Tax Rebate In Bangladesh 2023 24 Verkko 11 lokak 2023 nbsp 0183 32 Total Rebate To find the total rebate add the lowest rebate 28 500 to the Advance Income Tax 18 000 This equals a total rebate of 46 500 Net Tax To

Verkko Report on Tax Expenditure in the Direct tax of Bangladesh FY 2020 21 Publish Date 01 11 2023 Verkko Posted on 15 Jun 2023 I received a lot of questions on the laws surrounding investment rebates given we have a new income tax act about to be passed by the parliament

Tax Rebate In Bangladesh 2023 24

Tax Rebate In Bangladesh 2023 24

https://bdesheba.com/wp-content/uploads/2023/03/Income-Tax-Rate-In-Bangladesh-725x405.jpg

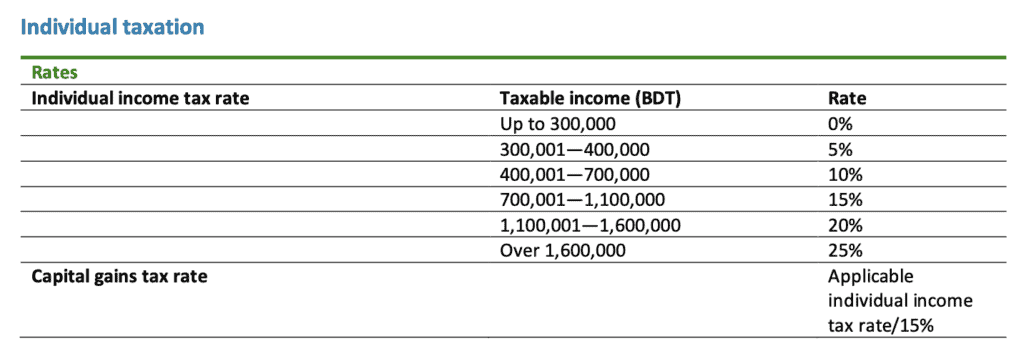

Personal Income Tax Slab In Bangladesh

https://charteredjournal.com/wp-content/uploads/2021/07/Personal-Income-Tax-Slab-in-Bangladesh-2022-2023.jpg

Corporate Income Tax Rate In Bangladesh In 2023 Hire The Most

https://tahmidurrahman.com/wp-content/uploads/2023/04/Screenshot-2023-04-03-at-7.07.09-PM.jpg

Verkko 21 hein 228 k 2023 nbsp 0183 32 Anyway there are few changes in the TDS rates FY 2023 24 due to enactment of the new Income Tax Act 2023 and Withholding Tax Rules 2023 Utse Verkko This Handbook incorporates many of the important provisions of the Income Tax Ordinance 1984 as amended up to the Finance Act 2023 and major changes brought

Verkko 6 kes 228 k 2023 nbsp 0183 32 The Bangladesh National Budget Speech for 2023 24 was delivered by Finance Minister Mustafa Kamal on 1 June 2023 Some of the main tax measures of Verkko refund of excess tax payment and Withholder Identification Number WIN have been introduced in the new act EY Tax Alert The parliament of Bangladesh has repealed

Download Tax Rebate In Bangladesh 2023 24

More picture related to Tax Rebate In Bangladesh 2023 24

Where To Invest For Tax Rebate In Bangladesh L Learn Everything L

https://i.ytimg.com/vi/dyGNwExk4TU/maxresdefault.jpg

Income Tax BD Income Tax Return In Bangladesh BDesheba Com

https://bdesheba.com/wp-content/uploads/2023/03/Income-Tax-BD-Income-Tax-Return-In-Bangladesh.jpg

Tax Credit Or Tax

https://i.ytimg.com/vi/IAs9ku69PyE/maxresdefault.jpg

Verkko The Ministry of Finance in Bangladesh has recently delivered the budget speech for the fiscal year 2023 24 The speech encompasses a range of measures including Verkko Sep 11 2023 Introducing the second edition of the Bangladesh Tax Guide updated to align with the amendments brought forth by the Finance Act 2023 This

Verkko 25 kes 228 k 2023 nbsp 0183 32 Bangladesh new Income Tax Act The new Income Tax Act 2023 was passed in parliament last week and it is going to create quite a stir in the coming days This is the first complete Verkko 1 kes 228 k 2023 nbsp 0183 32 Bangladesh Budget 2023 24 Finance Minister AHM Mustafa Kamal today proposed increasing the tax free income limit to Tk 3 5 lakh from the existing Tk

Tax Deduction Everything You Should Know About TDS And VDS

http://www.jasimrasel.com/wp-content/uploads/2021/08/Tax-Deduction-TDS-VDS-Book-2022.jpg

New Income Tax Slab 2023 24

https://moneyexcel.com/wp-content/uploads/2023/02/incometax-slab-2023-24.jpg

https://www.linkedin.com/pulse/calculate-income-tax-bangladesh-2023...

Verkko 11 lokak 2023 nbsp 0183 32 Total Rebate To find the total rebate add the lowest rebate 28 500 to the Advance Income Tax 18 000 This equals a total rebate of 46 500 Net Tax To

https://nbr.gov.bd/publications/income-tax/eng

Verkko Report on Tax Expenditure in the Direct tax of Bangladesh FY 2020 21 Publish Date 01 11 2023

Bangladesh Income Tax Tax Rebate On Investment

Tax Deduction Everything You Should Know About TDS And VDS

Bangladesh Tax Compliance Book Jasim Uddin Rasel

Investment For Tax Rebate In Bangladesh

2023 24 BUDGET Current Challenges The Financial Express

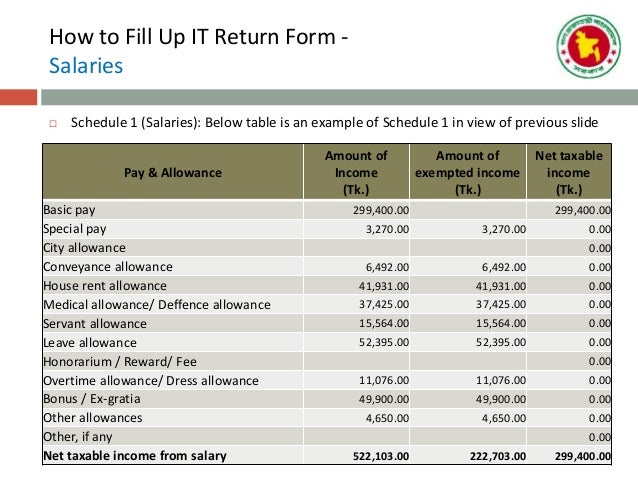

Tax Return Preparation Complete Guide 2021 Jasim Uddin Rasel

Tax Return Preparation Complete Guide 2021 Jasim Uddin Rasel

Bangladesh Holiday Calendar 2023 pdf Smarteduguide

Lululemon Customer Support Salary Slip

Corporate Income Tax Rate In Bangladesh In 2023 Hire The Most

Tax Rebate In Bangladesh 2023 24 - Verkko 6 kes 228 k 2023 nbsp 0183 32 The Bangladesh National Budget Speech for 2023 24 was delivered by Finance Minister Mustafa Kamal on 1 June 2023 Some of the main tax measures of