Corporate Tax Rebate Ya2023 Web Corporate Income Tax Filing Season 2023 The deadline for filing your Corporate Income Tax Return Form C S Form C S Lite Form C for the Year of Assessment YA 2023

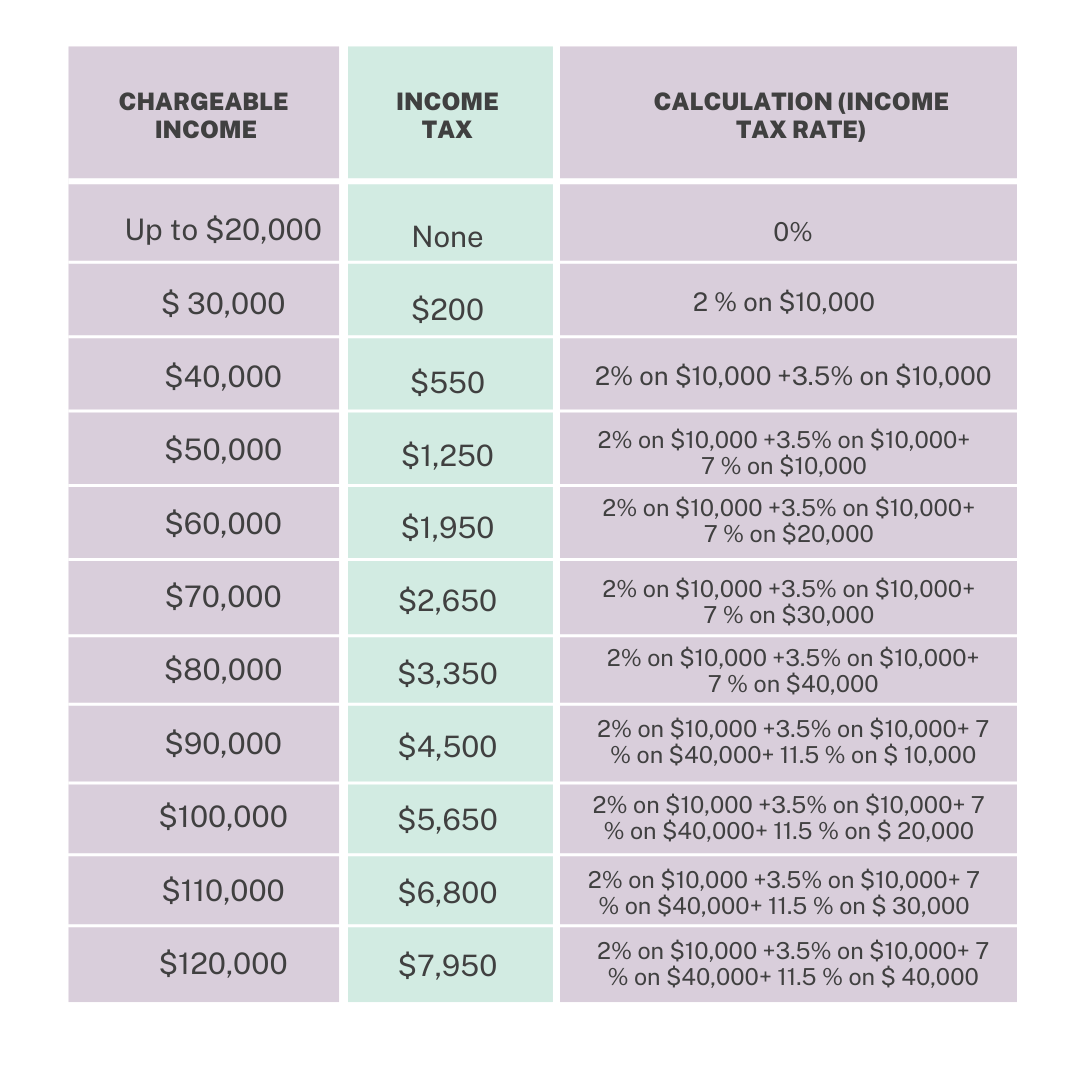

Web 18 f 233 vr 2020 nbsp 0183 32 From YA2023 onwards normal tax exemption scheme for Singapore companies applies If a company s chargeable income is Web Singapore s Corporate Income Tax rate is 17 Expand all Definition of a Company Basis Period amp Year of Assessment Corporate Income Tax Rate Corporate Income Tax

