Corporate Tax Rebate Iras Web Singapore s Corporate Income Tax rate is 17 Expand all Definition of a Company Basis Period amp Year of Assessment Corporate Income Tax Rate Corporate Income Tax Filing

Web 10 mai 2023 nbsp 0183 32 Your company s chargeable income declared in its Corporate Income Tax Returns Estimated Chargeable Income ECI and Form C S Guss C S Lite Forms C Web If the distribution is taxable your company must report the gross income indicated in the CDP statement as taxable income in the Corporate Income Tax Return for the relevant

Corporate Tax Rebate Iras

Corporate Tax Rebate Iras

https://singaporeaccounting.com/wp-content/uploads/2016/01/SingaporeAccounting-Tax-Exemption-KR.png

Tax Rebates As Economic Stimulus Can They Work Businessandfinance Blog

https://expertscolumn.com/image_files/thumbmain/imag_820158520_2005542813.jpg

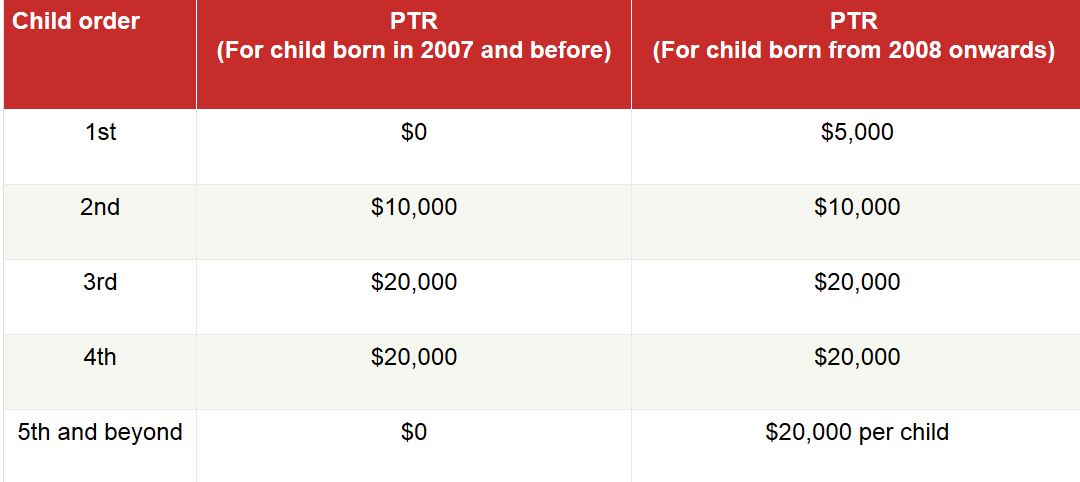

10 Things All Working Mums Should Know

https://thenewageparents.com/wp-content/uploads/2015/04/Parenthood-tax-rebate.jpg

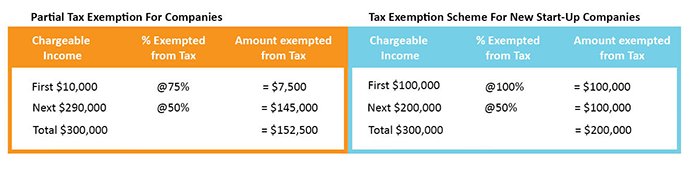

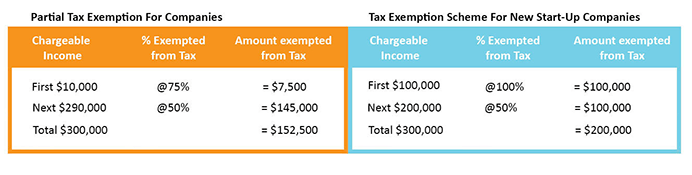

Web 3 mai 2023 nbsp 0183 32 Corporate Income Tax Rebate The Corporate Income Tax Rebate is designed to provide relief to all companies in Singapore This relief provides a 25 Web 22 juil 2022 nbsp 0183 32 Partial tax exemption start up tax exemption and corporate tax rebate VCC level Exemption of gains or profits from disposal of ordinary shares sub fund

