Is Donation Tax Deductible In Malaysia How do tax deductions for donations gifts and contributions work Like tax reliefs tax deductions will help to reduce the amount you need to pay tax on However while tax reliefs are applied to your chargeable income tax deductions are applied to your aggregate income

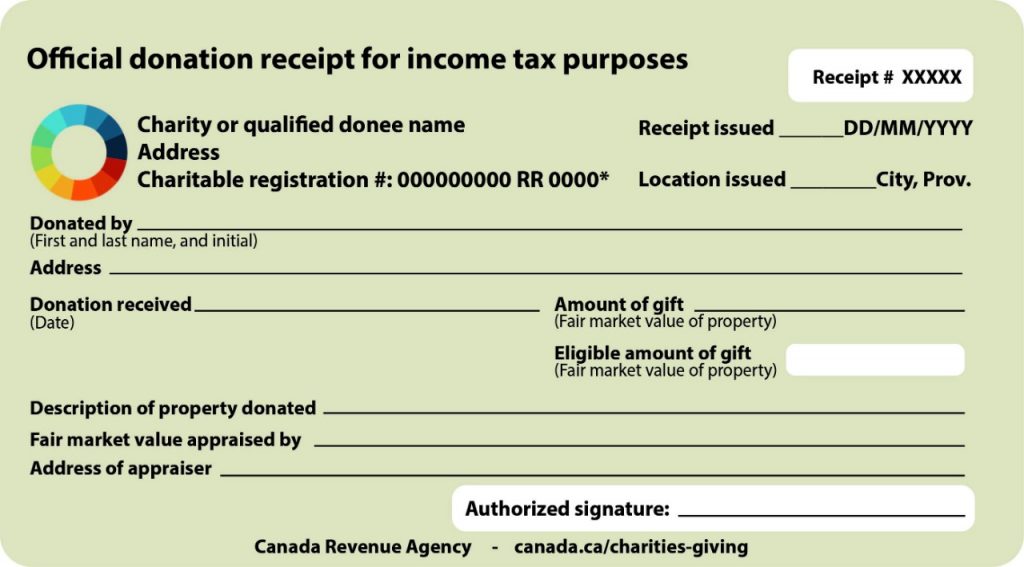

Donations are only tax deductible if they are made to a Government approved charitable organisation or directly to the Government and you must keep the receipt of the donation List of donations and gifts you can claim for income tax deduction Other taxes Income determination Deductions Foreign tax relief and tax treaties Other tax credits and incentives Tax administration Sample personal income tax calculation

Is Donation Tax Deductible In Malaysia

Is Donation Tax Deductible In Malaysia

https://cdn1.npcdn.net/image/1650978457680e089edf19567382624e16a78f6475.jpg?md5id=956f9d4b926a8af07bf32de21edd8eee&new_width=1190&new_height=1000&w=-62170009200

Are Your Donation Claims Tax deductible Gatherum Goss Assoc

https://www.gatherumgoss.com/uploads/198/484/Charity-Donations-Tax-Deductions.png

