Clean Vehicle Rebate Project 2024 The IRS strongly urges sellers of clean vehicles to register by Dec 1 2023 to receive advance payments starting Jan 1 2024 For updated clean vehicle credit frequently asked questions related to new previously owned and qualified commercial clean vehicles see Fact Sheet 2023 22 PDF More information Clean Vehicle Credits

Starting January 1 2024 the clean vehicle tax credits can be accessed as point of sale rebates at participating dealerships This is great for two reasons You no longer have to wait until tax time to take advantage of the tax credit When point of sale the tax credit is no longer based on your personal tax liability English Espa ol Oct 6 2023 If you buy a new or used clean energy vehicle you may qualify for a non refundable tax credit Visit FuelEconomy gov for a list of qualified vehicles Qualified two wheeled plug in electric vehicles may also be eligible for this credit

Clean Vehicle Rebate Project 2024

Clean Vehicle Rebate Project 2024

https://images.squarespace-cdn.com/content/v1/55a6b117e4b002796fd89798/1586389249733-HIY3QSTI4OOC2105FEY9/cleanvehilerebate.png

Clean Vehicle Rebate Project CVRP Enjoy OC

https://enjoyorangecounty.com/wp-content/uploads/2022/10/cvrp-clean-vehicle-rebate-project-1024x1024.jpg

/cloudfront-ap-southeast-2.images.arcpublishing.com/nzme/D6AUTOBYGPUZQ22Z7Z3R5QI5NY.jpg)

The feebate Govt Confirms Rebates For Buyers Of Electric Cars But Petrol Car Buyers Will

https://www.nzherald.co.nz/resizer/HHBwV9KdiG35JUfJerLM1hmHM_c=/1440x1019/smart/filters:quality(70)/cloudfront-ap-southeast-2.images.arcpublishing.com/nzme/D6AUTOBYGPUZQ22Z7Z3R5QI5NY.jpg

If you take possession of a new clean vehicle on or after April 18 2023 it must meet critical mineral and battery component requirements to qualify for the credit This applies even if you bought the vehicle before April 18 Find details in Q6 under Topic A in the fact sheet PDF The Clean Vehicle Tax Credit up to 7 500 for electric vehicles can now be used at the point of sale like an instant rebate Effective this year the changes may help steer more potential

