Is Donation Received Taxable In Malaysia Only cash donations supported by official receipts are eligible for deduction In kind donations such as food clothes computers and so on are not eligible for tax deduction and tax

When donated or given to avenues approved by the Lembaga Hasil Dalam Negeri LHDN these contributions can qualify for tax deductions that can lighten your tax burdens Donation tax relief in Malaysia allows individuals and businesses to claim tax deductions for contributions made to approved charitable organisations This can include

Is Donation Received Taxable In Malaysia

Is Donation Received Taxable In Malaysia

https://www.financepal.com/wp-content/uploads/2021/05/Taxable-Income-Formula-_Graphic-1-768x552.png

Are Gifts From Employer Taxable In Malaysia Mar 22 2022 Johor

https://cdn1.npcdn.net/image/1647910389b86773a8071a60603eb37c7b0c2a40d7.jpg?md5id=956f9d4b926a8af07bf32de21edd8eee&new_width=1190&new_height=1000&w=-62170009200

Are Donations For Medical Expenses Taxable

https://www.mycause.com.au/blog_images/donate.jpg

Donations are only tax deductible if they are made to a Government approved charitable organisation or directly to the Government and you must keep the receipt of the donation Here s the list of contributions that can qualify for tax In ascertaining the total income of a resident individual gifts and or contributions made by an individual to the government and approved institutions or organizations are allowed as

In Malaysia donations to approved charitable organizations can not only benefit society but also offer tax advantages for donors The Malaysian government encourages charitable contributions by providing tax deductions which reduce In order for your donation to be eligible for a tax deduction the organisation you donate to must be officially recognised or approved by the Inland Revenue Board of Malaysia

Download Is Donation Received Taxable In Malaysia

More picture related to Is Donation Received Taxable In Malaysia

Solved Please Note That This Is Based On Philippine Tax System Please

https://www.coursehero.com/qa/attachment/19096880/

Ask Money Today Received Donations From Friends And Family Will It Be

https://akm-img-a-in.tosshub.com/businesstoday/images/story/202105/donation_1_660_240521020118.jpg?size=948:533

How To Calculate Accounts Payable Formula Modeladvisor

https://imgmidel.modeladvisor.com/how_to_calculate_accounts_payable_from_income_statement.png

Donations and Gifts Allowable Deduction from Aggregate Income Gift of money to Approved Institutions or Organisations Enter the percentage of expenses from income and donations received by to the amount spent on its main activities in achieving the objectives for which it is established Note An association

When donated or given to avenues approved by the Lembaga Hasil Dalam Negeri LHDN these contributions can qualify for tax deductions that can lighten your tax burdens In ascertaining the total income of a resident individual gifts and or contributions made by an individual to the government and approved institutions or organizations are allowed as

