Company Tax Return Due Date 2023 Ato The payment due dates for a tax return are determined by client type the lodgment due date and when the return is lodged July 2023 Information for registered agents about preparing and lodging tax statements and returns due in July 2023 August 2023

Last updated 24 July 2023 Print or Download About these instructions How these instructions will help you to complete the company tax return How to lodge and pay How to lodge the company tax return including the first tax return and the payment options available What s new Due dates for lodging and paying Key lodgment and payment dates for business Last updated 1 March 2023 Print or Download On this page Keep up with key dates for small businesses Due date falling on a weekend or public holiday Substituted accounting periods If you need more time to lodge Keep up with key dates for small

Company Tax Return Due Date 2023 Ato

Company Tax Return Due Date 2023 Ato

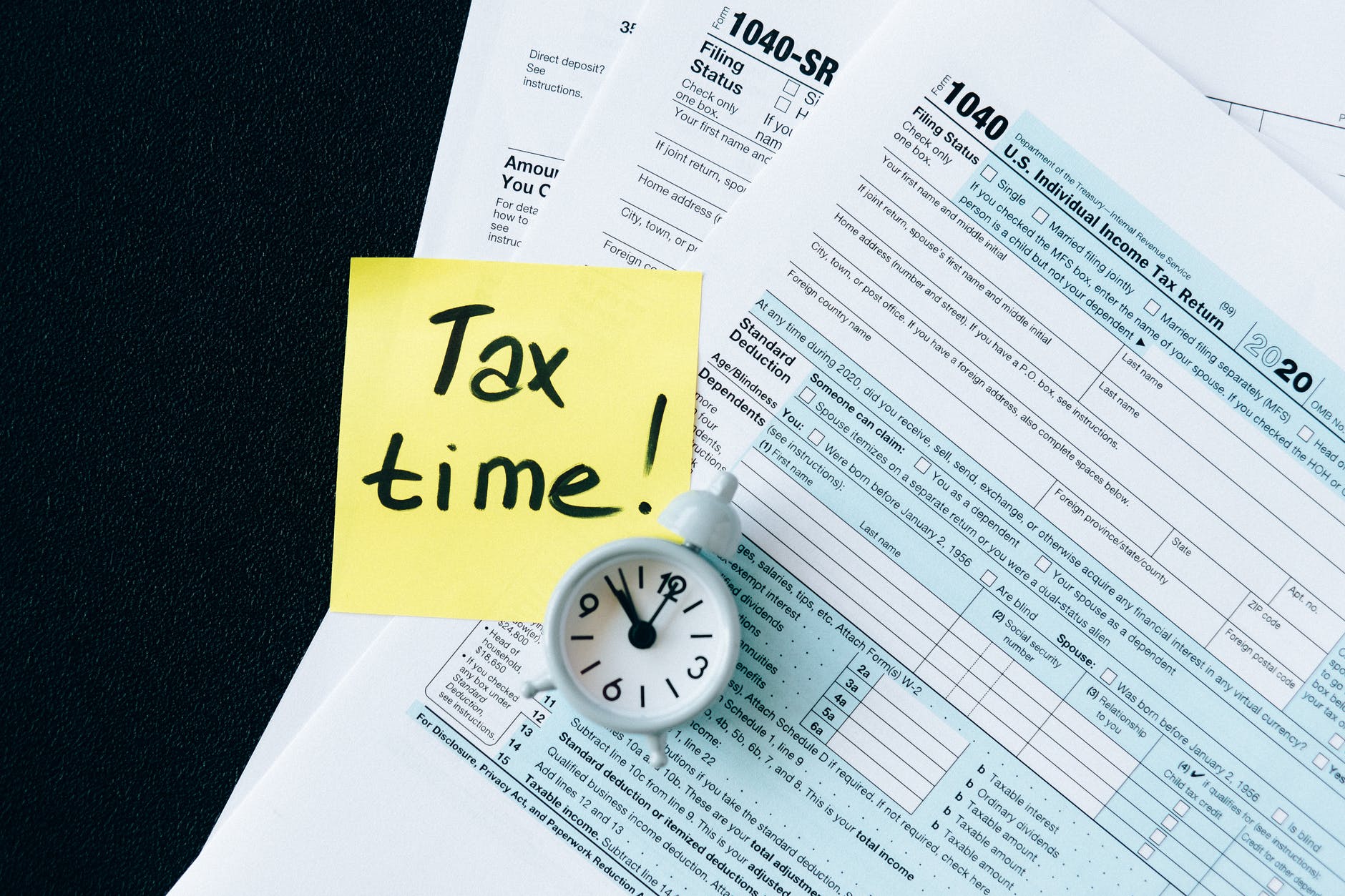

https://cacube.in/wp-content/uploads/2018/08/pexels-photo-6863259.jpeg

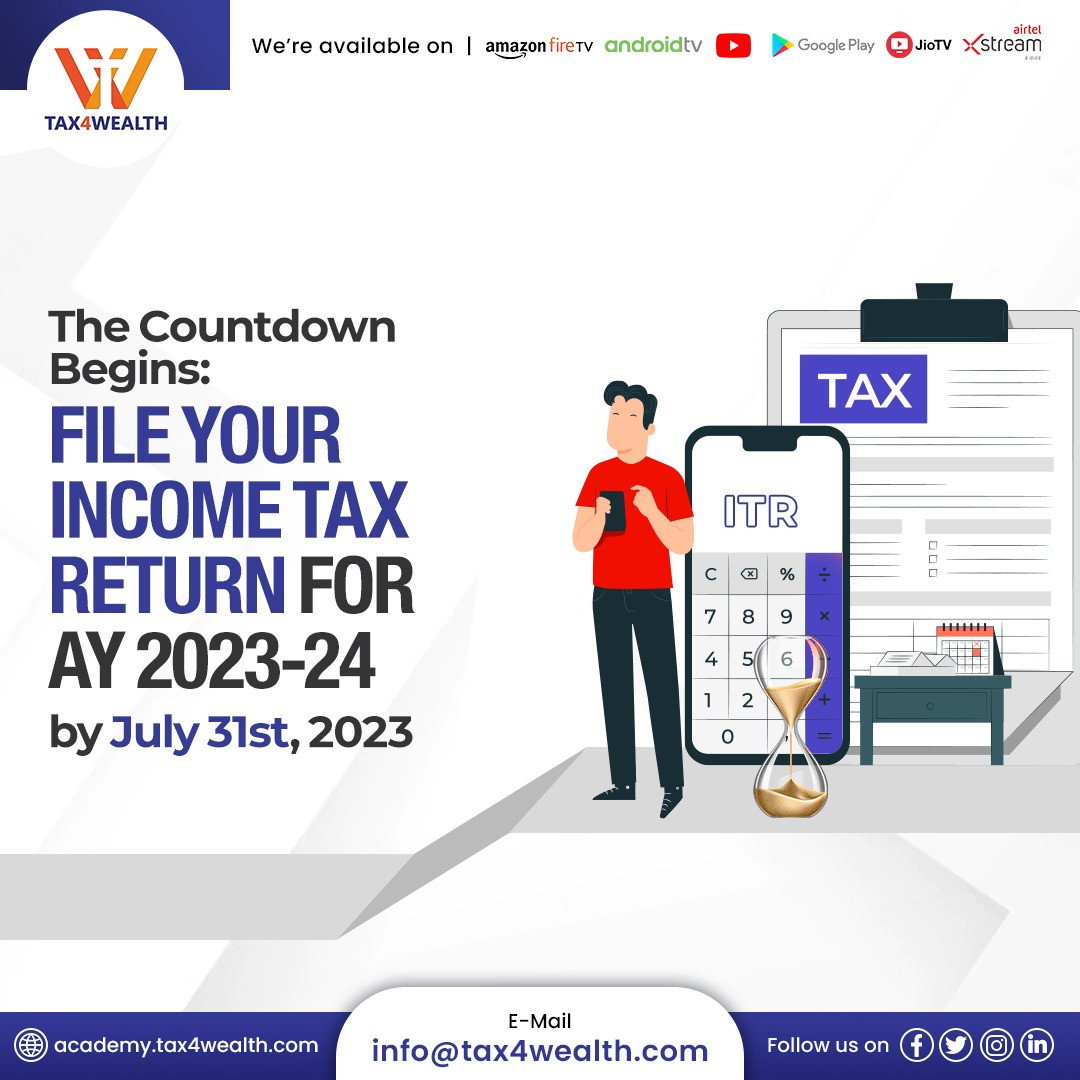

File Your Income Tax Return Now Last Date Is 31st July 2023

https://www.nbaoffice.com/wp-content/uploads/2023/06/Green-and-White-Tax-Day-Social-Media-Graphic.png