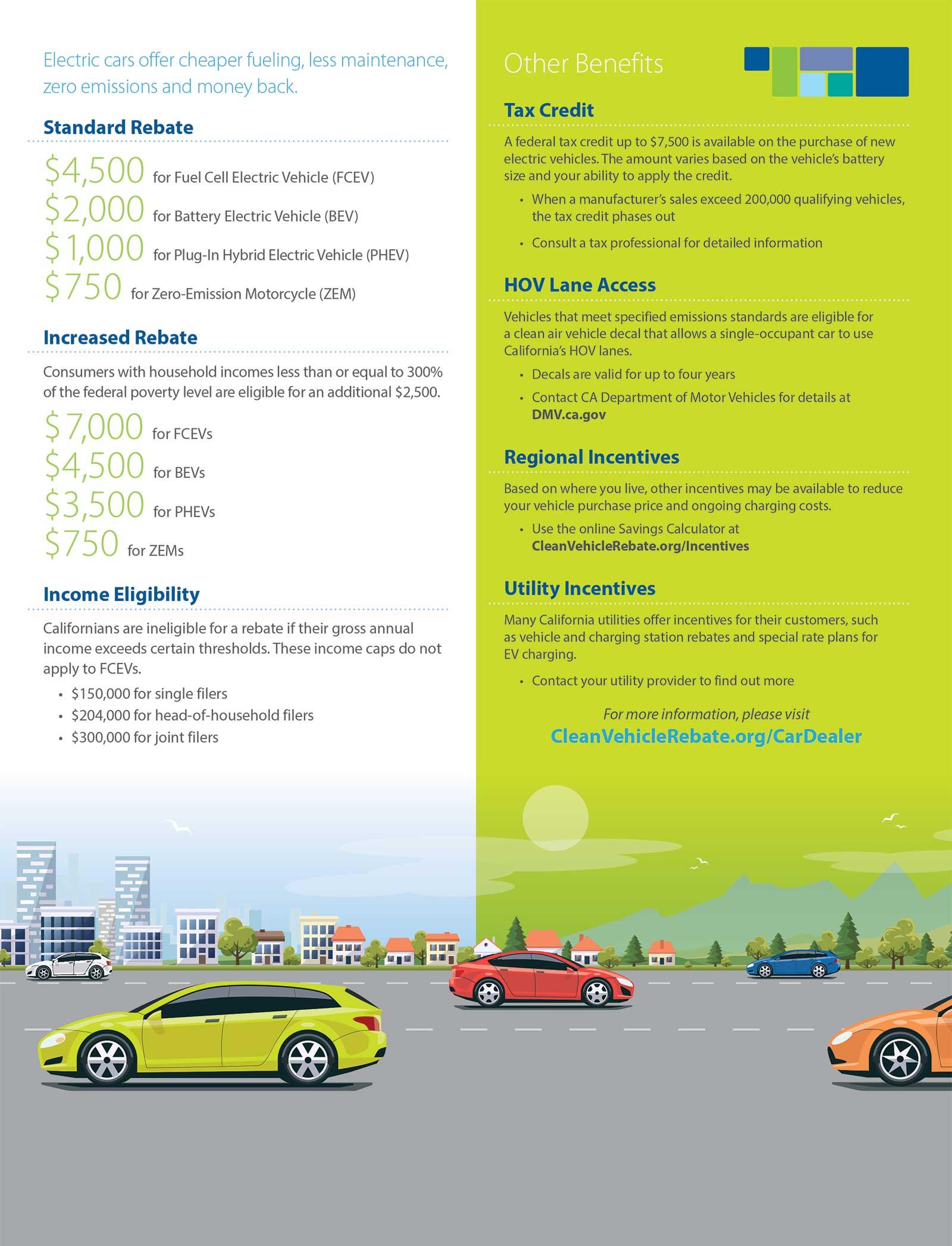

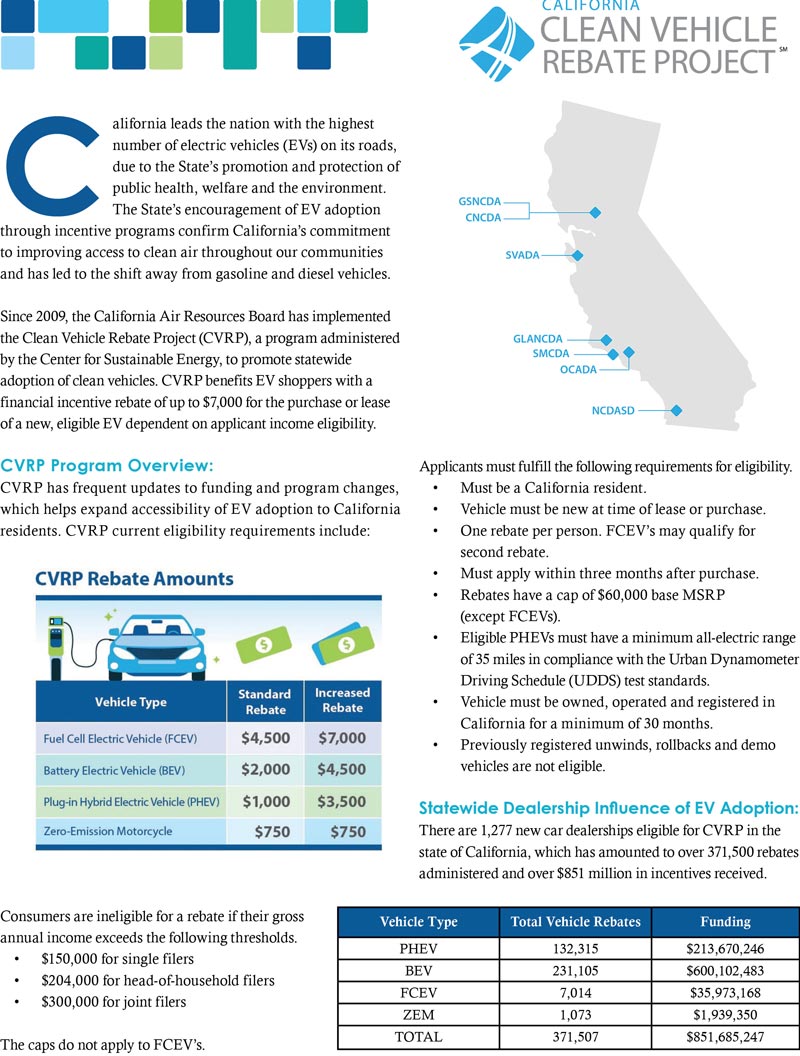

Clean Vehicle Rebate Project CVRP Back To All Programs Effective November 8 2023 CVRP is closed to new applications CVRP offers up to 7 500 to purchase or lease a new plug in hybrid electric vehicle PHEV battery electric vehicle BEV or a fuel cell electric vehicle FCEV The Clean Vehicle Rebate Project in existence since 2010 will end when it runs out of money this year In its place the state will expand a program next year that provides subsidies only to low to middle income residents those who have more trouble affording electric cars The income limits will be much more restrictive

Download Clean Vehicle Rebate Project 2024

More picture related to Clean Vehicle Rebate Project 2024

Plug In Hybrid EV And Incentives California Clean Vehicle Rebate Project CVRP

https://media.assets.ansira.net/websites/content/nissan-dublin-ca/4cb5e0ab2f774f578996e55abaeb50d1_1600x2094.jpg

Figure 1 From Impact Of The Clean Vehicle Rebate Project s Increased Outreach On California s

https://ai2-s2-public.s3.amazonaws.com/figures/2017-08-08/deb3a1c2dabbda72799eef6494f05a511b95b0f1/3-Figure1-1.png

Clean Vehicle Rebate Project California Climate Investments

https://images.squarespace-cdn.com/content/v1/55a6b117e4b002796fd89798/1489220493821-H77TBAVJHN4OG7Z3CCE0/CVRP_NDEW+San+Mateo_Rosie.jpg

What does it fund Rebates for the purchase or lease of new eligible light duty vehicles including electric fuel cell and plug in hybrid electric vehicles Who is eligible for funds Individuals businesses nonprofit and government entities based in California It s administered by a new Internal Revenue Service system launched Jan 1 to allow dealers to provide the up to 7 500 federal tax credit on qualifying electrified vehicle sales when customers