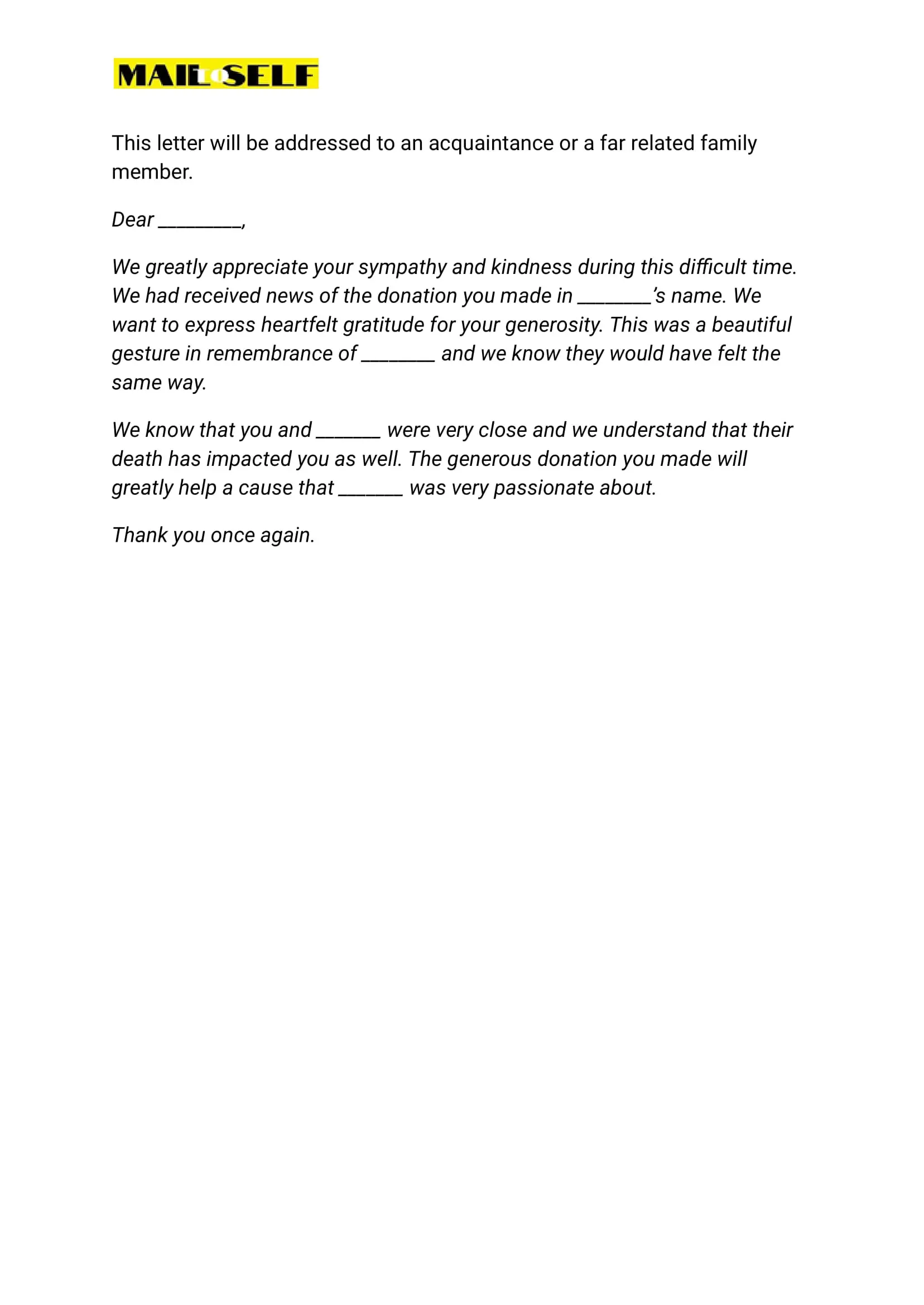

Thank You Letter For Donation In Memory Of The Deceased How To

https://www.mailtoself.com/wp-content/uploads/Thank-you-letter-for-donation-in-memory-of-the-deceased-2.jpg