2023 Tax Due Dates Decimal

https://uploads-ssl.webflow.com/5e41d080471798e913648c3e/63b5e591f30ddf62c7b5d0c9_tax due date.jpg

The lodgment due dates for companies and super funds are displayed on all client listings generated by the end of July 2023 You can review your clients payment options in Online services for agents or find further information on how to pay online Our standard processing time for processing your tax return is 2 weeks if you lodge online 10 weeks if you lodge on paper Your notice of assessment will be sent to your myGov inbox if you have a myGov account regardless of whether you lodge online or on paper mailed to you if you do not have a myGov account To check the progress of

January February April May Check all your due dates You might need to lodge other documents or pay other taxes or fees each year Check most due dates for lodging and paying on the Australian Taxation Office website Make sure you check when you need to renew or pay for your licences registrations industry memberships Last updated 24 July 2023 Print or Download Instructions for how to complete the company tax return Company information Instructions for how to complete the company information on the company tax return Items 1 to 5 Instructions for how to complete the labels for items 1 to 5 of the company tax return Information statement items 6 to 25

Download Company Tax Return Due Date 2023 Ato

More picture related to Company Tax Return Due Date 2023 Ato

Due Date ITR Fiing For AY 2023 24 Is July 31st 2023 Academy Tax4wealth

https://academy.tax4wealth.com/storage/uploads/1686567553-file-income-tax-return-for-ay-2023-24-by-july-31st-2023.jpg

Downloads 2023 Tax Deadlines Incite Tax

https://incitetax.com/wp-content/uploads/2023/01/Tax-Deadlines-2023.png

Income Tax Return Due Date Extension AY 2023 24 Why Tax Filers Wait

https://media.licdn.com/dms/image/D4D12AQEDQc1jkLft0w/article-cover_image-shrink_720_1280/0/1689852905220?e=2147483647&v=beta&t=zUfSszFS0q9ld-pdmZISfQ4k7XEsPUNpdmCKT7k6ffA

ATO Community Obligation type Find information for registered agents on the lodgment program including due dates listed by obligation type Tax returns by client type View a summary of lodgment due dates for tax returns for the major client types advised by the end of July Taxpayers with overdue tax returns

ABC News When is the Australia 2023 tax return deadline What happens if I miss the deadline How do I pay a tax debt Posted Wed 18 Oct 2023 at 8 54pm updated Thu 19 Oct 2023 at 12 02am The 2023 tax return deadline is under two weeks away Flickr williamnyk abc au news when is the tax return deadline how Quarter 1 July August and September 28 October Quarter 2 October November and December 28 February

