Corporate Tax Rebate Malaysia Web According to Short term Economic Recovery Plan Penjana newly established SME can get up to RM 20k tax rebate for the first three years New company LLP that

Web Income tax rebate for new SMEs or Limited Liability Partnerships LLPs Pursuant to the Finance Act 2020 a new Section 6D was introduced into the ITA to provide an income Web You will not receive the total RM60 000 corporate tax rebate all at once Instead you would get a maximum of RM20 000 in tax rebates every

Corporate Tax Rebate Malaysia

Corporate Tax Rebate Malaysia

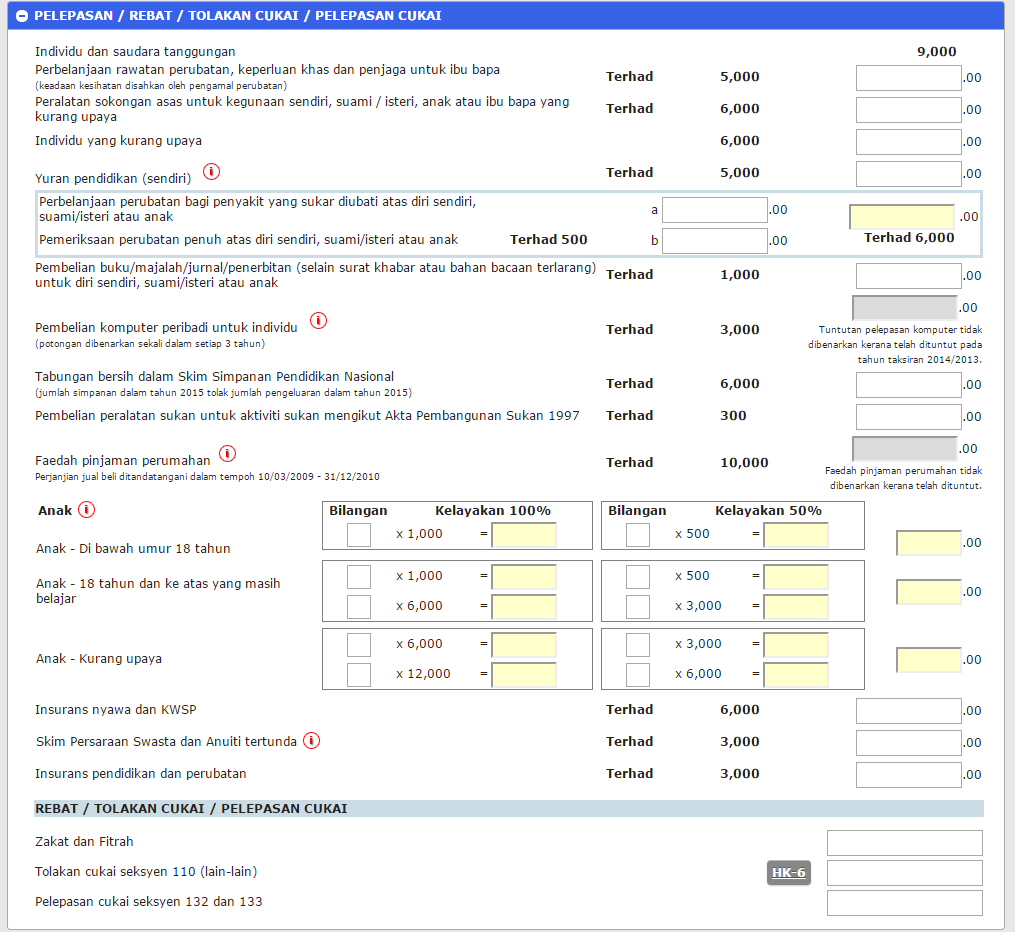

https://kcnstingy-95ad.kxcdn.com/wp-content/uploads/2016/04/Step-7-Reliefs-Rebates-and-Exemptions.png

Malaysia Corporate Tax Rate 2019

https://i0.wp.com/blog.investyadnya.in/wp-content/uploads/2019/09/Corporate-Tax-Rate-Cut_Competitive-tax-rates-compared-to-Asian-Peers-PNG.png?resize=640%2C440&ssl=1

Monthly Tax Deduction Malaysia Tax Is Generally Payable In 12 Monthly

https://lh5.googleusercontent.com/proxy/I2O4z3iD2pVE8THeqZE840PHIhvRhaePvGvOc_ppvPBAlH5I8f_O7aJxmt4PFXA7lrQ1sFjLO-3sstUBfGPtSFL-vWBRjmitx_xpDUYNkxbQxShONB8WrtG4JK-1QQ6OCvS2evOLi_tKAdqBF2SY5FM_0uoG=w1200-h630-p-k-no-nu

Web 20 mai 2022 nbsp 0183 32 If you re establishing a new SME by 31 December 2022 you re eligible for an income tax rebate of up to RM20 000 per Year of Assessment YA This tax rebate Web Special Income Tax Rate at a flat rate of 15 for a period of 5 consecutive years to non residents individuals holding key position C Suite for strategic investments made by