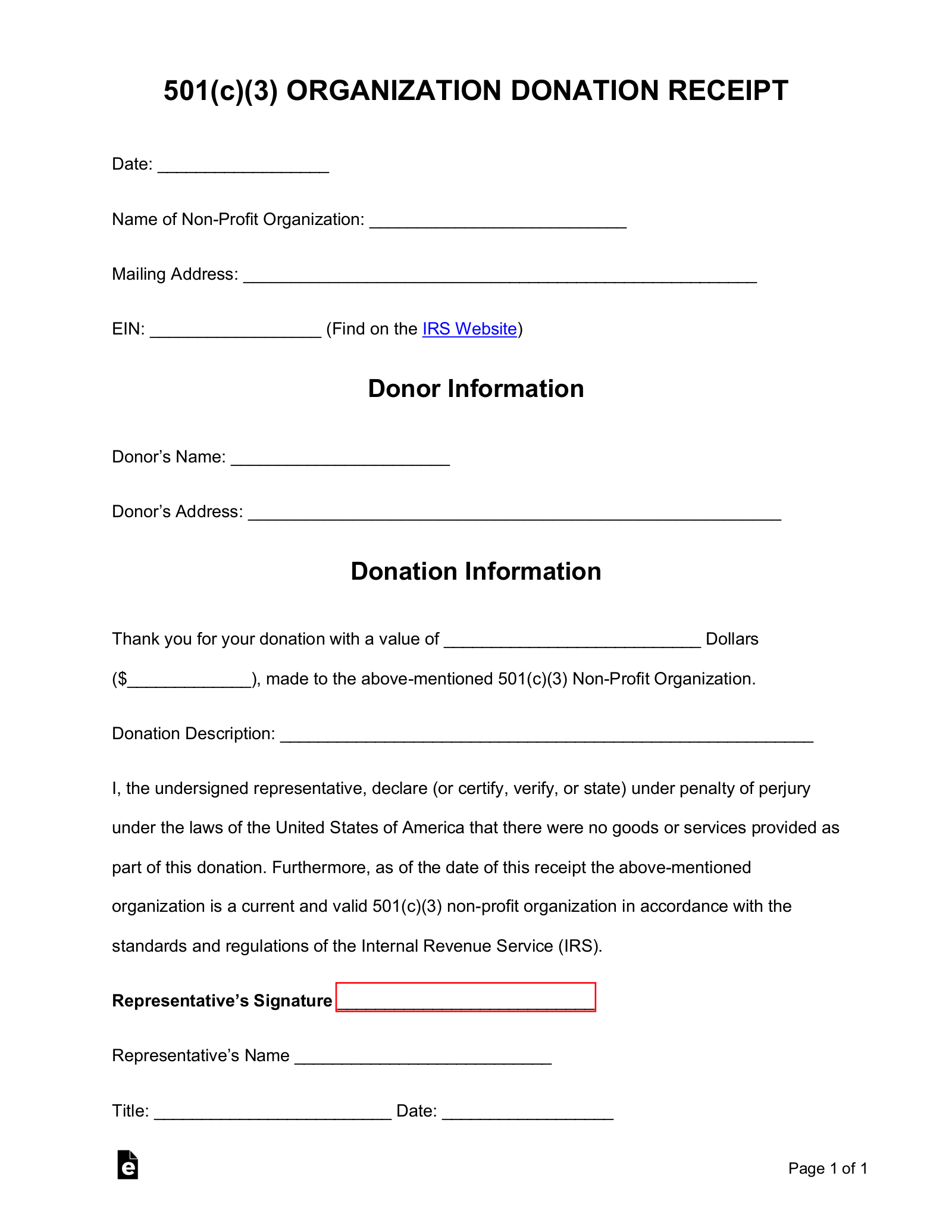

Non Profit Letter For Donations Database Letter Template Collection

https://eforms.com/images/2018/04/501c3-Donation-Receipt-Template.png

https://www.hasil.gov.my › en › institutions...

Only cash donations supported by official receipts are eligible for deduction In kind donations such as food clothes computers and so on are not eligible for tax deduction and tax

https://ringgitplus.com › en › blog › Income-…

When donated or given to avenues approved by the Lembaga Hasil Dalam Negeri LHDN these contributions can qualify for tax deductions that can lighten your tax burdens

