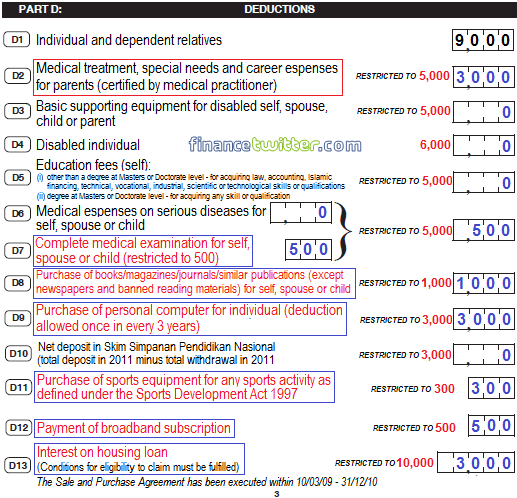

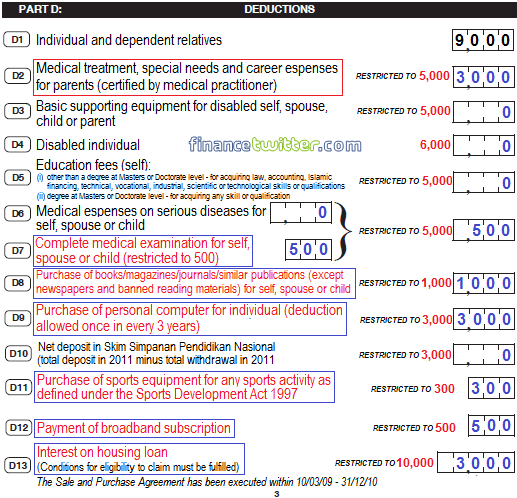

Tax Rebate For Donation In Malaysia Web Medical treatment special needs and carer expenses for parents Medical condition certified by medical practitioner 8 000 Restricted 3 Purchase of basic supporting equipment

