Tax Rebate On Investment In Bangladesh 2023 24 The highest annual tax rebate on investments in listed securities of the capital market will be reduced by one third or 33 per cent to Tk 1 million if the draft income tax act 2023 is approved by parliament

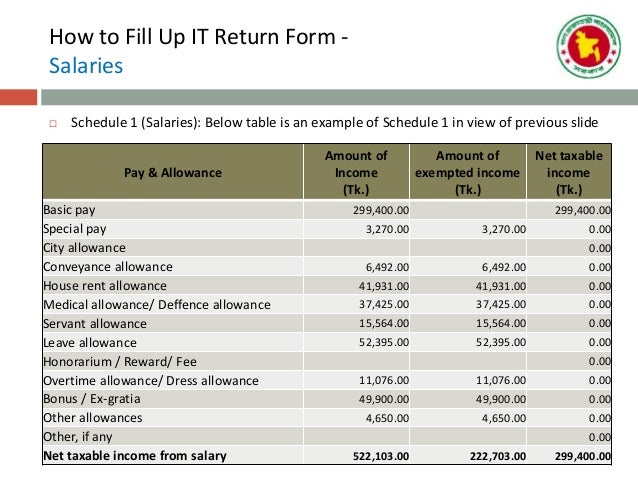

Investments 15 If you ve invested money you get a rebate of 15 of your total investment which is 120 000 here 10 00 000 BDT This amount is part of the calculation Amount of allowable investment is actual investment or 30 of total taxable income or Tk 1 50 00 000 whichever is less Tax rebate amounts to 15 of allowable investment