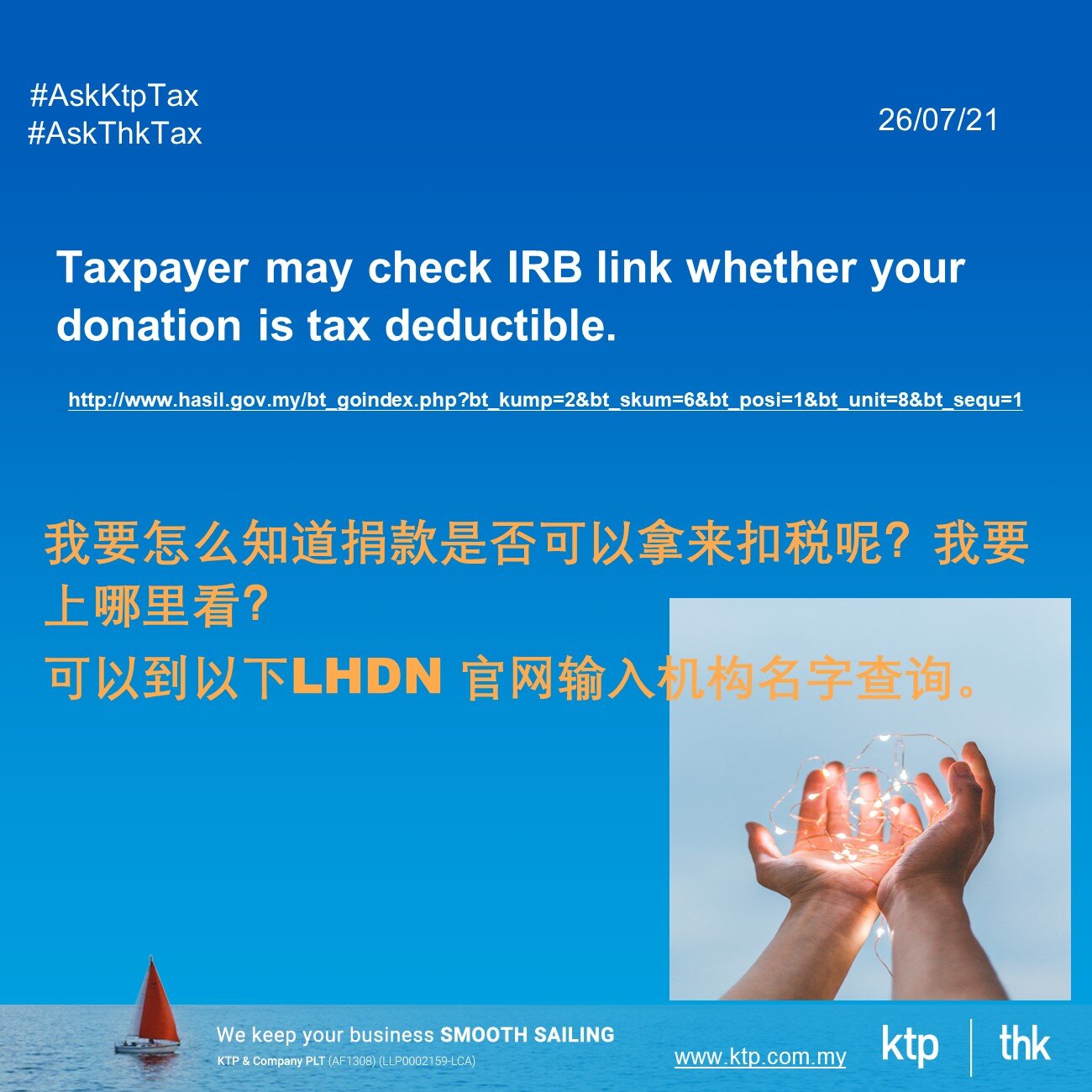

100 Tax Deduction On Your Donation In Malaysia Jul 26 2021 Johor

https://cdn1.npcdn.net/image/16272778521a6ef50158b79f67207a9ee7fe2b2eb3.jpg?md5id=956f9d4b926a8af07bf32de21edd8eee&new_width=1600&new_height=1600&w=-62170009200

The objective of this Public Ruling PR is to explain 1 1 gifts or contributions made by a resident individual that are allowable in determining the total income for a year of assessment YA and 1 2 tax deductions that are allowable to a resident individual in In Malaysia donations to approved charitable organizations can not only benefit society but also offer tax advantages for donors The Malaysian government encourages charitable contributions by providing tax deductions which reduce taxable income

According to the Income Tax of 1967 one of the activities that make you eligible for a tax deduction in Malaysia is donating to an approved body organization or institution Currently there are nine types of contributions with different beneficiaries that can deduct your tax Donations and Gifts Allowable Deduction from Aggregate Income Gift of money to Approved Institutions or Organisations

Download Is Donation Tax Deductible In Malaysia

More picture related to Is Donation Tax Deductible In Malaysia

Understanding Nondeductible Expenses For Business Owners

https://cdn.shopify.com/s/files/1/0070/7032/files/non-deductible-expenses.png?format=jpg&quality=90&v=1666892015