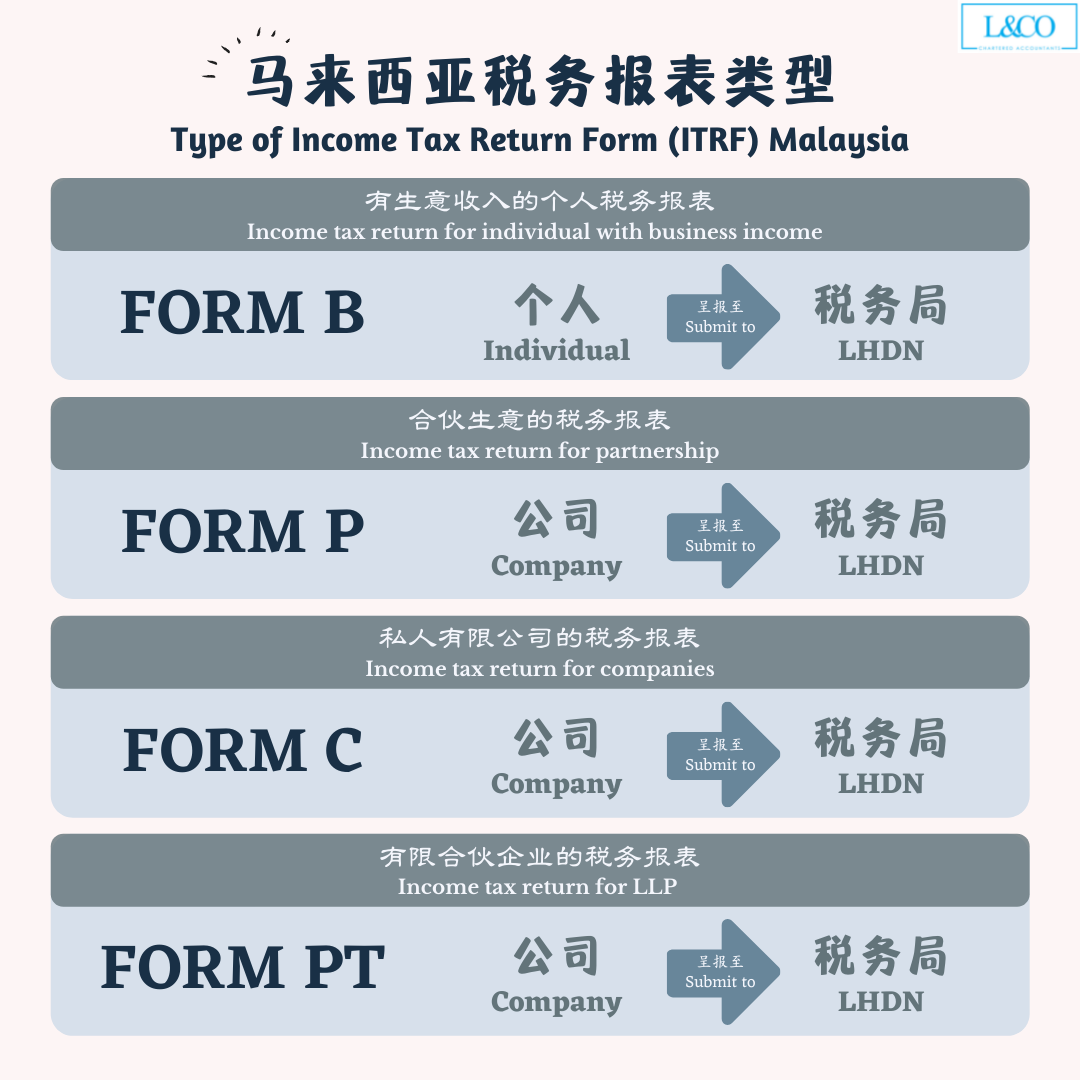

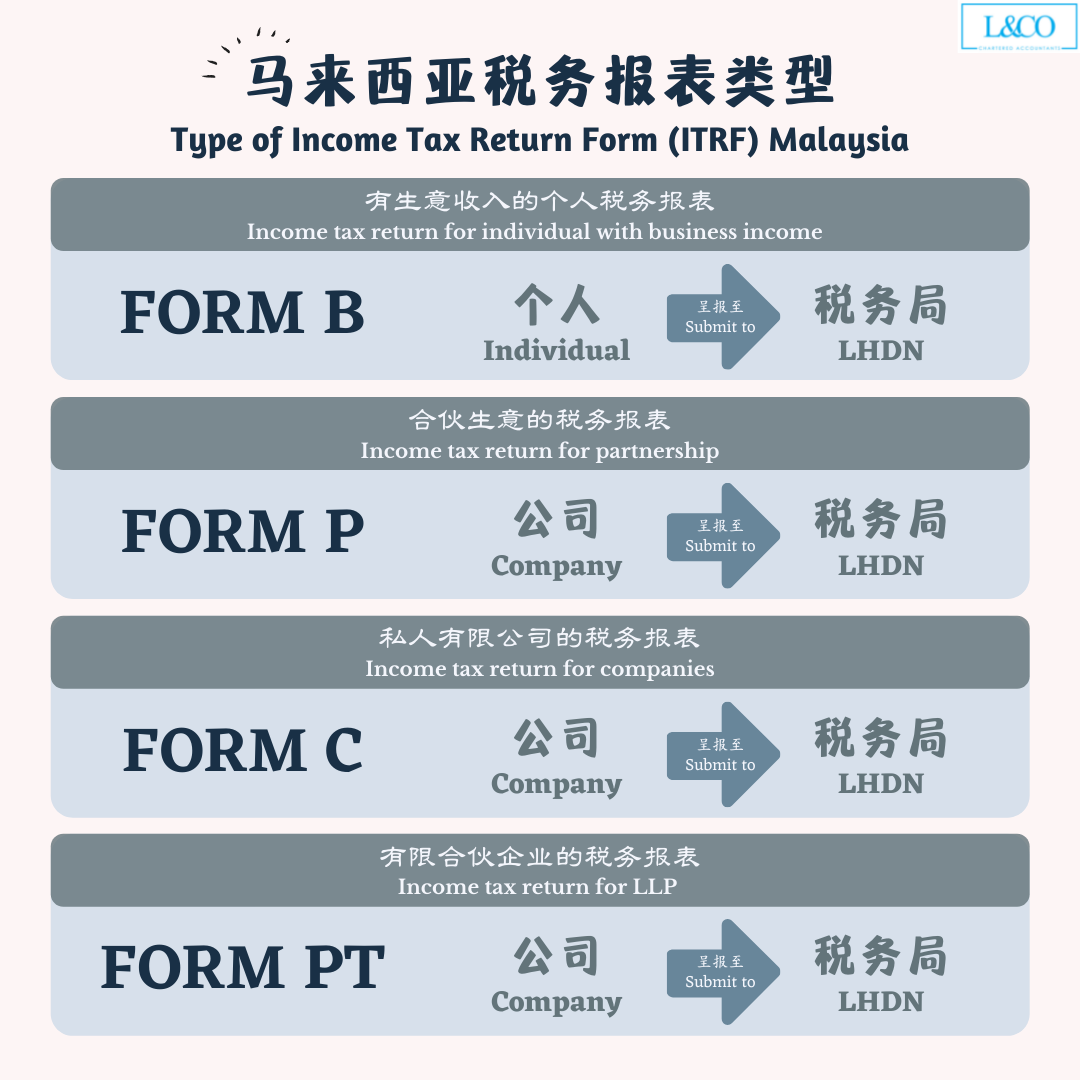

Deadline For Malaysia Income Tax Submission In 2023 for 2022 Calendar

https://landco.my/wp-content/uploads/2021/02/3-9.png

Company Tax Return Due Date 2023 Australia Pay Period Calendars 2023

https://i.ytimg.com/vi/_z-Z3hV2SmQ/maxresdefault.jpg

https://www. ato.gov.au /.../prepare-and-lodge/due-dates

The payment due dates for a tax return are determined by client type the lodgment due date and when the return is lodged July 2023 Information for registered agents about preparing and lodging tax statements and returns due in July 2023 August 2023

https://www. ato.gov.au /forms-and-instructions/...

Last updated 24 July 2023 Print or Download About these instructions How these instructions will help you to complete the company tax return How to lodge and pay How to lodge the company tax return including the first tax return and the payment options available What s new

No Extension For Income Tax Return Due Date 2023

Deadline For Malaysia Income Tax Submission In 2023 for 2022 Calendar

Main Page

Publication Details

.png)

Income Tax Return Who Is Required Which Form Due Dates Fy 2022 23 Ay

You Can Still File Your ITR For AY 2023 24

You Can Still File Your ITR For AY 2023 24

:max_bytes(150000):strip_icc()/balance-tax-return1-8b74d7fde2b44e5baa394d2ceda7d730.jpg?strip=all)

Emancipation Day Dc 2023 Day 2023

Taxation Updates Mayur J Sondagar On Twitter Income Tax Return And

Income Tax Calculator Ay 2023 24 Excel Apnaplan Printable Forms Free

Company Tax Return Due Date 2023 Ato - Generally the tax return for a corporation is due to be lodged filed with the ATO by the 15th day of the seventh month following the end of the relevant income year or such later date as the Commissioner of Taxation allows Additional time may apply where the tax return is lodged filed by a registered tax agent Payment of tax