Clean Vehicle Rebate Syaing I Didnt Submit Taxes Web 29 d 233 c 2022 nbsp 0183 32 IR 2022 231 December 29 2022 WASHINGTON The Internal Revenue Service today released frequently asked questions FAQs about clean vehicle credits

Web 31 mars 2023 nbsp 0183 32 A1 For purposes of the new clean vehicle credit a new clean vehicle is a clean vehicle placed in service on or after January 1 2023 that is acquired by a Web 31 mars 2023 nbsp 0183 32 For more information see FAQ 7 However if you entered into a written binding contract to buy a new clean vehicle after December 31 2021 and before

Clean Vehicle Rebate Syaing I Didnt Submit Taxes

Clean Vehicle Rebate Syaing I Didnt Submit Taxes

https://s.aolcdn.com/dims-global/dims3/GLOB/legacy_thumbnail/1200x675/quality/85/https://o.aolcdn.com/images/dims3/GLOB/legacy_thumbnail/800x450/format/jpg/quality/85/http://s.aolcdn.com/commerce/blogcdn/green.autoblog.com/media/2011/07/clean-vehicle-rebate.png

Electric Vehicle Rebates EClips Extra

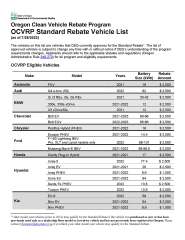

https://readallaboutitoregon.files.wordpress.com/2022/08/oregon-clean-vehicle-rebate-program-ocvrp-standard-rebate-vehicle-eligibility-list.jpg

Clean Vehicle Rebate Program El Cajon Mitsubishi

https://service.secureoffersites.com/images/GetLibraryImage?fileNameOrId=153942

Web 21 mars 2023 nbsp 0183 32 The new clean vehicle credit also covers pre owned clean vehicles starting in 2023 Beginning in 2024 you can opt for transferring the clean vehicle credit Web 15 ao 251 t 2023 nbsp 0183 32 FAQs Funds for CVRP are nearly exhausted Applications received on or after September 6 2023 will be placed on a standby list and are not guaranteed a

Web A1 For purposes of the new clean vehicle credit a new clean vehicle is a clean vehicle placed in service on or after January 1 2023 that is acquired by a taxpayer for original Web The IRA changed the IRC Section 30D quot new qualified plug in electric drive motor vehicles credit quot to a quot clean vehicle credit quot The clean vehicle credit is a dollar for dollar reduction

Download Clean Vehicle Rebate Syaing I Didnt Submit Taxes

More picture related to Clean Vehicle Rebate Syaing I Didnt Submit Taxes

PDF CVRP Household Summary Form Clean Vehicle Rebate Project Fill

https://www.pdffiller.com/preview/560/828/560828696/large.png

FAQs Clean Vehicle Rebate Project

https://cleanvehiclerebate.org/sites/default/files/images/nav/programs/cvrp/FAQ-upload-05.png

Clean Vehicle Rebate Project CVRP Enjoy OC

https://enjoyorangecounty.com/wp-content/uploads/2022/10/cvrp-clean-vehicle-rebate-project-1024x1024.jpg

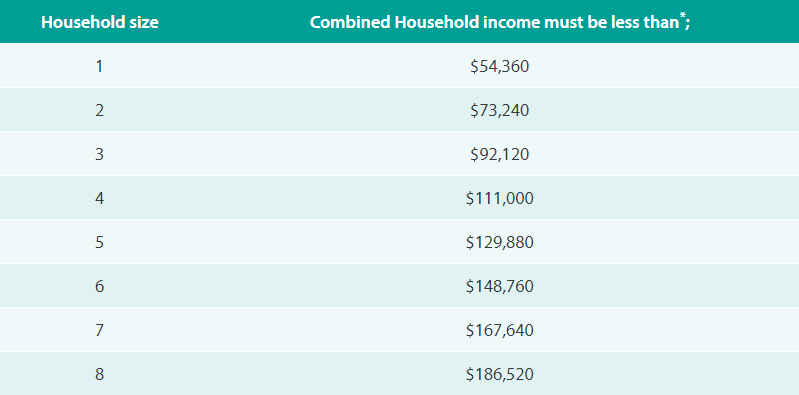

Web 225 000 for heads of households 150 000 for all other filers You can use your modified AGI from the year you take delivery of the vehicle or the year before whichever is less Web Applications received on or after September 6 2023 will be placed on a standby list and are not guaranteed a rebate Please read the standby list FAQ for more information