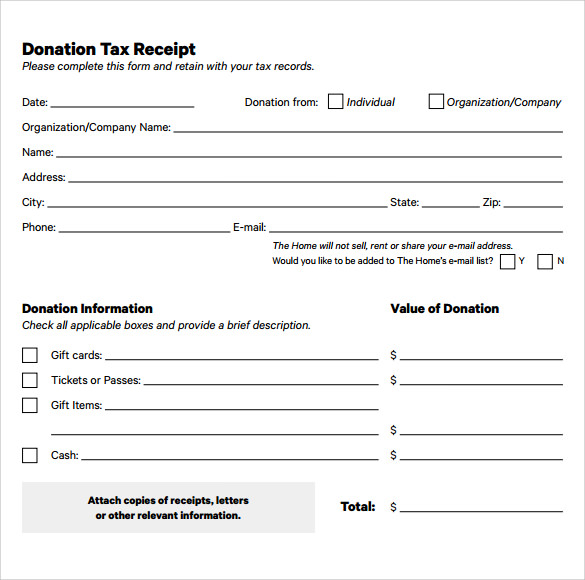

Uso Printable Donation Form Printable Forms Free Online

http://www.fabtemplatez.com/wp-content/uploads/2017/12/tax-deductible-receipt-template-87039-donation-receipt-form-free-printable-templates-cash-receipts-free-tax-deductible-receipt-template24581900.jpg