Tax Rebate On Investment In Bangladesh 2023 24

Tax Rebate On Investment In Bangladesh 2023 24

https://moneyexcel.com/wp-content/uploads/2023/02/incometax-slab-2023-24.jpg

2023 24 BUDGET Current Challenges The Financial Express

https://tfe-bd.sgp1.cdn.digitaloceanspaces.com/posts/12106/uj.jpg

Online E TIN Registration And Income Tax Return 2023 24

https://eduresultbd.com/wp-content/uploads/2023/03/income-tax-law-2023.png

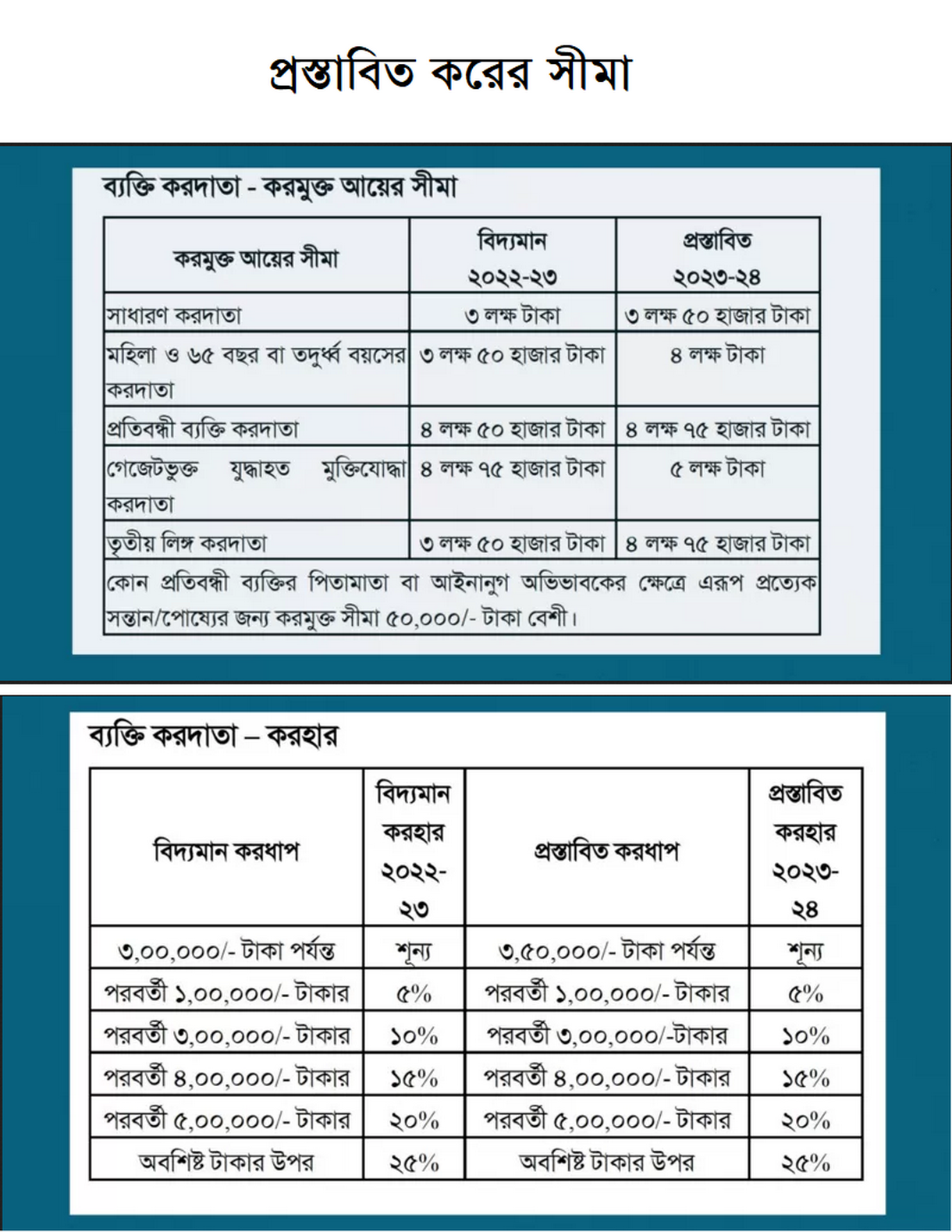

The government has proposed a certain tax rebate for wealthy individual taxpayers in the new fiscal year starting in July Currently the minimum threshold for collecting a surcharge from an How much money will need to invest for tax rebate to reduce your tax liability in Bangladesh Read the article for details

