 What Is The Tax Rate in BD The tax rate depends on the type of tax being imposed There are several types of taxes levied by the government including income Web Tax Rate For Bangladeshi individuals resident foreigners and firms Up to BDT 300 000 Next BDT 100 000 5 Next BDT 300 000 10 Next BDT 400 000 15 Next BDT

Bd Tds 2023 24 Archives Jasim Uddin Rasel

http://www.jasimrasel.com/wp-content/uploads/2023/07/TDS-VDS-Books-2023-Bangladesh.jpg

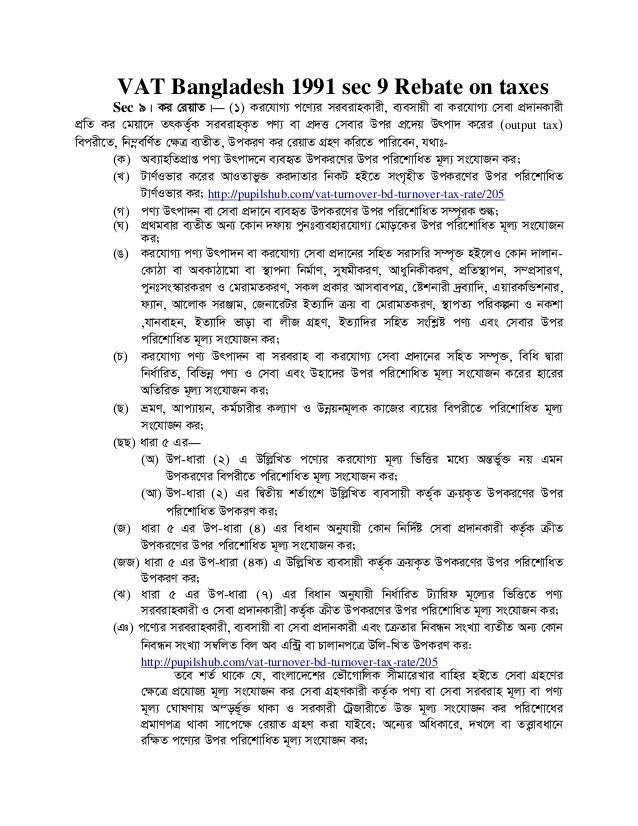

Vat Bangladesh 1991 Sec 9 Rebate On Taxes

https://image.slidesharecdn.com/vatbangladesh1991sec9rebateontaxes-131001045813-phpapp01/95/vat-bangladesh-1991-sec-9-rebate-on-taxes-1-638.jpg?cb=1380603555

https://kpmg.com/bd/en/home/insights/2023/06/finance-act-2023.html

Web Income Tax and VAT changes by Finance Bill 2023 Technical Highlights of Finance Bill 2023 Summary of key changes proposed by the Finance Bill 2023 as discussed in

https://nbr.gov.bd/taxtypes/income-tax/income-tax-paripatra/eng

Web

Vat Act 1991 Bangladesh Disposal Of Excess Input Tax And Rebate On I

Bd Tds 2023 24 Archives Jasim Uddin Rasel

Tax Credit Or Tax Rebate In Bangladesh

Tax Rebate Lanka Bangla Asset Management Company Limited

Where To Invest For Tax Rebate In Income Tax Of Bangladesh

Bangladesh Tax Compliance Book Jasim Uddin Rasel

Bangladesh Tax Compliance Book Jasim Uddin Rasel

Withholding Tax Rate In Bangladesh 2022 23 BDesheba Com

2007 Tax Rebate Tax Deduction Rebates

Investment For Tax Rebate In Bangladesh

Tax Rebate In Bangladesh - Web 15 juin 2023 nbsp 0183 32 For a person earning BDT 200 000 monthly the maximum rebate possible is BDT64 500 and he she has to invest BDT430 000 in that year in the above mentioned