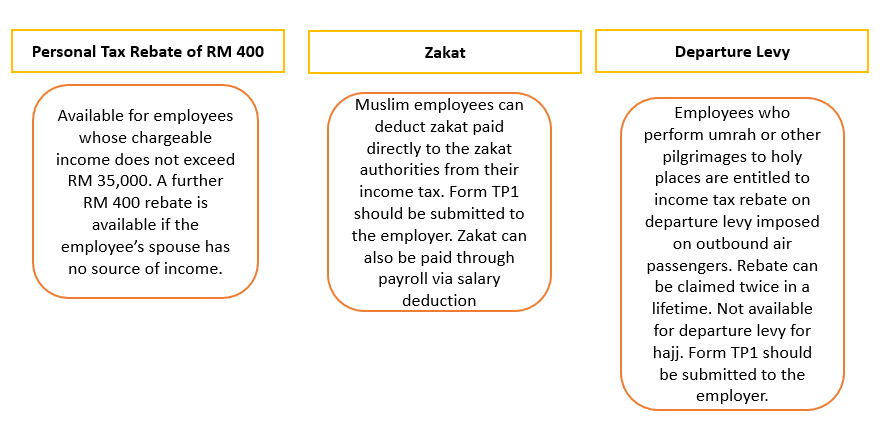

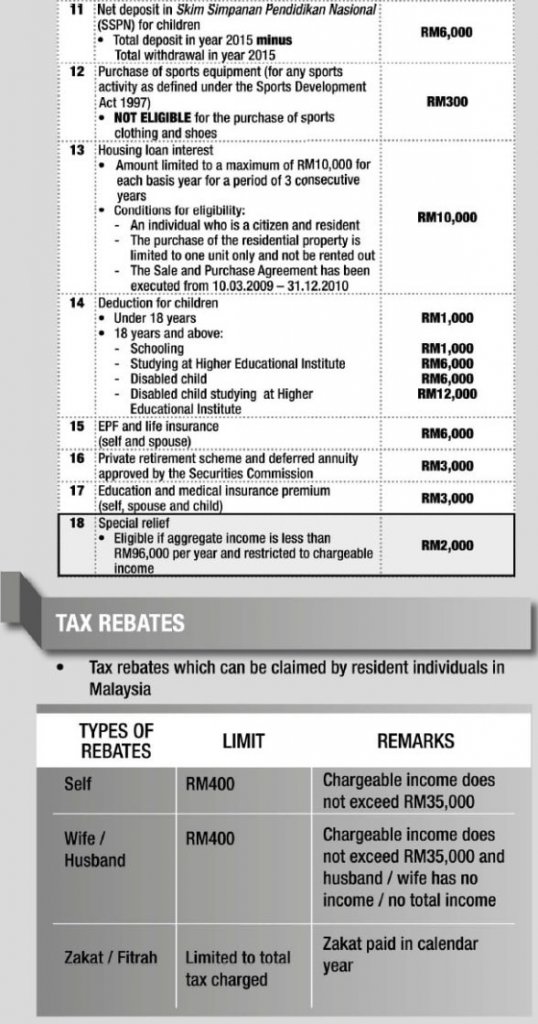

Web Tax Reliefs Rebates Donations Gifts Tax Rate Type of Assessment Business Code Payment Others Web Tax Rebates Year Of Assessment 2001 2008 RM Year Of Assessment 2009 Onwards RM a Separate Assessment Wife Husband 350 350 400 400 b Joint Assessment

Tax Rebate For Donation In Malaysia

Tax Rebate For Donation In Malaysia

https://static.wixstatic.com/media/5ad298_fa36b68799e848d9abafe02d6ac0f197~mv2_d_1587_2245_s_2.png/v1/fill/w_1000,h_1415,al_c,usm_0.66_1.00_0.01/5ad298_fa36b68799e848d9abafe02d6ac0f197~mv2_d_1587_2245_s_2.png

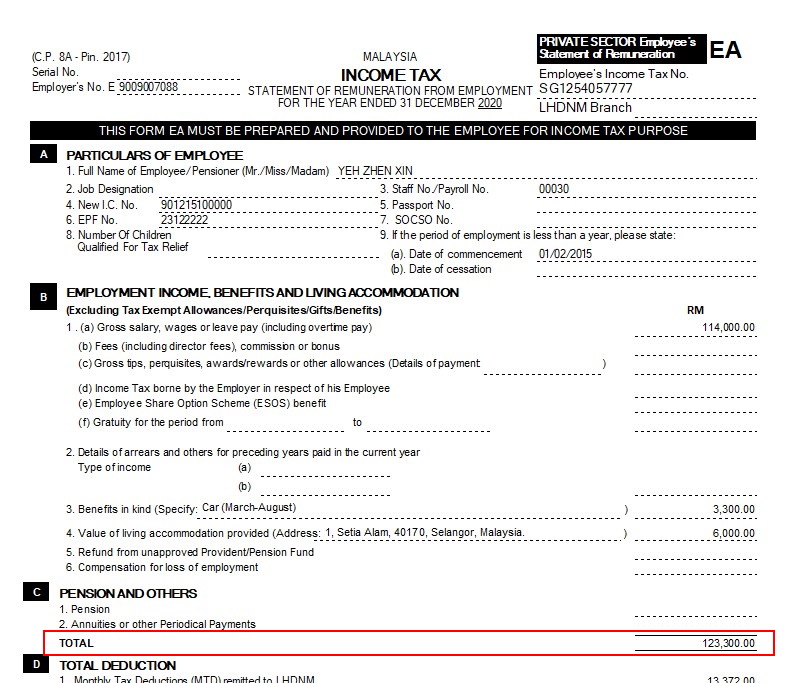

Personal Tax Relief Malaysia 2020 Alexandra Ross

https://external-preview.redd.it/yqeMmvn3C-ziJQmzhTxlOUxmSO27D3X6niTnadudqUE.jpg?auto=webp&s=32af36d6f6dbbedba3a50c55ef71a8736ebe6b1b