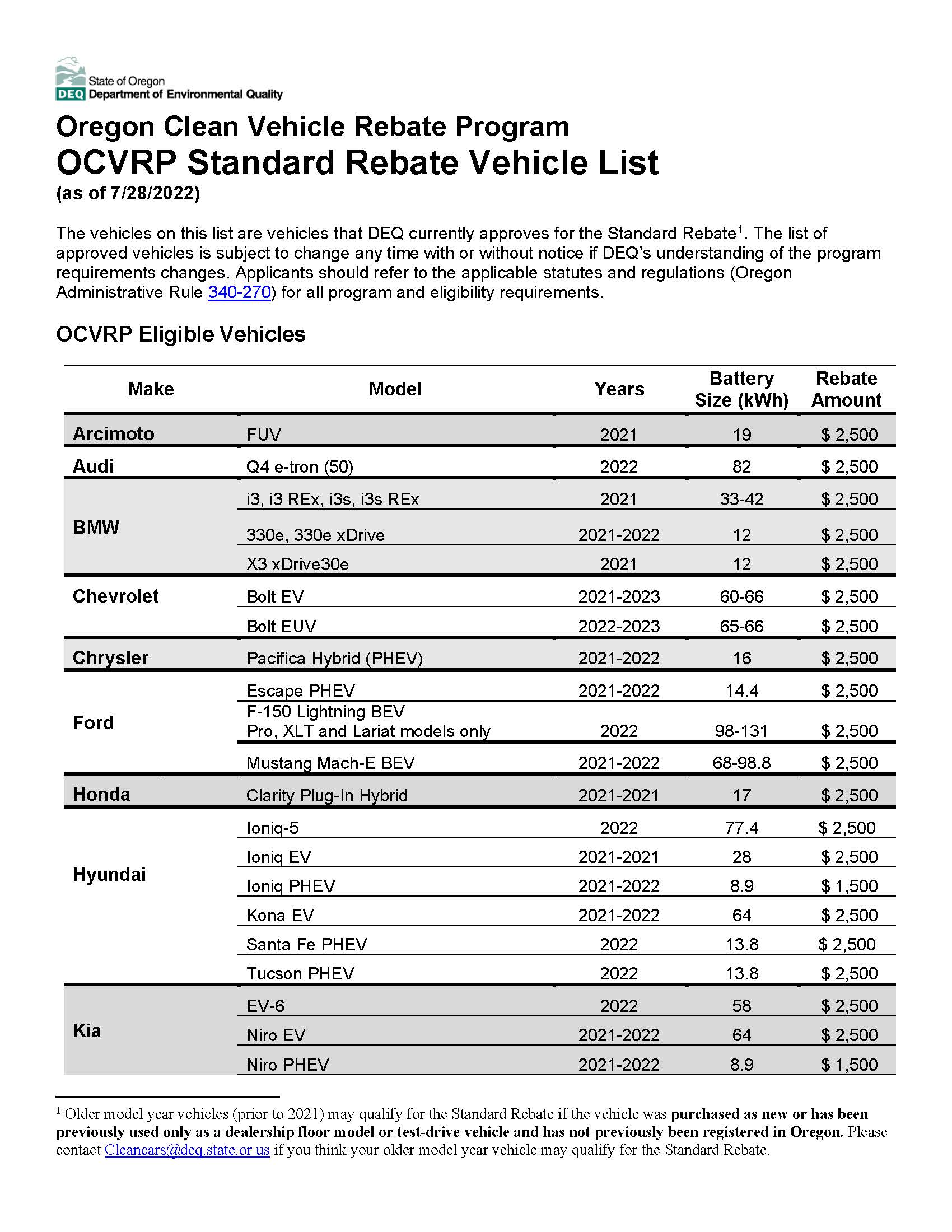

Web Used Clean Vehicle Credit Beginning January 1 2023 if you buy a qualified used electric vehicle EV or fuel cell vehicle FCV from a licensed dealer for 25 000 or less you Web 10 mars 2023 nbsp 0183 32 Starting January 1 2023 the most significant changes to Clean Vehicle Tax Credit are New clean vehicles are eligible for up to 7 500 depending on battery size

FAQs Clean Vehicle Rebate Project

https://cleanvehiclerebate.org/sites/default/files/images/nav/programs/cvrp/FAQ-upload-03.png

Plug In Hybrid EV And Incentives California Clean Vehicle Rebate

https://media.assets.sincrod.com/websites/content/nissan-dublin-ca/81fa44510f604f719f4e85209235737b_1600x2094.jpg

https://www.irs.gov/newsroom/irs-releases-frequently-asked-questions...