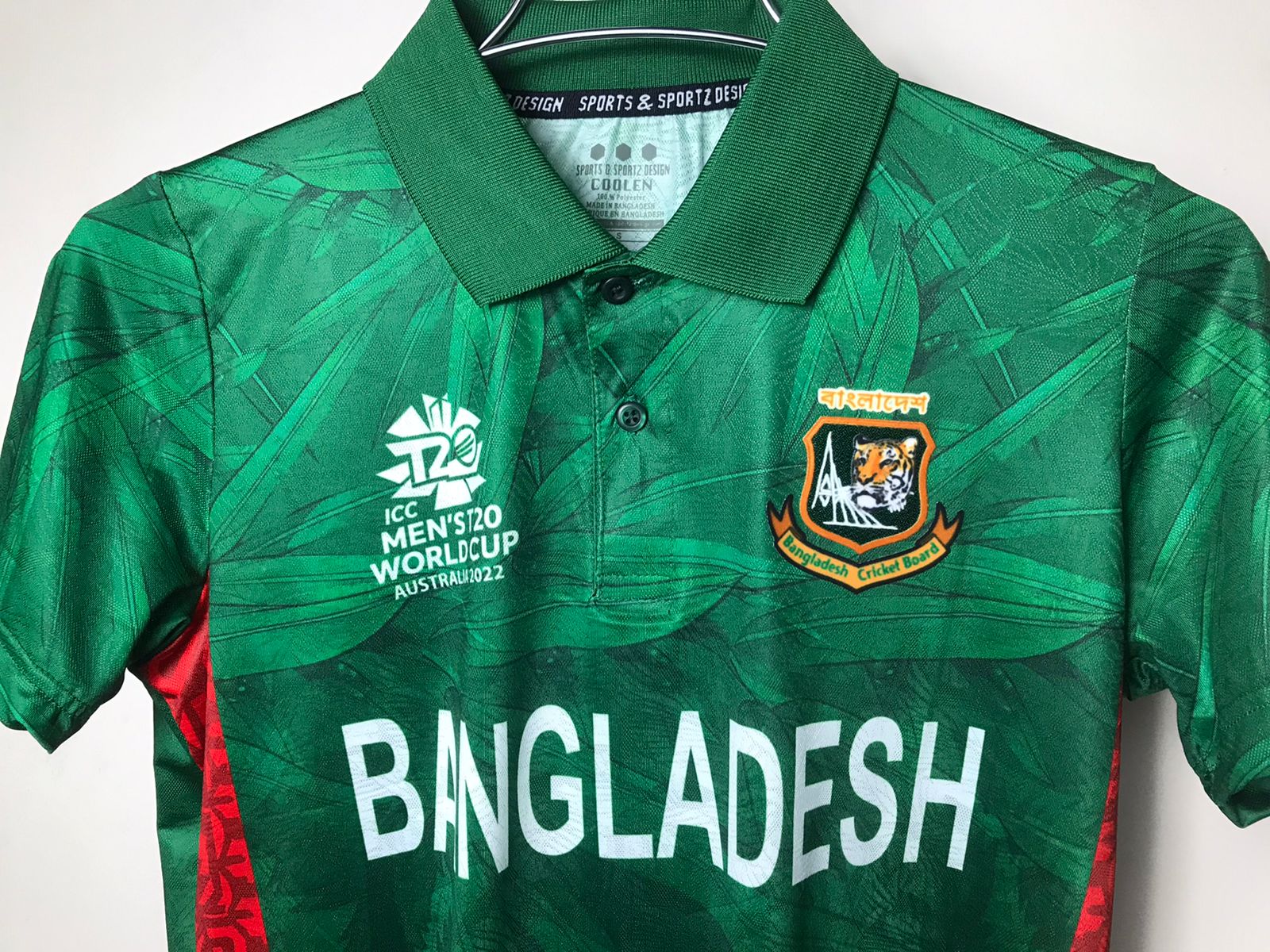

VAT Expenditure Report FY 2023 2024 Finance ministry officials have indicated that the government is planning to propose the withdrawal of rebates on investments in the secondary market in the budget for the upcoming fiscal 2023 24 The tax benefits would be limited only to investments made in initial public offerings IPOs

Download Tax Rebate On Investment In Bangladesh 2023 24

More picture related to Tax Rebate On Investment In Bangladesh 2023 24

Tax Return Support In Bangladesh Tax Return Support In Bangladesh

http://taxreturnsupportinbangladesh.weebly.com/uploads/1/2/6/8/126846783/59911520-1260340224138750-4124131668971749376-o_orig.jpg

Lululemon Customer Support Salary Slip

https://image.slidesharecdn.com/generalpresentationonincometax1-170901141150/95/general-presentation-on-income-tax-in-bangladesh-13-638.jpg?cb=1504275189

Investment For Tax Rebate YouTube

https://i.ytimg.com/vi/mW50dv6qfDU/maxresdefault.jpg

These insights incorporate many important aspects of the Income Tax Act 2023 as amended up to and including the changes in the Finance Act 2023 and the respective major changes in the VAT Act 2012 and Foreign tax relief A resident individual may credit income tax paid on foreign source income against their Bangladesh tax liability The amount of the credit is the lesser of the income tax paid abroad or the Bangladesh tax payable on the foreign source income

The draft Income Tax Bill 2023 has delivered bad news for big investors of mutual funds though it has retained all benefits for stock investors including the capital gains tax Drafted New Income tax Act 2023 to replace the existing Ordinance inter alia intending to simplify and clarify the provisions relating to accounting methods depreciation and amortisation rules earnings stripping rules capital gains income from intangible assets transfer pricing alternative dispute resolution etc in addition to ease of complianc

What To Expect With Your Upcoming Tax Rebate Mass gov

https://www.mass.gov/files/2022-11/Tax Rebates-11.png

Only A Few Days Left The Great Rebate From Coors Through July 31st At

https://wyattswetgoods.com/wp-content/uploads/coors-5-rebate.jpg

https://thefinancialexpress.com.bd/stock/...

The highest annual tax rebate on investments in listed securities of the capital market will be reduced by one third or 33 per cent to Tk 1 million if the draft income tax act 2023 is approved by parliament

https://www.linkedin.com/pulse/calculate-income...

