Contact Hmrc Re Tax Return Contact HMRC for help with questions about PAYE and Income Tax including coding notices and Marriage Allowance and for advice on savings including ISAs and claiming tax back on interest

Contact HMRC for help with questions about PAYE and Income Tax including coding notices and Marriage Allowance and for advice on savings including ISAs and claiming tax back on interest Posted Mon 01 Jan 2024 17 21 43 GMT by When I go to submit my tax return online I get a message saying name tax return 2022 23 Submitted Return As the HMRC service was not used to

Contact Hmrc Re Tax Return

Contact Hmrc Re Tax Return

https://www.loveaccountancy.co.uk/wp-content/uploads/2017/10/Screen_Shot_2017-10-11_at_18_12_15.png

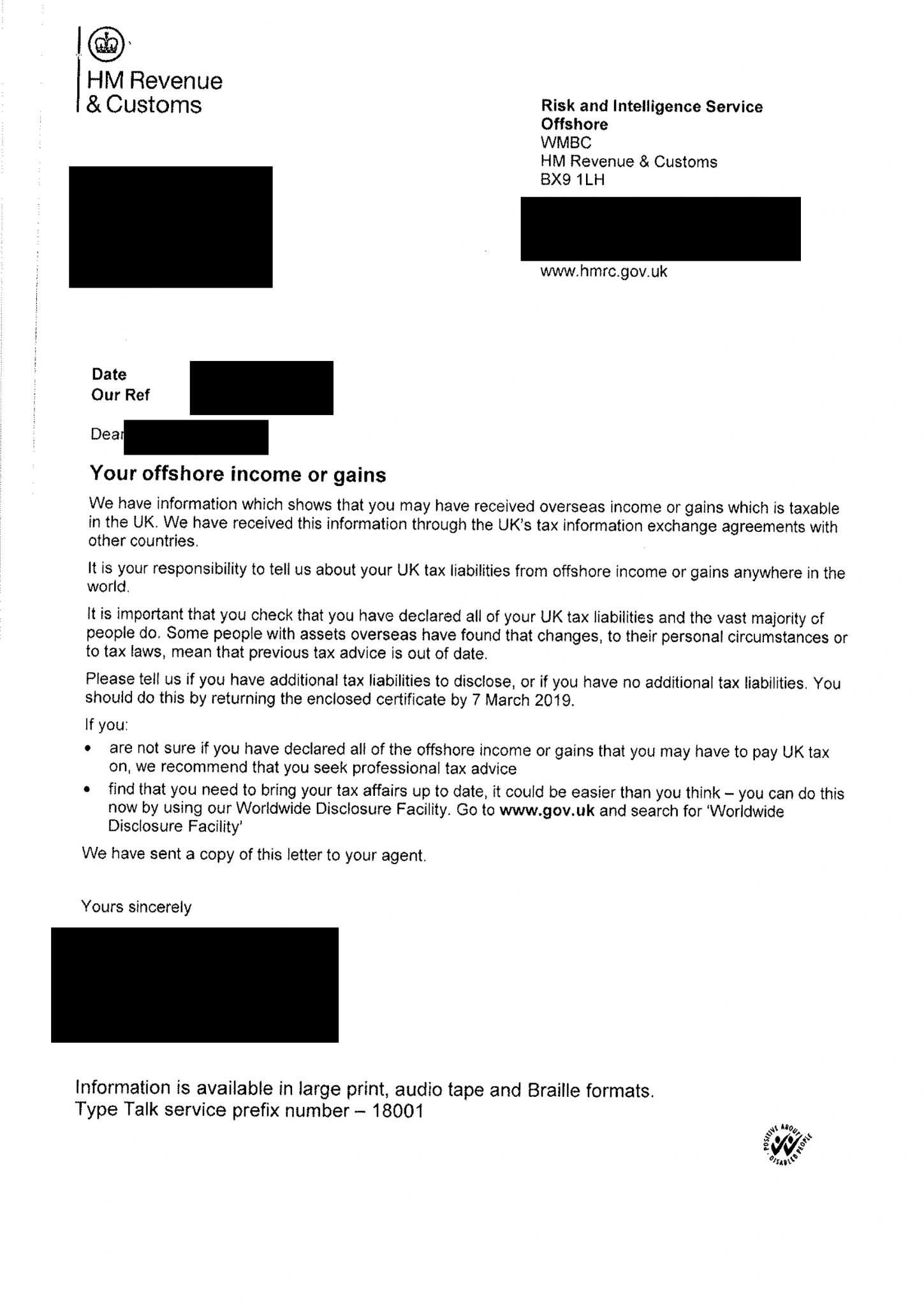

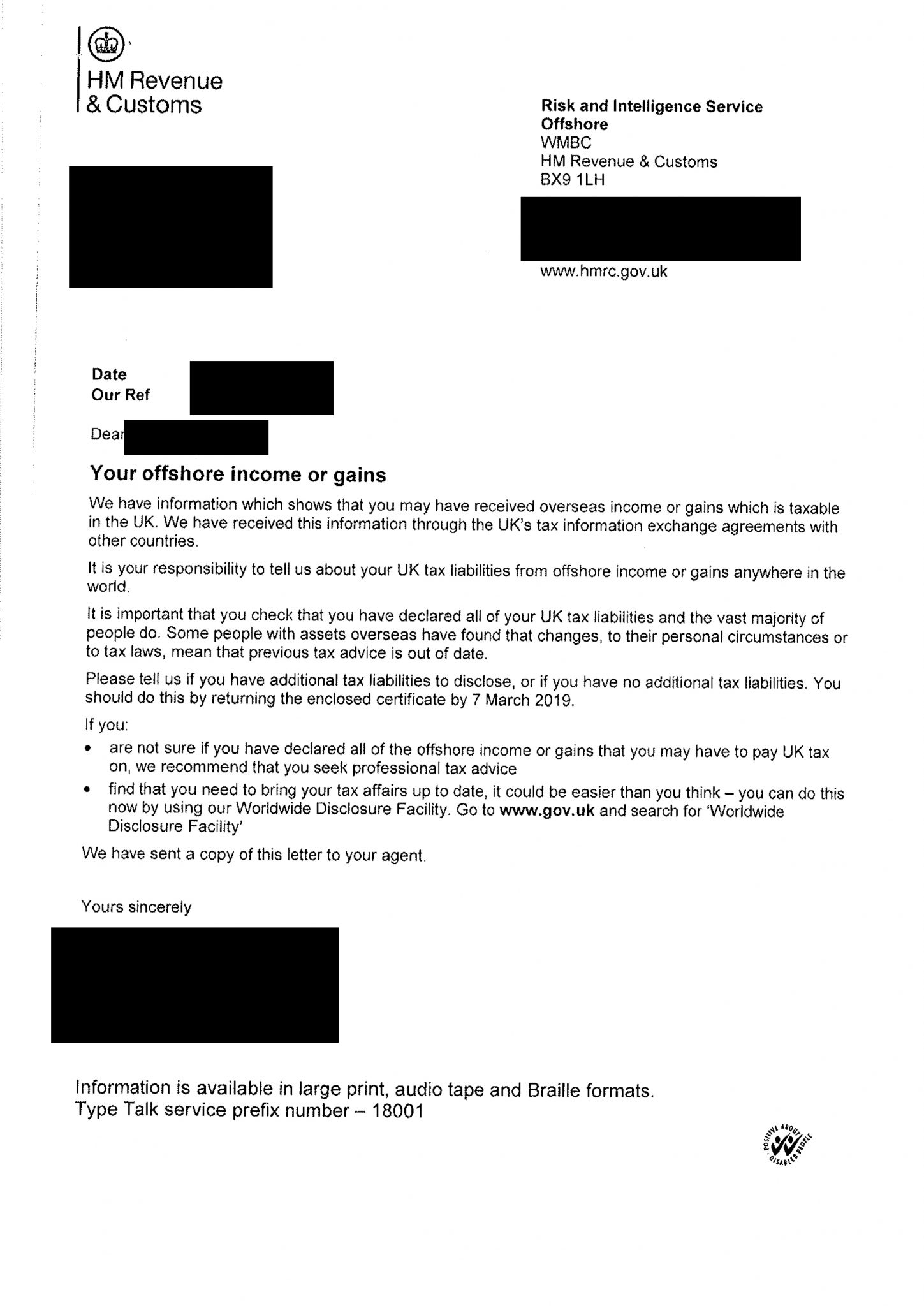

Letter From HMRC About Overseas Assets Income Or Gains

https://b6m6e4y6.rocketcdn.me/wp-content/uploads/2022/01/Letter-from-Hmrc-about-overseas-income-scaled.jpg

Hmrc Form Ca9176 Printable

https://www.pdffiller.com/preview/454/115/454115474/large.png

The Income Tax Office at HM Revenue Customs HMRC can accept most information over the phone but in certain circumstances you will need to write in This table will help you decide how To check if you still need to fill in a tax return go to www gov uk check if you need a tax return If you do not need to fill in a return you must contact us by 31 January 2023 to