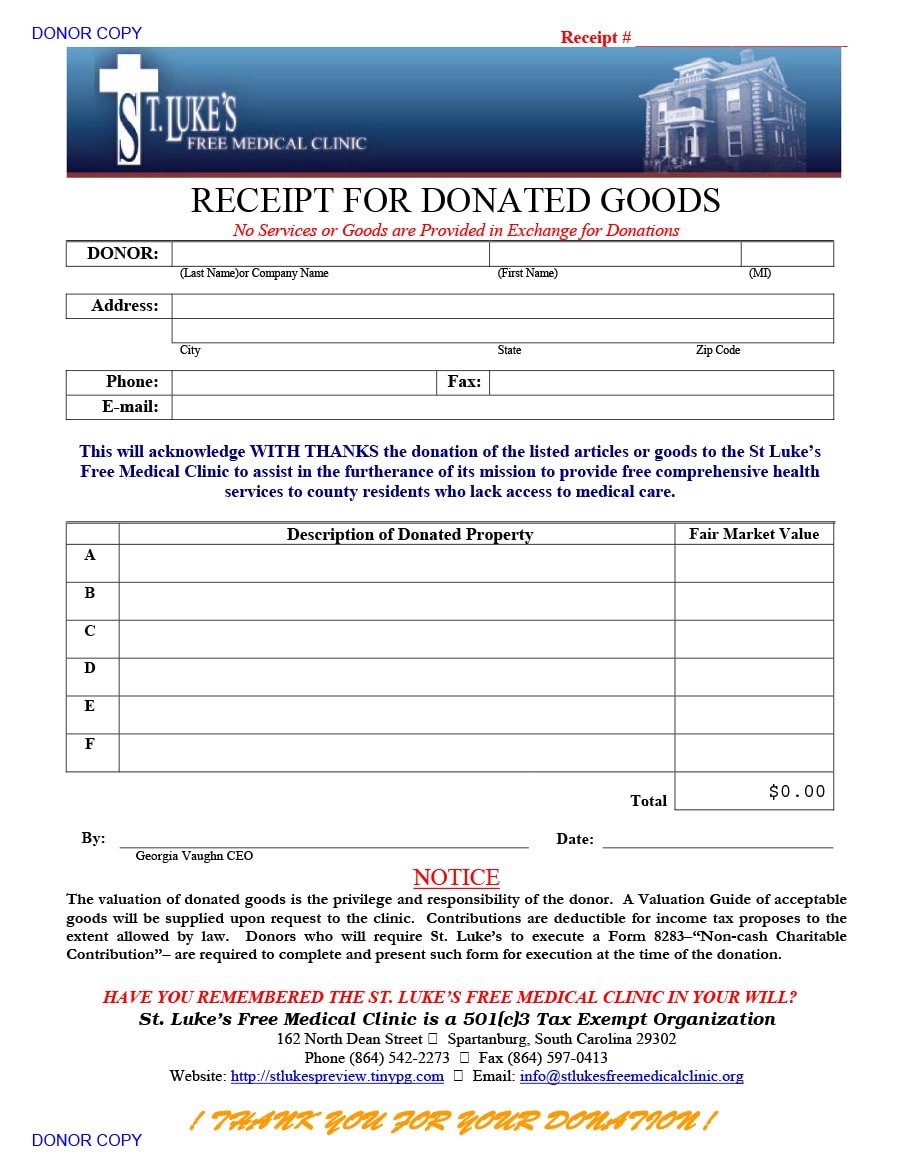

Exclusive Gift In Kind Tax Receipt Template Superb Receipt Templates

Thank You Letter For Donation In Memory Of The Deceased How To

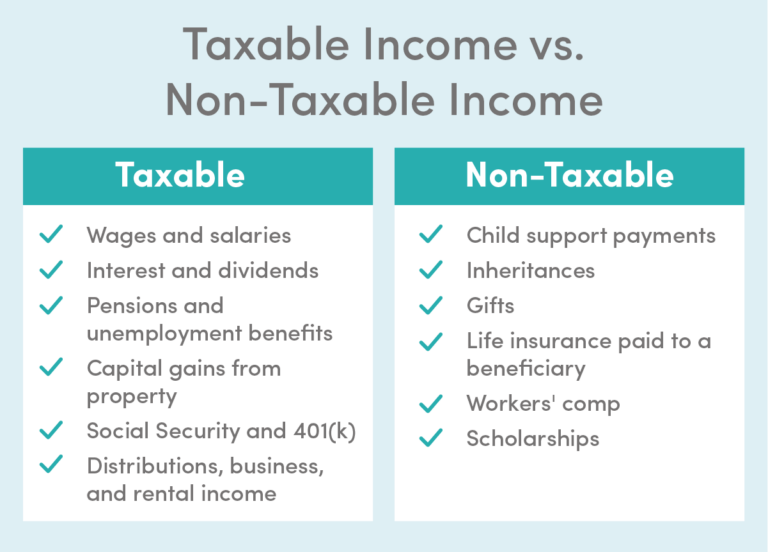