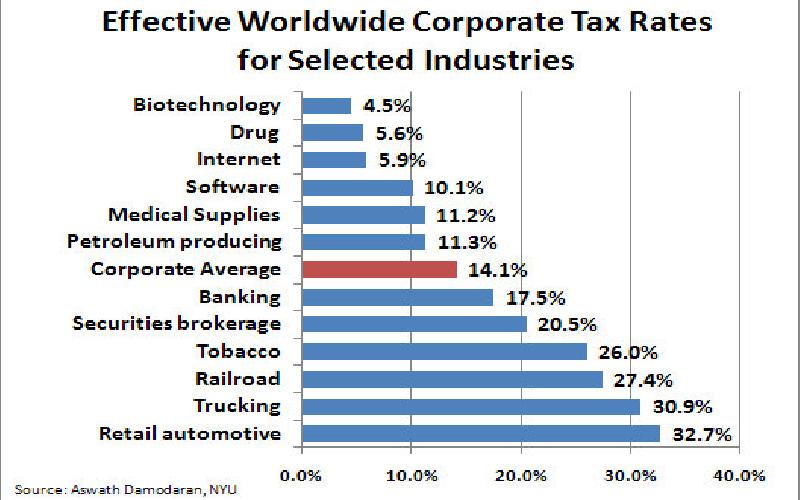

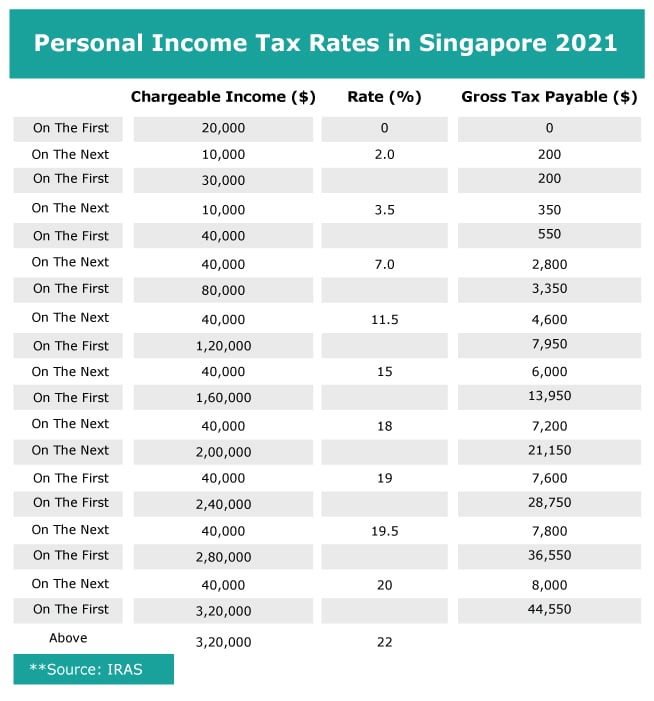

Web 30 nov 2022 nbsp 0183 32 For the table above the full contribution limit is 6 000 for 2022 and 6 500 for 2023 In addition individuals 50 years old and older qualify for an additional 1 000 Web 10 janv 2023 nbsp 0183 32 Corporate Income Tax Rate Your company is taxed at a flat rate of 17 of its chargeable income This applies to both local and foreign companies Corporate

Download Corporate Tax Rebate Iras

More picture related to Corporate Tax Rebate Iras

Illinois Tax Rebate Tracker Rebate2022

https://i0.wp.com/www.rebate2022.com/wp-content/uploads/2023/05/illinois-tax-rebate-2022-cray-kaiser-1.png

Corporate Income Tax Filing Season 2020 6 Things SMEs Need To Know

https://lh6.googleusercontent.com/xiKgxtRDGAbgUva0rSGk0iZo31MPgzCjHqhm55pcizJIWguYmgXVIJCrTXe-0S8eKvCgFaH3ZIsGVIdADxFV2zqLkRqNH1oGWKeUuAu_nRe_PPB7IhneXmqZDlQkh8wg3yMCrrA6

What Are The Best Ways To Manage Tax Rebates

https://bloggercreativa.com/wp-content/uploads/2022/08/Tax-Rebate-Calculator-2-1200x675.jpg

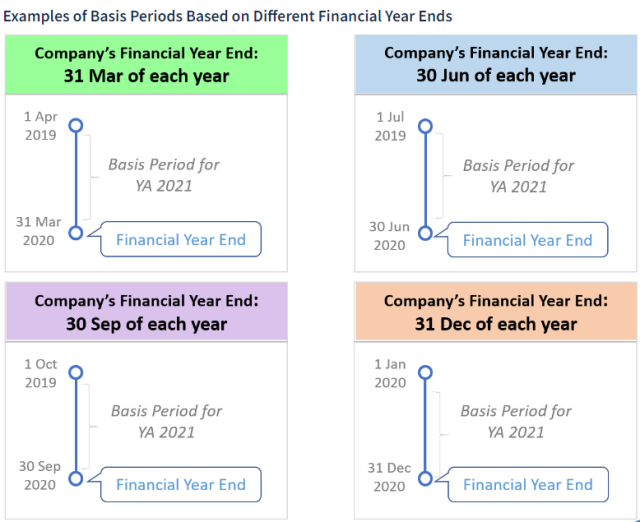

Web The IRAS guidance states that the following payments are taxable in the hands of employers as the amounts are considered revenue receipts for businesses Web February 2 2022 What s in the article Corporate Income Tax Exemption Schemes Corporate Income Tax CIT Rebate for YAs 2013 to 2020 There s no denying that