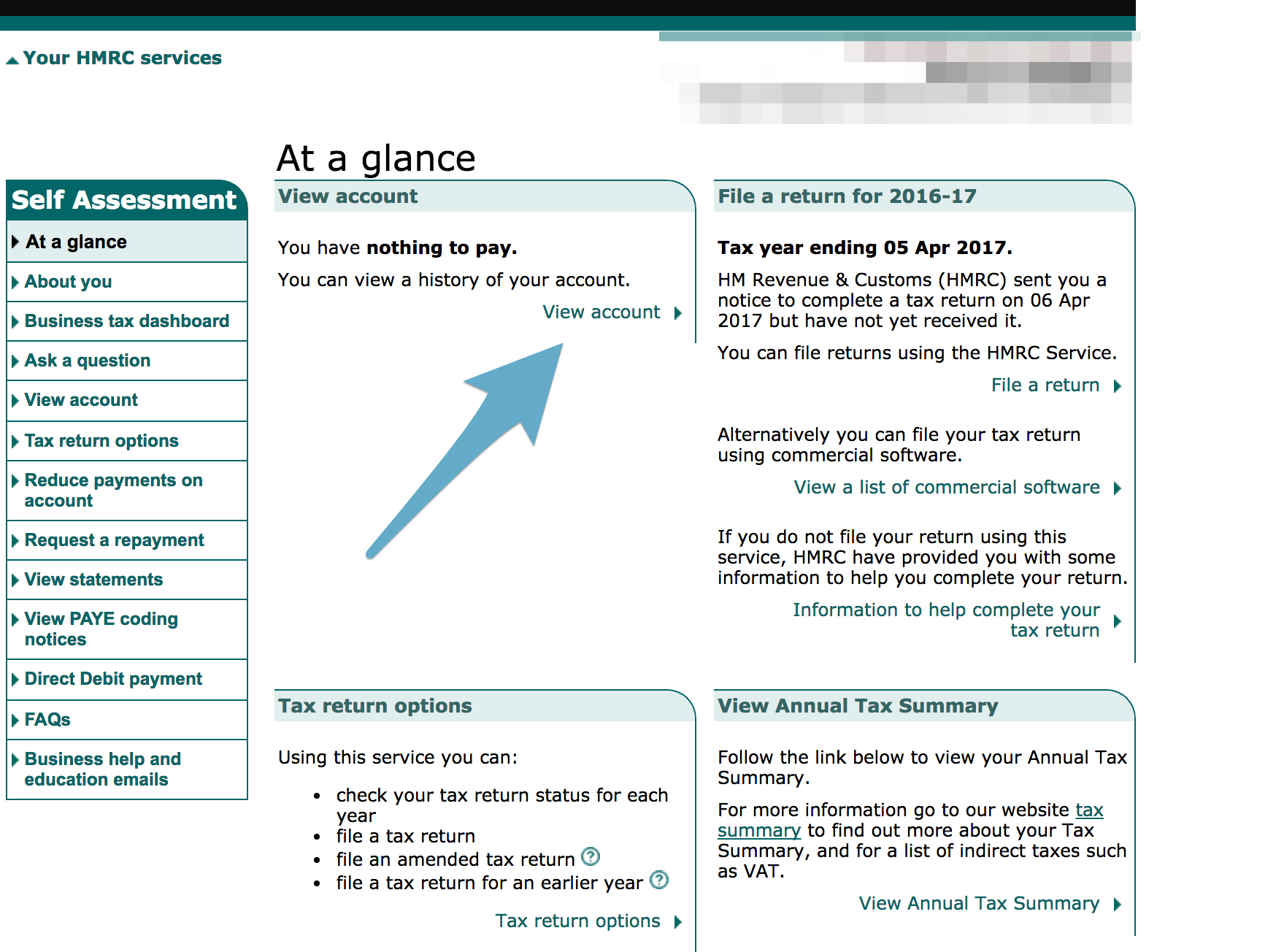

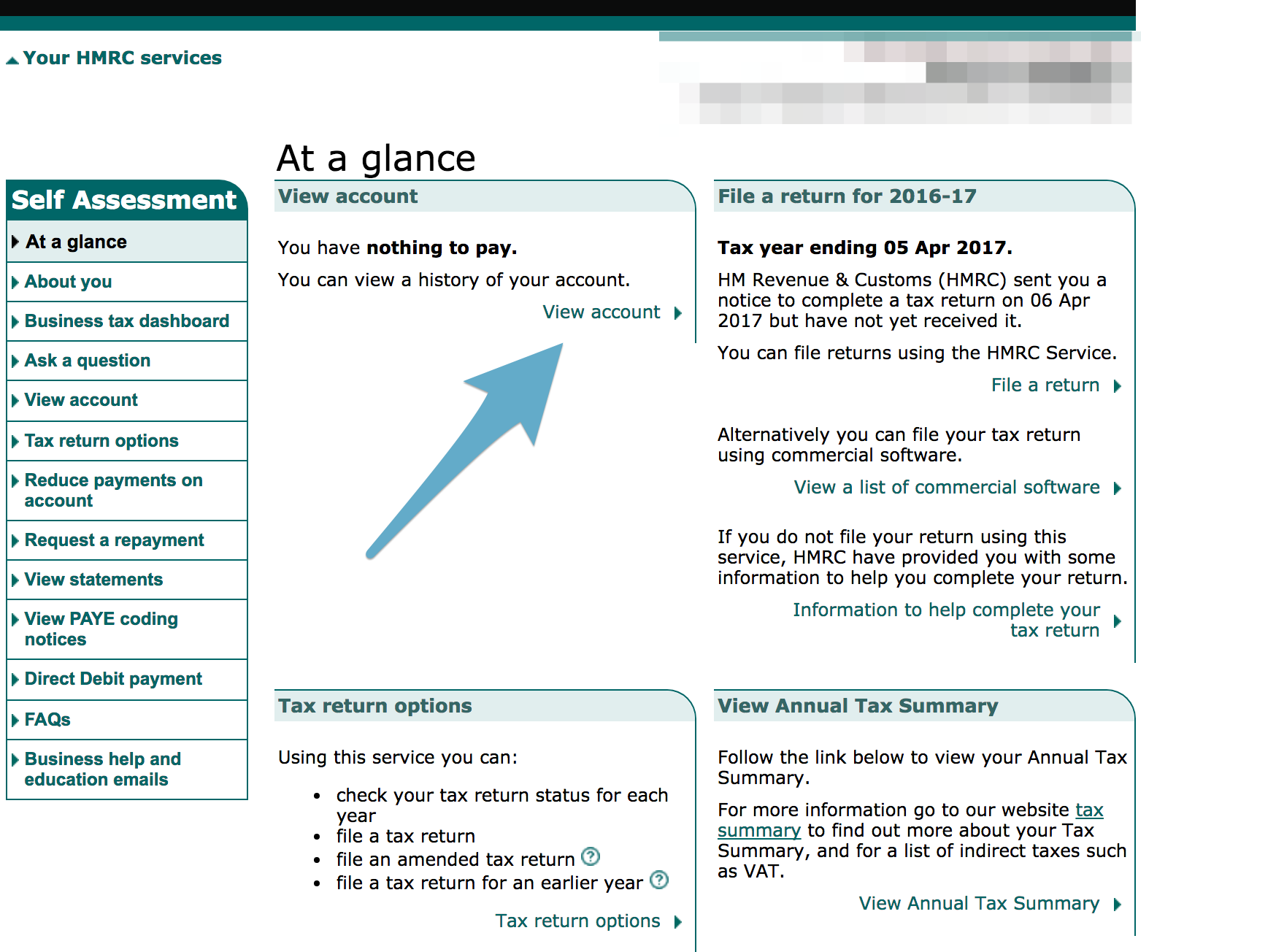

Sign in using your Government Gateway user ID and password From Your tax account choose Self Assessment account Choose More Self Assessment details Choose At a glance from the Employer helpline 0300 200 3200 Income Tax helpline 0300 200 3300 National Insurance helpline 0300 200 3500 HMRC online services helpdesk 0300 200 3600 Online debit and credit card payment support 0300 200 3601

Download Contact Hmrc Re Tax Return

More picture related to Contact Hmrc Re Tax Return

H R BLOCK TAX RETURN PROGRAM FOR AT HOME On Mercari Tax Software Hr

https://i.pinimg.com/originals/88/7e/86/887e86a83d98bae3ff75acd7bb2e00a7.jpg

How To Print Your SA302 Or Tax Year Overview From HMRC Love

https://www.loveaccountancy.co.uk/wp-content/uploads/2017/10/Screen_Shot_2017-10-11_at_18_12_37.png

HMRC To Begin Contacting Self employed Who May Be Eligible For Support

https://apex-contracting.co.uk/wp-content/uploads/2020/07/HMRC.jpg

Ask HMRC online chat bot You can also find information such as your Unique Tax Payer Reference employment history or PAYE tax records in your personal tax account or business tax account using HMRC online services the official HMRC app So if you do need to contact HMRC about your Self Assessment be sure to have the following Your personal details full name address date of birth Your National Insurance number Your Government Gateway ID Your Unique Tax Reference Number UTR Previous Self Assessment tax returns if relevant

[desc-10] [desc-11]