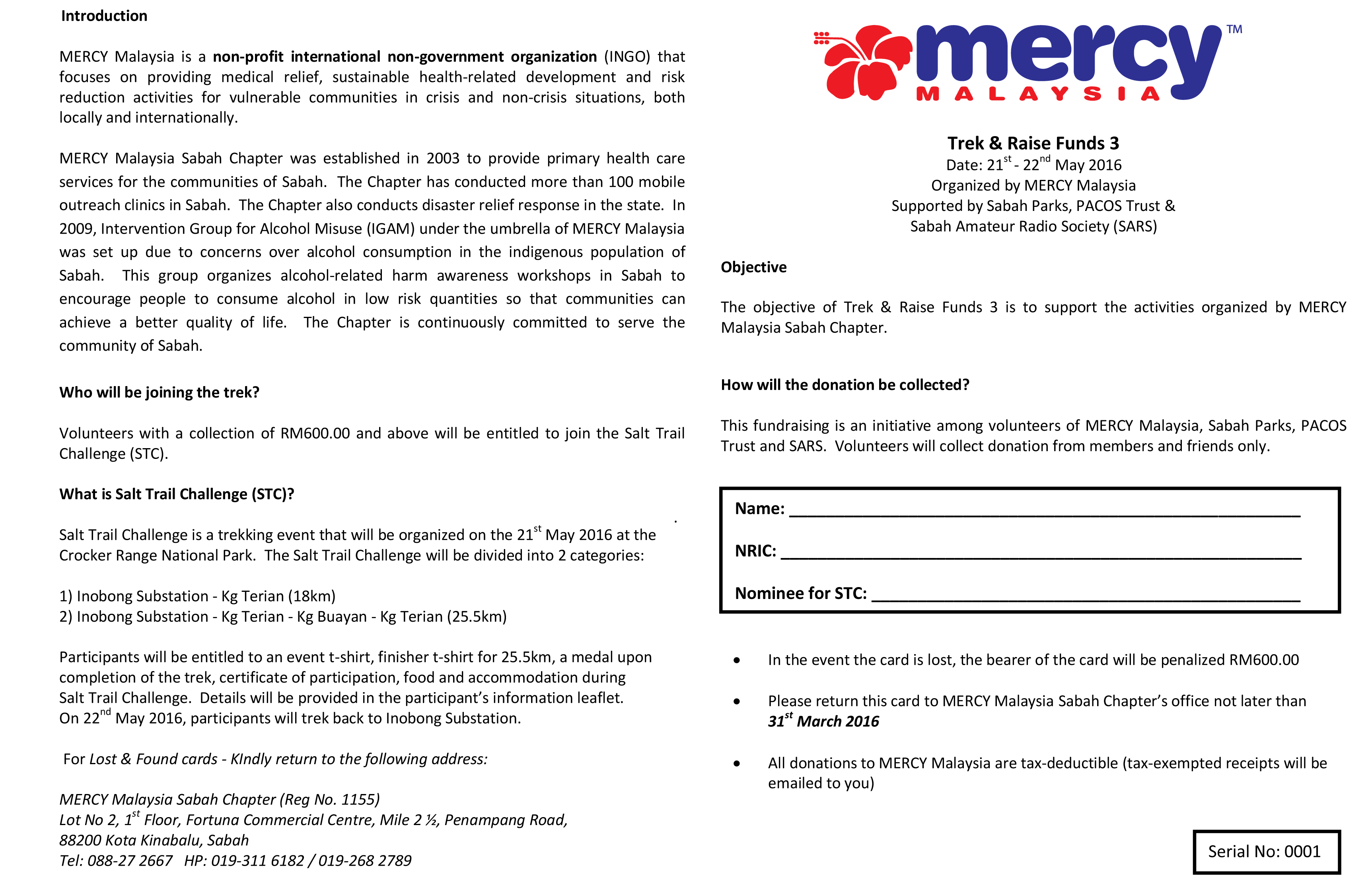

Donation Tax Deduction Malaysia Employees Are Allowed A Deduction For

https://www.mercy.org.my/wp-content/uploads/2016/02/Donation-Card_STC2016-1.jpg

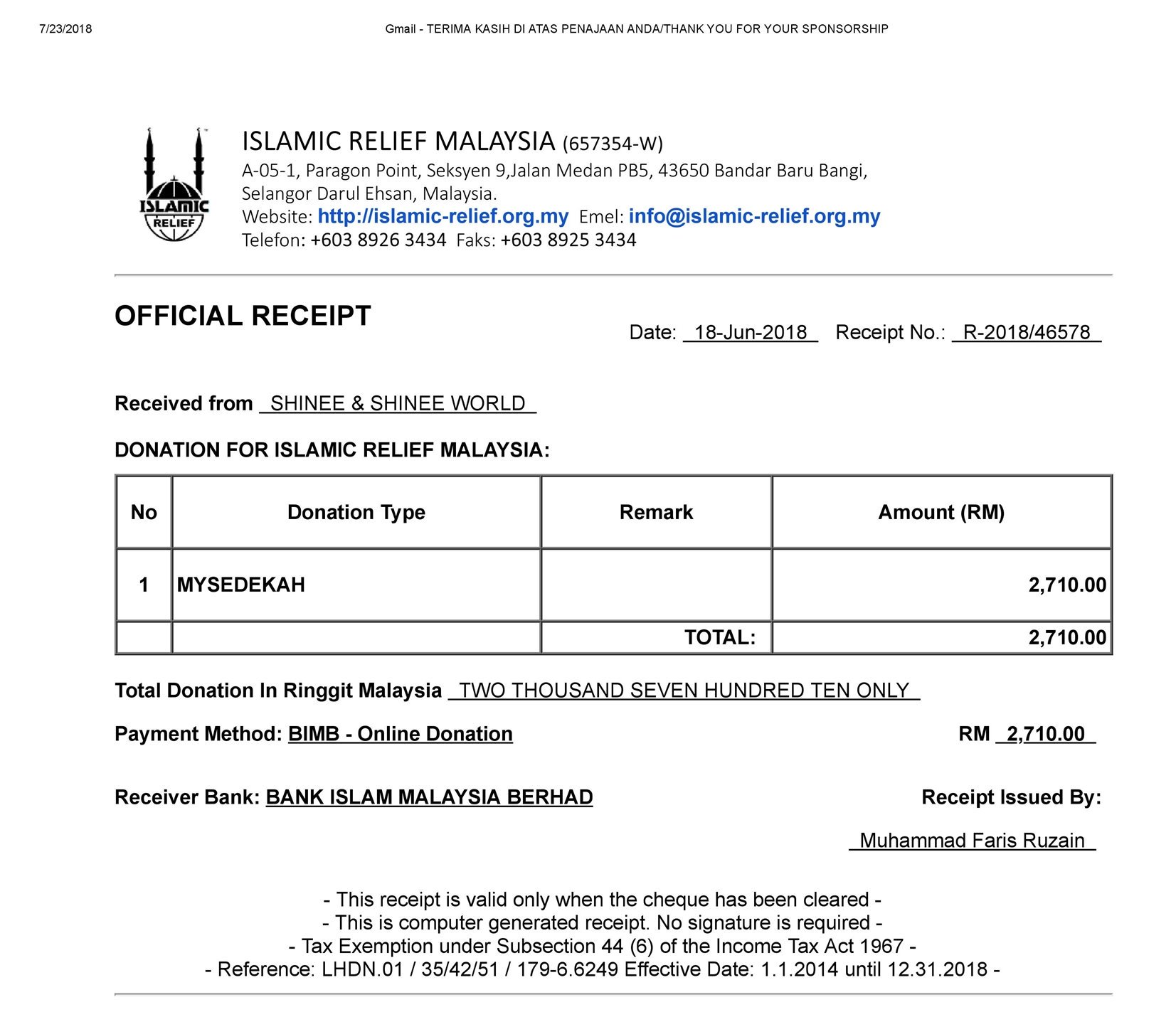

Web 3 avr 2023 nbsp 0183 32 For example if your chargeable income is RM55 000 and you ve donated RM2 500 to an approved charitable organisation you are allowed to deduct 10 of your Web Tax deduction Cash endowment cash wakaf made by donors are eligible for tax deduction under section 44 11D The amount of deduction claimed by the donor is subject to the