Corporate Tax Rebate Ya2023

Corporate Tax Rebate Ya2023

https://printablerebateform.net/wp-content/uploads/2023/01/Council-Tax-Rebate-Form-2023-768x701.png

YA2023

https://pic3.zhimg.com/v2-4846cd0333416f9042168f933b462102_r.jpg

Singapore Corporate Tax Rebate Ya 2022 Rebate2022

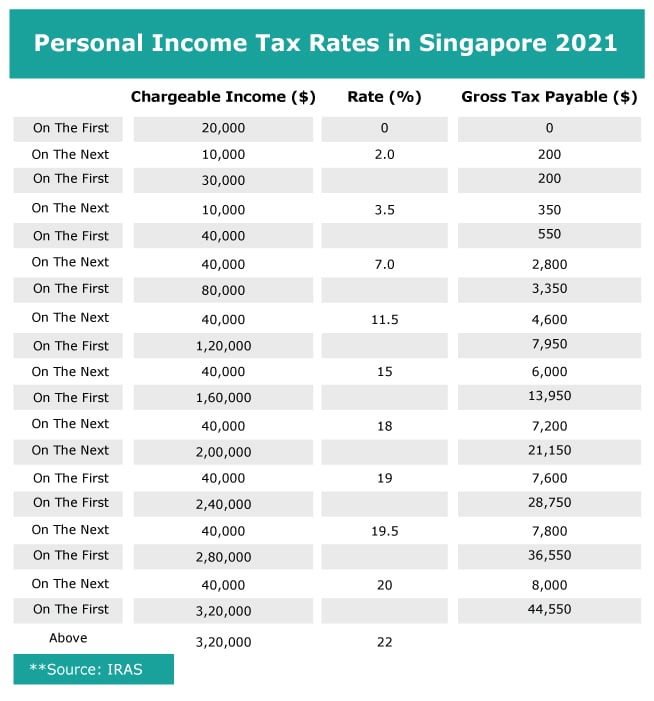

https://www.rebate2022.com/wp-content/uploads/2023/05/singapore-corporate-tax-rate-singapore-taxation-guide-2021.jpg

Web Current YA 2022 Proposed effective from YA 2023 With the additional condition existing companies and LLPs should review their foreign shareholding as they may no longer be Web Corporate Income Tax rebates were applicable for the Years of Assessment YAs 2013 to 2020 The rebates are no longer available for YA 2023 based on Budget 2023 us

Web Corporate income tax rate and rebate The corporate income tax rate would remain at 17 for year of assessment YA 2023 with no corporate income tax rebate proposed Web Visit our Basic Guide to Corporate Income Tax for Companies to find out about Filing obligations of a company i e forms to submit deadlines How to determine income

Download Corporate Tax Rebate Ya2023

More picture related to Corporate Tax Rebate Ya2023

YA2023

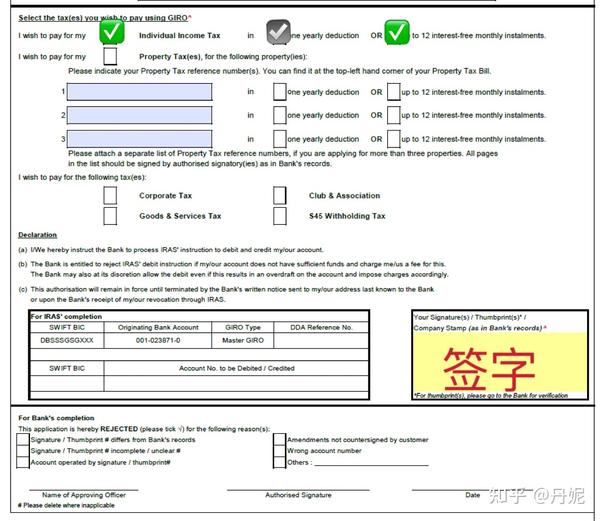

https://pic2.zhimg.com/v2-bd74e6c411cef4bf06e2eee84e091d69_b.jpg

State Corporate Income Tax Rates And Brackets For 2023 Prisma

https://files.taxfoundation.org/20230123172533/2023-state-corporate-income-tax-rates-and-brackets-see-state-corporate-tax-rates-by-state-1024x1000.png