HMRC Announce Breathing Space On Late Self Assessment Tax Returns

https://www.forres-gazette.co.uk/_media/img/G2UO83CJ0STY7VJ2UBX1.jpg

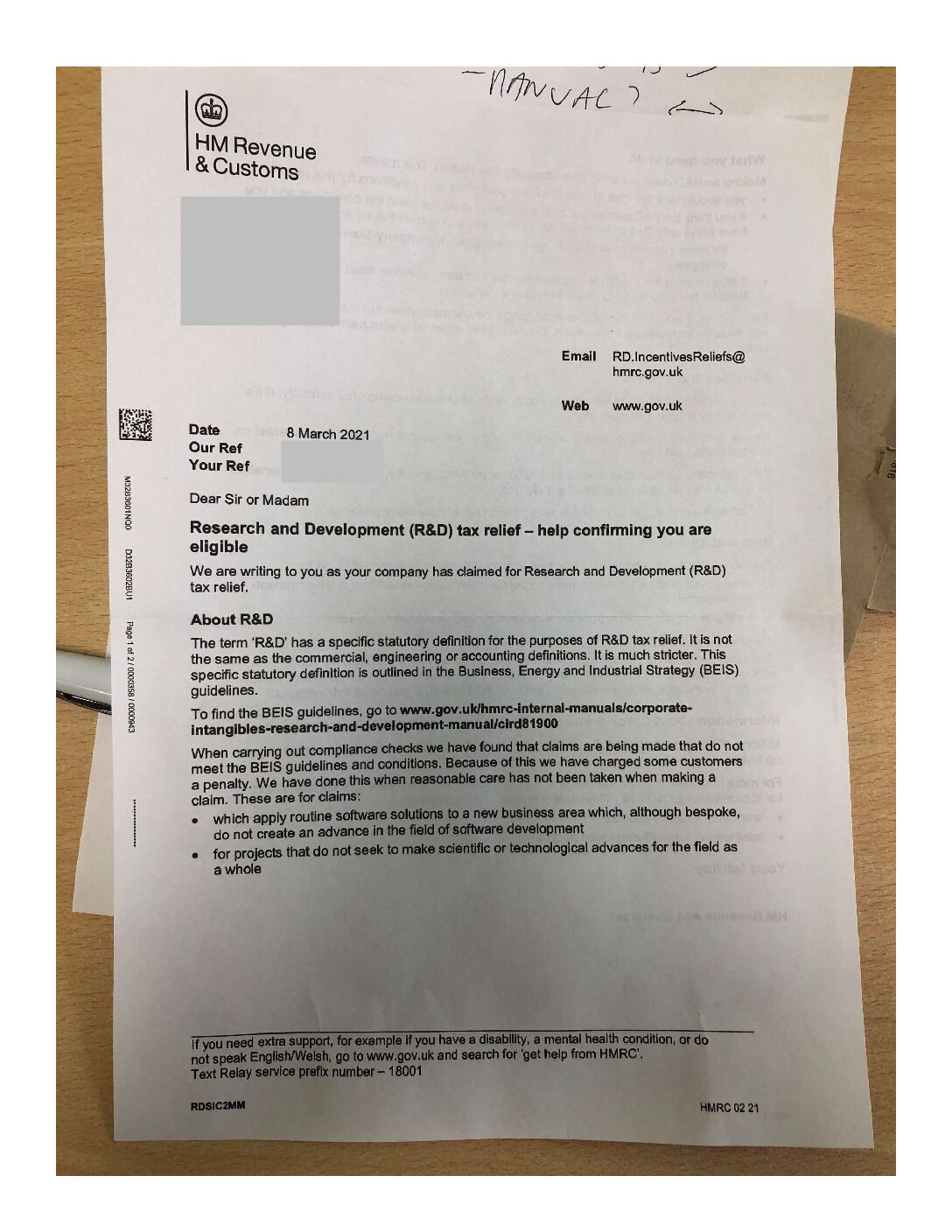

Hmrc Letter Management And Leadership

https://tectonapartnership.com/wp-content/uploads/2021/04/RD-Letter-1-pdf.jpg

https://www.gov.uk/government/organisations/hm-revenue-customs/...

Contact HMRC for help with questions about PAYE and Income Tax including coding notices and Marriage Allowance and for advice on savings including ISAs and claiming tax back on interest

https://www.gov.uk/.../hm-revenue-customs/contact

Contact HMRC for help with questions about PAYE and Income Tax including coding notices and Marriage Allowance and for advice on savings including ISAs and claiming tax back on interest