Investments 15 If you ve invested money you get a rebate of 15 of your total investment which is 120 000 here 10 00 000 BDT This amount is part of the calculation

Difference Between Tax Exemption Tax Deduction And Tax Rebate The

What To Expect With Your Upcoming Tax Rebate Mass gov

Tax Rebate On Income Upto 5 Lakh Under Section 87A

4 TAX REBATE U s 87A New TAX REBATE EXAMPLES Income Tax

Direct Clustering Algorithm DCA Chan Milner 1982 Download

Bangladesh T20 World Cup Official Jersey Price In Bd BlackBud

Bangladesh T20 World Cup Official Jersey Price In Bd BlackBud

Tax Rebate On Investment In Secondary Stock May Go The Business Standard

Law Proposes Cutting Tax Rebate By A Third For Investments In

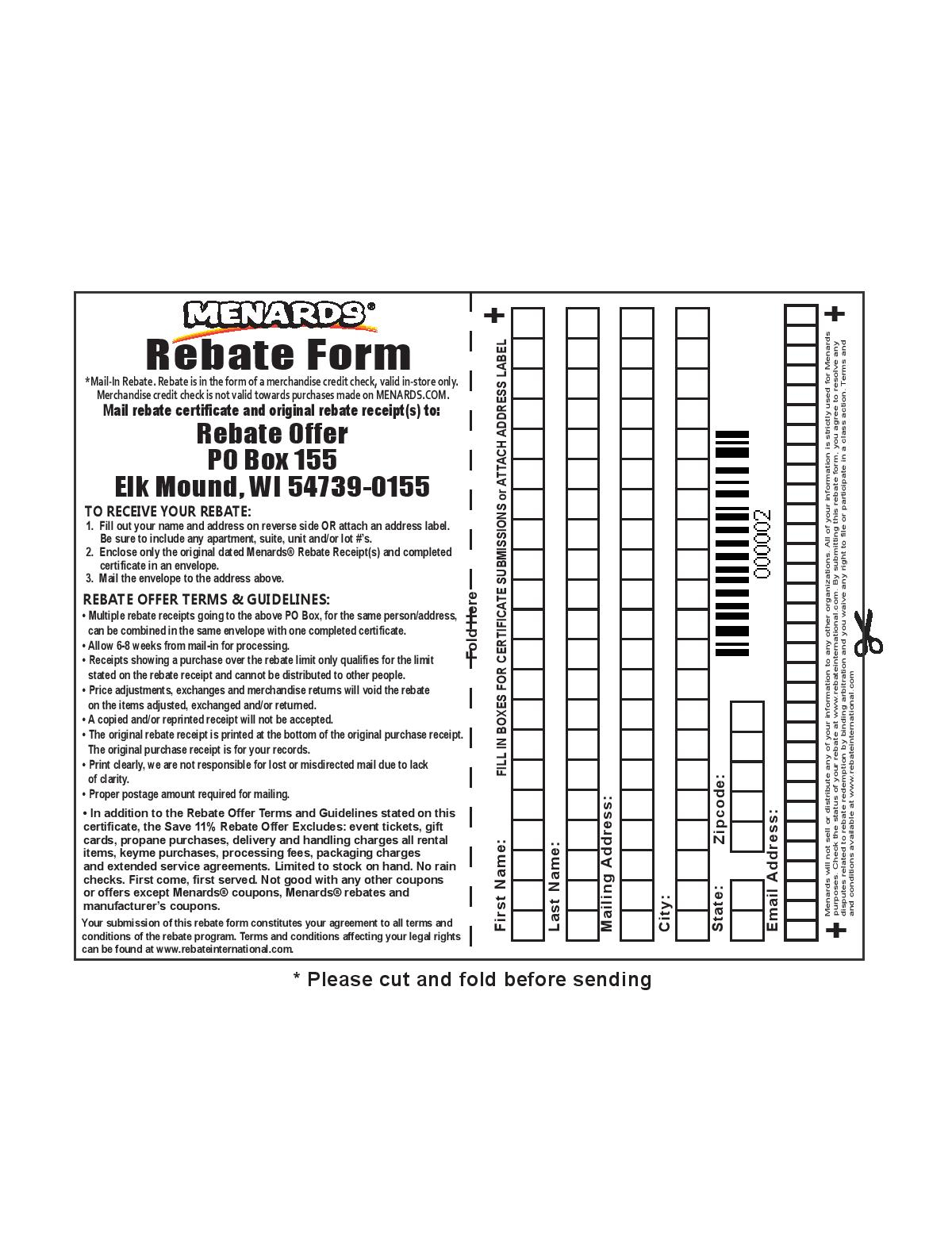

Menards Struggleville Printable Form 2022

Tax Rebate On Investment In Bangladesh 2023 24 - Finance ministry officials have indicated that the government is planning to propose the withdrawal of rebates on investments in the secondary market in the budget for the upcoming fiscal 2023 24 The tax benefits would be limited only to investments made in initial public offerings IPOs