What Is Taxable Income Explanation Importance Calculation Bizness

Don t Dread The IRS Three Part Guide To Tackle Your Taxes Financial

Required Information The Following Information Applies To The

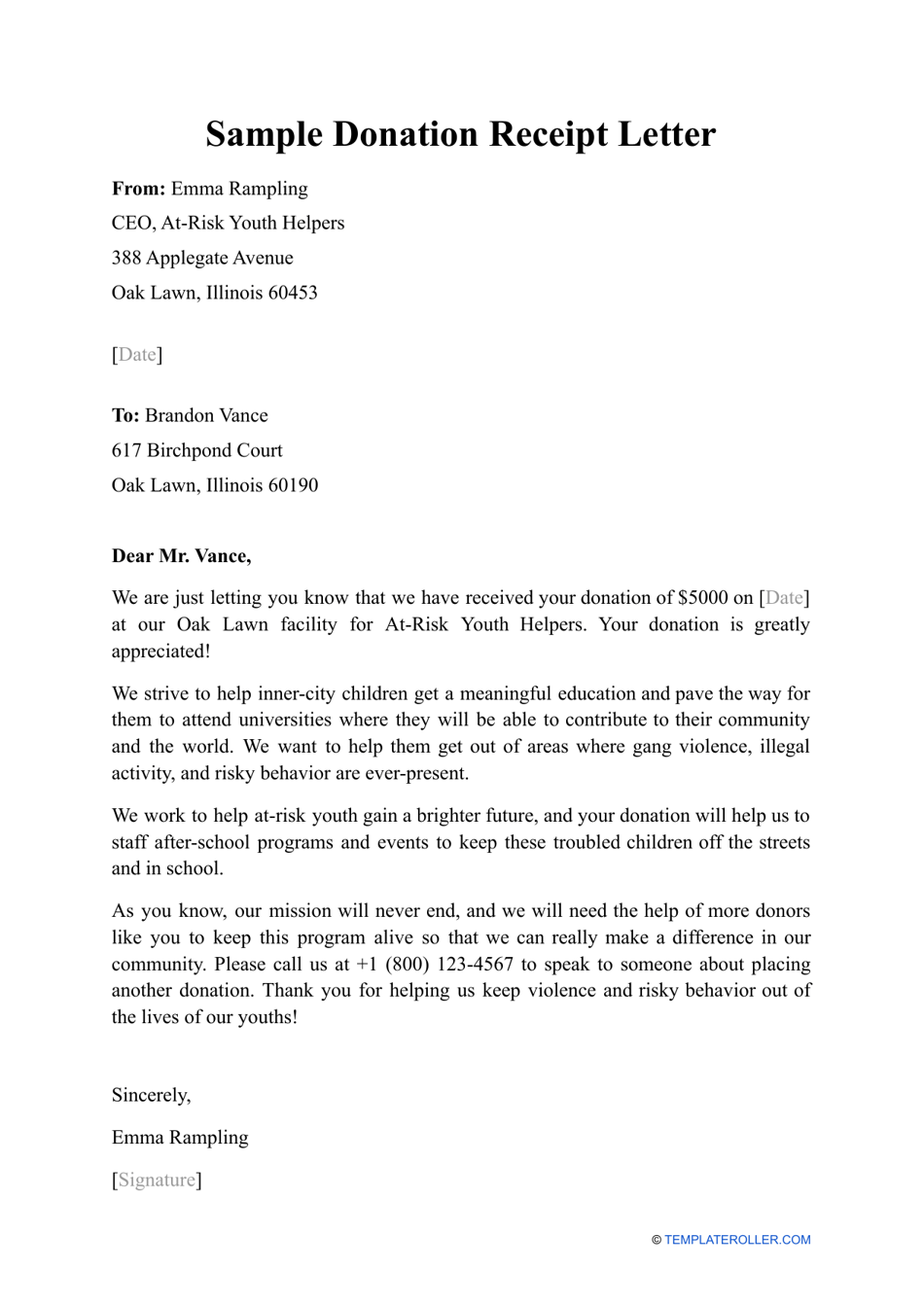

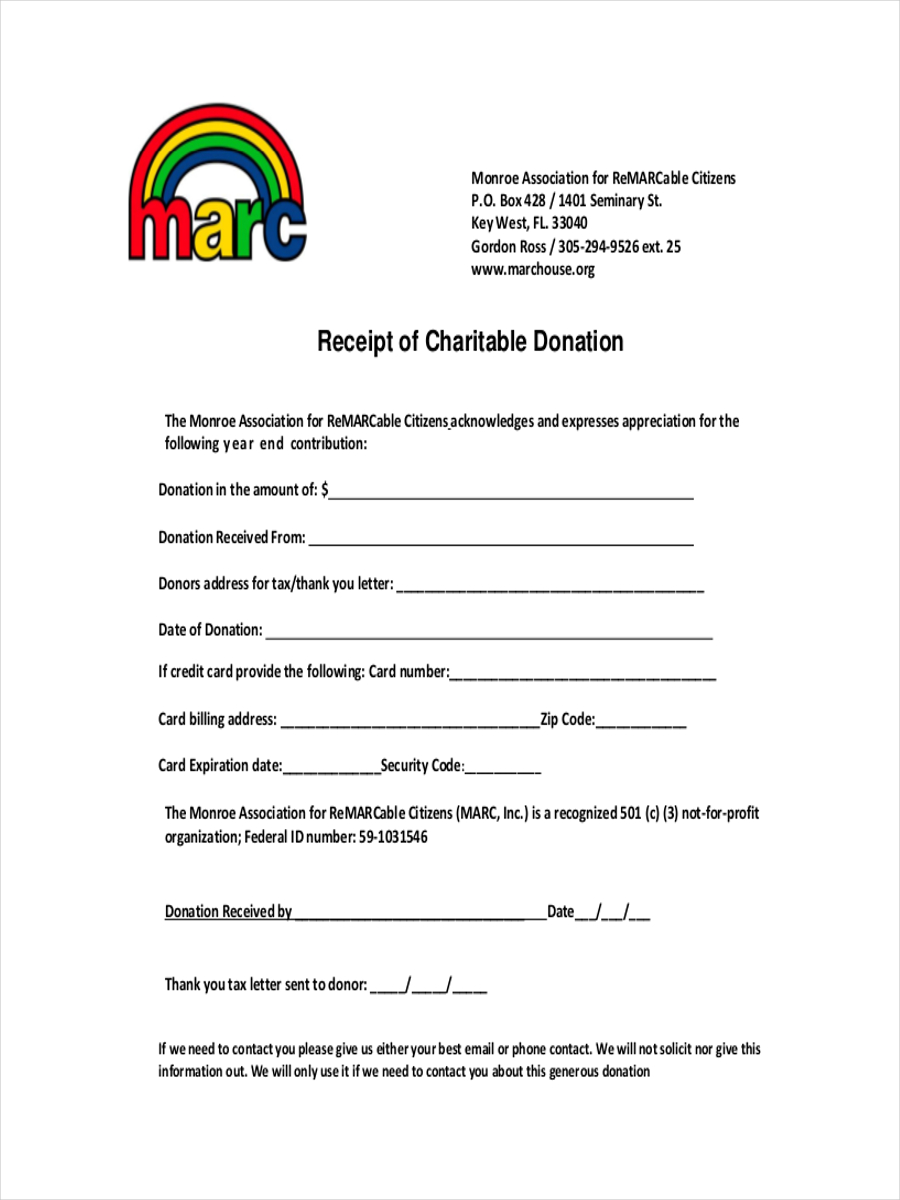

Sample Donation Receipt Letter Download Printable PDF Templateroller

Sample Donation Receipt Letter Download Printable PDF Templateroller