HMRC 2021 Paper Tax Return Form

HMRC Announce Breathing Space On Late Self Assessment Tax Returns

Hmrc Customs Contact Number

Government Institutions Archives Page 2 Of 2 UK Customer Service

HMRC Extends Threshold For Self employed time To Pay Applications IWORK

How Do I Know HMRC Received My Return Untied Know How

How Do I Know HMRC Received My Return Untied Know How

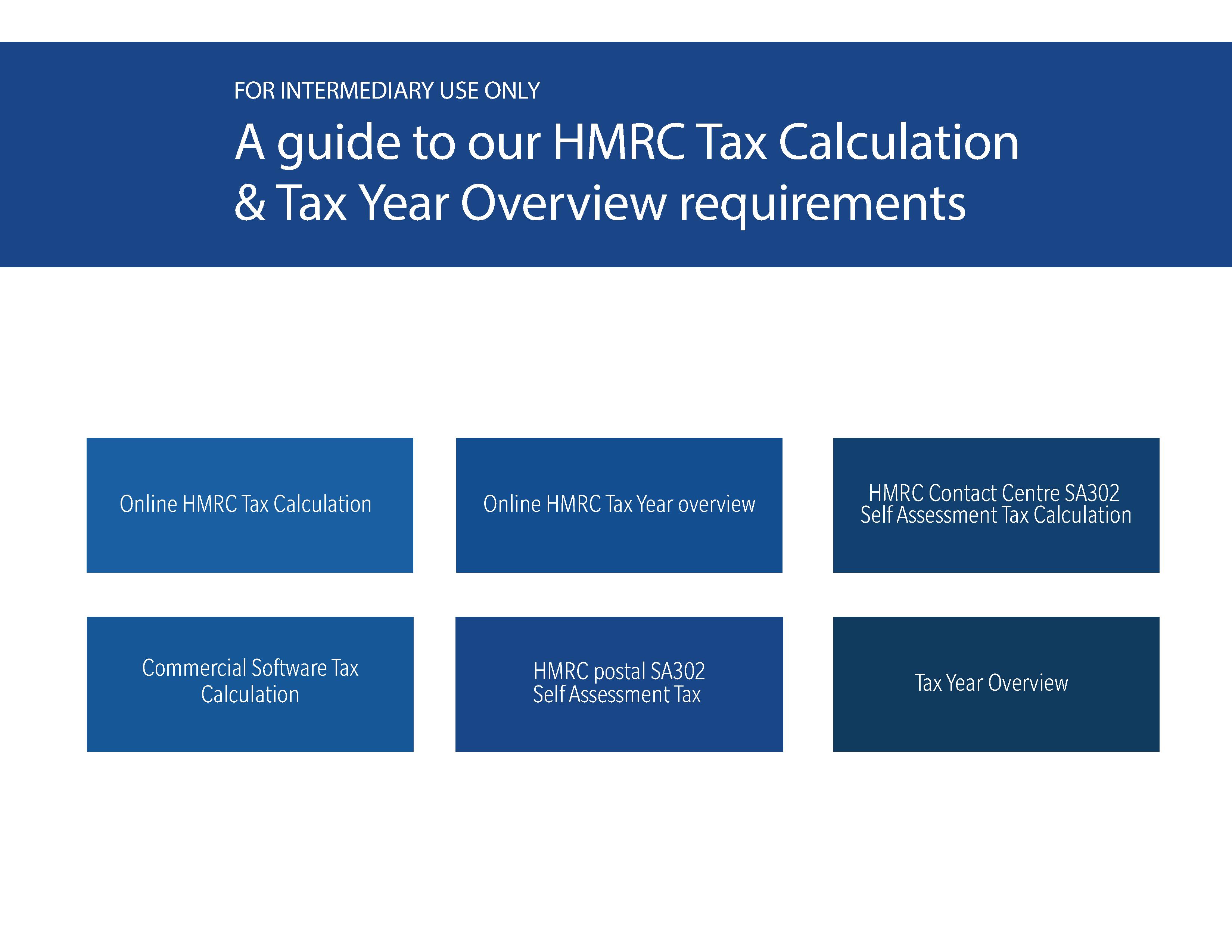

A Guide To Our HMRC Tax Calculation Tax Year Overview Requirements

2016 HMRC Tax Return Form

HMRC Letter Action Required Before 8 April 2021 Alterledger

Contact Hmrc Re Tax Return - [desc-13]