College Tuition Tax Credit 2023 An education tax credit allows you to reduce your taxes owed and may in some cases generate a tax refund The IRS offers two types of education tax credits to offset tuition

Learn how the American Opportunity Tax Credit AOTC can help pay up to 2 500 for tuition and other qualifying expenses per student each year on your tax return during the You can claim a tax credit for your college tuition or your dependent child s college tuition either through the American Opportunity Tax Credit AOTC or the Lifetime Learning Credit LLC However you cannot

College Tuition Tax Credit 2023

College Tuition Tax Credit 2023

https://d2zhlgis9acwvp.cloudfront.net/images/articles/0072-what-are-college-tuition-tax-credits.jpg?time=202207251442

What Is The Tuition Tax Credit In Canada

https://reviewlution.ca/wp-content/uploads/2022/09/reviewlution-guide2-10.png

What Happens To Unused Tuition Tax Credits Leftover Tuition Tax

https://www.liuandassociates.com/wp-content/uploads/2021/11/Unused-Tuition-Tax-Credit-Options.jpg

The American Opportunity Tax Credit for 2023 taxes is as follows Up to 2 500 per student can be claimed calculated as 100 of the first 2 000 in college costs and 25 of the next 2 000 You can claim an education tax credit if you re a college student who s paying for your own education expenses provided you aren t claimed as a tax dependent on someone

Both college students and parents of college students can take advantage of tax breaks that can mean thousands of dollars of savings on tuition fees books and supplies The American Opportunity Tax Credit and the Lifetime Learning Credit are federal tax credits that can lower your upcoming tax bill if you paid for college in 2023