Web Income tax rebate for new SMEs Stamp duty exemption for merger and acquisition Tourism sector Extension of 6 month deferment of instalment payments Special personal income Web Tel 03 21731188 Fax 03 21731288 This publication is a quick reference guide outlining Malaysian tax information which is based on taxation laws and current practice It incorporates key proposals from the 2023

Download Corporate Tax Rebate Malaysia

More picture related to Corporate Tax Rebate Malaysia

Tax Rebate In Malaysia Budget 2017 For A Cosmopolite

http://kindlemalaysia.com/wp-content/uploads/2016/10/14589801_1306153896061278_8083714886436330291_o.jpg

Malaysia Personal Income Tax Guide 2020 YA 2019 2022

https://ringgitplus.com/en/blog/wp-content/uploads/2020/02/tax-reliefs-rebates-income-tax.png?is-pending-load=1

Malaysia Personal Income Tax Rate 2016 DominiquetaroConley

https://www.rikvin.com/wp-content/uploads/2015/02/hk-mas-taxation.jpg

Web Corporate Tax Cooporative Tax Non Resident Company Company Resident Status Certificate of Resident Amending the Income Tax Return Form Web 7 lignes nbsp 0183 32 27 juin 2023 nbsp 0183 32 The current CIT rates are provided in the following table For year of assessment 2022 only a special one off tax at the rate of 33 is imposed on

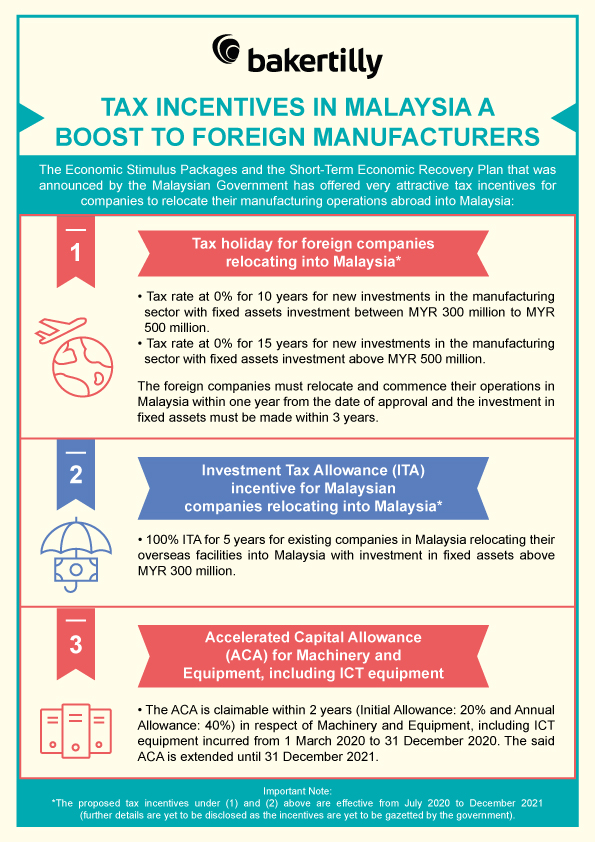

Web 31 d 233 c 2022 nbsp 0183 32 Malaysia offers a wide range of tax incentives ranging from tax exemptions allowances to enhanced tax deductions Generally tax incentives are available for tax Web 23 d 233 c 2021 nbsp 0183 32 An income tax rebate up to RM20 000 per year for 3 years of assessment was given to newly established small and medium enterprises SMEs between 1 July

10 Ways I Declutter My Finances For The New Year Figuringgitout

https://figuringgitout.com/wp-content/uploads/2020/12/Tax-Reliefs-2020.jpg

Tax Incentives In Malaysia 29 Incentive Destination Malaysia Was A

https://www.bakertilly.my/public/files/c5c5793a841d3cf5baec836ba070e8d7847ef5a8910f50ad9f624848014a6193.jpg

https://landco.my/covid19-advice-to-boss/tax-rebate-for-set-up-of-new...

Web According to Short term Economic Recovery Plan Penjana newly established SME can get up to RM 20k tax rebate for the first three years New company LLP that

https://www.ey.com/en_my/tax-alerts/income-tax-rebate-for-new-smes-or...

Web Income tax rebate for new SMEs or Limited Liability Partnerships LLPs Pursuant to the Finance Act 2020 a new Section 6D was introduced into the ITA to provide an income

Lhdn Tax Relief 2021 Tax Relief Malaysia LHDN s Full List Of Things

10 Ways I Declutter My Finances For The New Year Figuringgitout

Director Fees Taxation Malaysia Malaysia Taxation Junior Diary

Budget Highlights For 2021 22 Nexia SAB T

Pusat Rawatan Warga Ums

Tax Rebate For New Incorporated Company Malaysia With New T C Jan 07

Tax Rebate For New Incorporated Company Malaysia With New T C Jan 07

LHDN IRB Personal Income Tax Relief 2020

E Filing 2019 Malaysia Daffyqws

LHDN IRB Personal Income Tax Rebate 2022

Corporate Tax Rebate Malaysia - Web Special Income Tax Rate at a flat rate of 15 for a period of 5 consecutive years to non residents individuals holding key position C Suite for strategic investments made by