Tax Rebate In Bangladesh 2022 A tax Rebate is a benefit on income tax given by the government which means the total amount of salary you get in a year including bonuses and other benefits then a certain

All the information in this writing has been made under the light of the Income Tax Ordinance 1984 SROs as well as the National Budget Speech 2022 2023 Hence this writing contains According to the existing provisions an employer is allowed a 5 percent rebate on payable tax if at least 10 percent of the total workforce is recruited from the physically

Tax Rebate In Bangladesh 2022

Tax Rebate In Bangladesh 2022

http://www.jasimrasel.com/wp-content/uploads/2023/08/Tax-Rebate-Bangladesh.jpg

Where To Invest For Tax Rebate

https://i.ytimg.com/vi/wHMetXXJeXU/maxresdefault.jpg

More Than 30 000 Homes Get Council Tax Rebate In West Berkshire

https://www.newburytoday.co.uk/_media/img/XWR3OS658K3AP70S77XD.jpg

Easily calculate your tax rebate amount on your income Use our online income tax rebate calculator bd tool and get accurate tax amounts Also know about tax rebate rate in Bangladesh Under the present provisions an employer is allowed 5 rebate on payable tax if at least 10 of the total workforce is recruited from the physically challenged population

Government has encouraged taxpayers to invest money and get tax rebate And therefore specified the areas where you could invest for tax rebate From this article we will know where to invest or donate money for What s new in the Income Tax Act Bangladesh 2023 Find out and discover potential tax rebates

Download Tax Rebate In Bangladesh 2022

More picture related to Tax Rebate In Bangladesh 2022

Renters Rebate 2021 Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2021/07/Minnesota-Renters-Rebate-Form-2021.jpg

Tax Rebate 2022 Updates Direct Payments From 100 To 300 Scheduled

https://www.the-sun.com/wp-content/uploads/sites/6/2022/12/SC-Tax-Rebate-Blog-Off-Plat-copy-1.jpg?strip=all&quality=100&w=1920&h=1080&crop=1

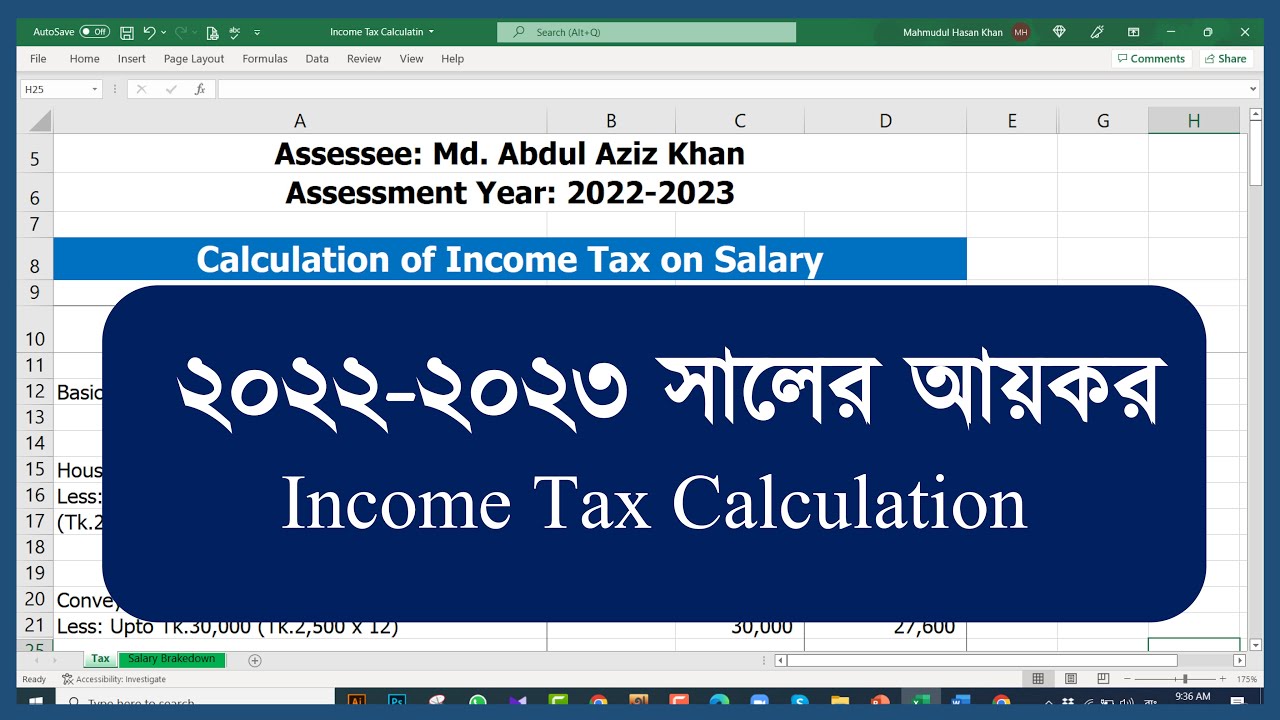

Income Tax Calculation 2022 2023 YouTube

https://i.ytimg.com/vi/HZl05bN8JDU/maxresdefault.jpg

Besides the tax free benefit has been reintroduced for the income from investment in zero coupon bonds against the demand by the businessmen The government has also withdrawn Reduce your income tax burden in Bangladesh by investing in Capital Market One of the ways to maximize your tax savings before the end of a financial year is by using your equity

Understanding tax rebates on investments is crucial for optimizing your returns in Bangladesh Whether you re investing in the Dhaka Stock Exchange DSE Sanchaypatra or mutual funds In terms of maximum tax rebate and investment security a Fixed Income Mutual Fund is the best fit Though Fixed Income Mutual Funds have already made their

Tax Vat Rates Of Bangladesh For The Year 2022 2023 YouTube

https://i.ytimg.com/vi/0rt-2WGXkEw/maxresdefault.jpg

https://daptari.com/wp-content/uploads/2022/07/income-tax-rebate-in-bangladesh-768x432.jpg

https://bdesheba.com › calculate-tax-rebate

A tax Rebate is a benefit on income tax given by the government which means the total amount of salary you get in a year including bonuses and other benefits then a certain

https://juralacuity.com › income-tax-bd

All the information in this writing has been made under the light of the Income Tax Ordinance 1984 SROs as well as the National Budget Speech 2022 2023 Hence this writing contains

Tax Credit Or Tax

Tax Vat Rates Of Bangladesh For The Year 2022 2023 YouTube

Council Tax Rebate 2022 Council Issues THIRD Date To Pay 150

Budget For Fiscal Year 2023 24 Tax Waivers Counted In Subsidy Account

Rebate And Releif Of Tax Rebate 87a Of Income Tax Rebate And Relief

2022 Tax Brackets DhugalKillen

2022 Tax Brackets DhugalKillen

List Of Top Software Company In Bangladesh With Great Company Culture

Pa 1000 2021 2024 Form Fill Out And Sign Printable PDF Template

Income Tax Calculation Slab 2023 2024

Tax Rebate In Bangladesh 2022 - As previously reported the Bangladesh Budget Speech for 2022 2023 was delivered by Finance Minister Mustafa Kamal in June 2022 and the budget measures were