Web A donation tax deduction is eligible for a person or a company that donates to an approved organization in Malaysia But before these approved organizations can issue a tax relief Web 10 mars 2023 nbsp 0183 32 It directly affects your amount of tax charged 1 Tax rebate for self Rebate RM400 You will be entitled to this rebate of RM400 on the tax charged if your chargeable income after tax relief and deductions

Download Tax Rebate For Donation In Malaysia

More picture related to Tax Rebate For Donation In Malaysia

Tax Rebate In Malaysia Budget 2017 For A Cosmopolite

http://kindlemalaysia.com/wp-content/uploads/2016/10/14589801_1306153896061278_8083714886436330291_o.jpg

Donation Tax Deduction Malaysia Everything You Should Claim For

https://pbs.twimg.com/media/DixNGM3VAAECWVe.jpg:large

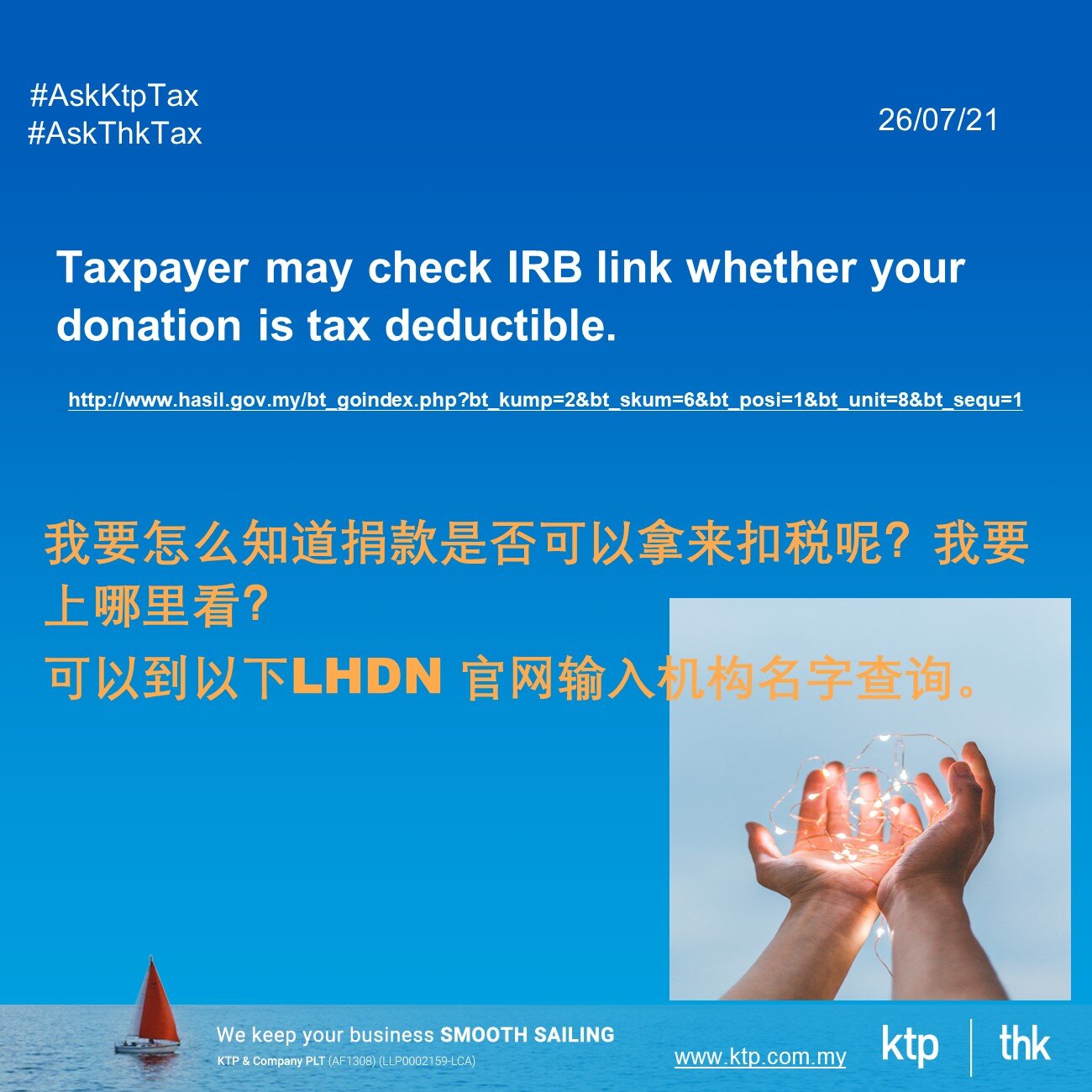

KTP Company PLT Audit Tax Accountancy In Johor Bahru

https://images.squarespace-cdn.com/content/v1/59bb3b0146c3c48c4746b775/1627276974763-R23ZGYXWLDS6MEQLQRYJ/Slide4.JPG

Web 20 mars 2023 nbsp 0183 32 1 Individual amp dependent relatives Claim up to RM9 000 It is granted to an individual for themselves and their dependents 2 Medical treatment special needs and carer expenses for parents Claim Up to Web 12 mars 2020 nbsp 0183 32 Tax deduction for COVID 19 related donations Individuals and corporations from all over Malaysia have made contributions and donations toward efforts to combat the COVID 19 pandemic Generally

Web 10 mars 2022 nbsp 0183 32 1 Donations to charities sports bodies and other approved projects funds Deduction Up to 10 of aggregate income Donations that fall under the following Web This publication is a quick reference guide outlining Malaysian tax information which is based on taxation laws and current practices This booklet also incorporates in coloured