YA2023

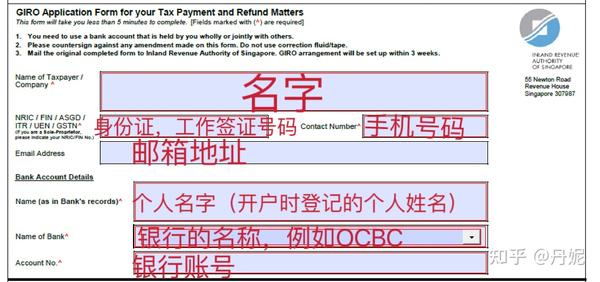

https://pic4.zhimg.com/v2-eff68e38dddb319d79cc51b7de748f43_b.jpg

Web 14 mars 2023 nbsp 0183 32 The Singapore corporate income tax rebate is no longer available for YA 2023 This is based on the Singapore Budget 2023 which was delivered by Singapore s Deputy Prime Minister and Minister for Web Effective from YA 2023 Tiered rate incentive based on outcome Income tax rate for the first RM150 000 of chargeable income be reduced from 17 to 15 Effective from YA 2023

Web Budget 2023 tax changes An overview of their impact on businesses and industries From enhanced tax deduction schemes to progressive property and vehicle taxes here s a Web 1 979 results Most relevant Percentage of Normal Technical Level Students Who Passed Mother Tongue Language Percentage of N T Level Students Who Passed

Georgia Income Tax Rebate 2023 Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2023/03/Georgia-Tax-Rebate-2023-768x683.png

Louisiana Tax Credits 2023 Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2023/04/Louisiana-Tax-Rebate-2023-768x681.png

https://www.iras.gov.sg/taxes/corporate-income-tax/basics-of-corporate...

Web Corporate Income Tax Filing Season 2023 The deadline for filing your Corporate Income Tax Return Form C S Form C S Lite Form C for the Year of Assessment YA 2023

https://pwco.com.sg/guides/corporate-tax-ex…

Web 18 f 233 vr 2020 nbsp 0183 32 From YA2023 onwards normal tax exemption scheme for Singapore companies applies If a company s chargeable income is

Corporate Tax Rebate Budget 2022 Rebate2022

Georgia Income Tax Rebate 2023 Printable Rebate Form

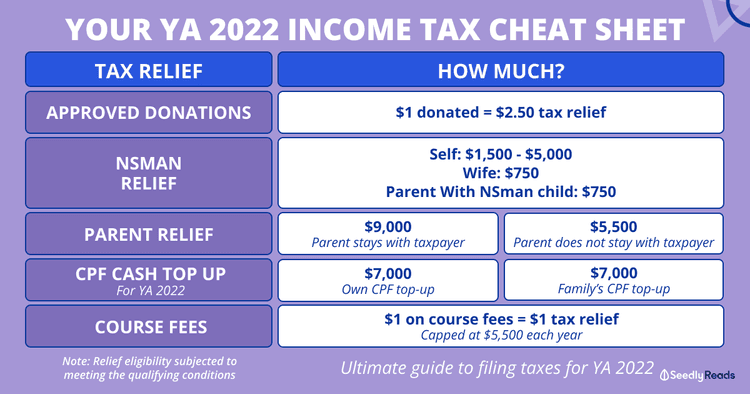

YA2023 Reducing Your Personal Income Tax In Six Ways SG Financial Advice

Missouri State Tax Rebate 2023 Printable Rebate Form

Maine Tax Relief 2023 Printable Rebate Form

Everything You Should Claim As Income Tax Relief Malaysia 2023 YA 2022

Everything You Should Claim As Income Tax Relief Malaysia 2023 YA 2022

Singapore Income Tax 2023 Guide Singapore Income Tax Rates How To

Delaware Tax Rebate 2023 Printable Rebate Form

Hawaii Rebate 2023 Printable Rebate Form

Corporate Tax Rebate Ya2023 - Web Corporate Income Tax rebates were applicable for the Years of Assessment YAs 2013 to 2020 The rebates are no longer available for YA 2023 based on Budget 2023 us