Co State Tax Due Date Estimated tax is not required for estates or trusts This form is provided for those who prefer filing estimated tax 20th day of the month following the filing period end date May 15th of each year

Due Date Individual Returns April 15 or same as IRS Extensions Colorado offers individual taxpayers an automatic 6 month extension to file their income tax return if it cannot be submitted by the April 15 due date Original Deadline to prepare and e File a Colorado Income Tax Return You have until October 15 2024 to complete and e File your Federal Income and Colorado State Income Tax Return eFileIT April 15 2024 Deadline has passed However

Co State Tax Due Date

Co State Tax Due Date

https://i.ytimg.com/vi/bIaladziAOI/maxres2.jpg?sqp=-oaymwEoCIAKENAF8quKqQMcGADwAQH4AZQDgALQBYoCDAgAEAEYciBdKB0wDw==&rs=AOn4CLC5AwqW9jZQ1C2_Jgao5HkCfECdoQ

Federal And State Income Taxes Due July 15th

https://townsquare.media/site/757/files/2016/03/Taxes.jpg?w=1200

Co State Tax Exempt Form ExemptForm

https://i0.wp.com/www.exemptform.com/wp-content/uploads/2022/08/fillable-form-dr-5002-standard-colorado-affidavit-of-exempt-sale.png

The state filing deadline is April 15th 2024 Returns that are mailed must be postmarked by April 15th An automatic extension is granted until October 15th 2024 but there is no extended time to pay any income taxes owed No application is required for an But if you live in one of the 41 states that charge state income taxes on wages you might have a different due date to contend with this year Although the vast majority of states use the federal

Regardless of when the state begins processing returns the deadline for sending in your Colorado tax return is the same as the IRS deadline April 15 also known as Tax Day On this page we have compiled a calendar of all sales tax due dates for Colorado broken down by filing frequency The next upcoming due date for each filing schedule is marked in green Simplify Colorado sales tax compliance

Download Co State Tax Due Date

More picture related to Co State Tax Due Date

Income Tax Due Date Extension FY 2020 21 ITR DUEDATE EXTENSION

https://i.ytimg.com/vi/6ZQnWYpoTdA/maxresdefault.jpg?sqp=-oaymwEmCIAKENAF8quKqQMa8AEB-AHUBoAC4AOKAgwIABABGH8gIiglMA8=&rs=AOn4CLCh1VW97qX5rYLetACcM7ouv7M0ig

Property Taxes Due Thursday

https://www.gannett-cdn.com/-mm-/96591d0009f63067b237f650ad95edf60abaf1a7/c=0-31-4515-2582/local/-/media/2016/11/10/INGroup/LafayetteIN/636143828912388907-propety-tax-illustration.jpg?width=3200&height=1680&fit=crop

Sales Use Taxes Deadline March 17th 2023

https://pasfirm.com/wp-content/uploads/2023/02/blog-calendar-sales-use-taxes-0317.jpg

Your browser appears to have cookies disabled Cookies are required to use this site Due Dates Estimated tax payments are due in four equal installments on the following dates April 15 first calendar quarter June 15 second calendar quarter September 15 third calendar quarter January 15 fourth calendar quarter If the due date falls on a

January 1 Assessment Date for all Personal Property April 15 Declaration Schedules due to county assessor Deadline to request a filing extension June 15 Deadline for assessor to mail Notice of Valuation June 30 Last day to protest to county assessor June 15 July You must send payment for taxes in Colorado for the fiscal year 2023 by April 16 2024 The Extension Deadline is October 15 2024 to file your Colorado Individual Income tax return Colorado automatically grants 6 months extensions on filing personal income

Colorado State Tax Withholding Form 2023 Printable Forms Free Online

https://www.pdffiller.com/preview/423/924/423924506/large.png

These Are The States That Updated Their 2020 Tax Filing Deadlines

https://loganmartinrealtypros.com/wp-content/uploads/2021/04/177543769_313969630174178_2688524765217555803_n.jpg

https://tax.colorado.gov/sites/tax/files/documents/...

Estimated tax is not required for estates or trusts This form is provided for those who prefer filing estimated tax 20th day of the month following the filing period end date May 15th of each year

https://support.taxslayerpro.com/hc/en-us/articles/360009169254

Due Date Individual Returns April 15 or same as IRS Extensions Colorado offers individual taxpayers an automatic 6 month extension to file their income tax return if it cannot be submitted by the April 15 due date

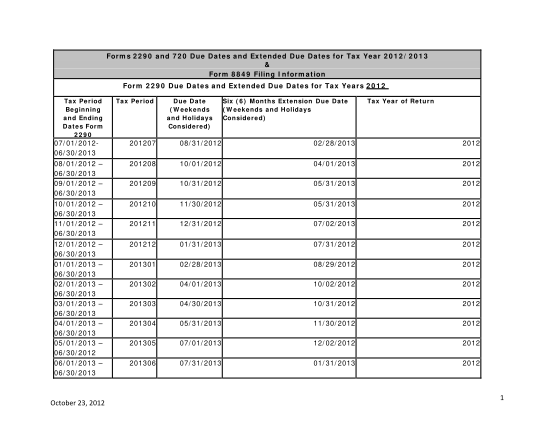

18 2290 Tax Due Date Free To Edit Download Print CocoDoc

Colorado State Tax Withholding Form 2023 Printable Forms Free Online

I T Return Filing Interest Penalties On The Cards If Failed To File

HSA And FSA TriCounty Eye Associates

V A Accounting Tax Solutions Kasganj

Solved Please Note That This Is Based On Philippine Tax System Please

Solved Please Note That This Is Based On Philippine Tax System Please

When Are State Taxes Due 2021 Hacquestions

PDF Pennsylvania Tax Update Special Edition PDFSLIDE NET

2020 California Sales Tax Due Date

Co State Tax Due Date - The state filing deadline is April 15th 2024 Returns that are mailed must be postmarked by April 15th An automatic extension is granted until October 15th 2024 but there is no extended time to pay any income taxes owed No application is required for an