Download College Tuition Tax Credit 2023

More picture related to College Tuition Tax Credit 2023

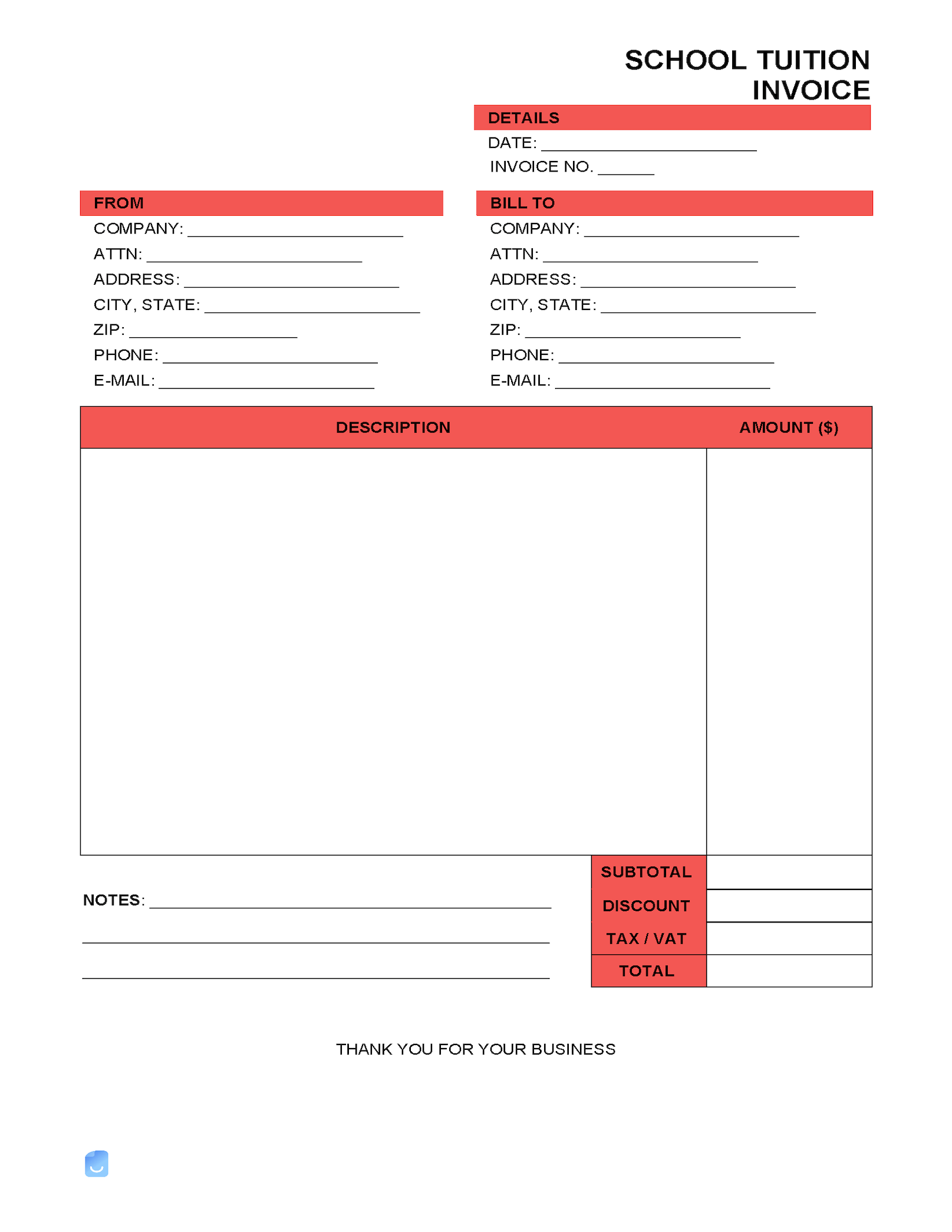

School Tuition Invoice Template Invoice Maker

https://im-next-wp-prod.s3.us-east-2.amazonaws.com/uploads/2022/11/School-Tuition-Invoice-Template.png

Tuition Tax Credit In Canada How It Works NerdWallet

https://www.nerdwallet.com/ca/wp-content/uploads/sites/2/2022/01/GettyImages-936987292-e1643665970419.jpg

Sending Kids To School Tax Breaks For Parents Paying For College

https://www.templateroller.com/img/blog_post_img/17acfc59af0c79d09e902ac65de1d57c.jpg

There are tax breaks for people saving for college current students and graduates who are paying off student loans Taking advantage of these tax breaks may help you keep Discover how to take advantage of valuable tax credits that can significantly reduce the financial burden of higher education In this video we break down the different college tax

There are two federal education tax credits that can cut your tax bill by thousands of dollars You ll save more with the American Opportunity Credit up to 2 500 per student Eligible taxpayers who paid higher education costs for themselves their spouse or dependents in 2021 may be able to take advantage of two education tax credits The

Is College Tuition Tax Deductible How To Ease The Financial Burden

https://media.marketrealist.com/brand-img/dwwJ-N4IO/1024x536/is-college-tuition-tax-deductible-1648663571830.jpg?position=top

2022 Education Tax Credits Are You Eligible

https://www.taxdefensenetwork.com/wp-content/uploads/2022/11/2022-Education-Credits-Comparison-scaled.jpg

https://www.forbes.com › advisor › taxes › tuition-and-fees-deduction

An education tax credit allows you to reduce your taxes owed and may in some cases generate a tax refund The IRS offers two types of education tax credits to offset tuition

https://www.irs.gov › credits-deductions › individuals › aotc

Learn how the American Opportunity Tax Credit AOTC can help pay up to 2 500 for tuition and other qualifying expenses per student each year on your tax return during the

Everything You Need To Know About The College Tuition Tax Credit

Is College Tuition Tax Deductible How To Ease The Financial Burden

Collegue And Forex College Tuition

College Tuition Tax Credits ENG YouTube

What About College Tuition Tax Breaks For Dual Credits College

Streetfighter 1098 Discount Dealers Save 59 Jlcatj gob mx

Streetfighter 1098 Discount Dealers Save 59 Jlcatj gob mx

How Does A College Tuition Tax Credit Work Venezuela Today

Now You Can Crowdfund A 529 College Savings Plan CBS News

Everything You Need To Know About The College Tuition Tax Credit

College Tuition Tax Credit 2023 - There used to be a Tuition and Fees Deduction which allowed people to deduct up to 4 000 in higher education expenses That particular tax break no longer exists as of 2021