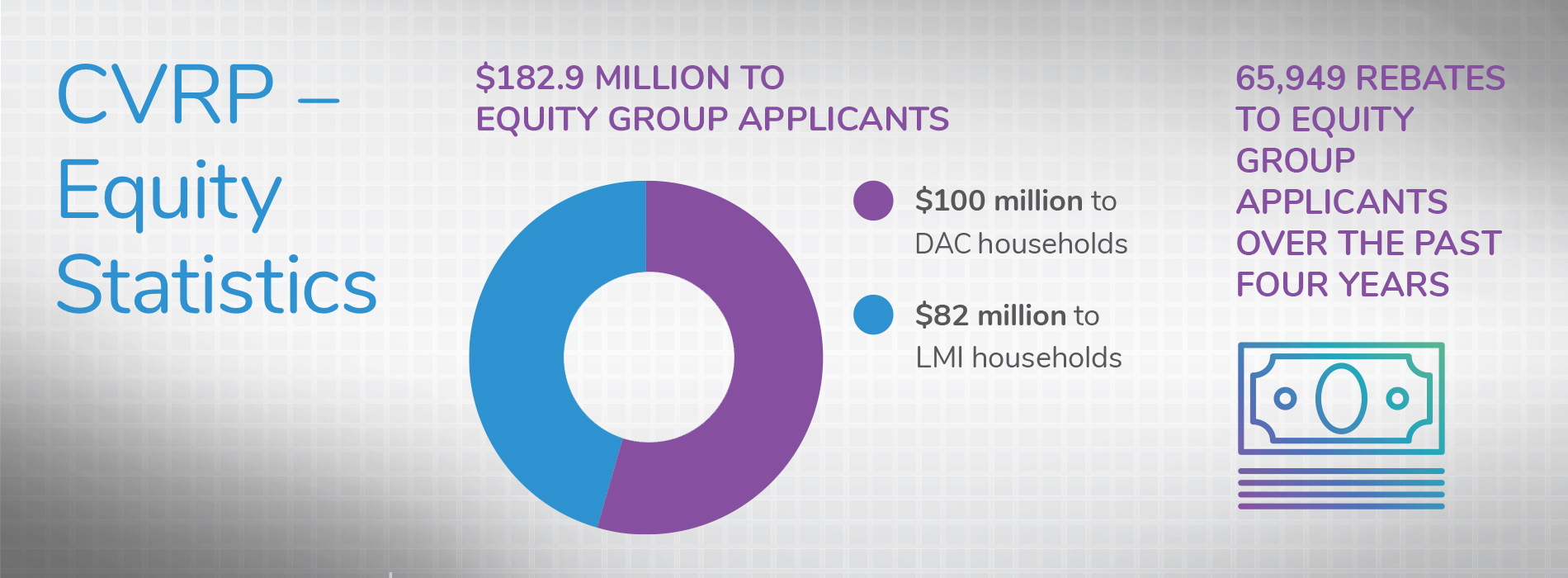

SACRAMENTO The California Air Resources Board today announced that it will transition its existing Clean Vehicle Rebate Project CVRP program to a new program that helps low and middle income Californians access zero emission vehicles Applications are due by 5pm PST January 25 2024 2023 Clean School Bus CSB Rebate Program The U S Environmental Protection Agency EPA announced it has opened the 2023 Clean School Bus CSB Rebate Program The 2023 rebate program offers at least 500 million in rebate funding for clean school buses and zero emission school buses with

CVRP Overview Clean Vehicle Rebate Project

https://cleanvehiclerebate.org/sites/default/files/column-images/cvrp-info.jpg

Clean Vehicle Rebate Project Jumpstarts Zero Emission Vehicle Adoption California Climate

https://images.squarespace-cdn.com/content/v1/55a6b117e4b002796fd89798/1554308796748-UKXMWL627YMFRTTL60M1/21_HSP_Photo_1.jpg

https://www.irs.gov/newsroom/clean-vehicle-credits-can-help-car-buyers-pay-less-at-the-dealership

The IRS strongly urges sellers of clean vehicles to register by Dec 1 2023 to receive advance payments starting Jan 1 2024 For updated clean vehicle credit frequently asked questions related to new previously owned and qualified commercial clean vehicles see Fact Sheet 2023 22 PDF More information Clean Vehicle Credits

https://blog.greenenergyconsumers.org/blog/upcoming-2024-changes-to-the-federal-clean-vehicle-tax-credit

Starting January 1 2024 the clean vehicle tax credits can be accessed as point of sale rebates at participating dealerships This is great for two reasons You no longer have to wait until tax time to take advantage of the tax credit When point of sale the tax credit is no longer based on your personal tax liability

Program Reports Clean Vehicle Rebate Project

CVRP Overview Clean Vehicle Rebate Project

Clean Vehicle Rebate Project Los Angeles Dealer Magazine

California Directs More Clean Vehicle Rebates To Lower Income Families Center For Sustainable

Clean Vehicle Rebate Project Center For Sustainable Energy

CVRP For Business

CVRP For Business

Resource Guide Clean Vehicle Rebate Project

Program Reports Clean Vehicle Rebate Project

CVRP Rebate Statistics Clean Vehicle Rebate Project

Clean Vehicle Rebate Project 2024 - The Clean Vehicle Rebate Project in existence since 2010 will end when it runs out of money this year In its place the state will expand a program next year that provides subsidies only to low to middle income residents those who have more trouble affording electric cars The income limits will be much more restrictive