Concept Of Service Tax Service tax was a tax levied by the Government of India on services provided or agreed to be provided excluding services covered under the negative list and considering the Place of Provision of Service Rules 2012 and collected as per Point of Taxation Rules 2011 from the person liable to pay service tax

1 An activity which constitutes merely a A transfer of title in goods or immovable property by way of sale gift or in any other manner or b Such transfer delivery or supply of any goods which is deemed to be a sale c A transaction in money or actionable claim 2 The goods and services tax GST is a value added tax VAT levied on most goods and services sold for domestic consumption The GST is paid by consumers but it is remitted to the government

Concept Of Service Tax

Concept Of Service Tax

https://imgv2-2-f.scribdassets.com/img/document/288320977/original/8b62c7ce22/1667836182?v=1

Tax Clipart Service Tax Picture 2111056 Tax Clipart Service Tax

https://webstockreview.net/images/document-clipart-source-document-15.png

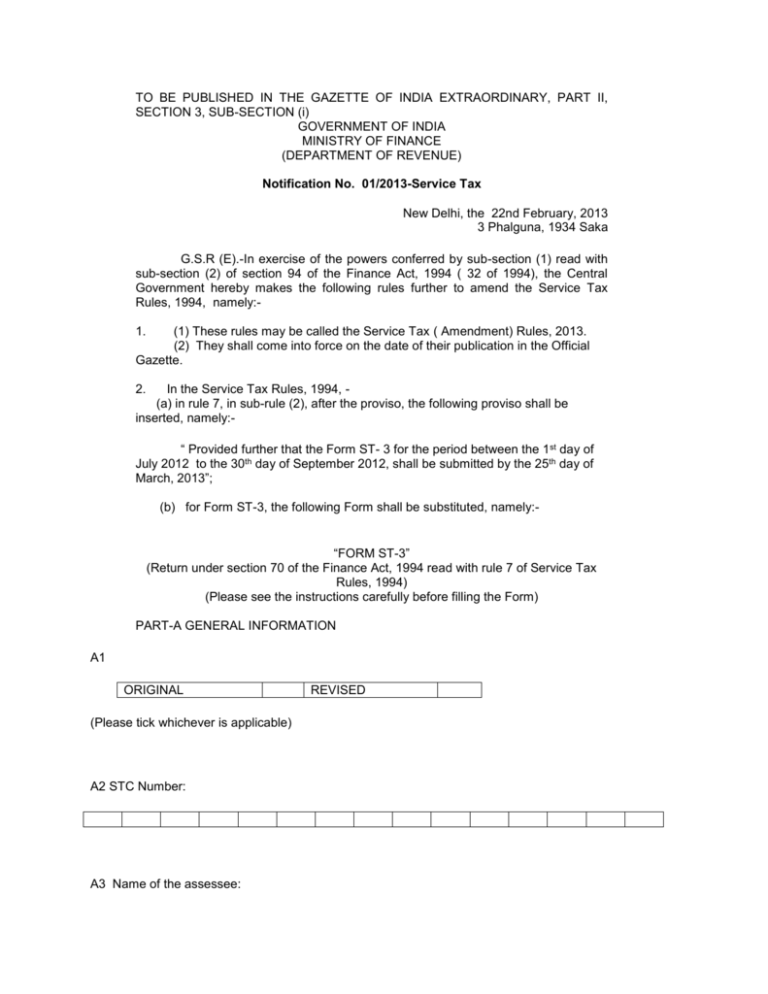

New Service Tax Return ST3 Notified

https://s3.studylib.net/store/data/009282741_1-42c3c1808171f9e125254b86cb777639-768x994.png

Service tax was an indirect tax levied by the government on services offered by service providers Introduced under Section 65 of the Finance Act 1994 service tax was on July 2017 replaced by Goods and Services Tax GST which subsumed the various types of indirect taxes Service tax is a tax levied on the services provider for providing the taxable service as defined under section 65 105 of Finance Act 1994 Service implies the existence of two parties Service cannot be given to one self

What is Service Tax In this video you will learn basic structure of Service Tax Implementation Rate of Service Tax etc Further it is important to note that service tax is a value added tax which in turn is a general tax which applies to all commercial activities involving production of goods and provision of services

Download Concept Of Service Tax

More picture related to Concept Of Service Tax

Service Tax

https://s3.studylib.net/store/data/008532933_1-caaa3727954eff15b74fe4230f543397-768x994.png

Taxpayer Income Tax Concept Burden Avoid Evasion Loopholes Etsy Tax

https://i.pinimg.com/736x/fa/12/a5/fa12a5e870c080bdd7c6259ce3a569f9.jpg

Taxation Consultancy Service At Rs 3000 month In Mumbai

https://5.imimg.com/data5/SELLER/Default/2022/12/DI/PG/VV/61456754/taxation-consultancy-service-1000x1000.jpg

The Finance Act 2012 in respect of service tax Members of our Institute play a significant role in enriching the knowledgebase in the domain of Service Tax Due to increasing changes and complexities taking place in the field of service tax and expected implementation of the Goods and Service Tax in the near future I am glad to know that Tax on goods and services is defined as all taxes levied on the production extraction sale transfer leasing or delivery of goods and the rendering of services or on the use of goods or permission to use goods or to perform activities They consist mainly of

Concept of place of provision of service Sec 66C Since provision of service in the taxable territory is an important ingredient of taxability therefore Central Government is empowered to make rules for determination of place of provision of service 3 Sec 66E lays down the concept of declared services 4 Taxes are generally an involuntary fee levied on individuals or corporations that is enforced by a government entity whether local regional or national in order to finance government activities

Manual Filing Of Service Tax Return By Isdaq4 Issuu

https://image.isu.pub/171228080132-0b50da6626e89e87648eb5e2920d8735/jpg/page_1.jpg

Service Tax Revision Video 6 YouTube

https://i.ytimg.com/vi/AftSdJDyQ6g/maxresdefault.jpg

https://en.wikipedia.org/wiki/Service_tax

Service tax was a tax levied by the Government of India on services provided or agreed to be provided excluding services covered under the negative list and considering the Place of Provision of Service Rules 2012 and collected as per Point of Taxation Rules 2011 from the person liable to pay service tax

https://taxguru.in/service-tax/service-tax-concept-service.html

1 An activity which constitutes merely a A transfer of title in goods or immovable property by way of sale gift or in any other manner or b Such transfer delivery or supply of any goods which is deemed to be a sale c A transaction in money or actionable claim 2

What Is The Rate Of Service Tax On Vimeo

Manual Filing Of Service Tax Return By Isdaq4 Issuu

A Full Service Tax And Accounting Franchise Opportunity

PDF Centralised Registration Of Service Tax DOKUMEN TIPS

Service Tax Basic Exemption Notification

Service Tax

Service Tax

Service Tax On Mutual Fund Services Concept Of RCM Reverse Charge A

Service Tax On Sponsorship Services Concept Of RCM Reverse Charge

Service Tax What Is Service Tax BetterPlace

Concept Of Service Tax - What is Service Tax In this video you will learn basic structure of Service Tax Implementation Rate of Service Tax etc