Web 29 d 233 c 2022 nbsp 0183 32 IR 2022 231 December 29 2022 WASHINGTON The Internal Revenue Service today released frequently asked questions FAQs about clean vehicle credits

https://www.irs.gov/newsroom/topic-a-frequently-asked-questions-about...

Web 31 mars 2023 nbsp 0183 32 A1 For purposes of the new clean vehicle credit a new clean vehicle is a clean vehicle placed in service on or after January 1 2023 that is acquired by a

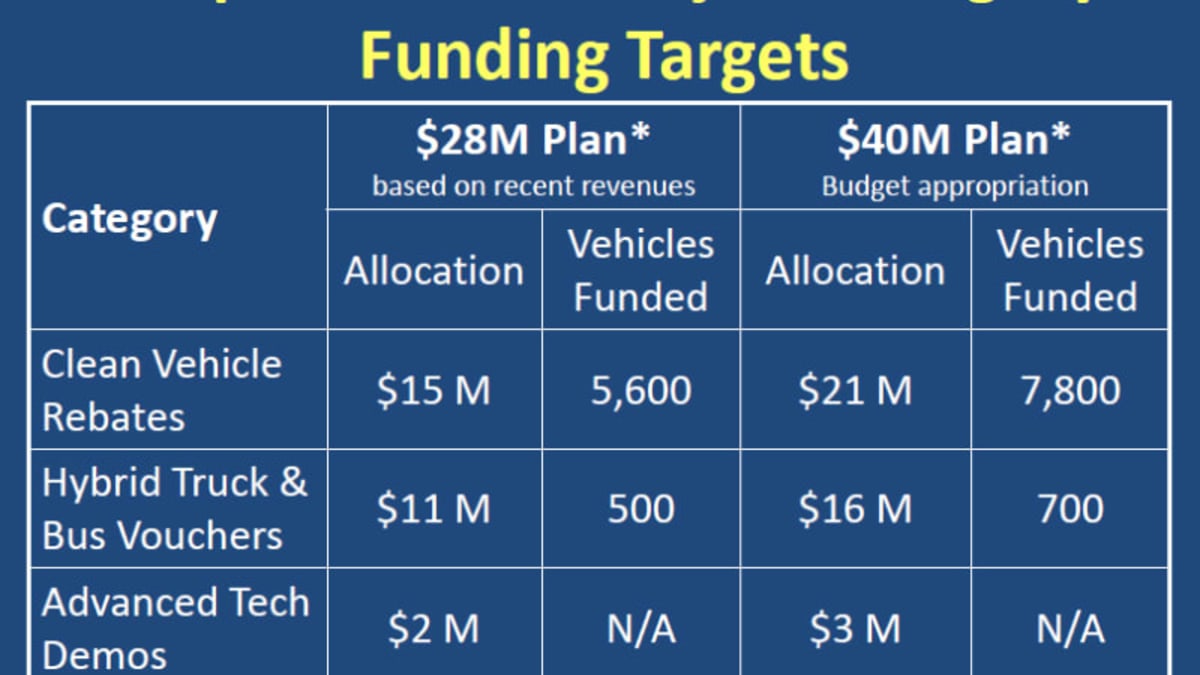

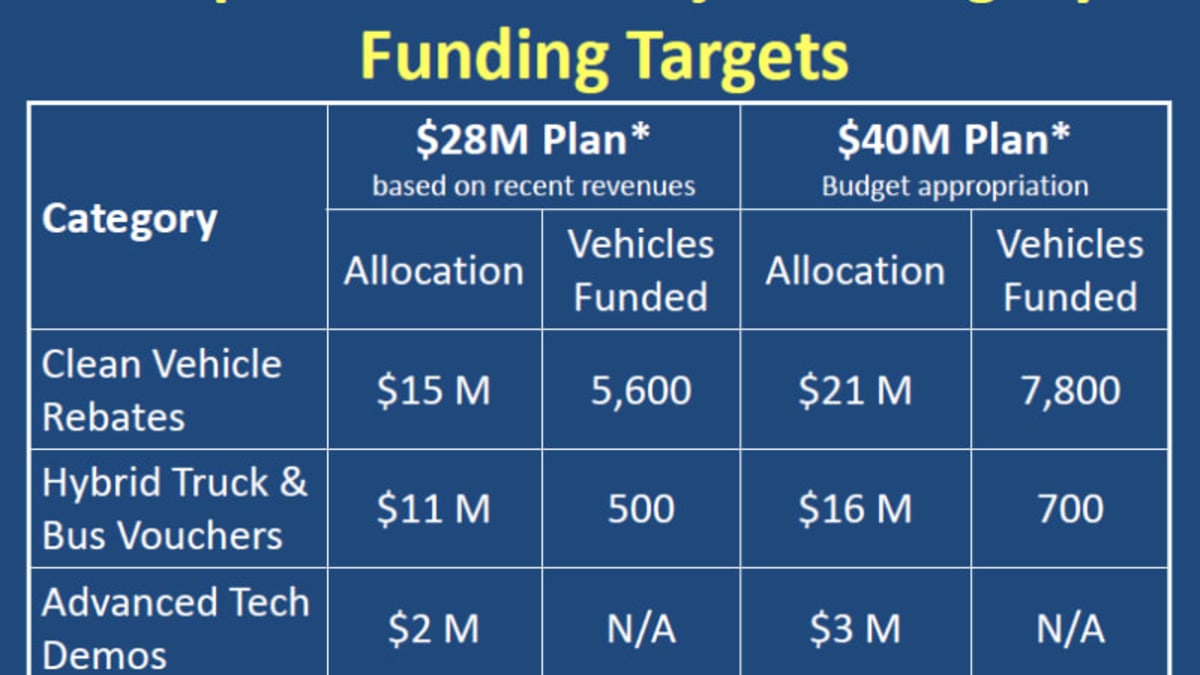

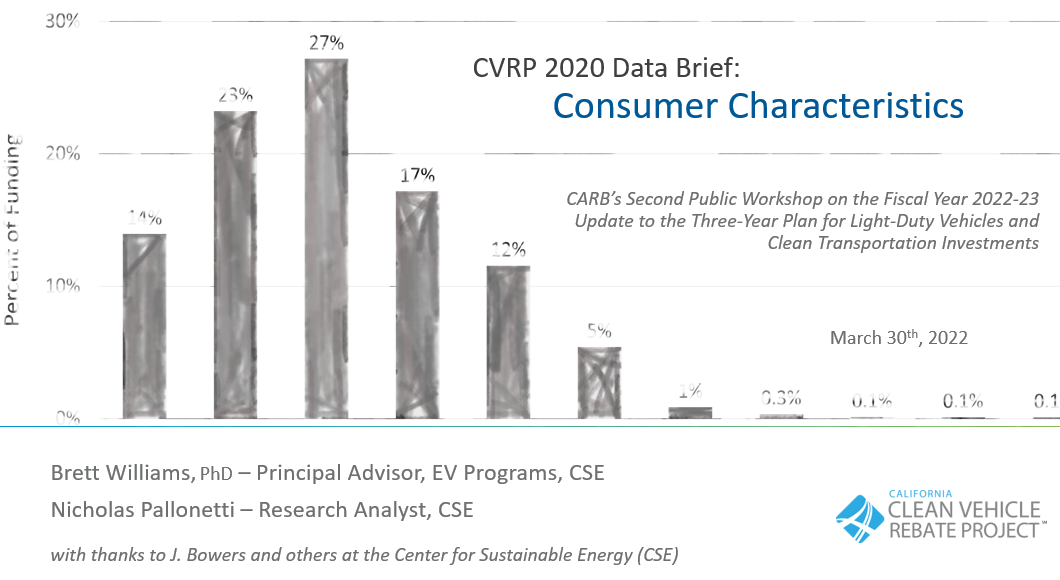

Program Reports Clean Vehicle Rebate Project CVRP Overview Clean

FAQs Clean Vehicle Rebate Project

California Clean Air Vehicle Rebate Californiarebates

FAQs Clean Vehicle Rebate Project

Clean Vehicle Rebates Put On Waiting List CSE

Clean Autos Get Boost In 3 Bills Los Angeles Times

Clean Autos Get Boost In 3 Bills Los Angeles Times

Electric Car Available Rebates 2023 Carrebate

Program Reports Clean Vehicle Rebate Project CVRP Overview Clean

The Delaware Clean Vehicle Rebate Program Shop With Me Mama

Clean Vehicle Rebate Syaing I Didnt Submit Taxes - Web 15 ao 251 t 2023 nbsp 0183 32 FAQs Funds for CVRP are nearly exhausted Applications received on or after September 6 2023 will be placed on a standby list and are not guaranteed a