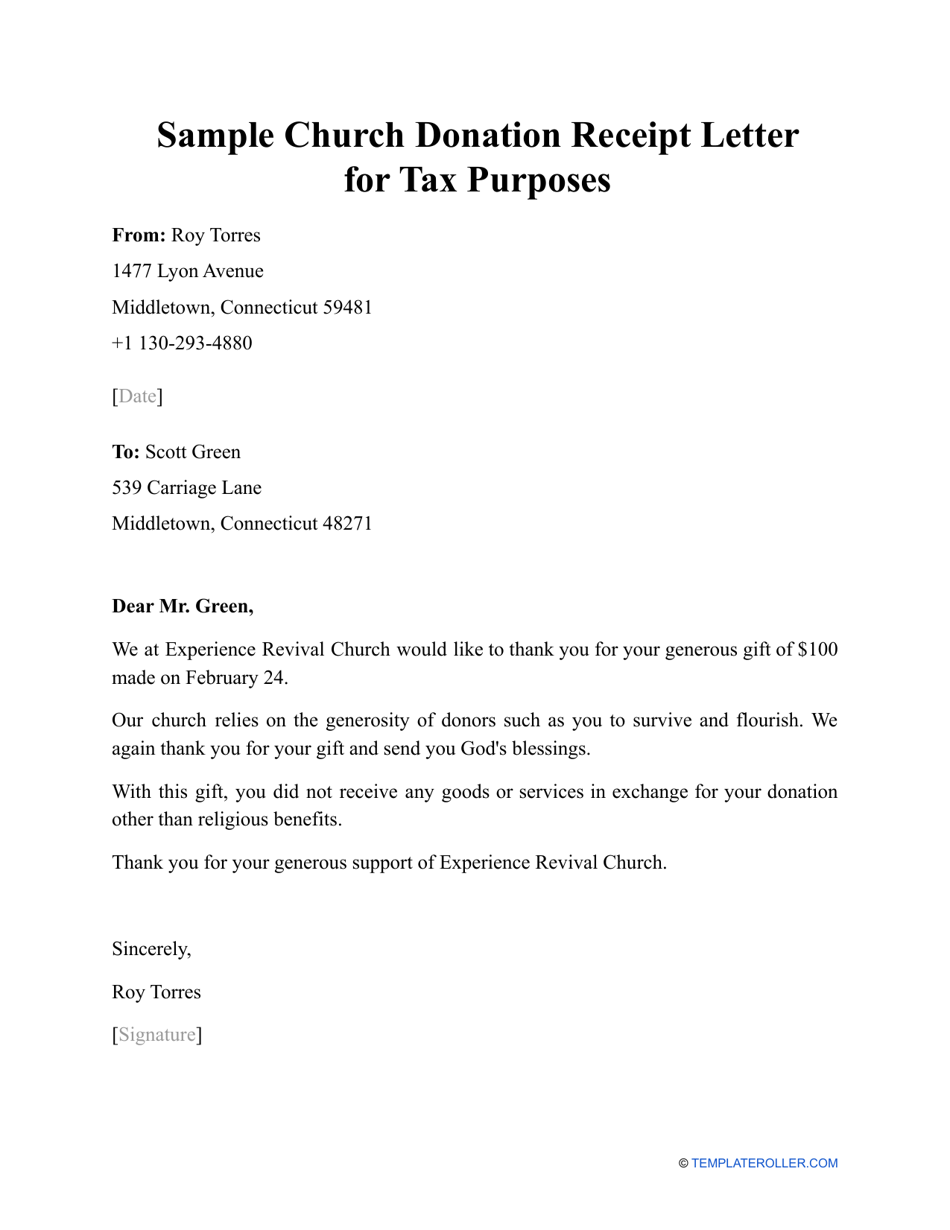

Sample Church Donation Receipt Letter For Tax Purposes Fill Out Sign

https://data.templateroller.com/pdf_docs_html/2209/22095/2209587/sample-church-donation-receipt-letter-for-tax-purposes_print_big.png

The Malaysian Inland Revenue Board Nov 20 issued General Ruling No 6 2023 explaining rules for allowable deductions and deductions for donations made by resident individuals For donation under section 44 6 can an employer collect the contribution donation on behalf of the employees and donate it to the relevant agencies Q G21 Yes employers are allowed to collect on behalf of employees The tax deduction can only be claimed by the employee and not the employer The following information is to be furnished

This publication is a quick reference guide outlining Malaysian tax information which is based on taxation laws and current practices This booklet incorporates in coloured italics the 2022 Malaysian Budget proposals based on the Budget 2022 announcement on 29 October 2021 and the Finance Bill 2021 These proposals will not become law until their Q2 Is my donation tax exempted A Yes WWF Malaysia is an NGO under sub section 44 6 of Income Tax Act 1967 and all cash donations to WWF Malaysia are tax deductible applicable only to donations made within Malaysia

KTP Company PLT Audit Tax Accountancy In Johor Bahru

https://images.squarespace-cdn.com/content/v1/59bb3b0146c3c48c4746b775/1605589743001-F0VIXCGG60TAIXKKTMNI/Slide1.JPG

Car Allowance Taxable In Malaysia JorgefvSullivan

https://chengco.com.my/wp/wp-content/uploads/2021/08/POINT14.jpg

https://ringgitplus.com/en/blog/Income-Tax/Income...

How do tax deductions for donations gifts and contributions work Like tax reliefs tax deductions will help to reduce the amount you need to pay tax on However while tax reliefs are applied to your chargeable income tax deductions are applied to your aggregate income

https://www.imoney.my/articles/income-tax-guide...

Donations are only tax deductible if they are made to a Government approved charitable organisation or directly to the Government and you must keep the receipt of the donation List of donations and gifts you can claim for income tax deduction

Vehicle Donation Receipt Template

KTP Company PLT Audit Tax Accountancy In Johor Bahru

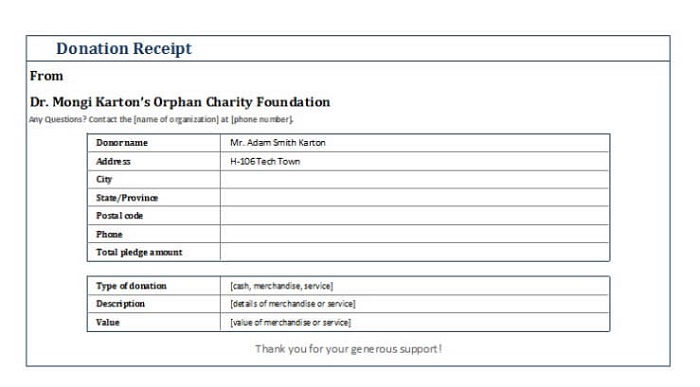

Donation Receipts For Providing Services Smith Neufeld Jodoin LLP

Inspiring Tax Receipt For Donation Template

KTP Company PLT Audit Tax Accountancy In Johor Bahru

Donation Tax Deduction Malaysia Employees Are Allowed A Deduction For

Donation Tax Deduction Malaysia Employees Are Allowed A Deduction For

How To Maximize Your Charity Tax Deductible Donation WealthFit

Nonprofit Tax Receipt Template Printable Receipt Template

An Outline Of Donation Receipts And The Tax Deduction Process Cascade

Is Donation Tax Deductible In Malaysia - All cash donations are tax deductible applicable only to donations made within Malaysia If you do not receive your tax exemption receipt within 2 weeks of your contribution please notify us at donation mercy my