Lhdn Tax Relief 2021 Tax Relief Malaysia LHDN s Full List Of Things

https://4.bp.blogspot.com/-JTsquM0HYuI/XmW7noYMLVI/AAAAAAAAIt8/upx_BvbleAMpvjOk73KfmRmQcO37CDOqwCLcBGAsYHQ/s1600/LHDN%2Btax%2Brelief%2Bassessment%2Byear%2B2019.jpg

Malaysia Personal Income Tax Guide 2020 YA 2019 2022

https://ringgitplus.com/en/blog/wp-content/uploads/2020/02/tax-reliefs-rebates-income-tax.png?is-pending-load=1

https://www.hasil.gov.my/.../how-to-declare-income/tax-reliefs

Web Medical treatment special needs and carer expenses for parents Medical condition certified by medical practitioner 8 000 Restricted 3 Purchase of basic supporting equipment

https://www.hasil.gov.my/.../how-to-declare-income/donations-gifts

Web Tax Reliefs Rebates Donations Gifts Tax Rate Type of Assessment Business Code Payment Others

Everything You Need To Know About Running Payroll In Malaysia

Lhdn Tax Relief 2021 Tax Relief Malaysia LHDN s Full List Of Things

Income Tax Relief 2020 Malaysia You Can Claim A Tax Relief Of Up To

List Of Approved Institution For Donation In Malaysia

CTOS LHDN E filing Guide For Clueless Employees

Donation Tax Deduction Malaysia Malaymuni

Donation Tax Deduction Malaysia Malaymuni

Tax Rebate 2017 Malaysia Income Tax Rebate U s 87A For F Y 2017 18

2007 Tax Rebate Tax Deduction Rebates

Receipt For Tax Deductible Donations Amandamuslim

Tax Rebate For Donation In Malaysia - Web 12 mars 2021 nbsp 0183 32 A tax rebate directly reduced your amount of tax charged and there are currently four types of tax rebates for income tax Malaysia YA 2020 Tax rebate for