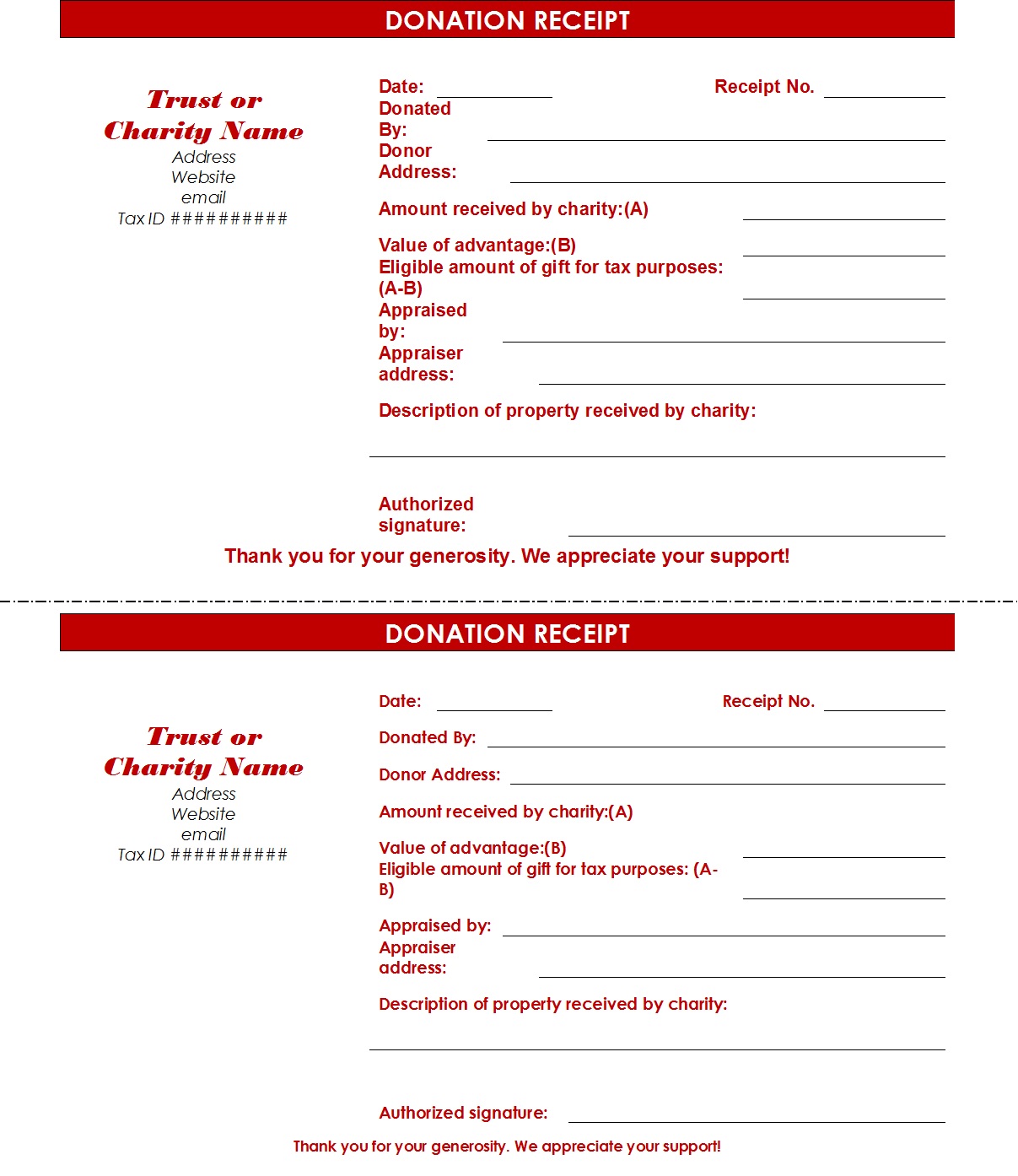

Gift Receipt Template

Donation Receipt Format Ikigai razaodeser

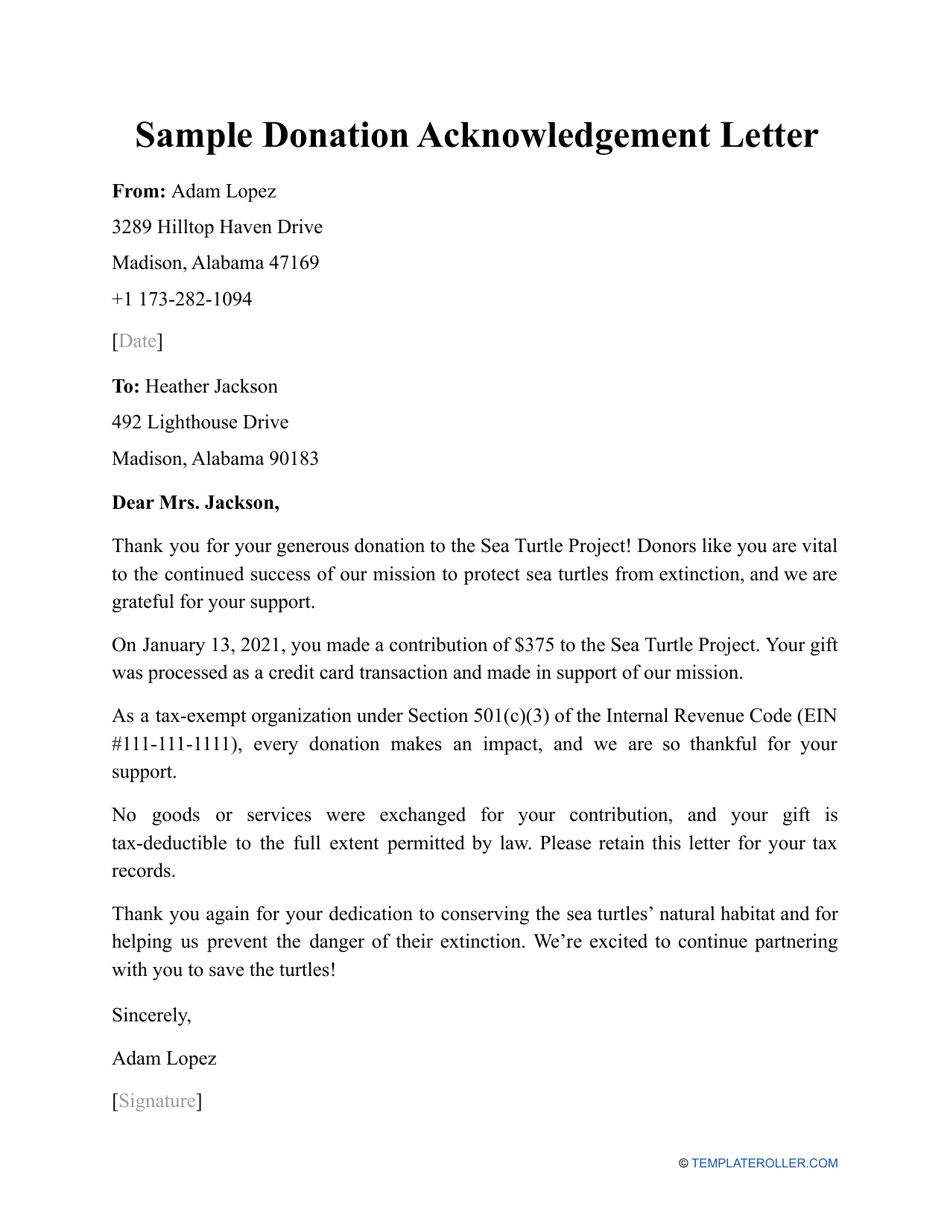

Sample Donation Acknowledgement Letter Download Printable PDF

Is Donation Received Taxable In Malaysia - A donation tax deduction is eligible for a person or a company that donates to an approved organization in Malaysia But before these approved organizations can issue a tax relief