Web All companies with corporate income tax CIT payments due in April May and June 2020 will be granted an automatic three month deferment of these payments The Inland Web 13 d 233 c 2019 nbsp 0183 32 Individuals employees or sole proprietors and companies are required to file annual income tax returns to the Inland Revenue Authority of Singapore IRAS and pay

Letter From IRAS On Tax Reliefs And Rebate

https://i2.wp.com/financesmiths.com/wp-content/uploads/2020/01/tax.jpg?fit=1024%2C685

Corporate Tax Rebate Budget 2022 Rebate2022

https://www.rebate2022.com/wp-content/uploads/2023/05/latest-income-tax-slab-rates-for-fy-2022-23-ay-2023-24-budget-2022.jpg

https://www.iras.gov.sg/taxes/corporate-income-tax/basics-of-corporate...

Web Singapore s Corporate Income Tax rate is 17 Expand all Definition of a Company Basis Period amp Year of Assessment Corporate Income Tax Rate Corporate Income Tax Filing

https://nccncntouch.sbs

Web 10 mai 2023 nbsp 0183 32 Your company s chargeable income declared in its Corporate Income Tax Returns Estimated Chargeable Income ECI and Form C S Guss C S Lite Forms C

Tax Evasion What Happens If You Don t Report Your Taxes Accurately

Letter From IRAS On Tax Reliefs And Rebate

Corporate Tax Overview Corporate Tax Rates Rebates Mudra Nidhi

Singapore Corporate Tax Rebate Ya 2022 Rebate2022

2020 Singapore Corporate Tax Update Singapore Taxation

Deferred Tax And Temporary Differences The Footnotes Analyst

Deferred Tax And Temporary Differences The Footnotes Analyst

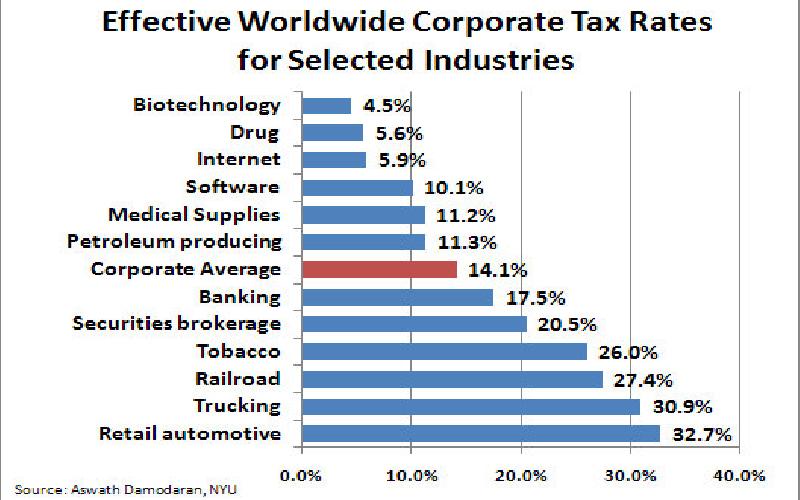

Corporate Tax Overview Corporate Tax Rates Rebates

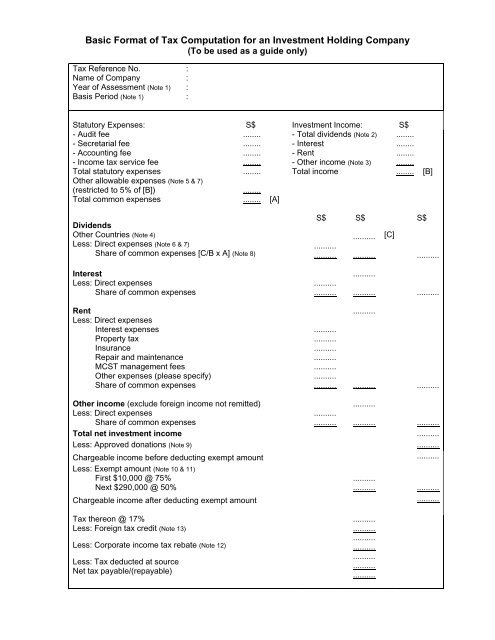

Basic Format Of Tax Computation For An Investment Holding IRAS

Government Rebate Program Fill Out Sign Online DocHub

Corporate Tax Rebate Iras - Web YA 2020 The changes to the tax exemption scheme for new start up companies announced in Budget 2018 will apply with effect from YA 2020 The exempt amount on normal